The Complete Beginner's Guide to Web3

A comprehensive overview of the trends, technologies, important sectors, key players, problems and potential of Web3.

This article is intended to provide a somewhat thorough introduction to Web3 for beginners. It’s over 20K words (a 1+ hour read) and is organized into 8 parts, which are summarized below for the tl;dr crowd:

What is Web3?: Contrary to popular belief, Web3 is not just the “next version of the internet”. Instead, it’s creating the world’s first truly autonomous digital nations

The Problem with Centralized Economies: While our current system has benefited society in several ways, it’s relatively inefficient, constrained with a myriad of financial and legal regulations and often prone to corruption and abuse

The Benefits of Decentralized Economies: Proponents argue that decentralized digital nations will retain all of the benefits of our traditional system – namely trust, security and growth – while being much more open, efficient, flexible, transparent and democratic

How does Web3 Work?: Web3 economies use blockchains to store their funds and smart contracts to enforce their own laws – meaning that they don’t have to rely on traditional intermediaries such as banks or courts. As such, they largely operate outside of the purview of the existing financial and legal ecosystem, allowing them to eliminate many of the costs, restrictions and regulations we face today

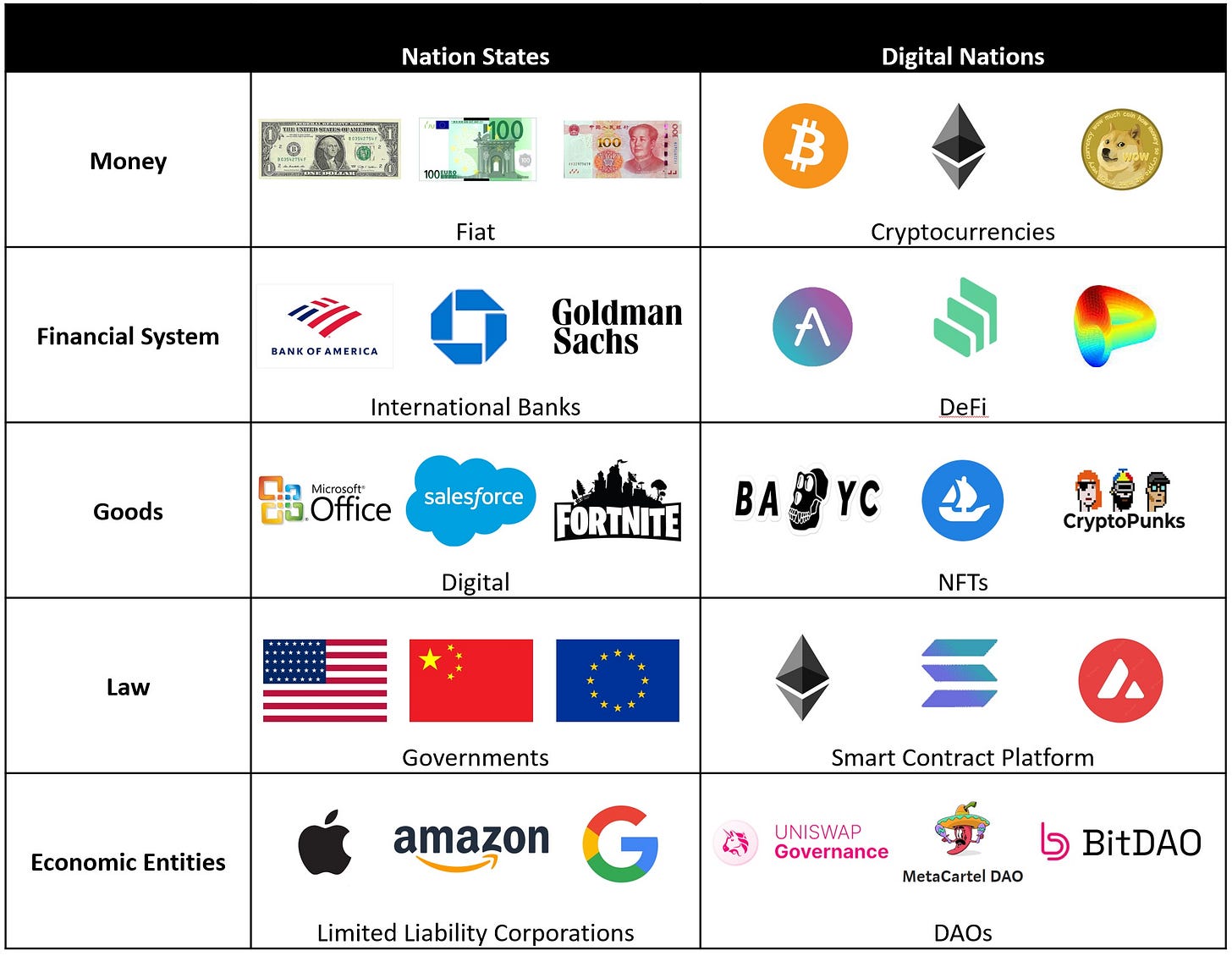

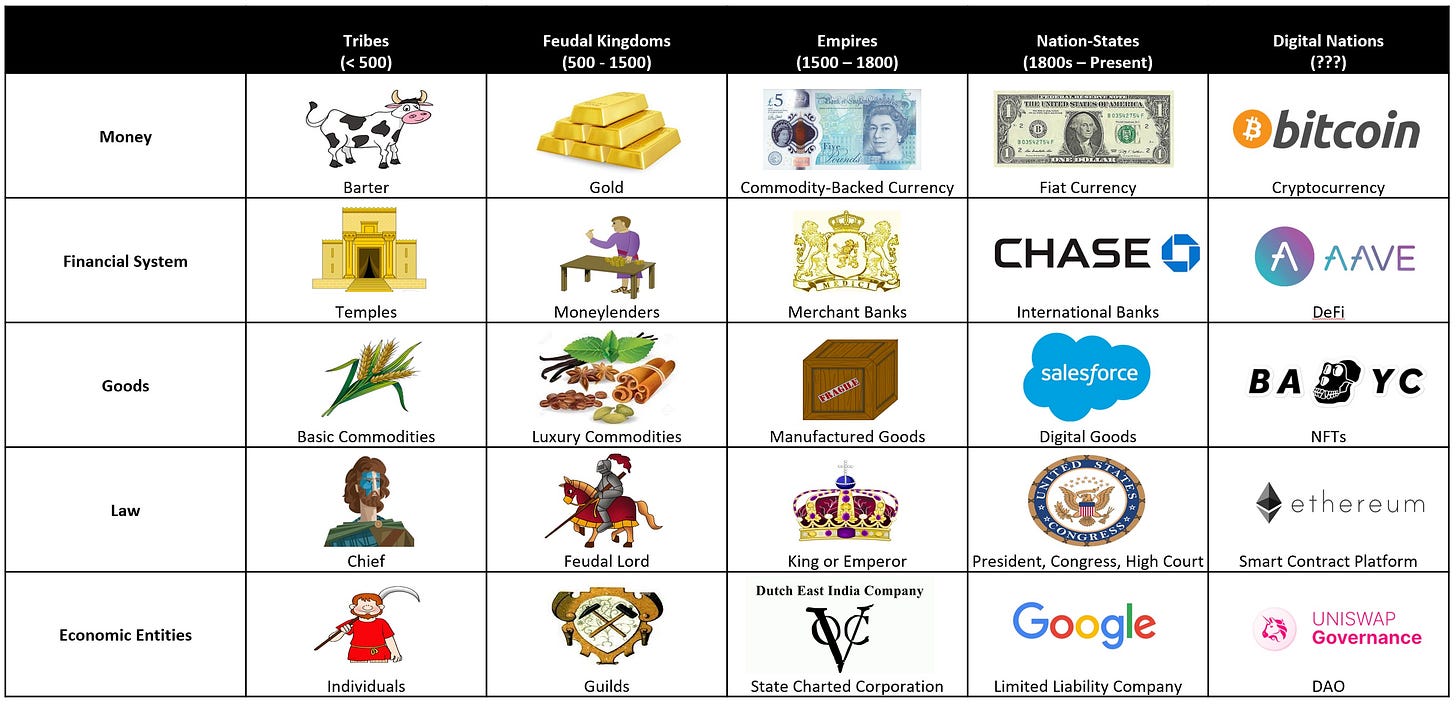

The Web3 Ecosystem: The digital nations of Web3 will use cryptocurrencies as money, DeFi as the financial system, NFTs as native goods, smart contract platforms to codify and enforce laws and DAOs as the native economic entity

Web3 Infrastructure: The Web3 ecosystem is powered by several key pieces of infrastructure including virtual worlds, wallets, decentralized ISPs, node providers, smart contract platforms and decentralized storage providers

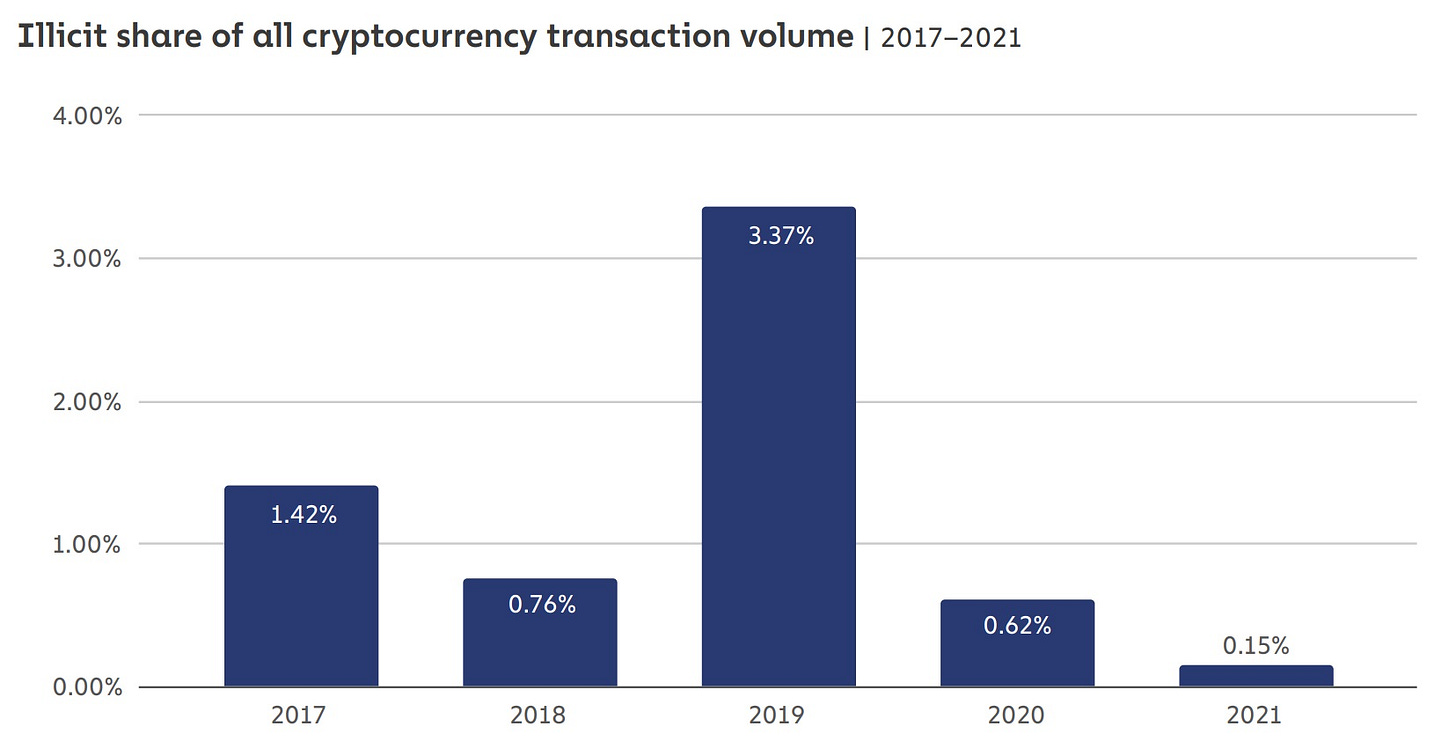

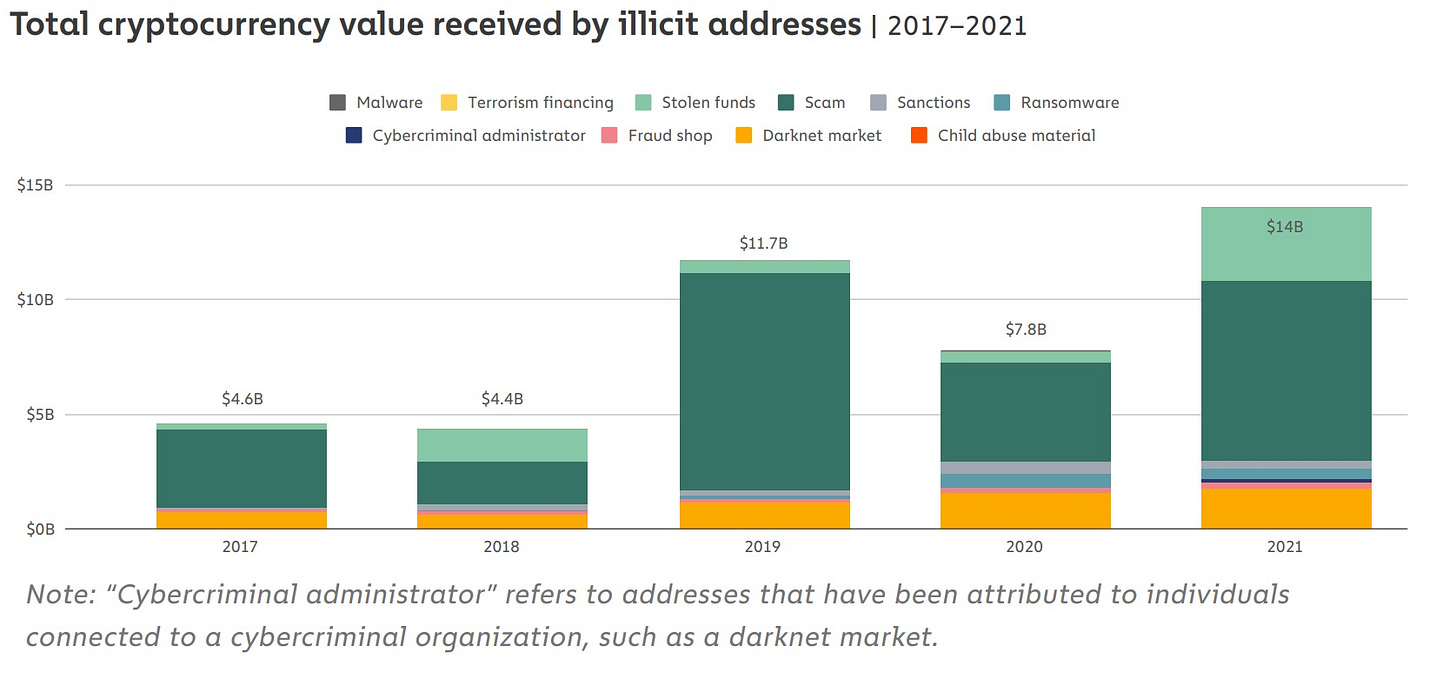

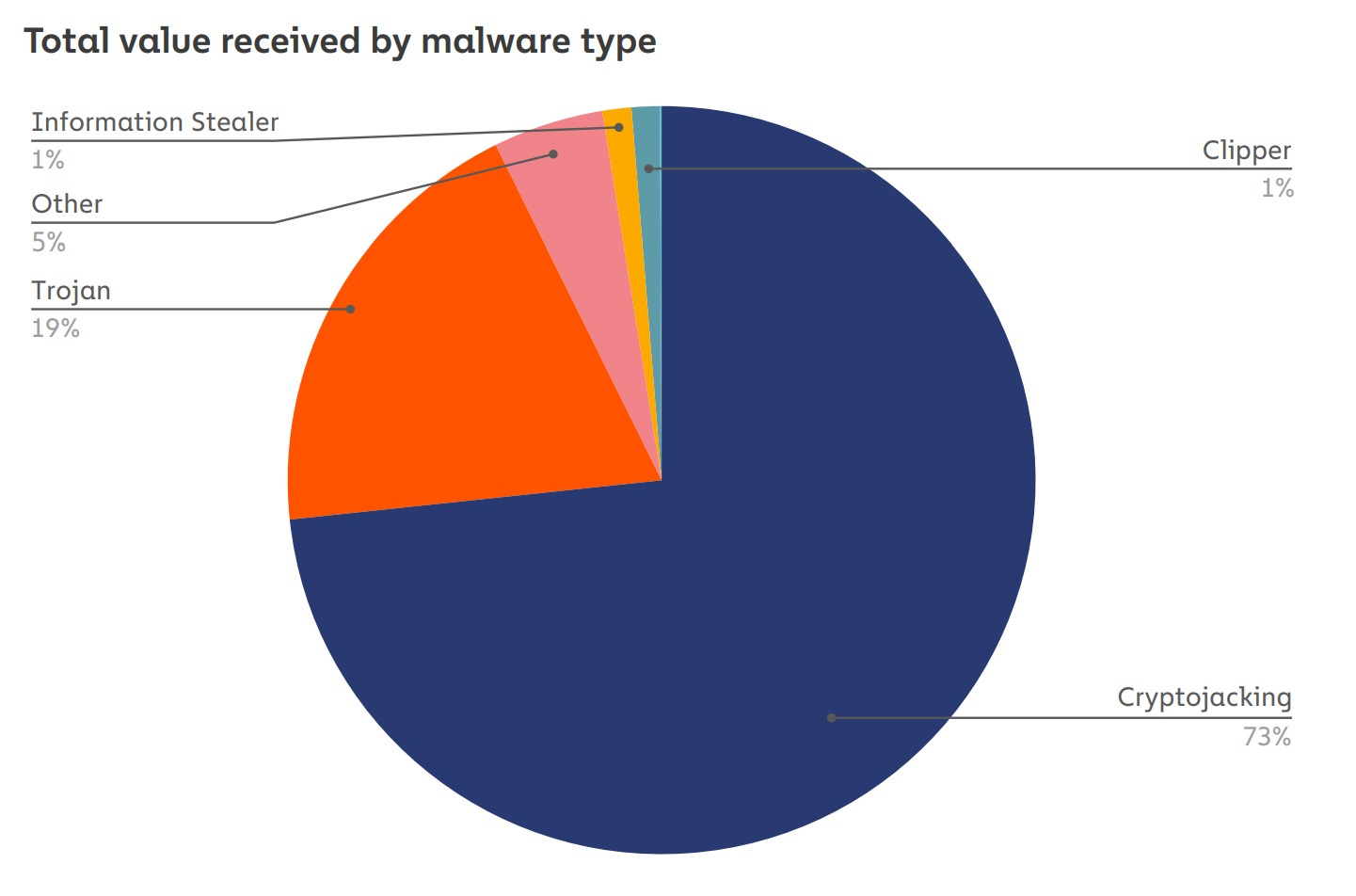

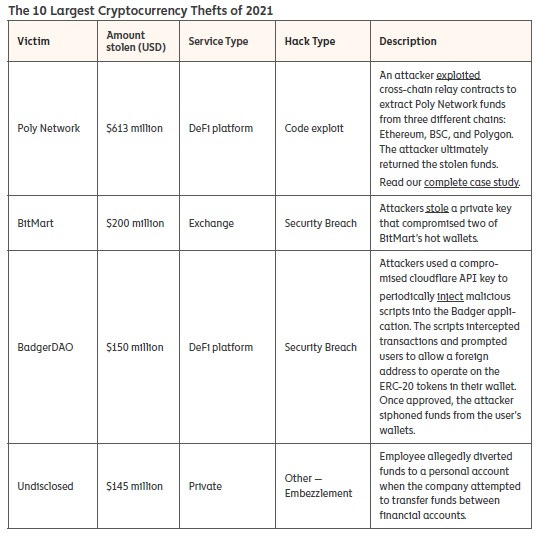

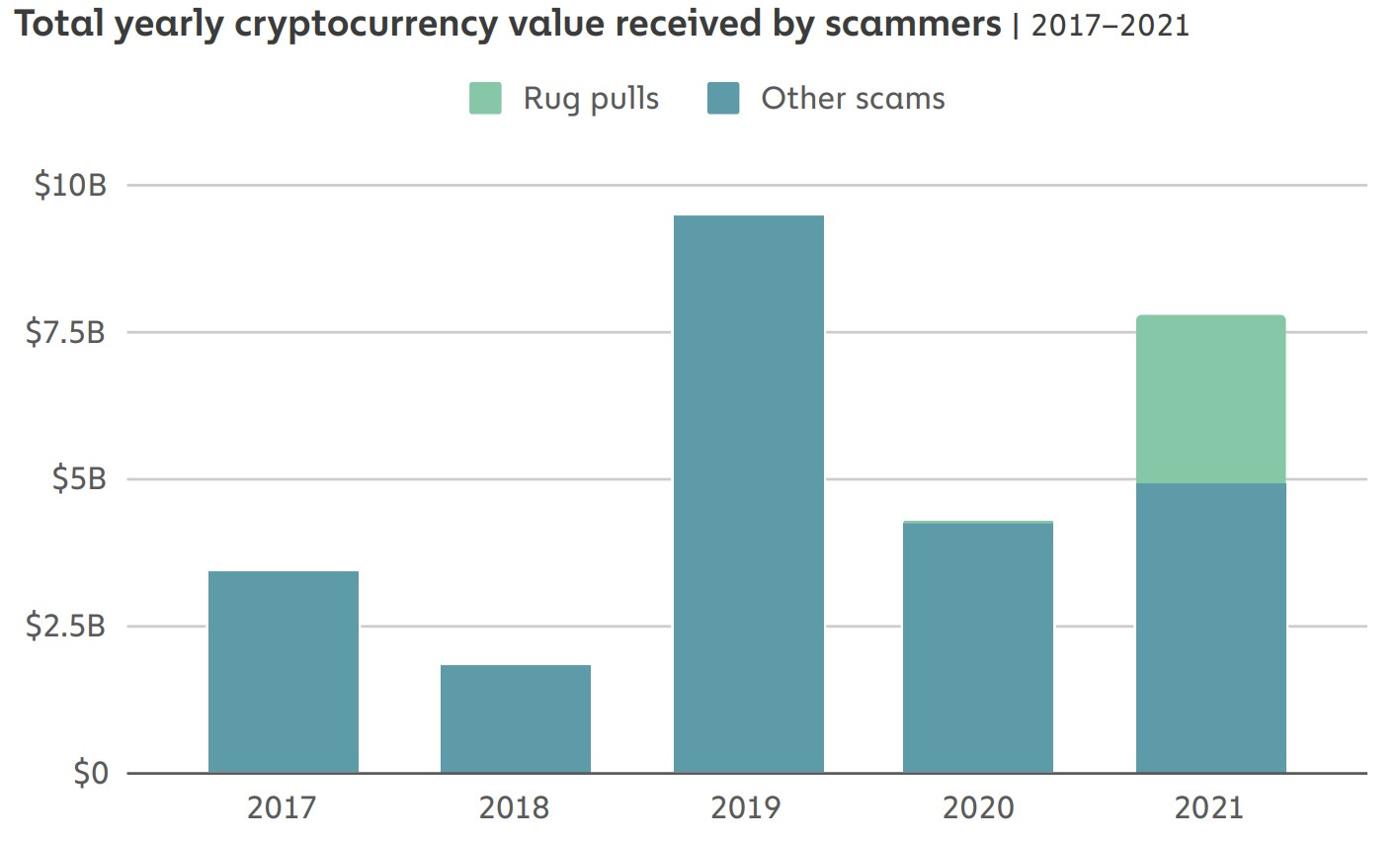

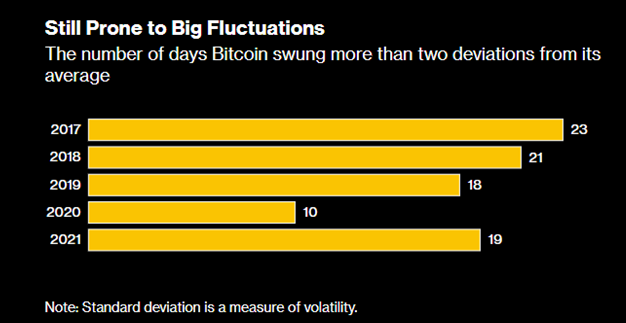

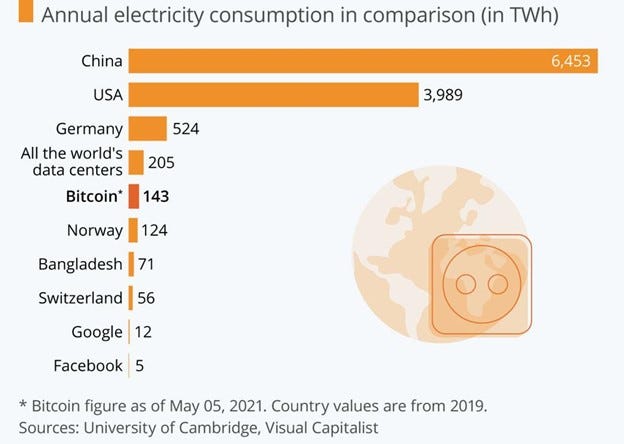

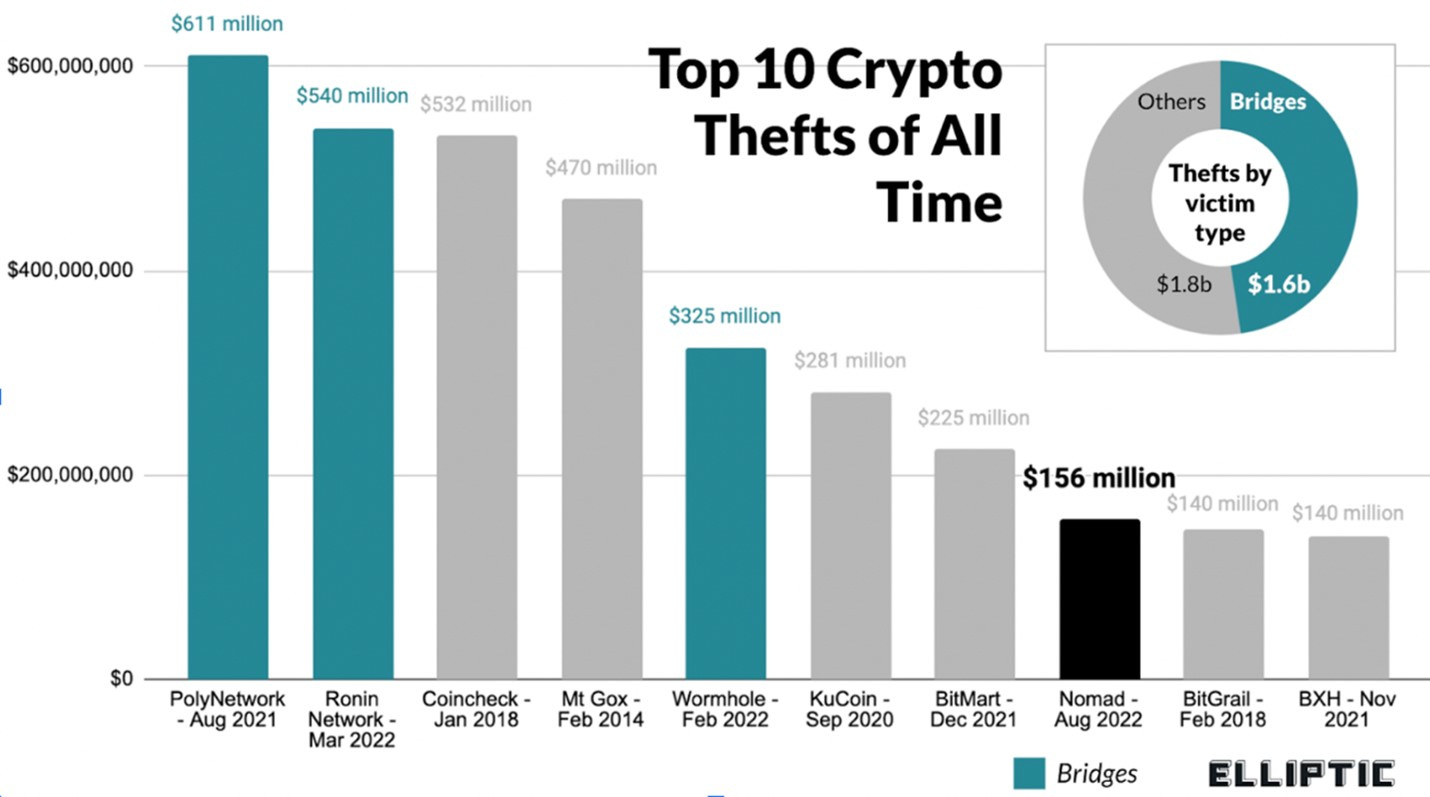

Problems with Web3: Web3 suffers from several unsolved problems including high fees, volatility, environmental concerns, poor user experience, limited interoperability and significant crime

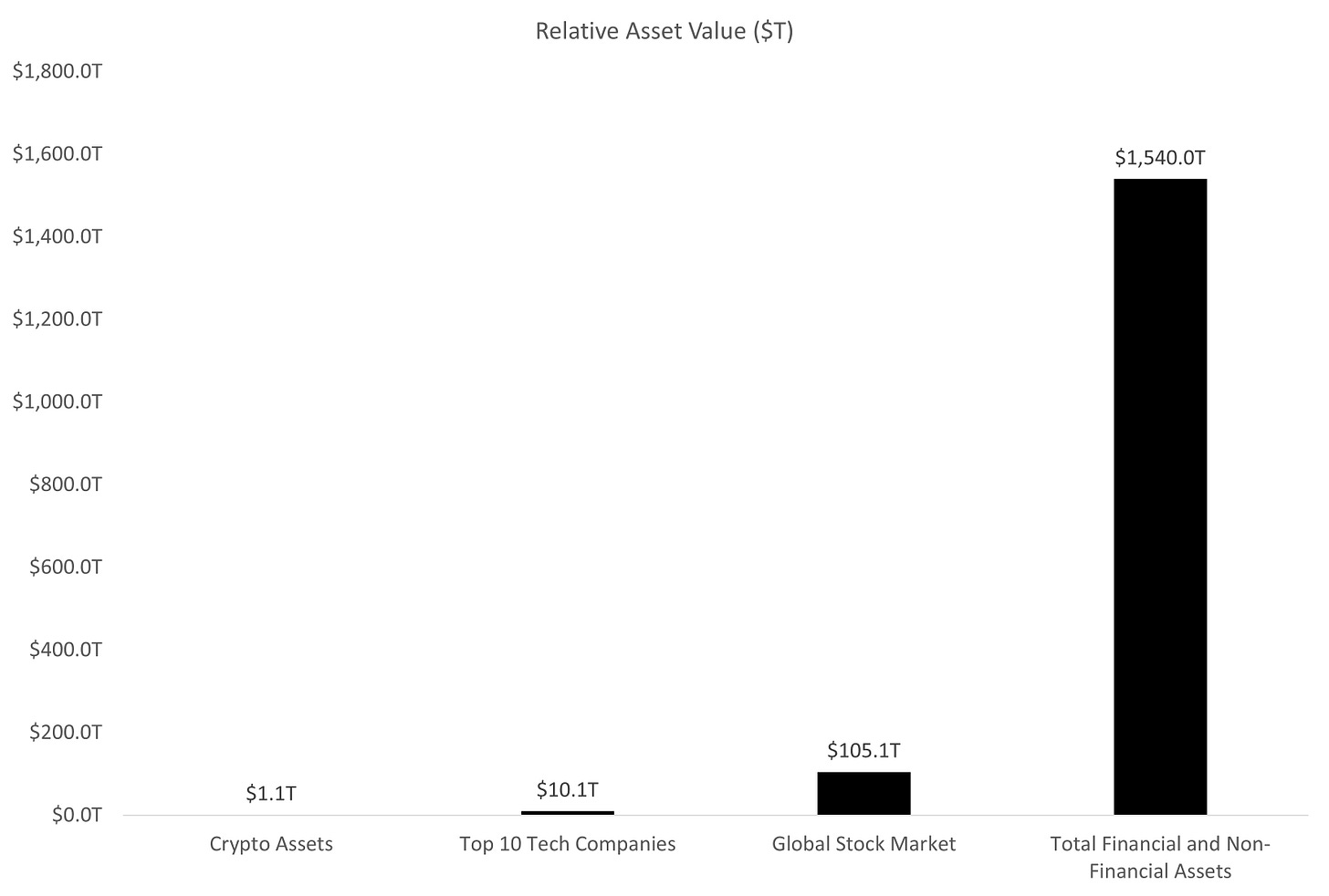

Why Web3 Will Eat The World: Web3 is a truly disruptive technology that has the potential to grow 100x or more.

Without further ado, let’s jump into the analysis!

What is Web3?

Few people truly understand the potential of Web3.

It’s not – as most people think – simply the “next version of the internet”. Instead, it’s creating the world’s first autonomous digital nations.

Seemingly disparate verticals such as cryptocurrencies, DeFi, NFTs, smart contract platforms and DAOs will combine to form the building blocks of “borderless” economies that operate outside of the purview of the existing financial, legal and political ecosystem. These new organizations can eliminate many of the costs, restrictions and regulations that hamper us today, and may also help overturn centuries of inequality and economic oppression.

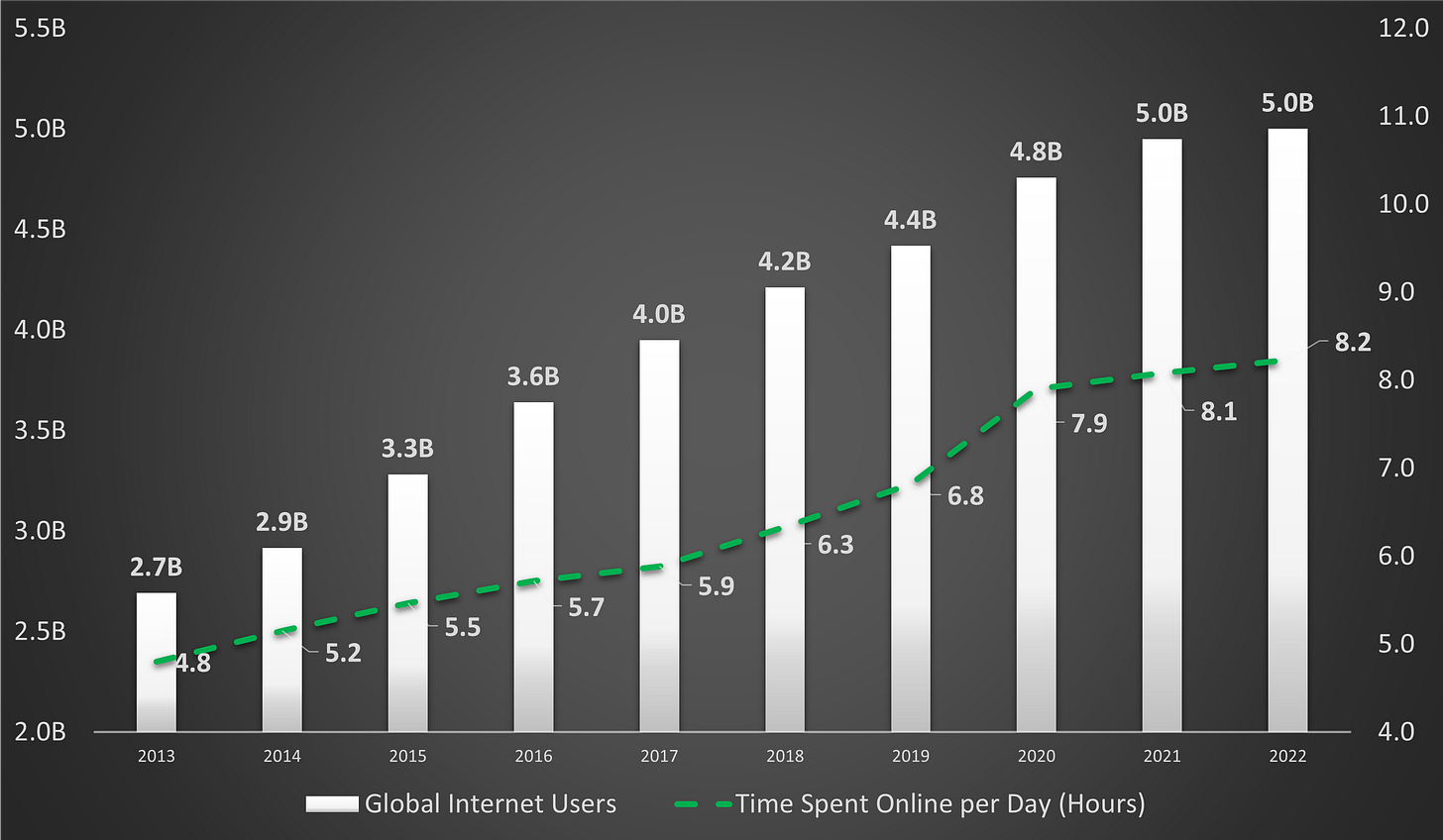

To understand why this is so relevant now, consider the fact that we are becoming a digital species. Over 5 billion people use the internet and the average American spends more than 8 hours online everyday (over 50% of our waking hours!). The technology has revolutionized information sharing, communication and connectivity, becoming arguably the most efficient system for organizing people that has ever existed.

5+ Billion People Use the Internet, Spending an Average of 8 Hours Online per Day

Despite all this, the internet is still a vassal to legacy economic systems. It is almost entirely controlled by third parties – we make transactions in national currencies such as the US Dollar, digital goods are created and controlled by companies such as Google, Amazon, Facebook and Apple and the space is subject to a patchwork of local laws and regulations – such as the European Union’s GDPR or China’s Great Firewall.

The technology behind Web3 changes all of this, and allows us – for the first time in history – to create fully sovereign, self-sufficient online economies with their own:

Money: Cryptocurrencies will replace national, fiat currencies as the new nation’s money

Financial System: DeFi will replace banks as the native financial system

Native Goods: NFTs – assets which are entirely created, used and owned online – will become the native goods of this new economy

Laws: Smart Contract Platforms will replace local administrations and legacy legal systems as the governing law

Corporations: DAOs will replace corporations as the primary economic entities

The potential for this shift is massive, as liberating the trillions in value created by the internet into its own sovereign entities could change the world in ways we can’t even imagine.

The Problem with Centralized Economies

Our current political-legal-economic infrastructure is highly centralized and still relatively autocratic.

National governments are the only entity with the power to create laws and issue currencies, banks control the money supply and flow of capital and large corporations have a near monopoly on the production and sale of most goods and services.

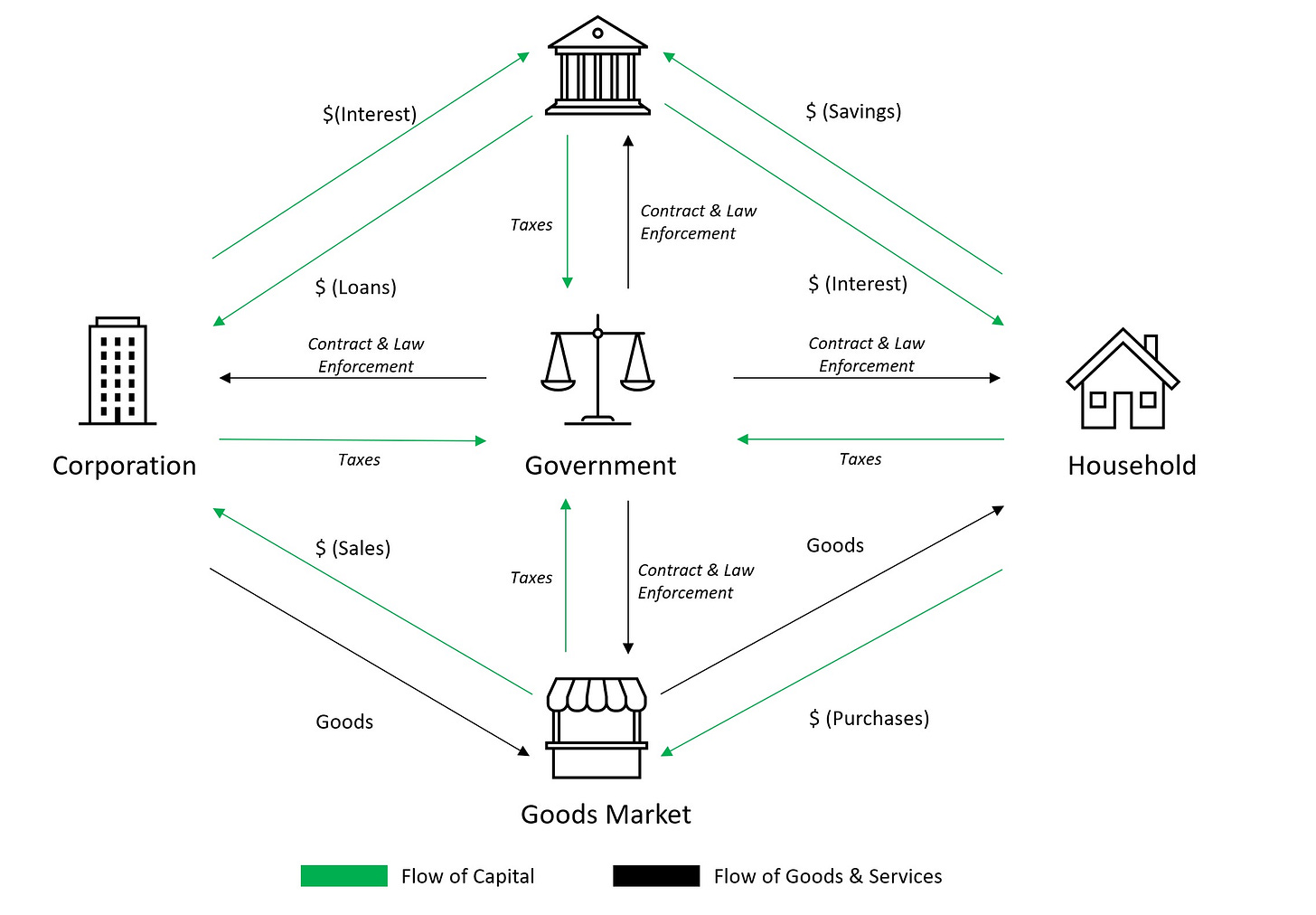

Governments, Banks and Corporations Have a Monopoly on the Economy

Unlike many in the crypto space, I don’t hate this system. In fact, I think that it has served us remarkably well and has undoubtedly been a key driver of prosperity over the few centuries. Governments provide security and help establish trust through laws and regulation, the international financial sector facilitates growth via trade and the international flow of investment capital and corporations help coordinate the production and distribution of goods and services.

But, like any centralized system, our current infrastructure has its issues. It’s bloated, byzantine and draconian and – worst of all – it consolidates power in the hands of the few. This leads to numerous problems including:

Expensive and Inefficient: Governments, banks and large corporations are highly inefficient. Hierarchical layers slow communication and new ideas must often pass-through multiple rounds of approval before being implemented. To make matters worse, armies of bankers, lawyers, accountants, executives and bureaucrats are required to maintain the system, costing an estimated $7 trillion a year in the US (or 35% of GDP)

Potential for Corruption: Even the best centralized economies are notoriously opaque. We aren’t privy to many of the internal decisions of our government, corporations are only required to share certain types of information on an intermittent basis and – as the financial crisis of 2008 proved – even the banks and regulators had little idea what was sitting on the balance sheets of our largest financial institutions. At best, this opacity is a recipe for negligence, at worst, it is a breeding ground for corruption

Seizure: In our current system, it’s debatable whether you really own your assets. Many governments can arbitrarily revoke citizenship, corporations can take your digital goods and banks can freeze and even seize your assets at will. While this may seem far-fetched, consider that in 2013, the Government of Cyprus seized 47.5% of all bank accounts over €100,000 to bail-out its failing banking system

Limited Access: The economic agents of nation-states are the ultimate gatekeepers. Gaining citizenship to many countries is often impossible and banks can decide whether they want you as a customer. While the latter is generally not a problem in the developed world, this is a huge issue in growing economies. Today, nearly 1.7 billion people remain unbanked simply because they aren’t profitable enough to be considered by global financial institutions

Limited Privacy: Our current system offers citizens very little privacy. Governments require extensive documentation, banks must collect detailed personal information to adhere to KYC, AML and CFT regulations and companies such as Facebook own all the data you post. While in some cases this produces comical effects (such as a man learning from Facebook that he was going to be a father before his wife told him), it has also produced dystopian ones (such as Facebook illegally sharing user vast amounts of private user data with third parties in the Cambridge Analytica scandal)

Censorship: While many modern democracies have codified freedom of speech, this unfortunately doesn’t always apply to private institutions. Companies such as Twitter have full discretion over who can access its site and whom they can ban. To date, they have banned hundreds of thousands of people, including several high-profile users. This problem also isn’t limited to social media, as Apple recently banned Epic Games, the creator of the multi-billion dollar game Fortnite, from its App Store after a revenue dispute

Hidden Taxes: In addition to the taxes we pay to the federal government, citizens of many developed nation states are also subject to a variety of “hidden taxes”. For instance, banks often charge enormous fees on credit card transactions and international money transfers, and “Big Tech” often takes a large cut of revenues earned by artists and entrepreneurs. For instance, Spotify garners 30% of the revenues from a song, and Apple often charges a 30% “tax” on every sale made through their App Store

Lack of Interoperability: Many players in the economic ecosystem of modern nation-states operate as “walled gardens”, limiting the interoperability between financial institutions and technology companies (i.e. an app built for Apple’s App Store will rarely work on Google). This makes it difficult to even transfer assets between entities let alone share and collaborate on new technologies and products

Together, these concerns represent a major problem. Not only do they limit growth, but they also continue to drive inequality.

So why do we tolerate these inefficiencies? Well, we don’t really have a choice due to what is known as the Byzantine General’s Problem. While I’m oversimplifying a bit, this concept basically states that large groups of humans can’t trust one another or coordinate across vast distances without using centralized third parties (such as governments, banks or corporations) to establish trust. For example, when a stranger sends you money online, you must rely on your bank to ensure that 1) they are whom they say they are and 2) they have the money they say they have and 3) they actually send it.

The Benefits of Decentralized Economies

This all changed in 2009 when Satoshi Nakamoto invented Bitcoin, solving the Byzantine General’s Problem and setting off a chain of events which made the concept of “decentralization” possible.

While the mechanics of this invention will be discussed more below, the key thing to remember is that he (or she) combined three technologies - blockchains, public and private key cryptography and consensus mining – to create a system that could autonomously authenticate economic actors, verify their funds and guarantee the completion of a transaction.

In effect, for the first time in history, Satoshi made it possible to create an economy that doesn’t rely on third parties such as corporations, banks, governments or courts to function.

Web3 Economies don’t Require Banks, Governments, Courts or Corporations to Function

The effect of this cannot be overstated and requires a bit of tabula rasa thinking. Imagine for a bit, how you would design an economy if you no longer needed intermediaries:

After all, what’s the point of relying on central banks and treasury departments if you can issue your own money and control the supply?

What’s the point of banks if you can safely hold your own assets, raise your own funds and orchestrate your own lending and borrowing protocols?

Why do we need Big Tech if we can create and own our own digital goods?

Why do we need to rely on local governments and courts if we can enforce our own laws through smart contracts?

If you’re like me, you’re probably envisioning something much simpler and more elegant than what we have today…

In short, an economy without unnecessary middlemen.

This, my friends, is Web3. And it may allow us to reap all the benefits of a traditional economy – namely trust, security and growth – while removing most of the downsides. Indeed, Web3 is:

Fast and Efficient: Web3 operates almost entirely via computer programs which automate the execution of all transactions. As such, there’s no need for intermediaries such as bankers, regulators, lawyers, accountants, executives or government bureaucrats – making the system much faster and cheaper

Transparency: Every transaction in Web3 is broadcast to the public allowing for real-time monitoring and maximum transparency. In addition, protocols are built with open-source code allowing any user to audit them, greatly reducing the threat of corruption and serving as a safeguard against negligence

Seizure-Proof: In Web3, you control your assets. Instead of relying on banks, governments and corporations, you hold your funds, identity and digital goods in your own digital wallet. As such, there’s no one to seize your assets, limit withdrawals or tell you where you can and can’t spend your money

Permission-Less: No one can stop you from accessing Web3. Anyone with an internet connection can participate in markets that are open 24 hours a day, 7 days a week and 365 days a year

Borderless: Web3 has no borders. Users can store millions (or more) on a thumb drive or online wallet (not recommended) and go anywhere they please. They can send money to relatives living abroad, perform cross-border transactions and invest in foreign companies without having to pay outrageous fees or navigate a labyrinth of international laws

Private: Web3 is designed so that users have complete ownership of their data – in fact, it’s completely possible (and often preferred) to navigate Web3 in a completely anonymous fashion

Eliminates Censorship: No one in Web3 can censor you. Anyone is free to upload any content, no matter how controversial, to any platform they so choose

Permanence: Because a decentralized internet is hosted on thousands of devices across the world, it’s very resistant to failures and almost impossible to shut down (unlike traditional nations, digital states can’t be conquered with tanks, bombs or guns)

More Money for Artists: Artists, musicians, game developers and entrepreneurs could increase their profits by an order of magnitude when we remove the current gatekeepers of the web. In fact, we are already seeing this take shape, as some Web3 services such as Audius (a decentralized version of Spotify) increase a musician’s share from 12% to 90%!

More Money for Consumers: Users will be able to choose whether they want to be paid for creating content or sharing their data and they will also have the right to sell the virtual goods that they earn online. We already saw this happen last year in the Philippines, where many citizens made more money selling the digital assets they earned playing the blockchain-based game Axie Infinity than they would have from working full-time as a teacher, construction workers or office assistant

Interoperability: Web3 protocols are built to be composable, that is, they can be programmed to work with one another allowing users to build increasingly complex and novel products

I know this is a lot to take in. Crypto is so unique, so transformative, so unintuitive that I’ve been studying it for over six years now and sometimes I feel like I only partially get it.

But to help you understand more about how Web3 can transform the world, let’s go a bit deeper down the rabbit hole and learn how it works on a technical level…

How do Decentralized Economies Work?

As discussed, centralized systems exist because of the need to create trust. We trust banks to hold and transfer our money, governments to enforce contracts and laws and corporations to establish the legitimacy and ownership of digital goods.

Decentralized systems are so innovative because they allow us to do all of these functions without the aforementioned “middlemen”.

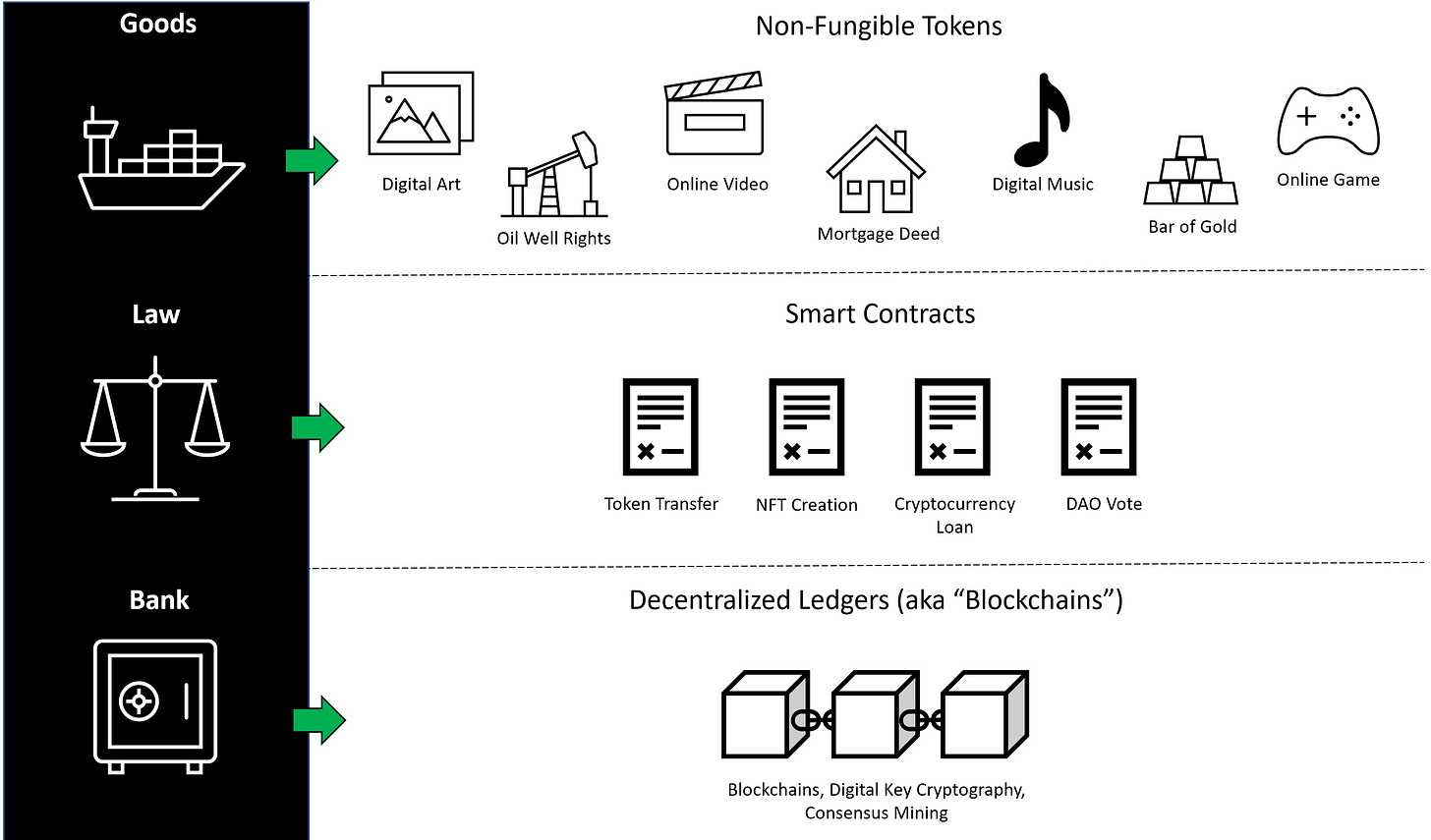

Decentralized Systems Provide the Money, Goods and Law of a Digital Nation

They do this by combining three separate innovations – decentralized ledgers, smart contracts and NFTs:

Decentralized Ledgers: Decentralized ledgers, often referred to as “blockchains”, serve as the “bank” of a decentralized economy. They are responsible for creating, storing and transferring money

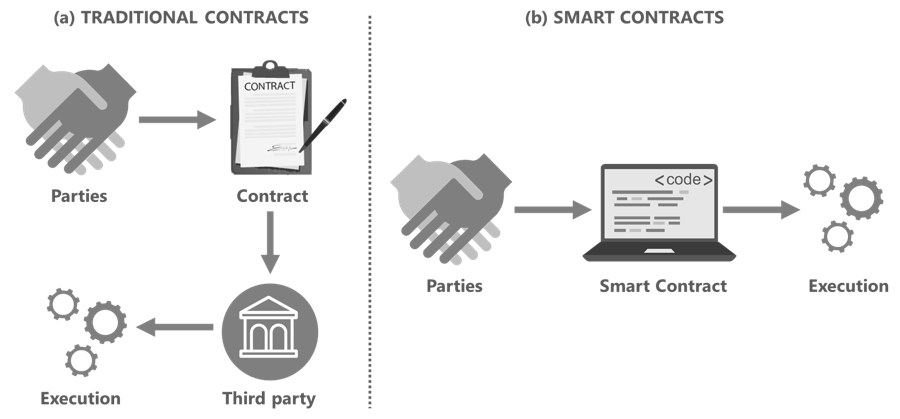

Smart Contracts: Smart contracts codify and enforce the “laws” of a digital nation. They are digital agreements that execute automatically when pre-determined conditions are met. Smart contracts operate on decentralized computers known as smart contract platforms (or “Layer 1 protocols”)

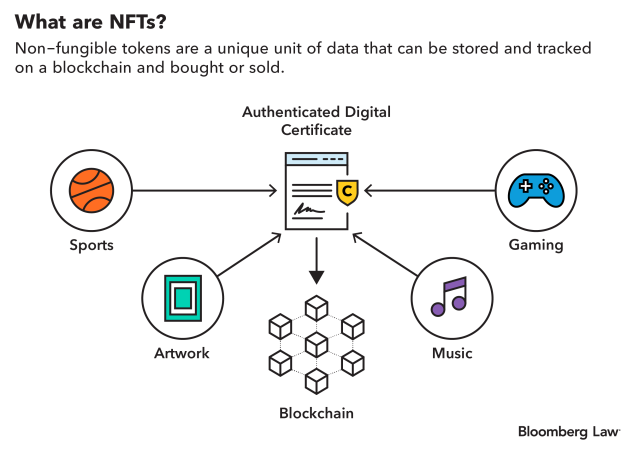

NFTs: Non-fungible tokens are the “goods” of a decentralized economy. They can represent digital assets (e.g. virtual land, digital art, music, games, videos, software), physical assets (e.g. gold, oil or real-estate) or intangible assets (e.g. voting rights, ownership stakes, membership privileges)

Let’s see how all of these tie together…

What are Decentralized Ledgers?

As discussed, decentralized ledgers serve as the “bank” of a digital nation. Bitcoin is the original decentralized ledger, invented in 2008 by a person or persons using the pseudonym Satoshi Nakamoto.

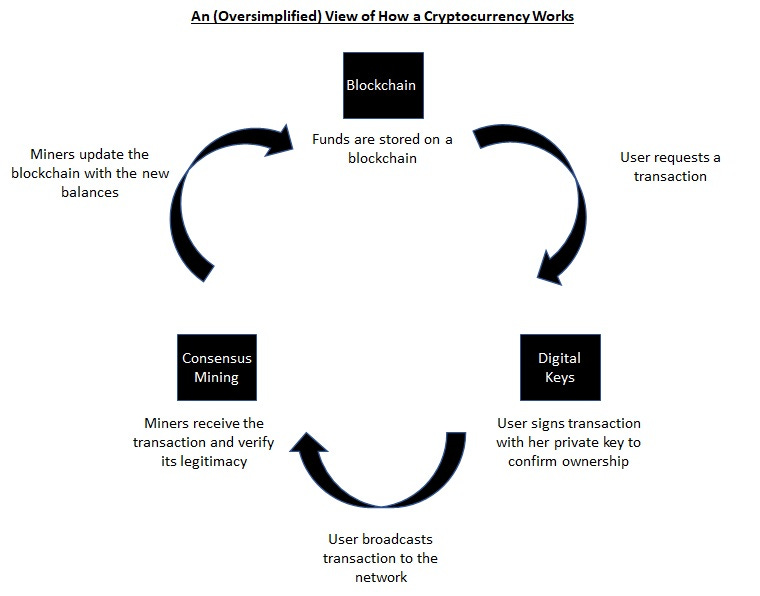

While often colloquially referred to as “blockchains”, these structures actually combine three different innovations – blockchains, digital key cryptography and consensus mining – to allow users to create, store and transfer assets.

To understand how this works in practice, imagine that Alice wants to buy a few bananas from Bob’s grocery store. She would historically rely on her bank to: 1) store her funds in a secure bank account, 2) provide her with a debit card to access these funds and 3) use auditors and accountants to ensure the transaction is legitimate and transfer the funds to Bob’s account.

Using decentralized ledger technology, she can perform all of these actions without relying on a bank:

Blockchains: Blockchains serve as the “bank account”. They are the distributed, immutable databases that store Alice’s assets

Digital Key Cryptography: Digital keys are the “debit cards”. They are cryptographic instruments that allow Alice to access her assets and send them to Bob

Consensus Mining: Miners are the “auditors” and “accountants”. They are random individuals that are chosen to ensure that the transaction is legitimate and update Alice and Bob’s accounts with the new balances

While often described as “trustless”, decentralized ledgers don’t eliminate the need for trust. Instead, they simply transfer that that responsibility from one, “centralized” party to hundreds or thousands of “decentralized” parties. This democratizes power – shifting it from the hands of the few to hands of the many.

Let’s take a deeper look into how blockchains, digital key cryptography and consensus mining work…

What is a Blockchain?

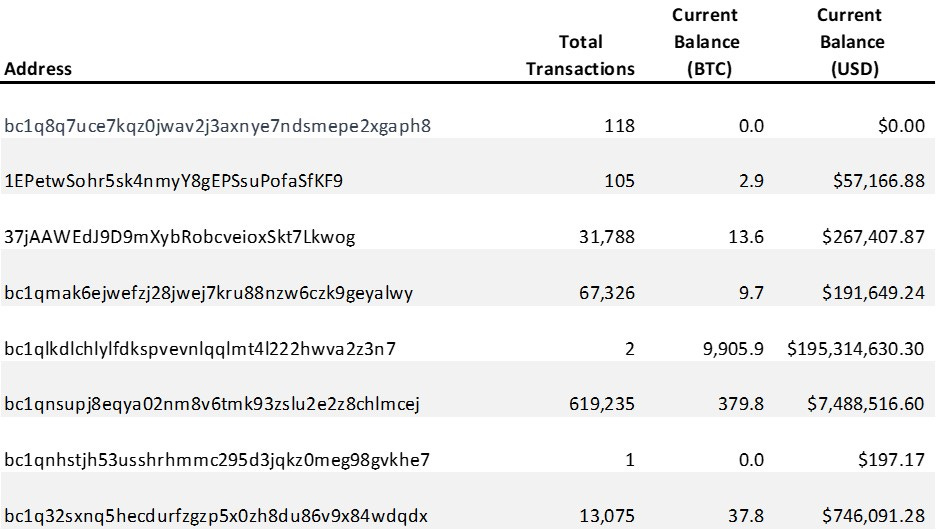

In many ways, a blockchain is similar to an online bank account. It is an electronic database that stores digital assets (such as cryptocurrencies or NFTs) along with a record of who owns them. For example, the Ethereum blockchain may have a record that says that account “0xb794f5ea0ba39494ce839613fffba74279579268” owns 10 Ethereum tokens and one Mutant Ape NFT.

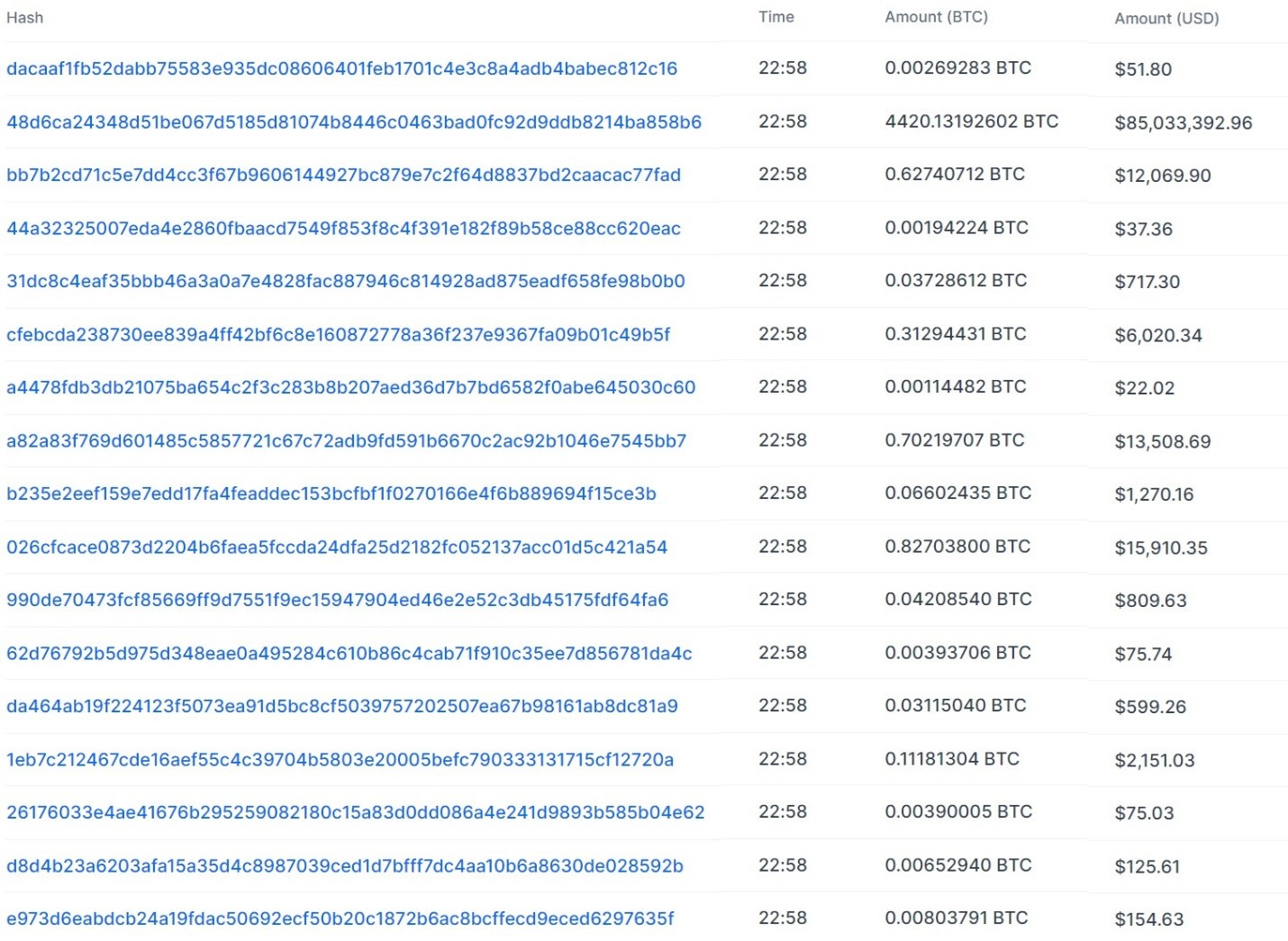

Database of Actual Balances on the Bitcoin Blockchain

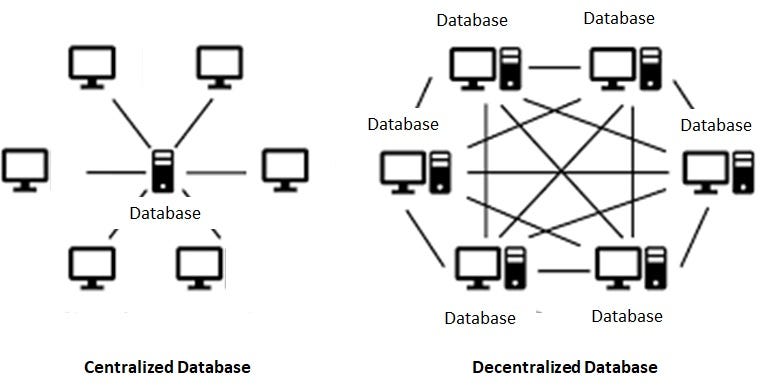

Unlike a traditional bank account, however, blockchains are distributed and decentralized:

Distributed: Instead of being hosted in a single location, they are hosted across thousands of individual computers located all over the globe

Decentralized: Blockchains are not controlled by any one party

Let’s take a look at each of these concepts…

How is a Blockchain Distributed?

Unlike traditional databases that live in a geographically centralized “server farms” (such as the ones owned by Amazon or Google), decentralized ledgers are hosted across thousands of individual computers located all over the globe.

These computers are called “nodes”, and they each contain an identical copy of the account balances and transaction history of a blockchain’s database.

Decentralized Ledgers are Distributed Across Thousands of Individual Computers

This distribution is very important because it means that: 1) it’s almost impossible for a third party to turn them off, 2) they are extremely resilient to hardware failures and 3) practically speaking, a distributed architecture is needed to design a decentralized system.

How is a Blockchain Decentralized?

Traditional banks have always been trusted to protect consumer’s assets.

In the old world they did this by storing money in secure vaults and defending it with armed guards. In the information age – where over 92% of money exists only in digital form – they do this with an army of accountants, auditors and cybersecurity experts. These professionals monitor accounts, check for fraud and assure that no one hacks the system and manipulates account balances.

Unlike traditional bank accounts, blockchains can’t rely on an in-house staff to safeguard a user’s assets and assure that no one tampers with the balances. Instead, they rely on a process known as “hashing” to protect the books.

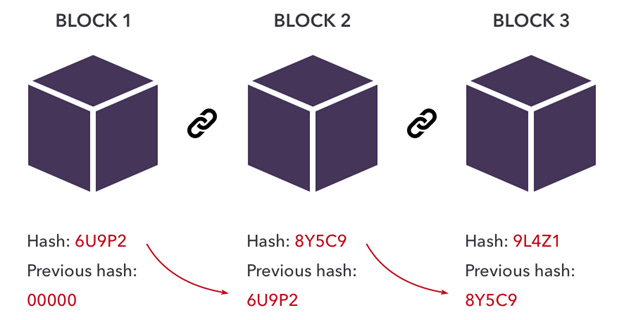

To initiate the hashing process, blockchains organize all incoming transactions into groups known as “blocks”. These blocks have a limited storage capacity, so when they become full, they are locked and linked to the previous block with a “hash”. This forms a chain – hence the name, blockchain.

These hashes are extremely important because they make blockchains immutable – that is, data (such as your Bitcoin or Ethereum balance) can’t be deleted, tampered with or changed once it is locked into the chain.

This is due to the unique properties of hashing, a cryptographic process that takes a given set of information and converts it into a unique code. For example, the word “fox” could be hashed as DFTY786DCFJ894SUSH865AAHJAI978 and the sentence “the quick brown fox jumps over the lazy dog” could be hashed as SOIAUYA7865ASLUAN098A5489USYAN. There are three important things to note about hashes:

Virtually anything can be hashed (i.e. you can hash a word, a sentence or the entirety of War and Peace)

Hashes are always unique (i.e. if you changed a single letter in War and Peace you would get a completely different hash)

It’s impossible to guess the original data from looking at the hash (i.e. you wouldn’t know that DFTY786DCFJ894SUSH865AAHJAI9785 was “fox”)

Because all new blocks are required to store the hash of the previous block, it’s easy to see if the blockchain has been tampered with. If the hash contained in the new block matches the old, you know that the data is secure. If they are different, everyone will know that the block has been manipulated.

What is Digital Key Cryptography?

Digital keys are the “debit cards” of the blockchain ecosystem in that they allow a user to prove ownership, access their account and control their assets.

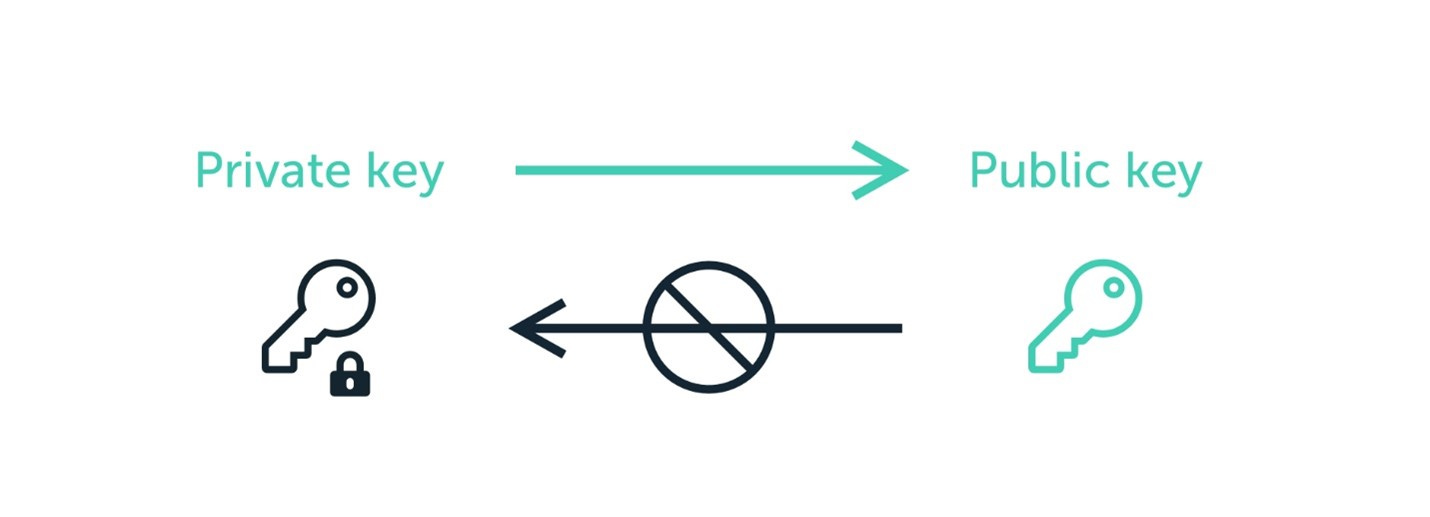

In reality, digital keys are nothing more than long strings of numbers (256 bits long for Bitcoin) that always come in pairs – a public key and a private key:

Public Key: A public key is similar to a bank account number as it serves as your address on a cryptocurrency network. For example, instead of recording that “Alice owns 2 BTCs”, the Bitcoin blockchain would record that “1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2 owns 2 BTCs”

Private Key: A private key is similar to a secret PIN code that allows users to access and control this account

Every public key has only one private key, and – like a key and a lock – they are linked through cryptography. The important thing to note about this link is that it only flows one way. Although one can always access a public key with a private key, it’s mathematically impossible to do the reverse.

It’s Impossible to Decipher a Private Key from a Public Key

This one-way logic forms the basis of cryptocurrency transactions. For example:

To Receive Funds: In order to receive funds, a user would share his public key with the sender, who would deposit the money in that address. Because it’s impossible to decrypt a private key from the public key, this is completely safe (and necessary).

To Send Funds: In order to send funds, a user would use her private key to “unlock” her public key on the blockchain to authorize the transfer of the money. Again, because it’s mathematically impossible for anyone but the holder of the private key to do this, the blockchain can be sure that this person owns the funds.

In practice, users rarely see either their keys, as they are often stored inside digital wallets and managed by software (i.e. you just click buttons that say “send” and “sign” on a wallet such as Metamask and the application does the rest for you).

What is Consensus Mining?

Centralized networks, such as banks, have a small army of bookkeepers, accountants and auditors to process transactions.

While decentralized networks can’t rely on an in-house staff, they can leverage a distributed group of users known as “miners” for a similar purpose.

Miners are the de facto auditors of decentralized platforms. They are responsible for processing the output of transactions, confirming asset ownership, ensuring there is no fraud and updating the blockchain with the new results. Unlike auditors at a traditional bank, almost anyone can be a miner – there’s no hiring process, no location requirements and miners don’t even have to disclose their identity (in fact, most miners are completely anonymous).

As such, most decentralized platforms have thousands of miners located all over the world that can validate transactions.

While this seems like an elegant solution to the problem of centralization, it raises a few concerns. In particular: how can we trust the miners? How do we know that they won’t abuse their power and send a bunch of money to themselves or their friends?

The answer is surprisingly simple – we use economic incentives to reward good behavior and punish bad behavior.

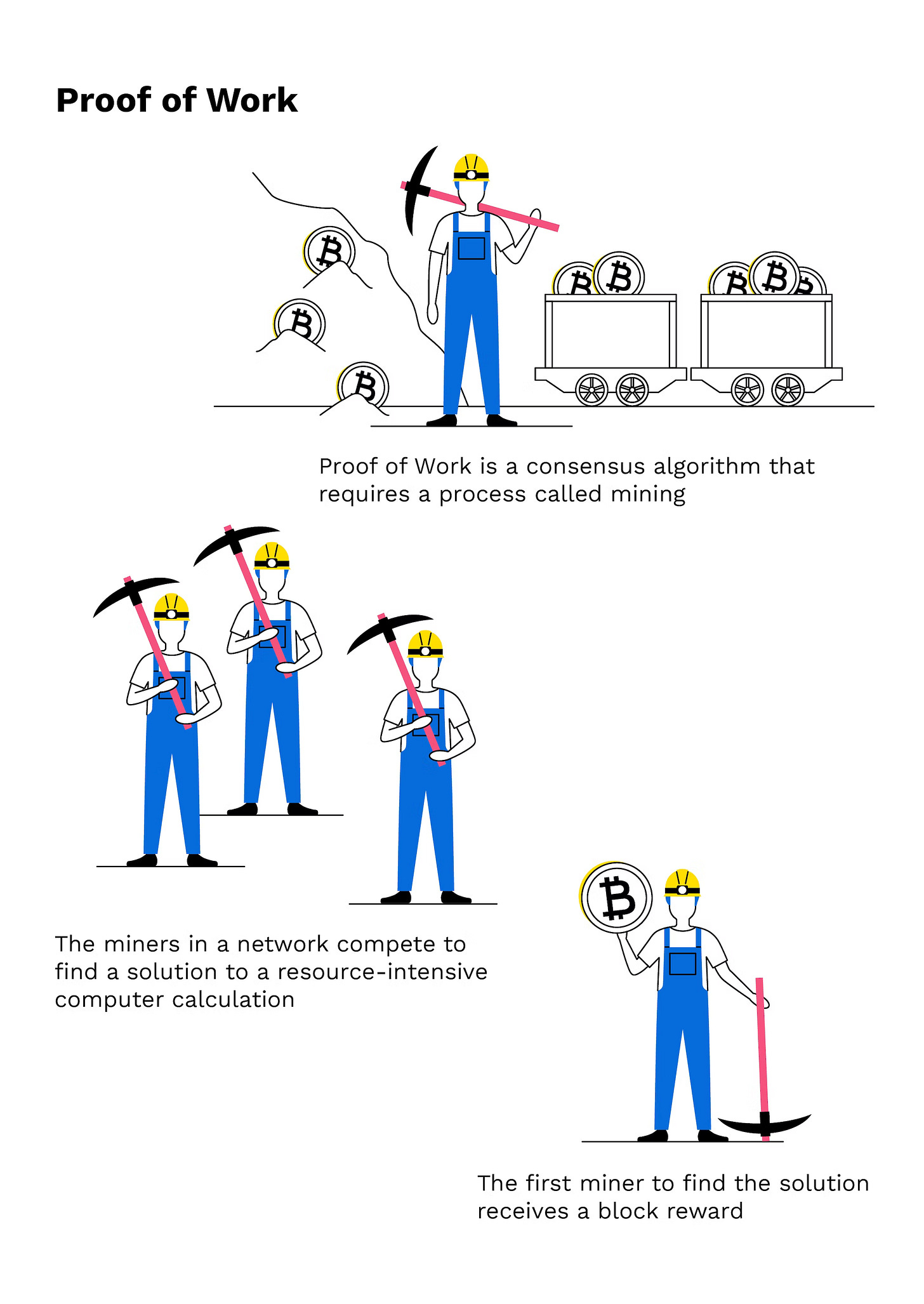

While there are several incentive schemes, the most popular– used by both Bitcoin and Ethereum – is known as “Proof of Work”.

Overview of Proof of Work Mining

Proof of Work requires miners to solve an extremely difficult math problem to earn the right to validate new blocks. This problem is so difficult that it can only be solved by random guessing. As such, miners often employ dozens to hundreds to thousands of computers to make millions of guesses, hoping that one of them gets the correct answer.

This uses a lot of electricity, and therefore effectively costs miners a lot of money to “bid” on the right to validate transactions (it’s not uncommon for a miner to spend tens to hundreds of thousands on electricity costs before successfully mining a block).

Once a miner solves the puzzle, she will then update the blockchain with the new transactions and send it to the other miners on the network for approval.

If she did everything correctly, the network will accept the new block and she will receive a reward (the current rewards are ~$4K for mining an Ethereum block and ~$180K for mining a Bitcoin block).

If, however, she tries to cheat the system, it would be painfully obvious to everyone – the aforementioned hash would be broken and the new block wouldn’t connect to the old one. As such, the network will reject the new block, causing the miner to not only lose out on the rewards, but also waste money on electricity costs.

So, at the end of the day, the network is secured by economic incentives and game theory – a miner who acts appropriately could receive hundreds of thousands of dollars in rewards, while one who attempts to cheat the system will almost certainly be left with nothing but a huge electricity bill.

Note: Ethereum is switching to a different consensus mechanism – known as Proof-of-Stake – in mid-September 2022. You can learn more about Proof-of-Stake in the article: “The Complete Beginner's Guide to Smart Contract Platforms”.

How to Read a Decentralized Ledger

As discussed, one of the cool things about decentralized ledgers is that everyone can view every single transaction in real time. For instance, if you go to the Blockchain.com Bitcoin explorer, you will see all of the given transactions at any moment.

Transactions on the Bitcoin Network at 10:58PM on September 7th, 2022

If you click into any of these transactions, you will see details on who is sending the funds, how much they are sending and who is getting paid. Ledger provides a great graphic and writeup explaining this:

Details of a Specific Bitcoin Transaction

Let’s dig into each:

Transaction ID: The “hash” represents the unique ID of each transaction. You can always save this number to look up the specific details later

Sender: This shows the public address of the person sending the BTC and how much they are sending

Fees: Shows the fees associated with the transaction

Receipient: This shows the public address of the person or persons receiving the BTC and how much they are receiving. Note that there is a particular technical quirk of Bitcoin that requires them to send all of your Bitcoin everytime you make a transaction and then send the unused amount back to you. So if Alice had 10 BTC and wanted to send 1 BTC to Bob, she would actually send all 10 BTC out, 1 BTC would go to Bob and the remaining 9 BTC would go back to her.

Transaction Status: Transactions often take several minutes to clear, so this section will often read “unconfirmed” until the transfer goes through

While all blockchains have slightly different formats, virtually every one has a public “block explorer” where you can view the transaction history (e.g. Ethereum’s is at etherscan.io).

Again, the ability for anyone to do this is groundbreaking in that it allows us to create highly transparent organizations that greatly reduce corruption and fraud. Imagine, for instance, if we could see where every dollar our government spent went today!

Even today, authorites are using these public block explorers to track (and often recover) stolen funds from cryptocurrency hacks.

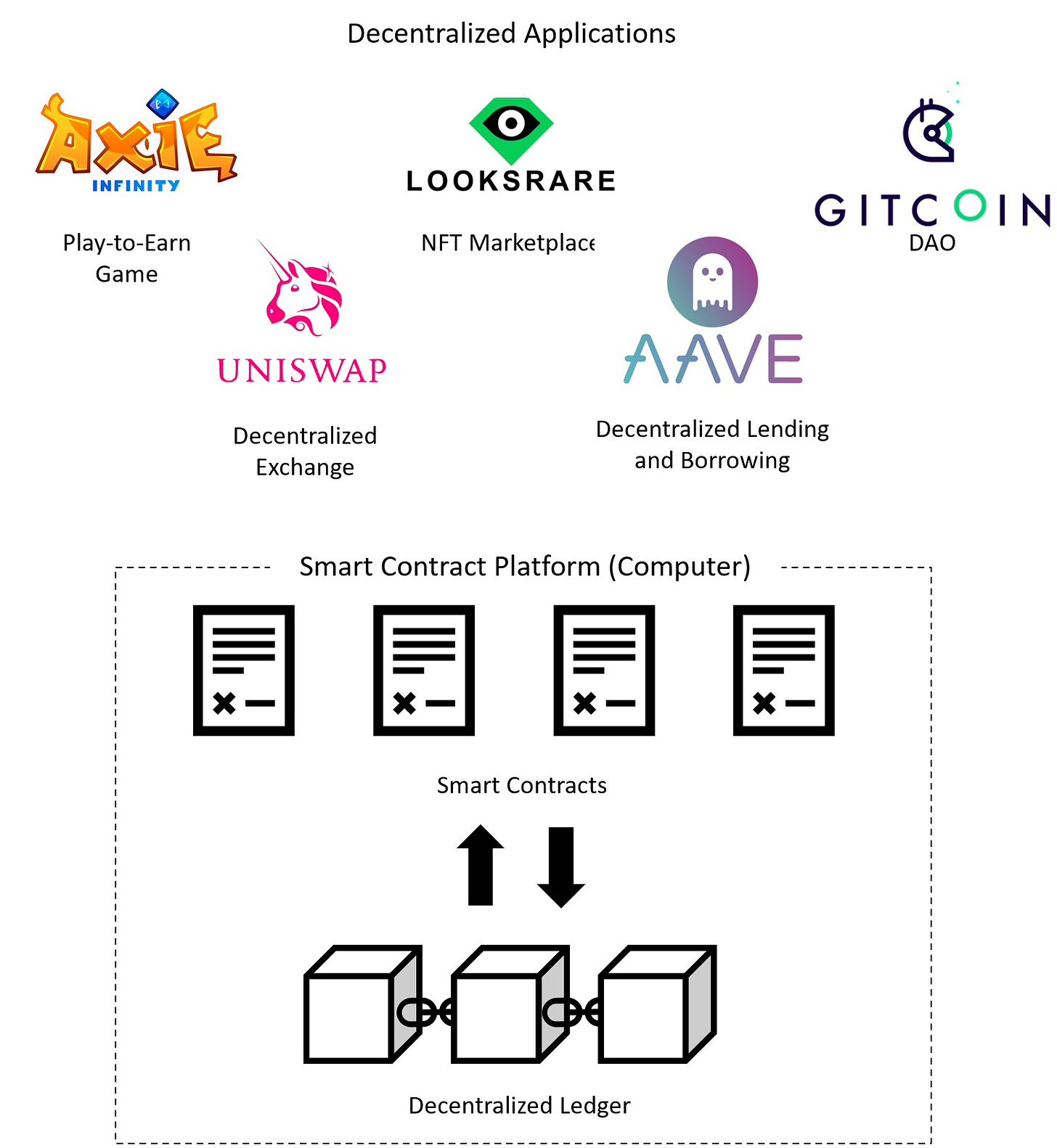

What are Smart Contract Platforms?

Smart contracts codify and enforce the “laws” of a decentralized economy.

Introduced with the launch of Ethereum in 2015, they represent a significant advancement in decentralized ledger technology.

The first blockchains – such as Bitcoin – required users to manually perform all transactions. For instance, if Alice made a loan to Bob in Bitcoin, Bob would still have to manually access his wallet each month to send Alice the interest payments.

Smart contracts – digital agreements that execute automatically when pre-determined conditions are met – expand on the original idea of Bitcoin by creating a form of “programmable” money.

For example, one could program a smart contract to make recurring interest payments on outstanding debt, pay an employee each time she launched a new product or feature or honor a farmer’s drought insurance claim if the temperature exceeded a certain threshold.

Unlike traditional contracts, smart contracts don’t rely on corporations, banks, lawyers, courts or local laws to guarantee their enforcement. Instead, users trust the technology and its pre-programmed code to automatically execute when they’ve upheld their end of the deal.

Smart Contracts Don’t Need Lawyers, Brokers, Banks, Courts or Governments

Despite the fancy name, smart contracts are just software programs – snippets of code that execute a series of programmed instructions. As such, they aren’t limited to financial transactions or even “contracts” in the traditional sense.

As such, when combined with decentralized ledgers, smart contacts can form fully functional, decentralized computers known as “smart contract platforms” (or “Layer 1 protocols”).

These computers serve as the foundation of Web3. They set the rules for the ecosystem and allow users to create, store and trade cryptocurrencies and digital assets such as NFTs. Much like a traditional computer can host apps such as Airbnb, Uber, Facebook, Tinder and Netflix, smart contract platforms such as Ethereum can host a variety of decentralized applications such as Uniswap (cryptocurrency trading), Aave (lending), LooksRare (NFT creation and trading), Axie Infinity (a blockchain-based game) and can even be used to run entire decentralized businesses known as DAOs.

Smart Contract Platforms are Computers That Can Run a Variety of Decentralized Applications

Unlike conventional computer networks – which are run by centralized third-parties such as Facebook, Microsoft or Google – these platforms retain the same benefits of Bitcoin in that they are 1) distributed (i.e. simultaneously hosted by thousands of different computers all over the world) and 2) decentralized (i.e. not controlled by a single entity).

This gives smart contract platforms several unique benefits, including the fact that they are:

Democratic: No single party can control the network and tell users what they can and cannot do

Open to Everyone: You don’t need permission to use smart contracts and you can’t be blocked – anyone with an internet connection can access them at any time and from any location

Permanent: Because they are hosted on thousands of nodes scattered across the globe, no one can ever turn them off or shut them down

Immutable: Data recorded on a smart contract platform is permanent, and can never be changed or manipulated

Transparent: Everyone can see every transaction on a smart contract platform and easily audit things when necessary

Secure: Information is stored on a decentralized and distributed blockchain, meaning that no one can manipulate the data and there is no risk of information loss

Perhaps most importantly, smart contract platforms give us the ability to create truly autonomous digital nations.

Because they use decentralized ledger technology to store their own funds and smart contracts to enforce their own laws, smart contract platforms don’t need to rely on traditional intermediaries such as banks or courts. As such, they can largely operate outside of the purview of the existing financial and legal ecosystem, allowing them to eliminate many of the costs, restrictions and regulations imposed on conventional networks.

Indeed, as they like to say in cryptoland – “code is law”.

NFTs (Non-Fungible Tokens)

Non-fungible tokens function as the goods of a decentralized economy.

While the term can sound confusing, one of the easiest ways to visualize an NFT is as a digital “record of ownership”. In many ways it’s like the deed to a house, a car’s title or an artwork’s certificate of authenticity.

Instead of a physical piece of paper you can hold, however, this “certificate” is recorded on a blockchain, where it is linked to your digital address. This not only guarantees the legitimacy of the asset, but also proves that you own it.

Like real-world assets, NFTs can be bought, sold, traded and consumed via smart contract platforms.

An NFT is a Digital Certificate of Ownership for an Asset that is Secured by a Blockchain

NFTs can represent digital assets such as virtual land, music, digital art, games or software; tangible assets such as oil, real-estate or gold; or intangible assets such as ownership stakes, voting rights, content licensing or membership privileges. In fact, virtually any asset can be represented as an NFT as long as it is ownable and has value.

Each and every NFT is unique – in fact, the term “non-fungible” is just a fancy way of saying “unique” – and they run on the same underlying technology that powers traditional tokens such as Bitcoin and Ethereum. This gives them three important properties:

Proof of Authenticity: NFTs use cryptography to prove their authenticity. As such, they cannot be counterfeited and it is relatively simple to spot a fake NFT

Record of Ownership: They maintain a record of ownership on a blockchain, which cannot be altered, destroyed, removed or confiscated

Inalienable Rights: Owners can often do anything they want with their NFT – they can sell it, rent it, license it and / or create derivatives works

While the idea of digital goods is not new, NFTs are transformative because they completely change the underlying economic foundation of the internet.

Historically, most digital goods have been owned by centralized third parties such as Apple, Amazon, Facebook, Google and Microsoft and “rented“ to consumers.

For example, if you bought an in-game asset (such as the ultra-rare, $16,000, Dragon Slaying Sabre in the game Age of Wulin), you would need permission from the developer to sell it and you likely wouldn’t be able to transfer it to other games. In addition, the gaming studio could easily choose to arbitrarily restrict access to your items and / or decide to charge you enormous fees.

NFTs change the game because – for the first time in history – they allow consumers to truly own their digital goods. This eliminates the need for centralized third-parties and provides substantial benefits to all stakeholders.

The Web3 Ecosystem

As discussed, Web3 uses blockchain technology to create fully autonomous digital nations that can operate outside of the purview of the existing financial, legal and even political ecosystems.

Each of these nations have their own:

Money: Cryptocurrencies are the native currency of a digital nation. To paraphrase Abraham Lincoln, they are the money “of the people, by the people and for the people” as they can’t be seized, restricted or regulated by the government. To learn more about cryptocurrencies check out “The Complete Beginner’s Guide to Cryptocurrencies”

Financial Systems: DeFi forms the financial system of a digital nation. Decentralized banks can’t appropriate your assets, restrict or regulate your transactions, block you from becoming a customer, force you to share private data or charge outrageous fees. To learn more about DeFi check out “The Complete Beginner's Guide to DeFi”

Goods: NFTs are the native goods of a digital nation. They are the first and only virtual asset that can be truly owned by a consumer. Big Tech can’t confiscate your NFTs, dictate how you use them or charge you exorbitant prices for selling them. To learn more about NFTs check out “The Complete Beginner's Guide to NFTs”

Laws: Smart contract platforms create and enforce the laws of a digital nation. They are decentralized computers that aren’t controlled by governments, banks or corporations. Anyone can use them for any purpose and they can never be shut down or turned off. To learn more about smart contract platforms check out “The Complete Beginner's Guide to Smart Contract Platforms”

Corporations: DAOs are the “corporations” of a digital nation. Unlike a traditional corporation, no single person or group owns or controls a DAO and they largely operate outside of the purview of the existing financial and legal ecosystem. To learn more about DAOs check out “The Complete Beginner’s Guide to DAOs”

Web 3 Infrastructure

To understand how Web3 would work, we first need to understand how the internet works today.

Although the terms are often used interchangeably, the internet and web aren’t the same thing.

The internet is the physical infrastructure of computers and cables that powers the world wide web – a digital collection of webpages and apps that lives on this network.

In 2006, the late Sen. Ted Stevens was relentlessly mocked for saying that “the internet is a series of tubes”.

Ironically, Stevens was kind of right. At its core, the internet is nothing more than a collection of computers that are connected to each other through a global network of “tubes” (aka “wires”). In fact, that’s where the word comes from – interconnected networks.

These connections allow computers to “talk” to each other to do things such as 1) send an email, 2) get a website or 3) buy goods and services.

To understand how a decentralized internet works, let’s take a journey though the evolution of these computers and wires.

Pre-Web

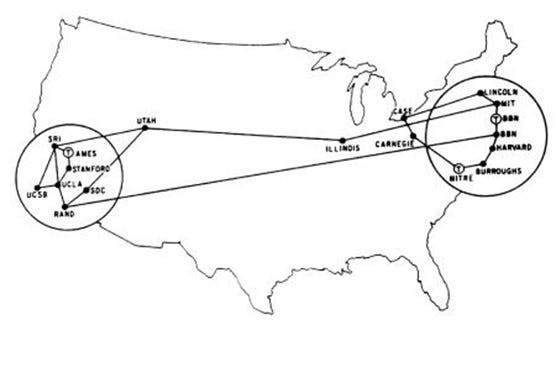

The internet was originally created by the United States Department of Defense as a messaging system that could withstand a first-strike nuclear attack.

The first versions, known as ARPANET, were decentralized – they were little more than groups of computers (fewer than 100 for most of the 70s) directly connected to one another through telephone lines.

The Internet in 1972 Connected a Handful of Computers Through Telephone Lines

While telephone lines proved sufficient for the early internet, they soon ran into problems.

Because computers think and communicate in 1s and 0s – a language called “binary” – all information is sent across the internet in this format. Each one or zero is called a “bit”, and 8 bits make up a “byte”. For example, in computer language the word “cat” translates to “01100011 01100001 01110100”, while a picture of a cat could contain millions of 1s and 0s.

These 1s and 0s can be transferred over a standard telephone line by transmitting alternating electrical pulses (1 if the pulse is on and 0 if it is off), but it’s not very efficient. Commonly known as “Dial-Up”, these networks were limited to 56 kilobytes per second (at that rate it would take over a minute to download a modern iPhone photo and 8 days to download a 4K movie).

As such, the infrastructure eventually expanded into new mediums with much faster speeds, including:

DSL (100 Mbps): DSL also transmits electrical pulses through existing copper phone wires, but it travels over previously unused frequency ranges, making it much faster than Dial-Up

Cable (1 Gbps): Cable companies can transmit electrical pulses through the same coaxial cables used to provide TV services

Fiber Optic (5 Gbps): Fiber optic cables use alternating pulses of light to represent 1s and 0s (light on for 1; light off for 0). They are the preferred medium for long-distance transmission, and 99% of international traffic is carried over fiber optic cables (most of them undersea)

Wi-Fi (100 Mbs – 1 Gbps): The internet also uses “Wi-Fi”, a wireless network that uses radio waves. By adjusting the frequency of these waves, networks also use the binary formula, sending one type of wave to represent a “1” and another to represent a “0”. Your smart phone is actually a radio!

Satellite (100 Mbps): Radio waves can also be used to send data to and from existing satellites

These evolutions increased the efficiency of the network and allowed for the creation of new paradigms such as the world wide web.

Web 1.0

For decades, the internet was primarily used as a messaging device. From the time the first email was sent in 1971 until the early 1990s, the vast majority of the internet’s traffic was text based and largely used for academic purposes.

This all changed when Tim Berners-Lee’s invented the world wide web.

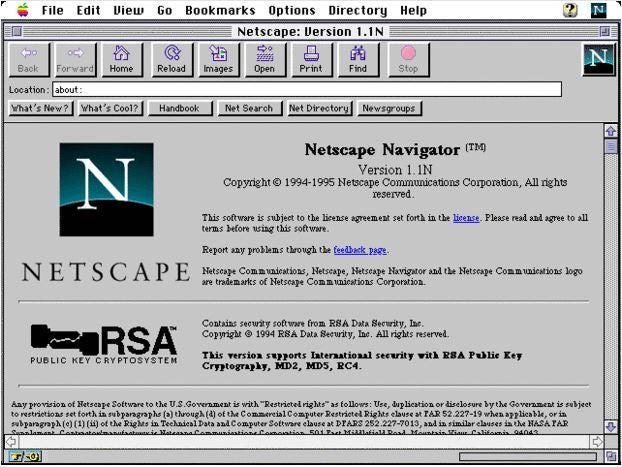

As the name suggests, the world wide web introduced the first websites to the internet in 1991. Over the next few years, thousands of pages were created that provided users with an alluring medium that allowed for the transmission of pictures, videos and audio. This effectively opened up the internet to everyday users, ushering in a new era of global communication and knowledge sharing.

Netscape Navigator was one of the First Web Browsers

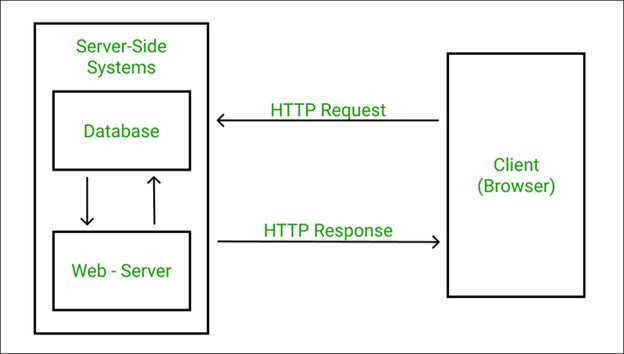

The web functioned by linking an interconnected system of webpages through a communication protocol known as the HyperText Transfer Protocol (or HTTP). HTTP creates a set of rules that allow individual computers to request and receive information from websites through a schema known as the client-server-database architecture.

HTTP Allows Individual Computers to Talk to Websites

As the name suggests, there are three key players in this system:

Clients: Clients are individually owned devices, such as personal computers, laptops, tablets or smart phones. Although they do have limited computing power, their primary function is to receive data and present it in a graphically pleasing format to the user (such as a website). Most websites are viewed through browsers (e.g. Google Chrome, Firefox or Safari) which are responsible for sending data requests to servers (and also responsible for receiving the data that is sent back).

Servers: Servers are large computers that have two primary functions: 1) they route data from client requests to the applicable database (and back again) and 2) they perform the complex logical operations that determine what data to show you on YouTube or Facebook.

Databases: Databases store data, which can be anything from photos on Facebook, to credit card number, to health records, to bank account information, to your personal shopping history on Amazon.

So when you want to access a website: your computer sends a request to a server to get information, the server forwards that request to a database, the database gathers the applicable content (e.g. text, videos, photos, comments, posts, tags, likes, etc..) and sends it back to the server, the server transfers it to your browser, and then your browser organizes everything into a visually pleasing format on your device. While this may seem complicated, it frequently happens in a fraction of a second (often literally at the speed of light).

Although revolutionary, the major problem with Web 1.0 was that the pages were “static” – like a newspaper or magazine, users could do little more than passively read what was displayed on the site.

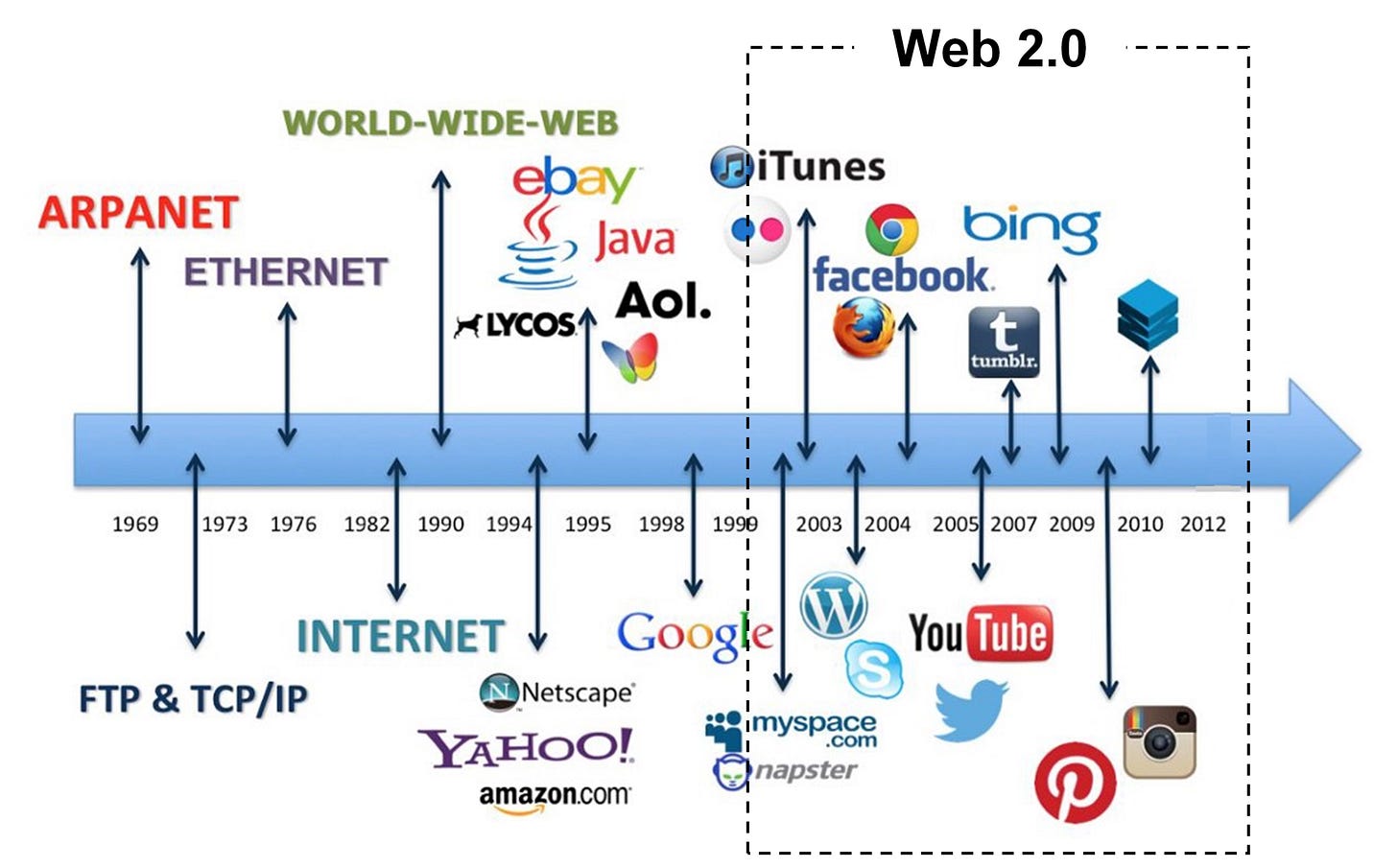

Web 2.0

The next major innovation in the web occurred in the early 2000s with the introduction of interactive webpages.

These sites provided a richer experience, allowed users to interact through social media and encouraged user-generated content. Popular Web 2.0 sites include social networks (Facebook), video sharing sites (YouTube), blogs (Medium), wikis (Wikipedia), microblogging sites (Twitter), and web applications (Google Docs).

Web 2.0 – the “Interactive Web” – Evolved in the Early 2000s

This new breed of website required a lot more storage and computing power to be successful and, as a result, we soon started to see the leaders in each of these categories – such as Facebook for social networking, Amazon for e-commerce, and Google’s YouTube for user-generated video – leverage economies of scale to break away from the pack and grab extraordinary market share.

Indeed, today it is estimated that four companies – Amazon, Microsoft, Google and Alibaba – own 67% of all major cloud servers and databases, and they hold many of them in a handful of locations known as hyperscale data centers (multi-hectare facilities designed to host thousands of “room-size” computers).

Map of Microsoft, Amazon and Google’s Data Centers

So in reality, the modern internet isn’t all that “global” as most of it is effectively stored in a few dozen locations owned by a small handful of companies.

Given that our modern economy runs off of data – we produce 28 trillion bytes every second – this should be a major cause for concern…

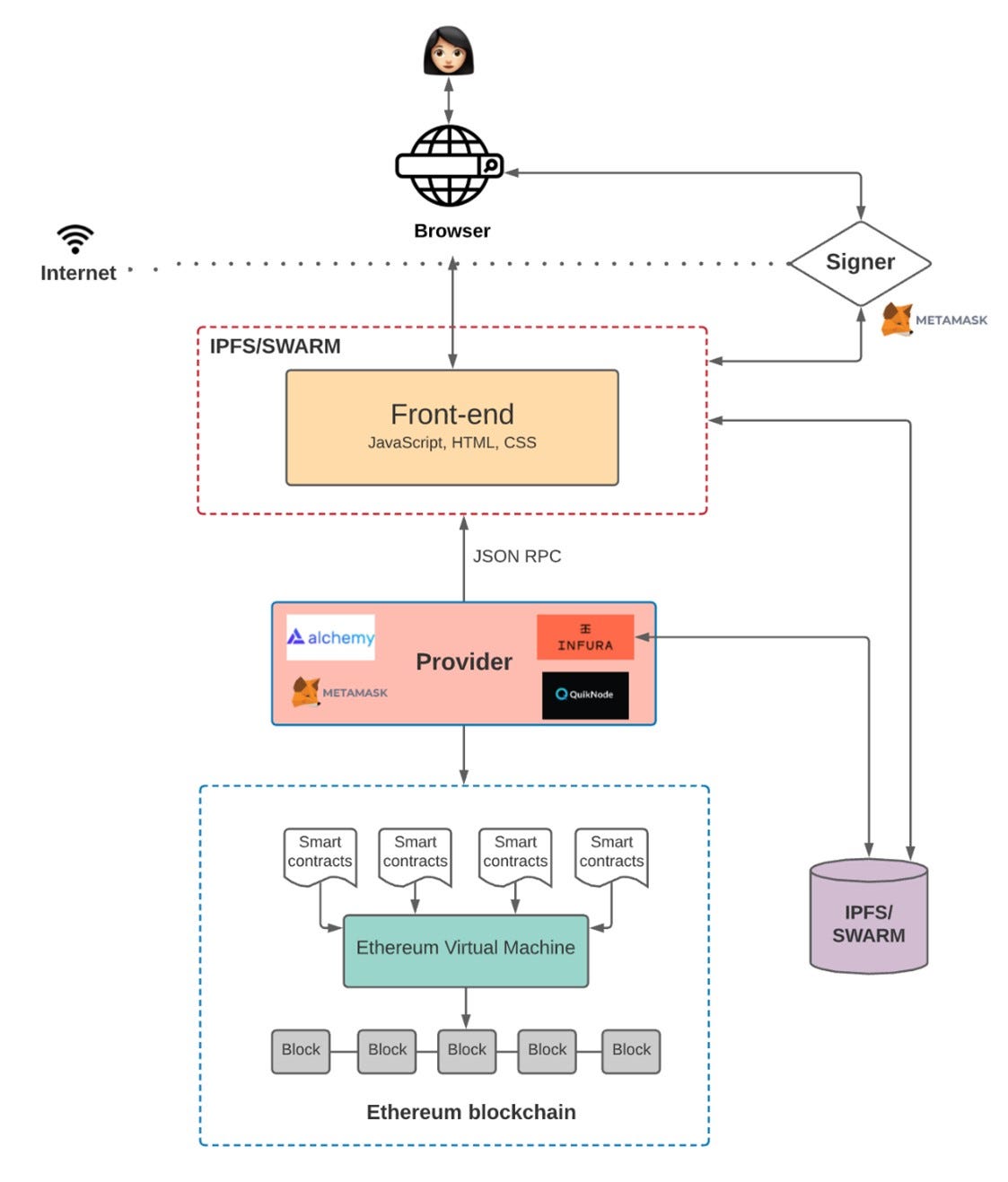

Web3

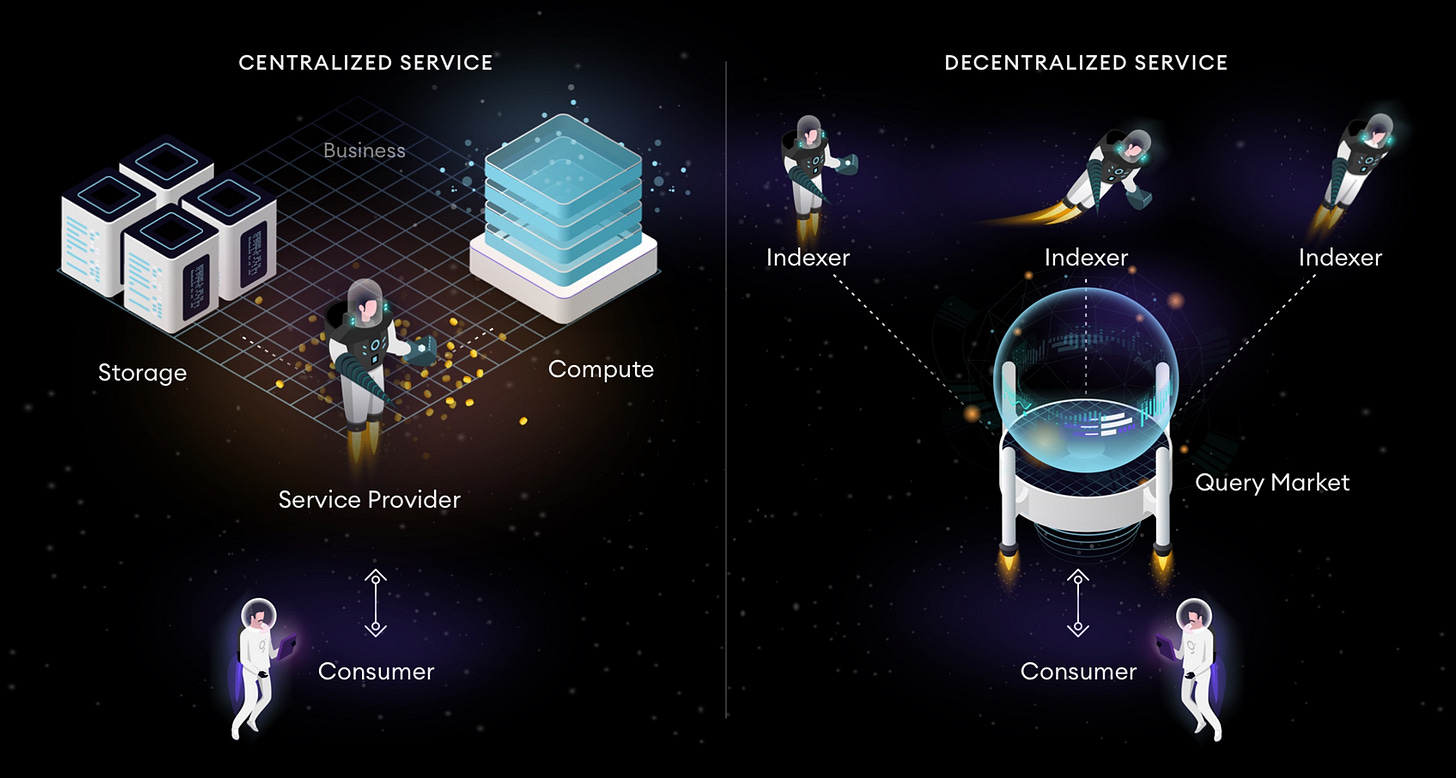

The next version of the internet will likely upend this structure. Instead of hosting most of the world’s data and computing power in centralized data centers, Web3 intends to “cut out the middleman” with two recent inventions:

Blockchains – decentralized databases which can replace traditional databases

Smart contracts – computer programs that can replace centralized servers

When combined, these two technologies are often referred to as “smart contract platforms” (for a much deeper dive on how smart contract platforms work, feel free to visit my writeup here: “The Complete Beginner's Guide to Smart Contract Platforms”)

This is revolutionary – for the first time in history, smart contract platforms give users full ownership and control of their data, content and assets. This means that no one can censor users, seize their assets, block their access, charge them outrageous prices for selling goods online or monetize their data without permission.

To borrow a phrase used by Messari’s Eshita Nandini – if Web 1.0 was the “read-only” web, and Web 2.0 was the “read-write” web, then Web3 is the “read-write-own” web.

Web3 Gives Users Full Ownership and Control of their Data, Content and Assets

While the use of smart contract platforms is groundbreaking, they are not enough on their own to create truly a decentralized internet as they: i) need additional pieces of infrastructure such as wallets and node providers, ii) require the replacement of the traditional “wires” of the internet with a decentralized alternative and iii) still need databases, albeit in a slightly different way.

Although we are probably still some time off from realizing the vision of a fully decentralized web, we’ve made a lot of headway and are starting to get a sense of what the final product may shape up to look like:

Key Components of Web3 Infrastructure

Although the user experience of a decentralized internet will likely stay more or less the same (i.e. users will still visit a website, click a few buttons and get the data they want), what’s going on in the background will be very different. In the next version of the internet, when a user wants to access data, she will likely follow the below roadmap:

Browser: The first step in the user journey will likely remain largely the same, with consumers accessing the internet through a browser (technically, we may all soon access it through virtual or augmented reality devices, but we’ll get to that in a second)

Wallet: Perhaps the biggest noticeable change for the user will be the addition of a digital wallet, which will replace emails and passwords as the primary means to sign into a website

Decentralized Internet: Once signed in, information could travel through the network over a decentralized internet service provider (ISP) such as Helium

Node Providers: In order to access a smart contract platform, users need to run a “node”. We’ll define what that means in a bit, but the key takeaway here is that running a node is challenging and, as such, most users will rely on third-party services known as node providers

Smart Contract Platforms: Smart contract platforms such as Ethereum will replace traditional servers and databases

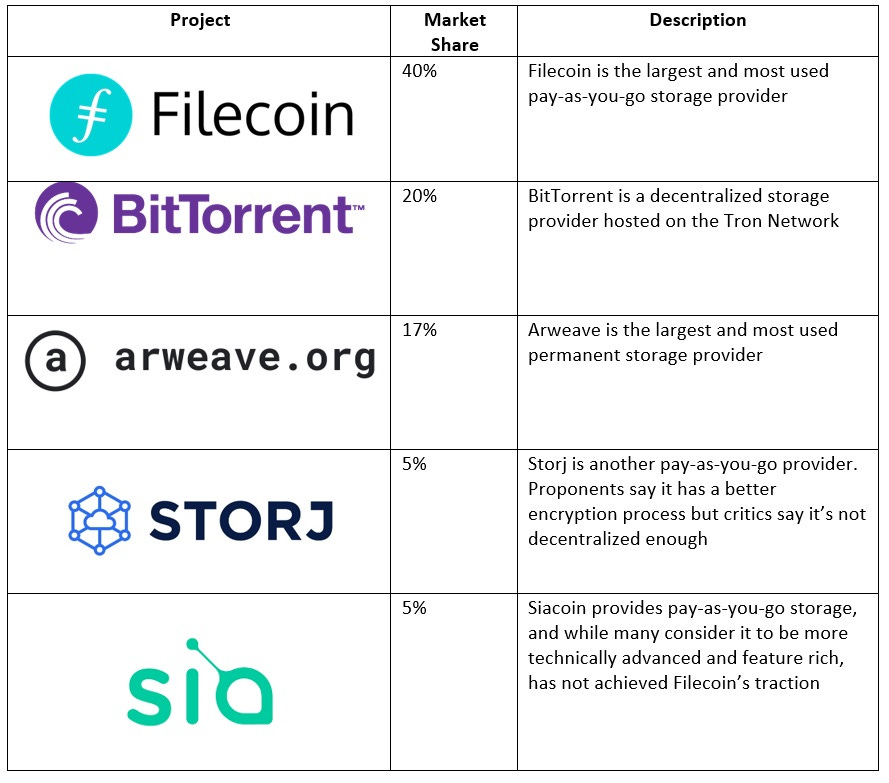

Data Storage: There will still be a need for databases, but decentralized databases such as IFPS or Arweave will work a bit differently than databases today, connecting directly into the “front-end” and assuming more of a support role

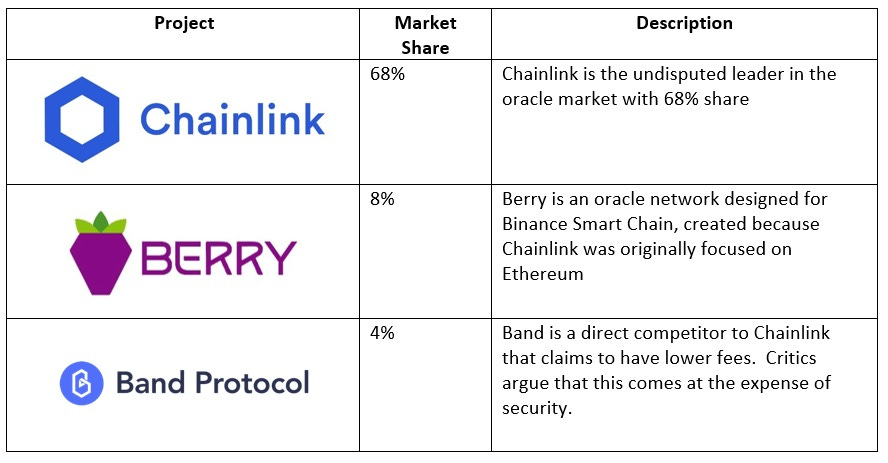

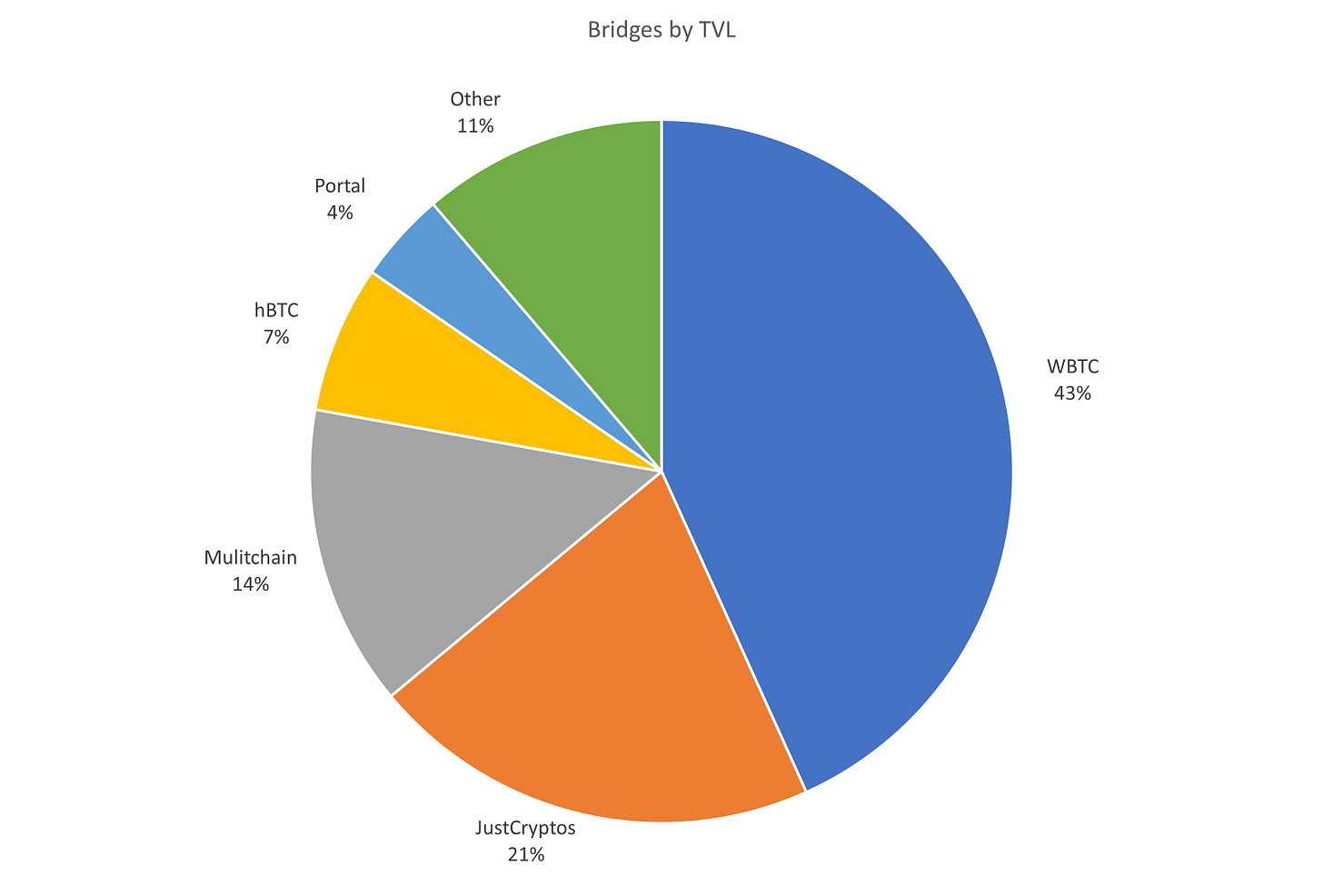

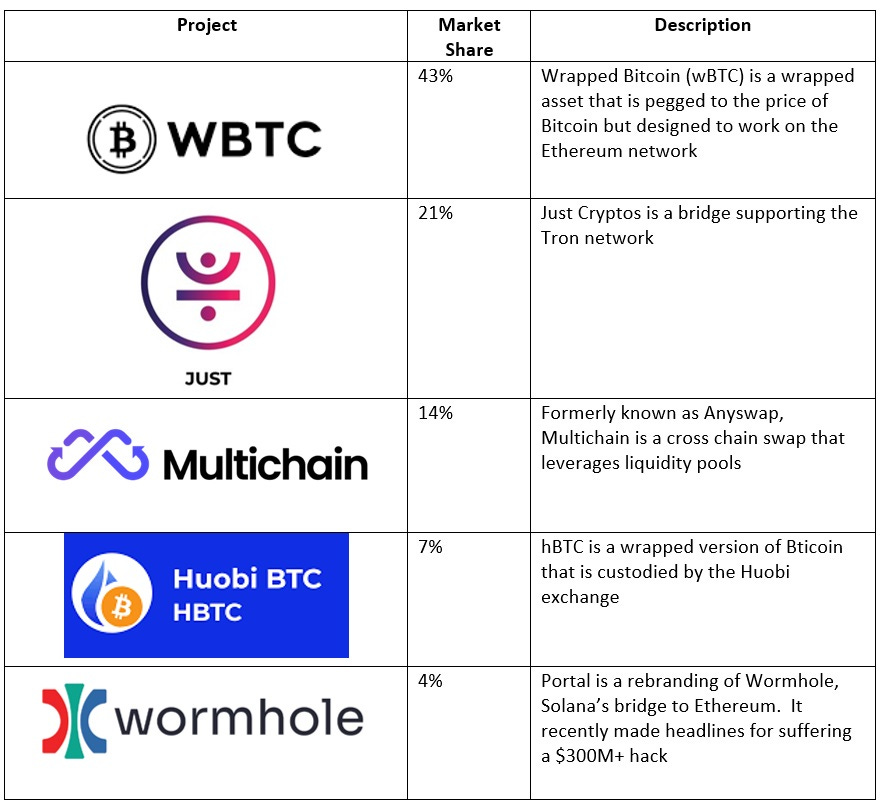

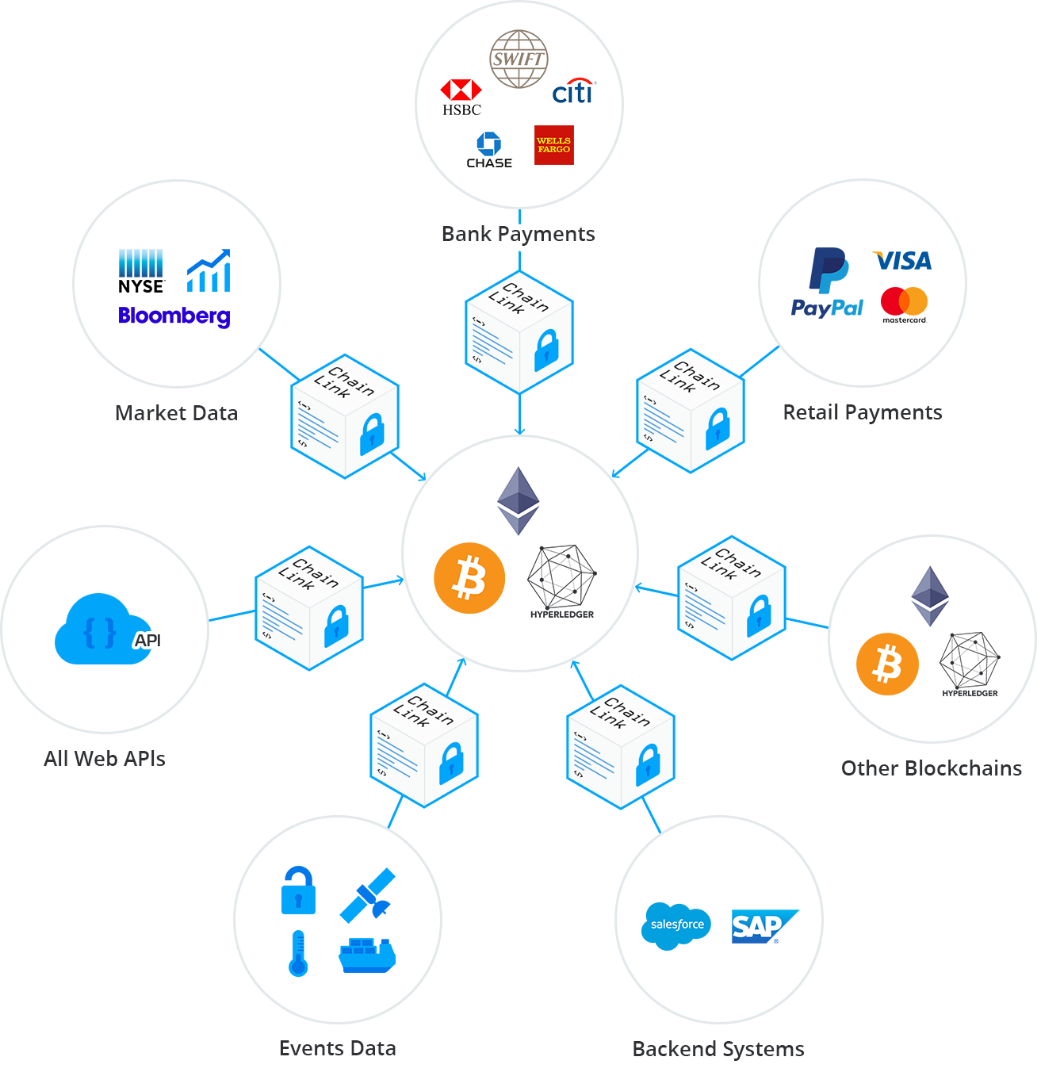

In addition to the above, Web3 will require several tools designed exclusively for blockchains such as decentralized domain name servers, Layer 2 solutions, querying tools, oracles, bridges and decentralized computers.

In the interest of clarity, we won’t expand on these here but will instead dive deeper into them in the next section…

Virtual Worlds

What are Virtual Worlds?

Virtual worlds are online, immersive, 3D spaces that may replace the webpages of today as our primary means of accessing the internet.

Instead of simply logging on to a website and reading its content, users can explore these virtual worlds, interact with other users, create and trade digital goods, participate in meetings, attend events, play games and build in-world objects and landscapes.

Like the web of today, there will likely be thousands of virtual worlds, all intertwined in a network known as the “metaverse”.

Justin Bieber Hosting a Concert in the Metaverse

Virtual worlds often host their own self-sufficient economies which include:

Land which can be bought, sold, rented and developed

Digital Goods which can be consumed and traded

Native currencies to buy and sell goods and services

While companies such as Meta (formerly Facebook) are making a strong push into the space, there is a sizable constituency hoping to create a user-owned and decentralized metaverse through the use of NFTs to represent land and goods and cryptocurrencies as the native currency.

Zuck is Coming to Take Over the Metaverse…

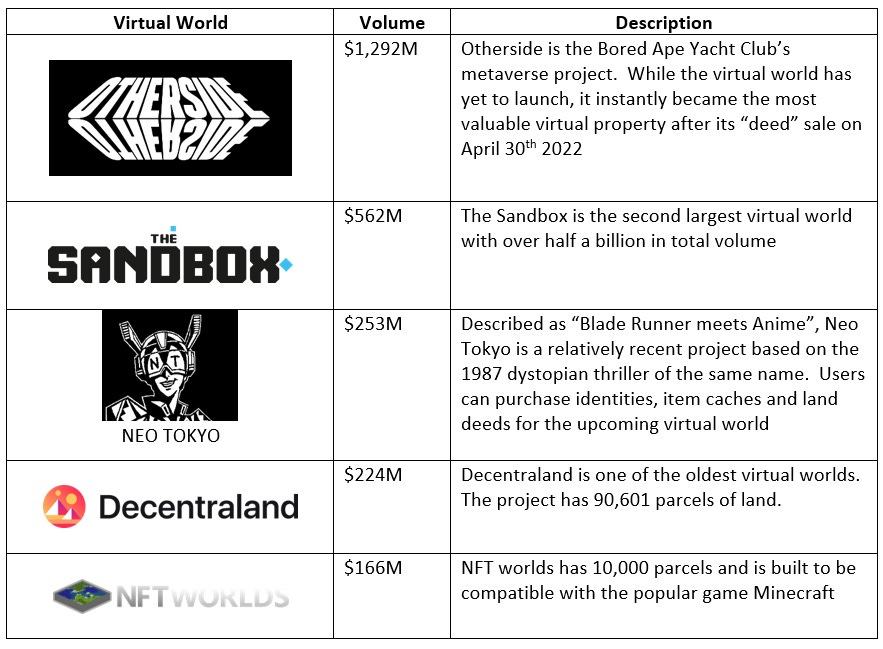

Virtual worlds are becoming extremely popular. To date, users have spent nearly $2.5B on digital land and in-game items in the metaverse, and many researchers believe the space represents a multi-trillion dollar opportunity (with some projections ranging as high as $30 trillion!)

Virtual Worlds and Virtual, Augmented and Mixed Reality

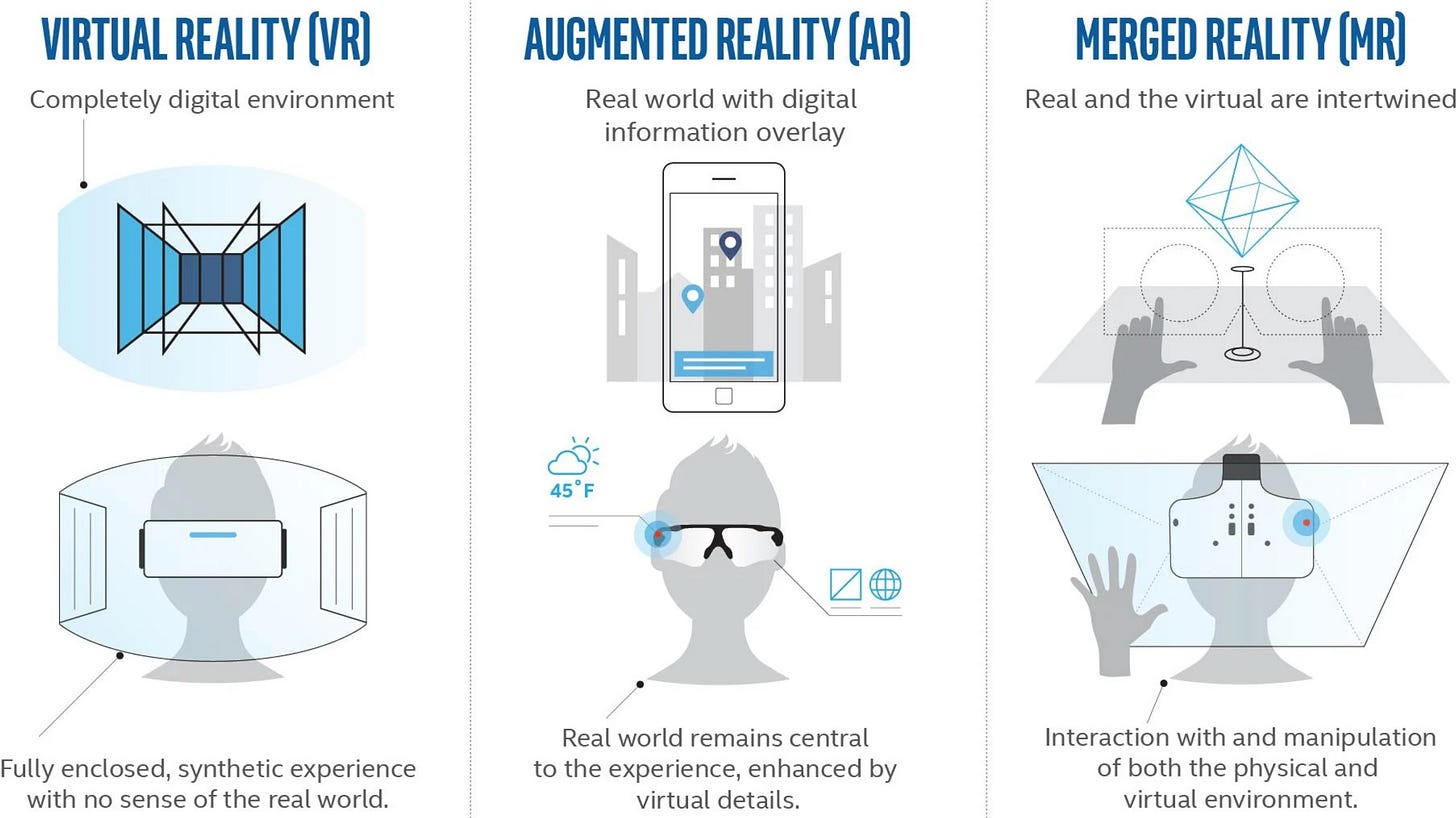

Although many virtual worlds are currently PC and / or mobile-based, it is expected that most will transition to a blend of virtual, augmented and mixed (or merged) reality known as “extended reality”.

Extended Reality is a Blend of Virtual, Augmented and Merged Reality

While closely related, it’s helpful to understand the difference between these three technologies:

Virtual reality (VR): a fully-immersive digital environment where the user is cut off from the outside world

Augmented reality (AR): an augmented representation of the real world that overlays virtual objects into our physical environment

Mixed Reality (MR): a medium combining VR and AR, allowing users to interact with both the physical and virtual world

This will create an experience that’s significantly more immersive than today’s internet. Instead of simply looking at a screen, users will feel like they are “in” the experience.

What are the Benefits of Decentralized Virtual Worlds?

Virtual worlds will offer numerous benefits to the consumer, including the ability to facilitate remote work, allow virtual doctor visits, create engaging and immersive games and generally just provide a “fantasy world” for us to escape reality and become anything we want to be.

One of the greatest threats to the metaverse is control by a digital monopoly. We have already seen the dangers of a centralized internet, and these threats have the potential to turn into a nightmare scenario as we move more of our lives online.

Indeed, if we aren’t careful, companies such as Facebook, Amazon, Microsoft, Apple, Google could gain even more power in the metaverse and form “digital dictatorships”, levying heavy taxes on usage and exercising absolute control over what we can and cannot do.

Fortunately, using blockchain technology, we can create a decentralized metaverse, where ownership remains with the community – creators, consumers and developers.

This would have several benefits including:

Fair economics: The Apple store currently charges participants up to a 30% tax on every sale. Eliminating the middleman would allow creators to sell directly to consumers without having to pay outrageous fees like these

Permission-less Access: Facebook notoriously shut down its most popular game Farmville over a disagreement in economics. Decentralized virtual worlds would eliminate this threat, as users can’t be banned or restricted access in any way, can’t be shut down and anyone can access them at any time

Reduced Censorship: Platforms such as Twitter have full control over the decision to ban or censor users, and unfortunately they are exercising this power more and more frequently. Decentralized worlds, by contrast, would eliminate censorship, allowing users to upload any content – no matter how controversial – to any platform they so choose

Interoperability: In their current form, virtual worlds are not interoperable – you can’t buy an item of clothing in The Sims and wear it in Second Life. An open metaverse, on the other hand, would allow users to freely transfer their virtual goods from one world to the next. For instance, if you bought a flaming sword in World of Warcraft, you could theoretically use it in Farmville (🤯)

How do Decentralized Virtual Worlds Work?

To understand how virtual worlds work, let’s look at one of the largest players – The Sandbox.

The Sandbox is a user-generated, 3D virtual world that allows users to own land, design characters and create and host their own play-to-earn games. While the project was originally created in 2012, it was acquired by Animoca Brands in 2018 for use as a blockchain-based gaming metaverse. The alpha version of The Sandbox was launch in late November 2021.

In many ways the platform functions like The Sims or Second Life, with one key difference – users maintain full ownership of their characters, land, games and virtual goods.

The Sandbox’s virtual economy is powered by several core tokens including:

SAND: The platform’s native in-game currency that is used for all transactions within the world

LAND: NFTs representing plots of digital real estate within the Sandbox Metaverse

ASSETS: NFTs representing digital goods such as characters, animals, vehicles, buildings, etc…

GAMES: Play-to-Earn games created and hosted by users

Core Tokens in The Sandbox

Let’s take a deeper look into each of these tokens…

SAND

The Sandbox’s virtual economy is powered by its native currency known as SAND. SAND is an ERC-20 token with a variety of uses, including:

Purchases: As the in-game currency for The Sandbox, SAND can be used to play games, purchase assets and land, customize and upgrade their characters, buy equipment, etc…

Staking: Holders can stake SAND to earn passive income

Governance: SAND also functions as a governance token, allowing users to vote on decisions impacting The Sandbox ecosystem

As of May 28th, 2022, there are currently 1.5 billion tokens available out of a maximum total supply of 3 billion. The current fully-diluted market capitalization of SAND is $2.9B.

LAND

The Sandbox contains NFTs representing 166,464 plots of LAND which can all be fully owned by users and traded much in the same way as physical real estate.

Developed Plot of Land in The Sandbox

Like in the real world, owners can also build whatever they want on their property, and we have already seen several commercial enterprises created on the system, including:

Casinos: The Sandbox has several virtual casinos

Concert Venues: Warner Music Group is launching a metaverse concert hall in partnership with Snoop Dogg

Cultural Venues: Several Hong Kong investors have joined to build “Mega City”, a cultural hub showcasing art, film, music and gaming

Nightclubs: The Sandbox boasts several nightclubs

Retail Stores: Gucci purchased land in February 2022 to create an online store

Sports: HSBC recently bought a plot of land to construct a virtual sports stadium

Virtual Offices: The government of Dubai has purchased a plot of land in The Sandbox to build a virtual headquarters for its Virtual Assets Regulatory Authority

Multiple plots of LAND can also be combined to form ESTATES.

ASSETS

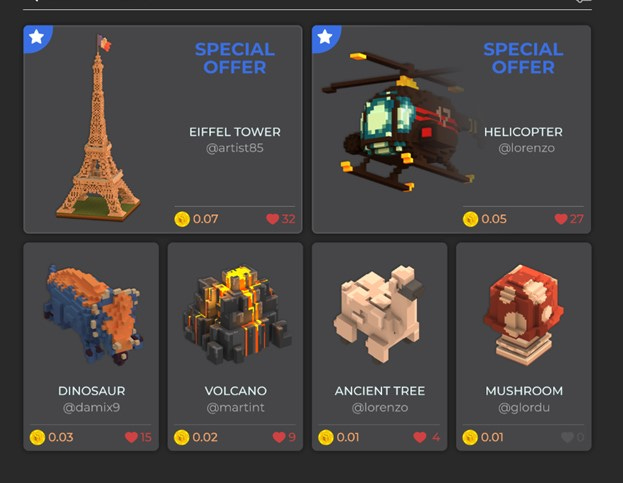

ASSETS are the native digital goods of The Sandbox. They can include anything that will populate the platform’s virtual world, including characters, equipment, outfits, buildings, etc…

Sample of Assets in The Sandbox

All ASSETS are represented as ERC-1155 (“semi-fungible”) tokens, allowing users to create unlimited copies of a given piece.

GAMES

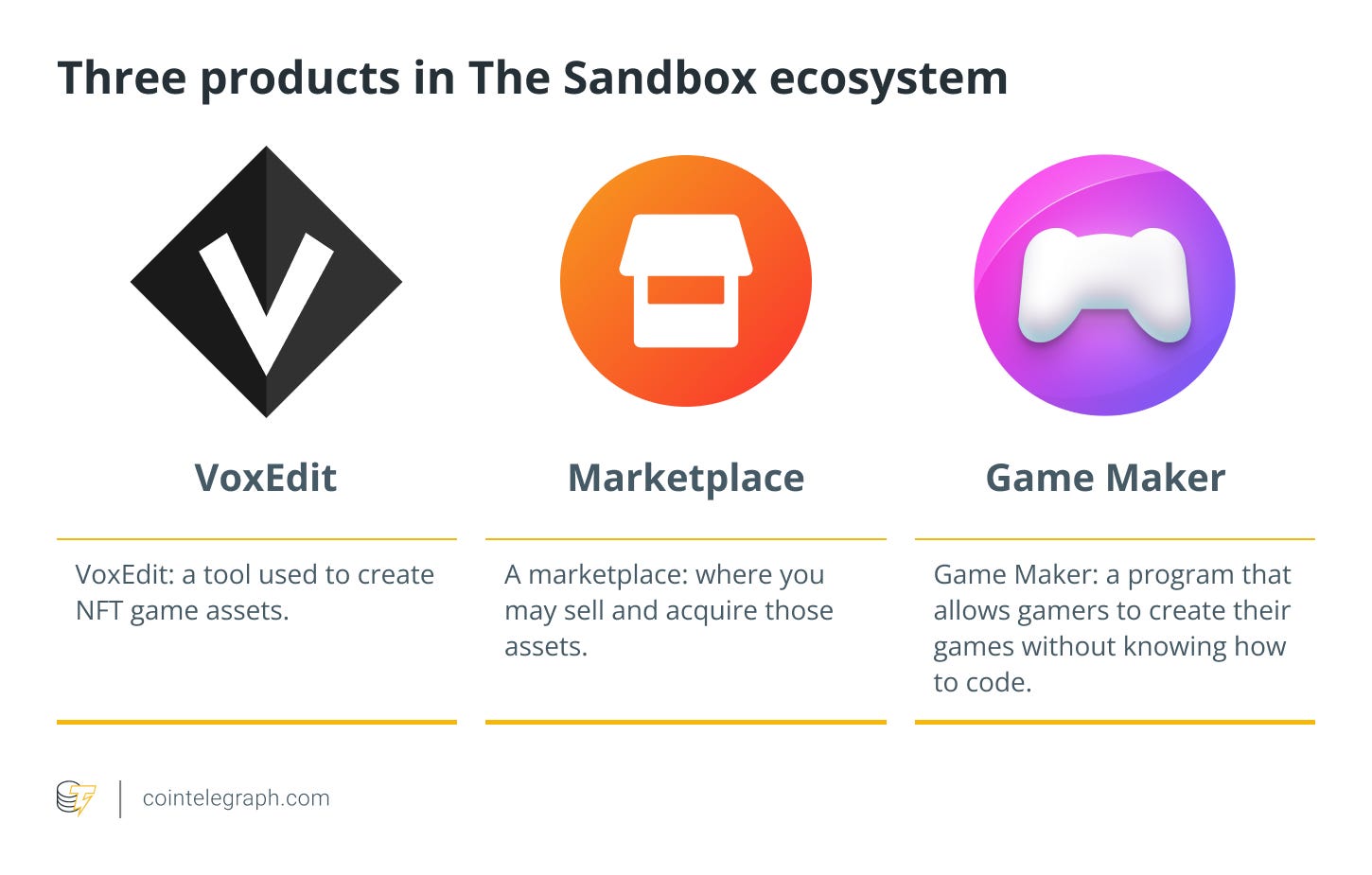

One of the key features of The Sandbox is that it allows users to create and host 3D, play-to-earn games on LAND that they own (or rent). To create a game, users have access to three tools.

VoxEdit: A program that allows users to create 3D virtual assets to populate the game such as characters, animals, structures, foliage, etc…

Marketplace: A decentralized platform that allows creators to buy and sell existing assets for use in the game

Game Maker: A simple editor that allows users to create games without needing to know how to code

Once created, creators can invite other users to play the game and also monetize it in any way they see fit – they can charge other users to play, sell the NFT ASSETS required to play the game or even sell the game itself.

While some describe The Sandbox itself as a game, it is more accurately described as a collection of user-generated games.

Traction

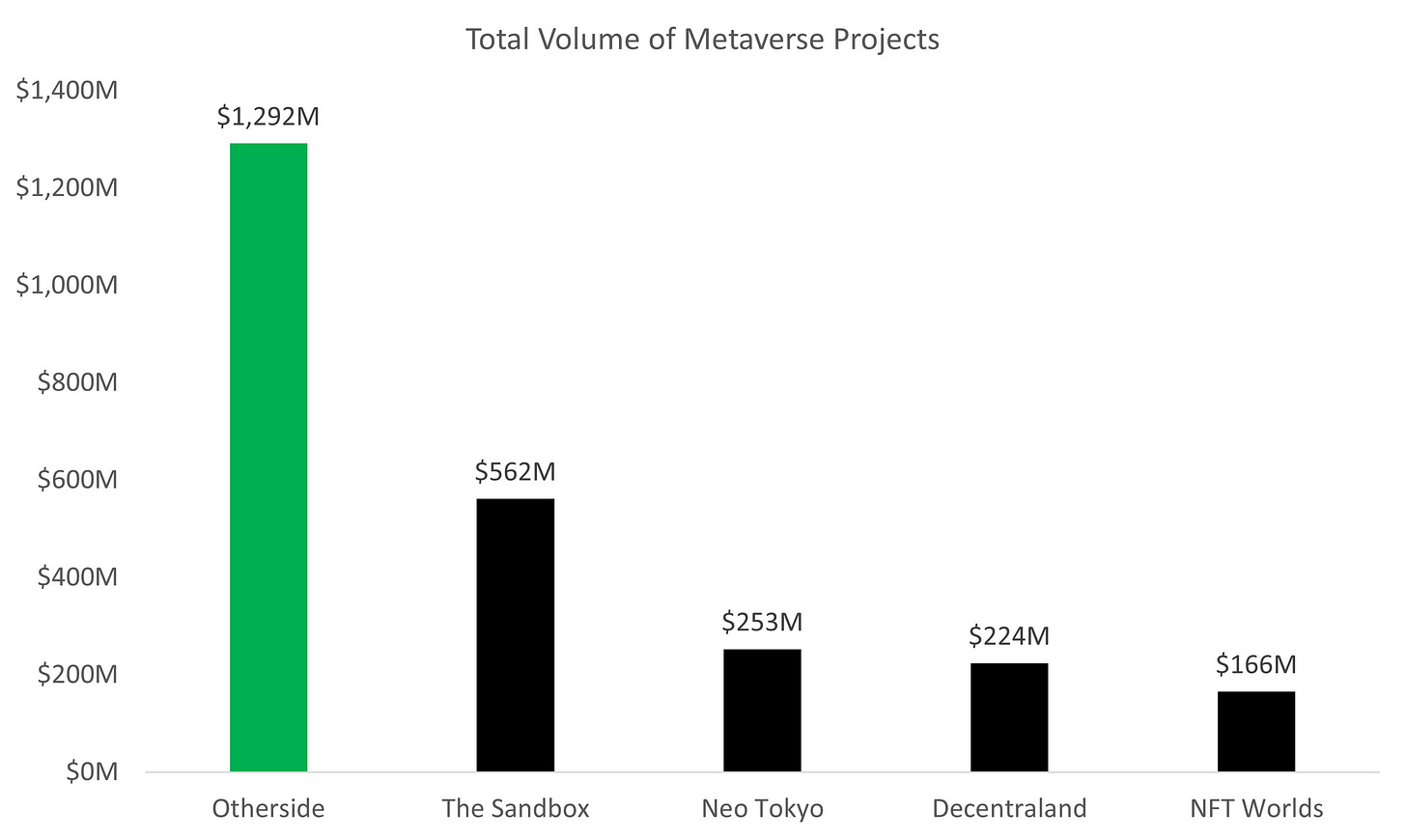

Although activity has slowed in the bear market, The Sandbox has nonetheless achieved impressive traction, garnering nearly 3.5M users and generating over $500 million in sales volume to date.

In addition, the project has recorded over 165 high-profile partnerships with individuals and companies such as Snoop Dogg, Adidas, The Walking Dead, The Smurfs and Atari. The project recently raised $400M at a $4B valuation and notable investors include Softbank, Liberty City Ventures and Samsung Next.

Who are the Key Players in the Virtual World Ecosystem?

In addition to The Sandbox, there are several other notable projects include Otherside, Decentraland, NFT Worlds and NEO Tokyo.

Wallets

Wallets serve as a user’s gateway to Web3.

The term itself is a bit of a misnomer, as they do so much more including:

Provide Access to Funds: As the name implies, wallets grant users access to their funds

Connect with dApps: In Web3, wallets replace passwords – once you connect to your wallet you can automatically use this to connect to any decentralized application (“dApp”)

Interact with dApps: Once you are on a dApp, wallets allow you to use your coins for a variety of purposes, such as spending them in games, staking them on a smart contract platform, buying NFTs, gambling with them, trading them on decentralized exchanges, etc…

To understand the importance of wallets better, let’s look at MetaMask, the most used wallet on the Ethereum network.

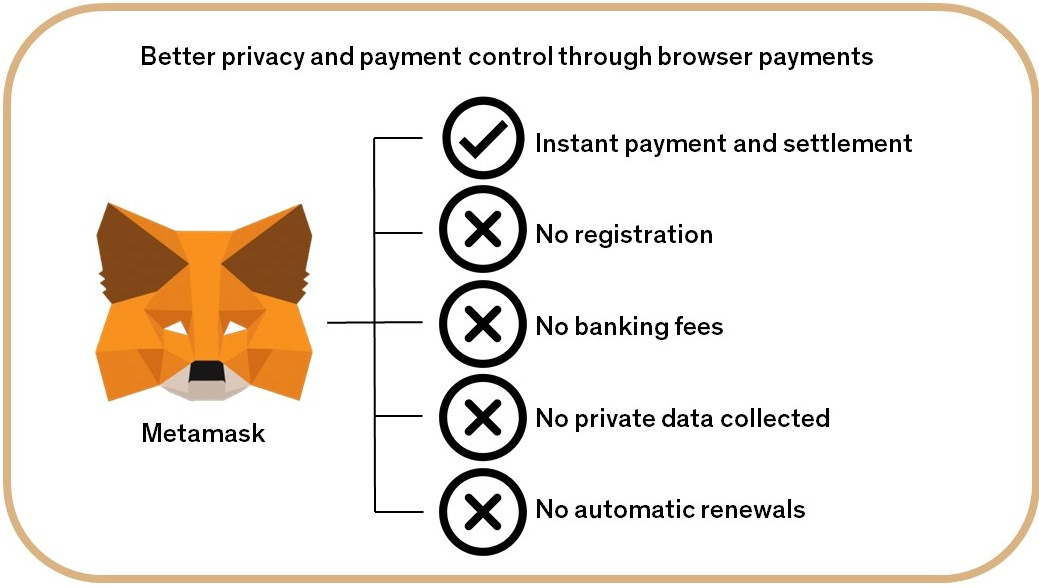

How do Wallets Work?

The most popular wallet is MetaMask, an Ethereum-based online – or “hot” – wallet. “Hot” wallets are always connected to the internet. While this makes them less secure, it also makes them much easier to use than “cold” wallets (such as Ledger Nano) which aren’t connected to the internet.

Metamask is free to use, easy to setup and – perhaps most importantly – is completely anonymous (all anyone will ever see is a number).

As discussed above, the product has three key functions. It serves as a wallet, a connection point and a Web3 “browser”.

1. Wallet

Like all crypto wallets, MetaMask does not hold cryptocurrencies (remember that they are stored on a blockchain), but instead holds a user’s private keys. The user maintains full control over these keys (and therefore their funds), and they can’t be forcibly confiscated by anyone (unless someone physically coerces you to give up your password).

Although MetaMask is closely connected to the Ethereum blockchain, it does not limit the wallet to hold Ether. The wallet can host a vast selection of different ETH-based currencies and tokens built using, for example, the ERC-20 and ERC-721 standards.

2. Connecting to dApps

One of the cool things about Web3 is that you don’t need passwords.

Once you are logged in, wallets such as MetaMask give you access to a variety of Web3 services – anything from DeFi exchanges to NFT marketplaces to online banks to games.

3. Interacting with dApps

Once connected to a dApp, users can spend their coins in games, stake tokens in gambling applications, make loans, etc…. For instance, through MetaMask, users can:

DeFi: Buy, sell, trade, stake, borrow or lend cryptocurrencies

NFTs: Buy, sell, trade, stake, borrow or lend NFTs

DAOs: Vote in DAOs

Web3: Play blockchain games, stream songs, purchase articles, etc…

Basically, you can do almost anything you can do on the internet with Metamask!

Key Players

Although MetaMask is the market leader, there are several popular crypto wallets including Rainbow, Wallet Connect (a software that connects cold wallets such as Ledger to dapps), Coinbase Wallet and Phantom (Solana’s most popular wallet).

Decentralized Domain Name Servers

What is the DNS?

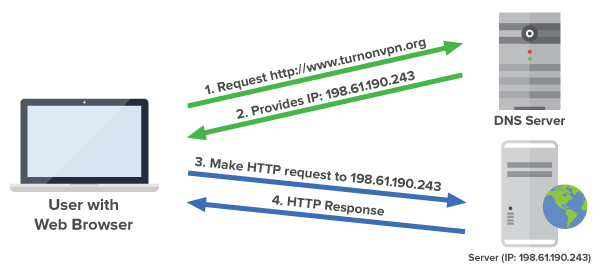

Every device on the internet has a unique address – called an IP address – that helps other computers identify it. Unfortunately, this address is represented with a string of numbers such as “198.61.190.243”.

As you can imagine, human beings aren’t very good at remembering random strings of numbers, nor do they provide any context as to what’s on the site. That’s why the Domain Name System (DNS) was created – it serves as the “phonebook” of the Internet and translates IP addresses into human readable names.

For instance, let’s say you wanted to look up www.facebook.com.

Your computer would send a request for www.facebook.com to a DNS server

The DNS server would look up the name www.facebook.com, find its IP address and send it back to you

Your computer would then use this new IP address to make a request to directly to Facebook’s servers

Facebook would send the requested webpage back to your computer

The Domain Name System is not just one server, but instead a global collection of servers. That way, if one doesn’t know the address you’re looking for, it can route it to another one. This also provides redundancy in case a single server is attacked or goes down.

While the DNS is extremely important to the internet, it has one major flaw – it’s centralized. This creates numerous risks including the lack of privacy, the potential for censorship and security vulnerabilities.

As such, decentralized DNSs such as the Ethereum Name Service, aim to supplant this ~40 year old system and become the “phonebook” of the blockchain.

How do Decentralized DNS services work?

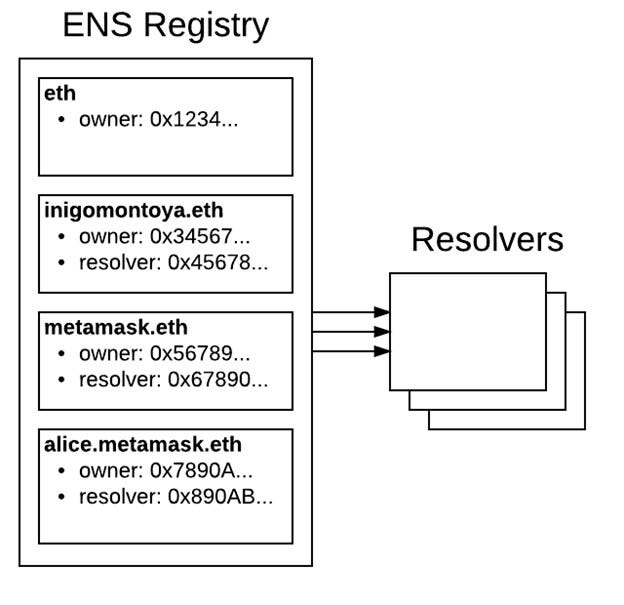

The Ethereum Name Service (ENS) is virtually identical to the internet's DNS system, in that it translates human-readable names into computer addresses

For instance, without ENS, if you wanted to pay your friend in cryptocurrency, you’d have to know the public address of her wallet, which might look something like “0x787192fc5378cc32aa956ddfdedbf26b24e8d78e40109add0eea2c1a012c3dec”. ENS allows users to create “nicknames” – such as “Alice.eth” – a and attach them to their wallet, allowing anyone to send any Ethereum enabled token to that address.

ENS operates using two main components, a main “registry” and a collection of “resolvers”. The registry contains all the “nicknames” (called domains) registered on the system and the address of their respective resolvers. The individual resolvers contain the information necessary to match each domain to its actual Ethereum address.

The ENS Registry Contains Individual Resolvers That Can Translate Each Domain

So if someone wanted to send 10 ETH to “alice.eth” using Metamask:

The user would open their Metamask wallet, hit the “send” button and add “alice.eth” as the recipient’s address

The system would then query the main registry to find out which resolver is responsible for “alice.eth”

The register would return the applicable resolver

The system would then query the resolver for the correct address, which would return “0x787192fc5378cc32aa956ddfdedbf26b24e8d78e40109add0eea2c1a012c3dec”

Metamask would then use this new address to complete the transaction

Like the DNS, this all occurs “under the hood”, so from a user perspective they simply type “alice.eth” in the address and the money is on its way.

While ENS originally only worked for .ens names, in late 2021, the protocol announced that it would also be integrating traditional domain names into the system. This opens up a world of potential as it makes it possible to register urls such as “alice.com” to a wallet and allow it to receive cryptocurrencies.

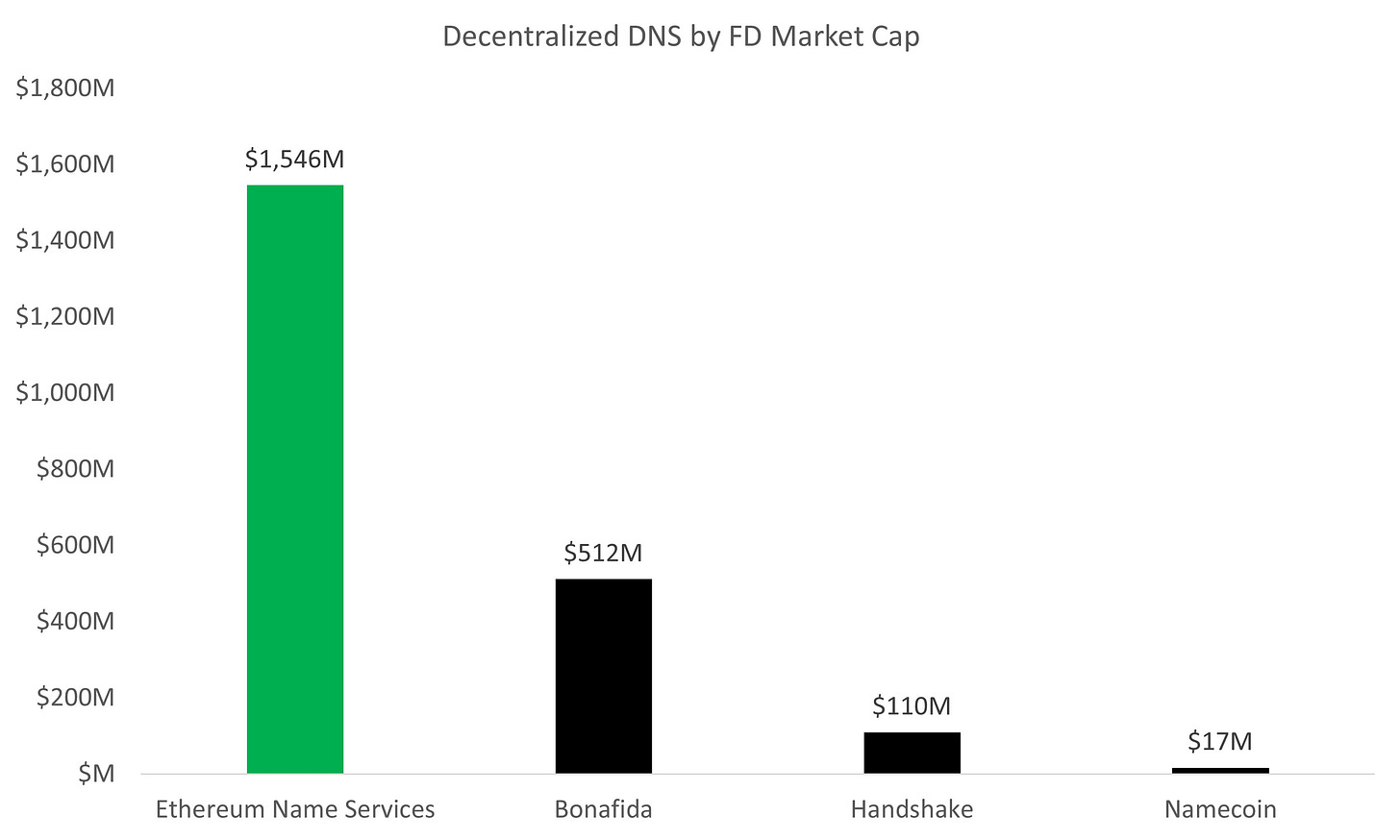

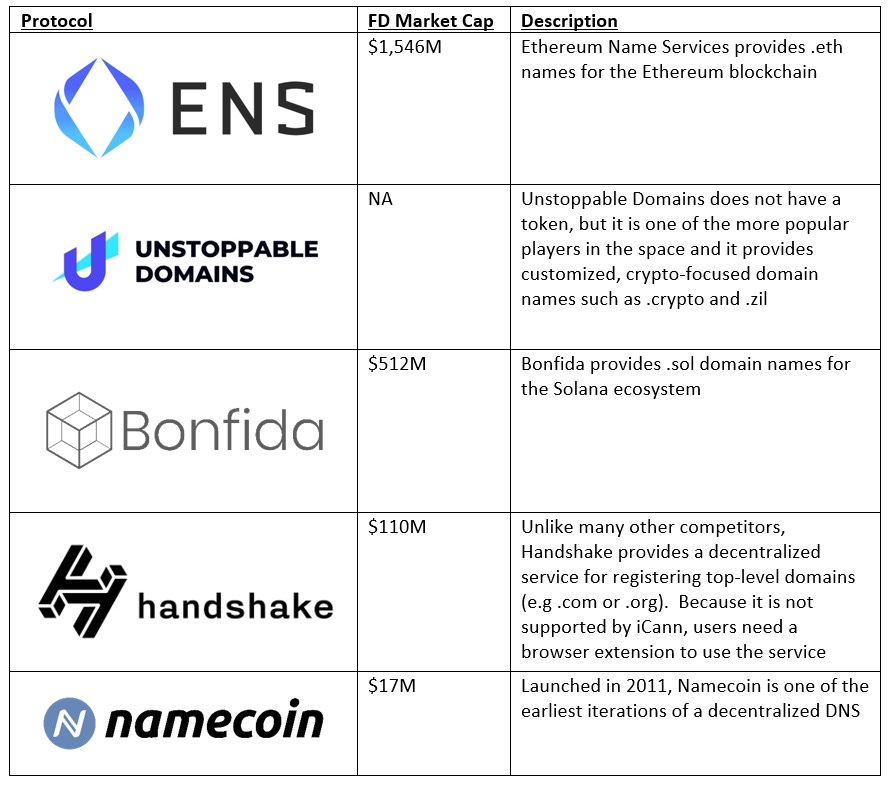

Key Players

Notable players in the decentralized DNS space include ENS, Unstoppable Domains, Bonfida, Handshake and Namecoin.

Decentralized Internet

How Does the Internet Work?

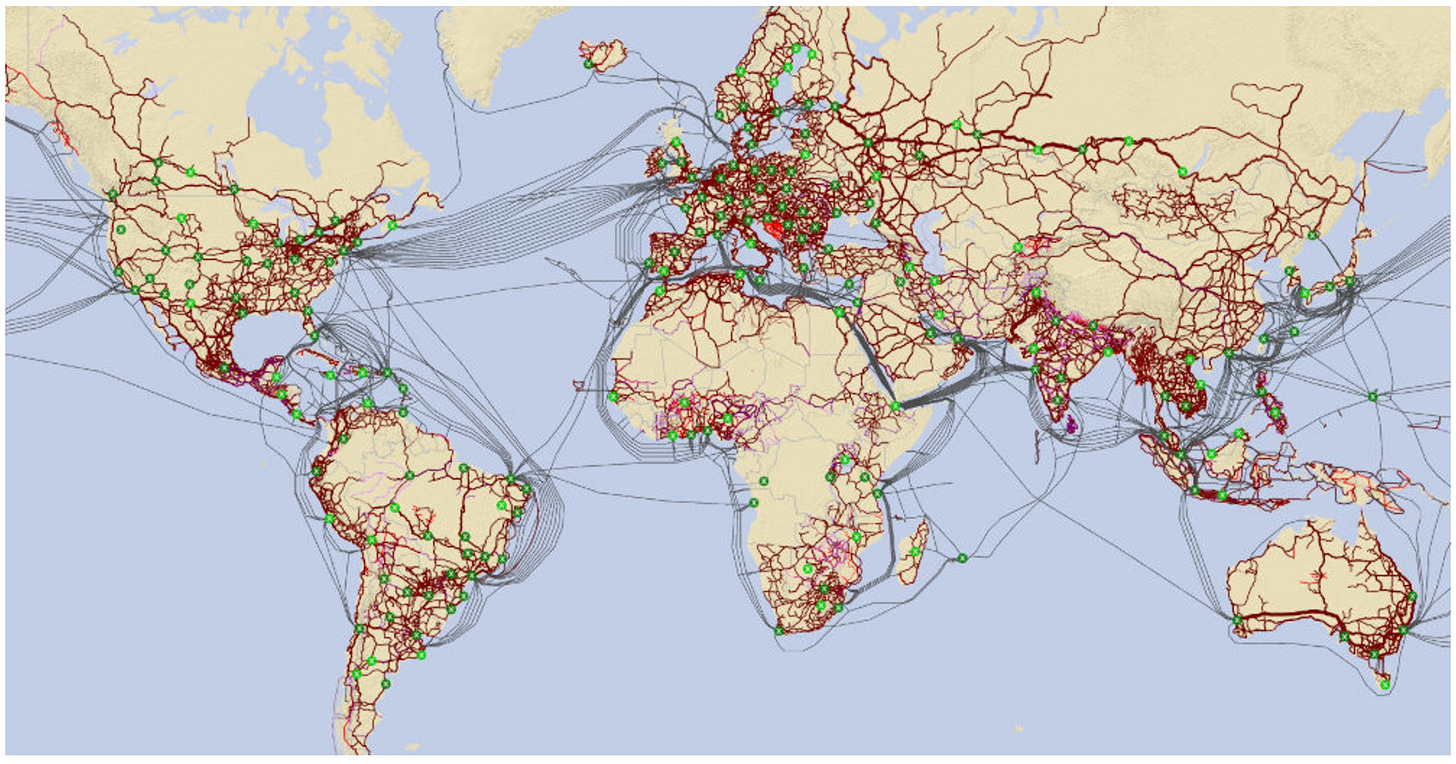

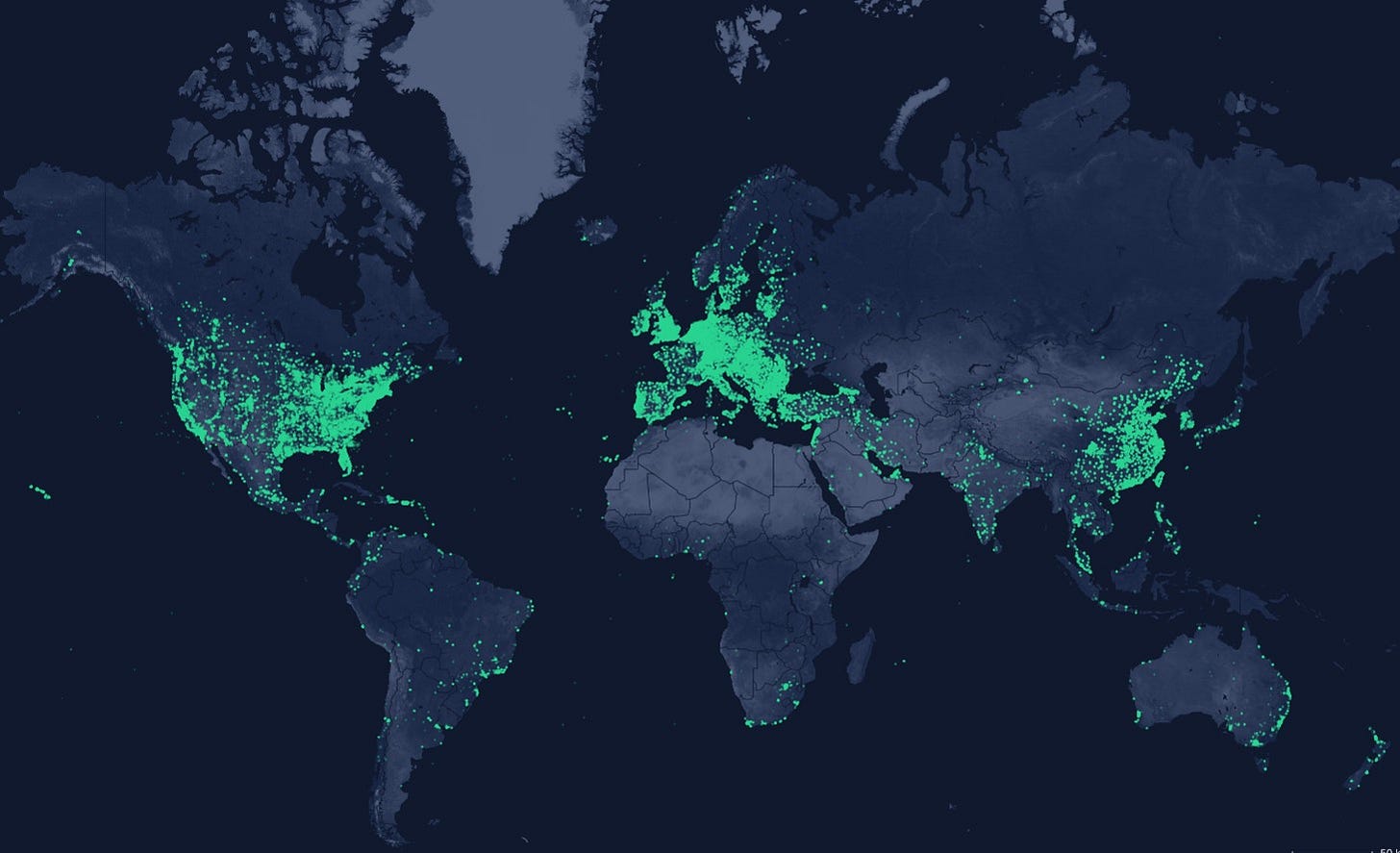

We discussed previously that information travels over the internet via wires (and sometimes via radio waves).

Map of all Major Internet Cables on Earth

These wires are owned by companies known as Internet Service Providers (ISPs) which are split into three levels, also known as “Tiers”:

Tier 1 - International: Tier 1 internet providers form the “backbone” of the internet. They are responsible for maintaining the high-speed cables that cross continents and major oceans. These providers do not deal directly with end users, and instead charge national and regional networks for carriage. Notable Tier 1 ISPs include AT&T, Verizon, China Telecom, PCCW, Singtel, NTT, Telstra, British Telecom and Deutsche Telekom.

Tier 2 – National and Regional: Tier 2 providers provide a bridge between the first and last mile. They pay Tier 1 networks for transit and sell transit to Tier 3 networks (and sometimes directly to large companies and governments). Major Tier 2 providers include Comcast, Virgin Media, Cox Communications and CTS Telecom

Tier 3 – Local: Tier 3 providers are responsible for connecting homes and small businesses to the internet. As such, they are often known as the “last mile”. The bulk of these connections run through the wires provided existing cable TV networks (although fiber optic service is growing)

As mentioned previously, the vast majority of global internet traffic is routed through a handful of Tier 1 providers. This presents several problems including: i) the ability to charge high premiums and extract monopolistic profits, ii) the power to block or censor traffic and iii) vulnerability to failures and outages (e.g. the entire island of Tonga lost its internet connection for over five weeks due to a damaged undersea cable) .

Decentralized ISPs, such as Helium, aim to fix this by allowing users to host their own internet access points.

How does a Decentralized Internet Work?

Helium is a decentralized wireless network powered by cryptocurrency. The company was founded in 2013 by Shawn Fanning of Napster, Amir Haleem, and Sean Carey, and is backed by a notable list of investors that includes Pantera Capital, Khosla Ventures and a16z.

Unlike traditional ISPs, transmission occurs over a global network of independently owned “hot spots” – small devices that can send data over long distances using radio frequencies. Owners can purchase these gadgets for around $500 and transmit the signal to nearby internet-enabled devices (this is similar to the Wi-Fi hotspot on your phone, but ~200x more powerful).

Helium has made significant progress to date and deployed nearly 1 million devices across 182 countries. This makes it the world’s largest user-owned wireless network.

The Helium Network Hosts Nearly 1 Million Hotspots Across 182 Countries

Although many have tried to disrupt the existing network of ISPs, Helium is the only company to make headway on this endeavor.

This is largely due to its novel use of cryptocurrencies as an incentivization mechanism. In exchange for hosting hotspots, Helium providers are rewarded with the project’s native coin, HNT. While earnings can vary greatly from user to user, some hosts have reported making upwards of $2,000 a month.

To ensure the stability of the network, the protocol uses a process known as “Proof-of-Coverage”, which randomly pings hotspots to verify that they are in the correct location and actively transmitting a signal.

Helium, also known as “the People’s Network”, eliminates many of the traditional concerns of centralized ISPs and may help:

Lower Fees: Transitioning from the current oligopoly of ISPs to a highly-competitive, decentralized network should significantly reduce prices in the long-run.

Eliminate Censorship: Anyone can use the Helium network, it can’t censor transactions and the network can’t be shut down by a third party

Reduce Failures and Outages: The use of multiple, overlapping hotspots reduces reliance on a single point and helps reduce the risk of outages

At the time of writing – September 12th, 2022 – Helium’s fully-diluted market cap is $1.2 billion.

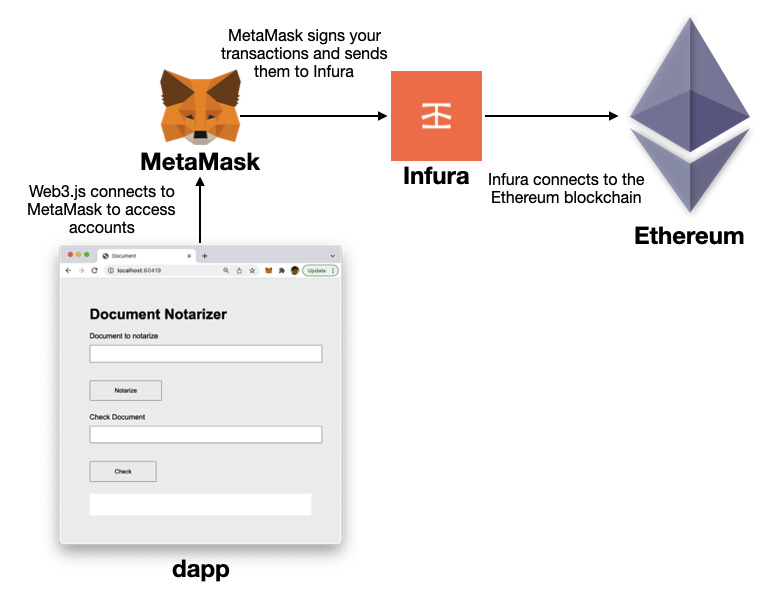

Node Providers

What are Node Providers?

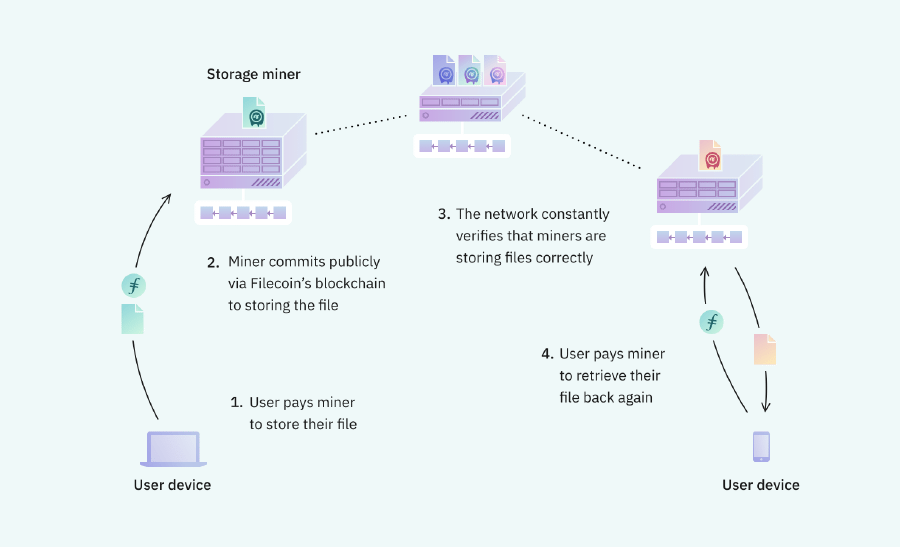

A “blockchain” is little more than a collection of computers – called “nodes” – that maintain an identical copy of a shared database. These nodes are responsible for hosting the blockchain, adding transactions and ensuring its security (and are often paid handsomely for this privilege).

Nodes are the only devices that can interact with a blockchain. That means if you want to use one, you must either:

Set up and run your own node

Connect to nodes provided by third-party services such as Alchemy or Infura

Most people lack the time, patience or technical knowledge to host their own node and, as such, the vast majority of users choose to use third-party providers (even as early as 2019, Infura was handling over 12 billion API requests per day).

Most Users Connect to Ethereum Network via a Third-Party Node Provider Such as Infura

Unfortunately, most of these providers are centralized and, as such, are seen by many to be blockchain’s dirty little secret.

For instance, Infura is owned and operated by ConsenSys (the in-house development studio of Ethereum) and hosted on cloud services owned by Amazon. This creates several problems including:

High Costs: Infura’s entrenched position gives it significant negotiating power and allows it to charge prices that are often above market

Frequent Outages: Dependance on Infura represents a single point of failure for Ethereum and has resulted in several outages, including major ones in November 2020 and April 2022

Potential for Censorship: In an attempt to block two separatist regions of the Ukraine in March 2022, Infura accidentally restricted access for users in Venezuela

Even Michael Wuehler, the co-founder of Infura admits that “If every single dapp in the world is pointed to Infura, and we decided to turn that off, then we could, and the dapps would stop working.”

Fortunately, decentralized alternatives such as the Pocket Network are emerging to remove this chokepoint.

How do Decentralized Providers Work?

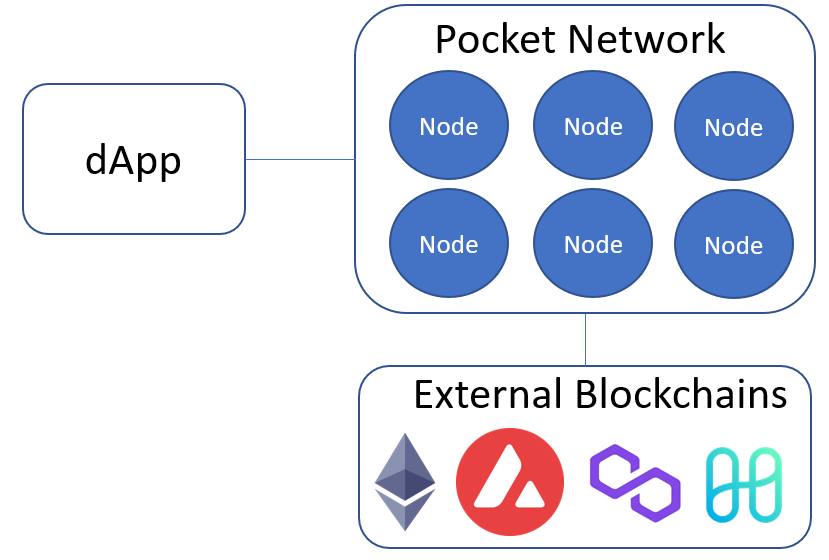

Founded in 2017 by Michael O’Rourke, the Pocket Network functions as a decentralized “marketplace” for nodes.

Instead of owning the nodes directly like Infura or Alchemy, the network simply connects users (Web3 applications that need to connect to public blockchains such as Ethereum, Solana or Polygon) with independent node providers (known as “Service Nodes” on the platform).

The Pocket Network is a Marketplace for Decentralized Nodes

Pocket Network’s marketplace is driven by the platform’s native token, POKT. To use the service, both customers and Service Nodes must stake POKT as collateral. Once deposited:

Users can make a request to the Pocket Network to connect to a blockchain

Requests are routed through Pocket’s software, which connects users to a random Service Node. These nodes are rotated out every hour, and the network immediately replaces any node that crashes or goes offline

Service Nodes connect users to the blockchain of their choice and relay the appropriate data

Another set of nodes, known as Validator Nodes, verify the legitimacy of the work performed by the Service Nodes

If the transaction is legitimate, it is finalized, if not, the Service Node is heavily penalized and its collateral stake is slashed

Upon completion of the transaction, Pocket debits the payment from the user’s staked collateral and sends 89% to the Service Node, 1% to the Validator Node and keeps 10% for itself (via it’s user-owned PocketDAO).

Using Pocket offers several benefits to Web3 applications. In addition to being decentralized, it is often up to 10x cheaper than traditional providers, highly resistant to outages and it offers multichain support to over 50 networks including Ethereum, Solana, Polygon, BSC, Avalanche and NEAR.

As a result, the network has grown considerably over the last few years – it currently hosts nearly 50K nodes over 30 countries and performs over 6 billion relays per week.

Key Players

While not an exhaustive list, key players in the node provider market include:

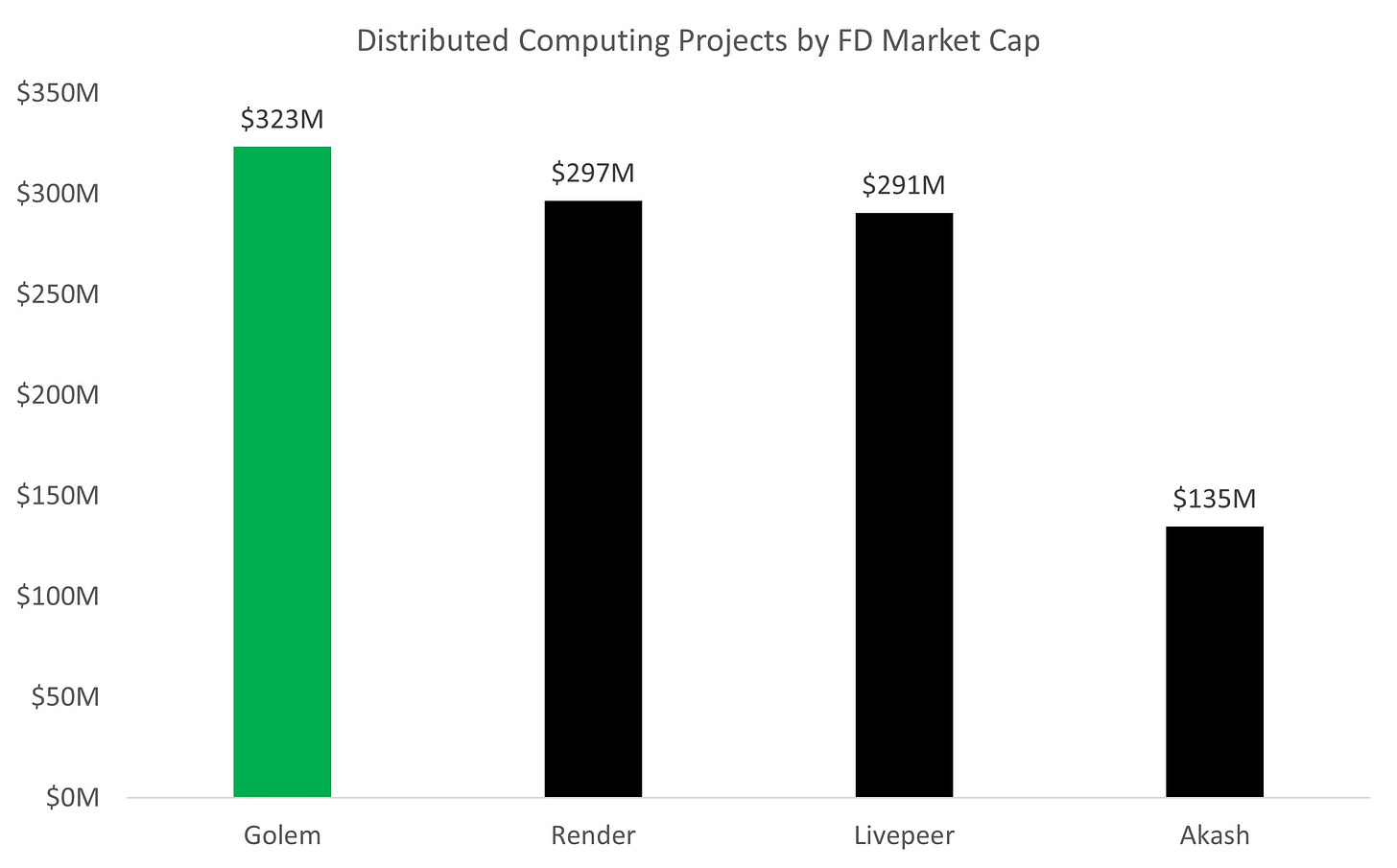

Smart Contract Platforms (Layer 1s)

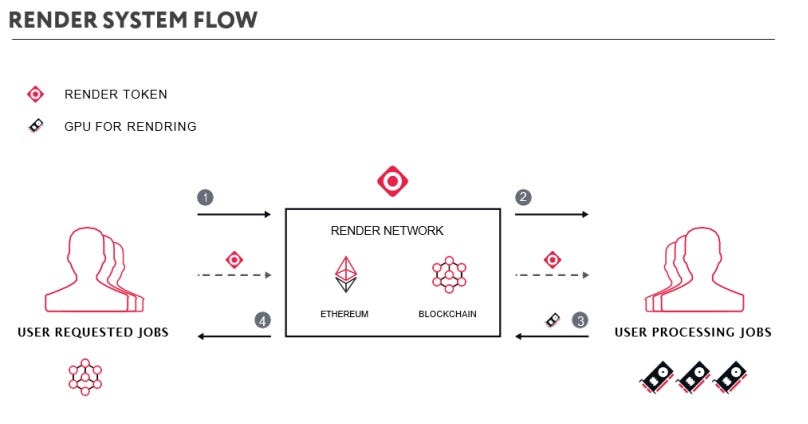

Smart contract platforms, also known as “Layer 1s”, serve as the foundation of Web3. They are the computers that set the rules for the ecosystem and allow users to create, store and trade cryptocurrencies and digital assets such as NFTs. Every time that you make a trade on Uniswap, lend money on Aave, mint an NFT on Opensea or vote in a DAO you need to use (and pay) a Layer 1 such as Ethereum.

Keeping with the ethos of Web3, smart contract platforms are decentralized and distributed, meaning that they aren’t controlled by any one party, they can never be shut down and anyone can use them at any time.

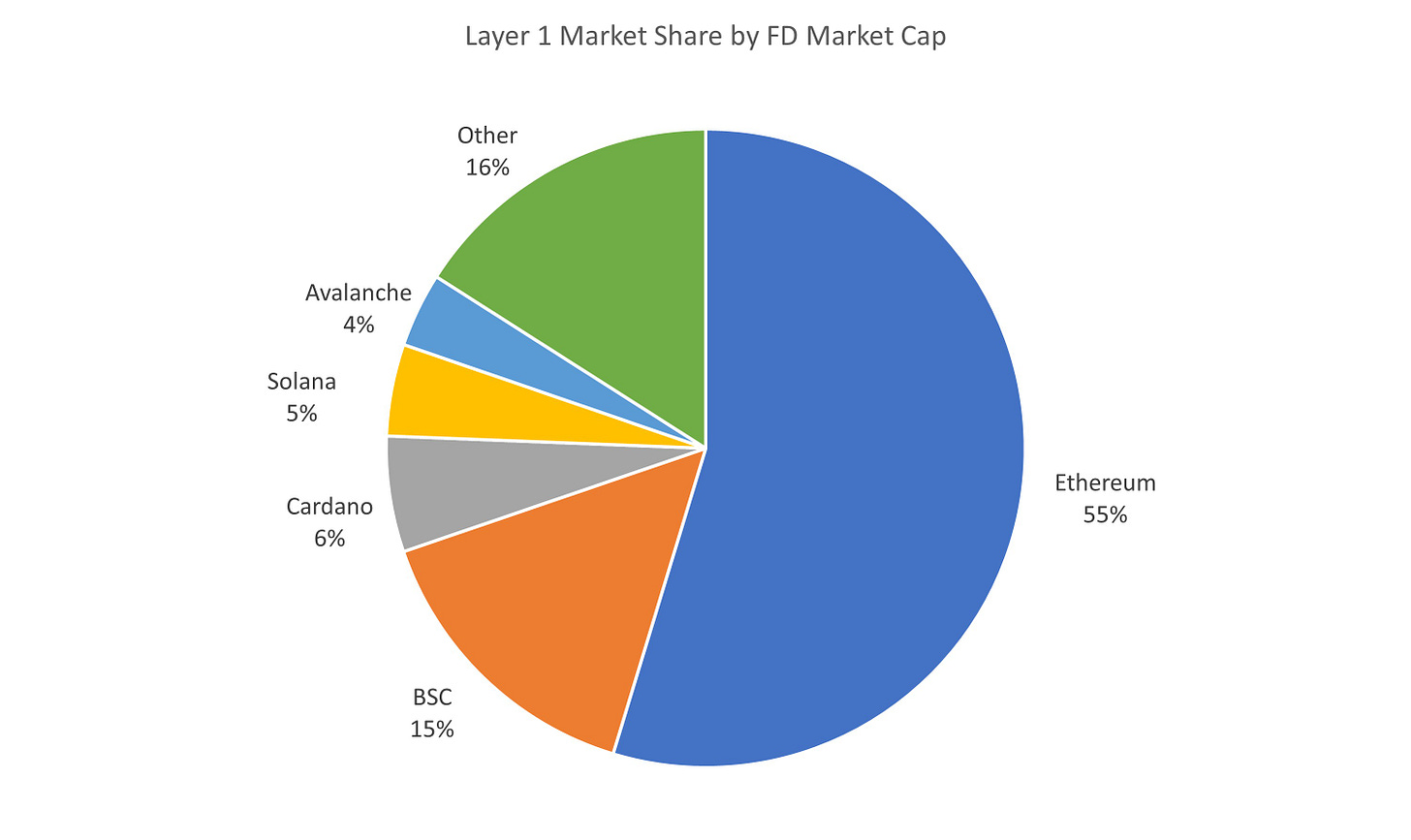

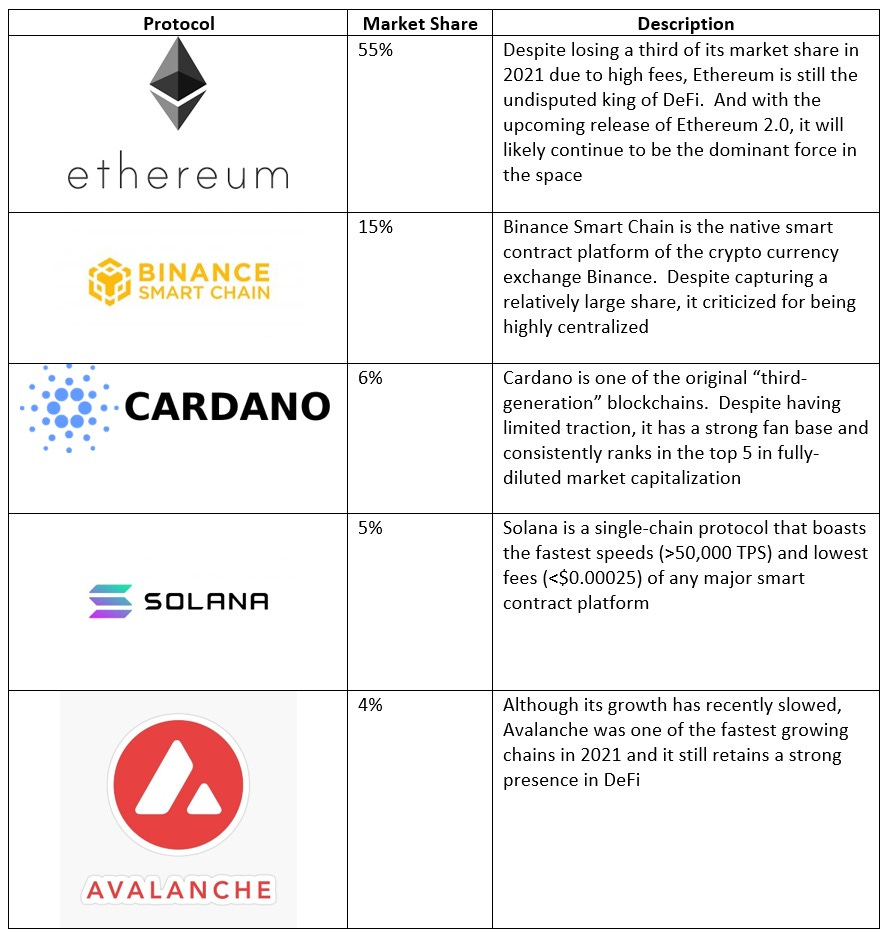

As of September 2022, the largest smart contract platforms by fully-diluted market capitalization are Ethereum, Binance Smart Chain, Cardano Solana and Avalanche.

Ethereum Leads the Market with over 55% of FD Market Cap

I won’t go into too much detail on smart contract platforms here but given their extreme importance, I’d highly recommend learning more via the article “The Complete Beginner's Guide to Smart Contract Platforms”, which dives into how they work, why they are important, who the key players are, how they stack up against one another and what’s next for the space.

Rollups (Layer 2s)

With the exception of Solana (which has its own challenges), most smart contract platforms are currently unable to handle the massive data and computational requirements that will be required for blockchain gaming, the metaverse and mass distribution of NFTs.

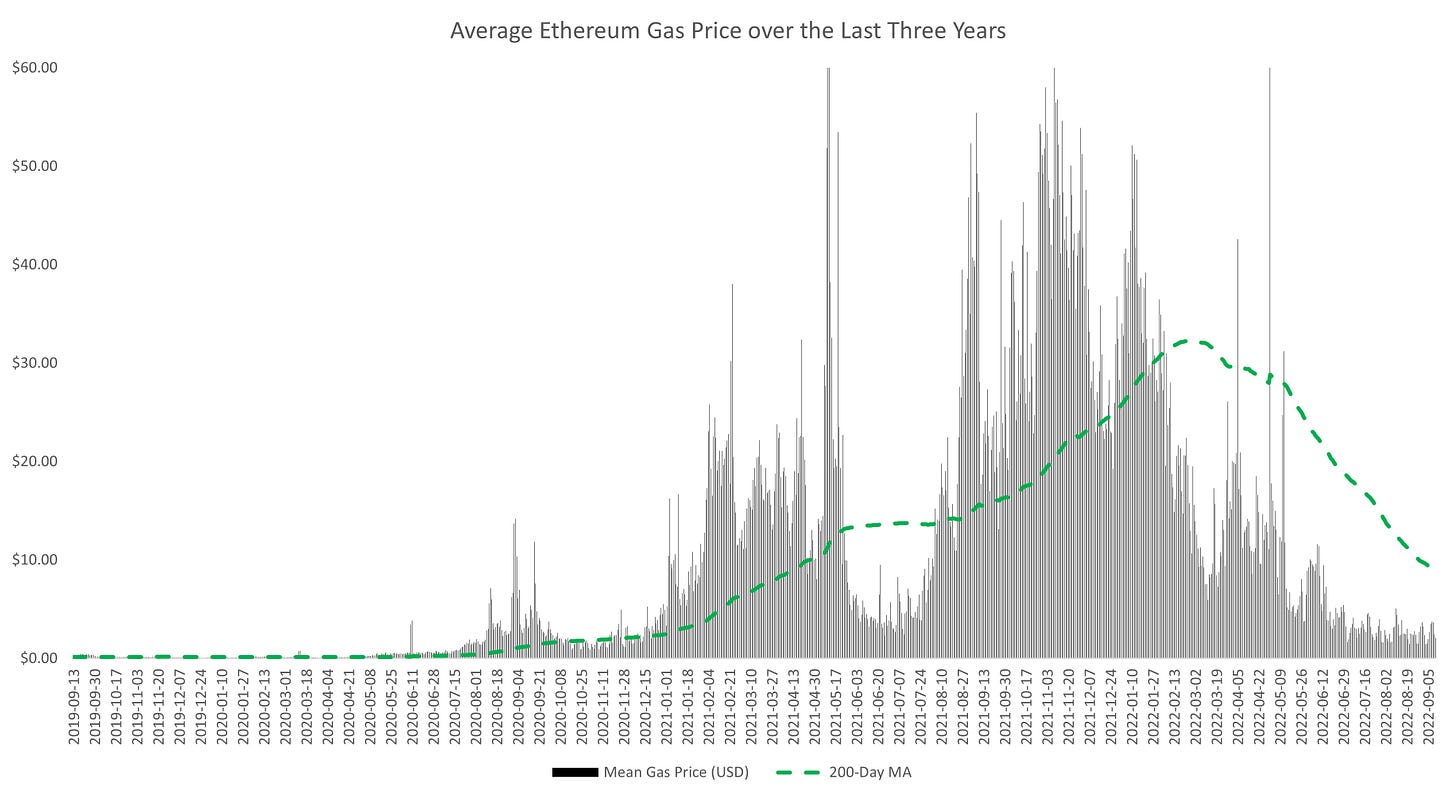

For instance, Ethereum can only handle around 25 transactions per second (vs. Visa’s 1,700) and the average fee for using Ethereum is ~$10 (and that’s the mean for all transactions – NFT transactions, which are generally much more complex, can often cost users several hundred dollars).

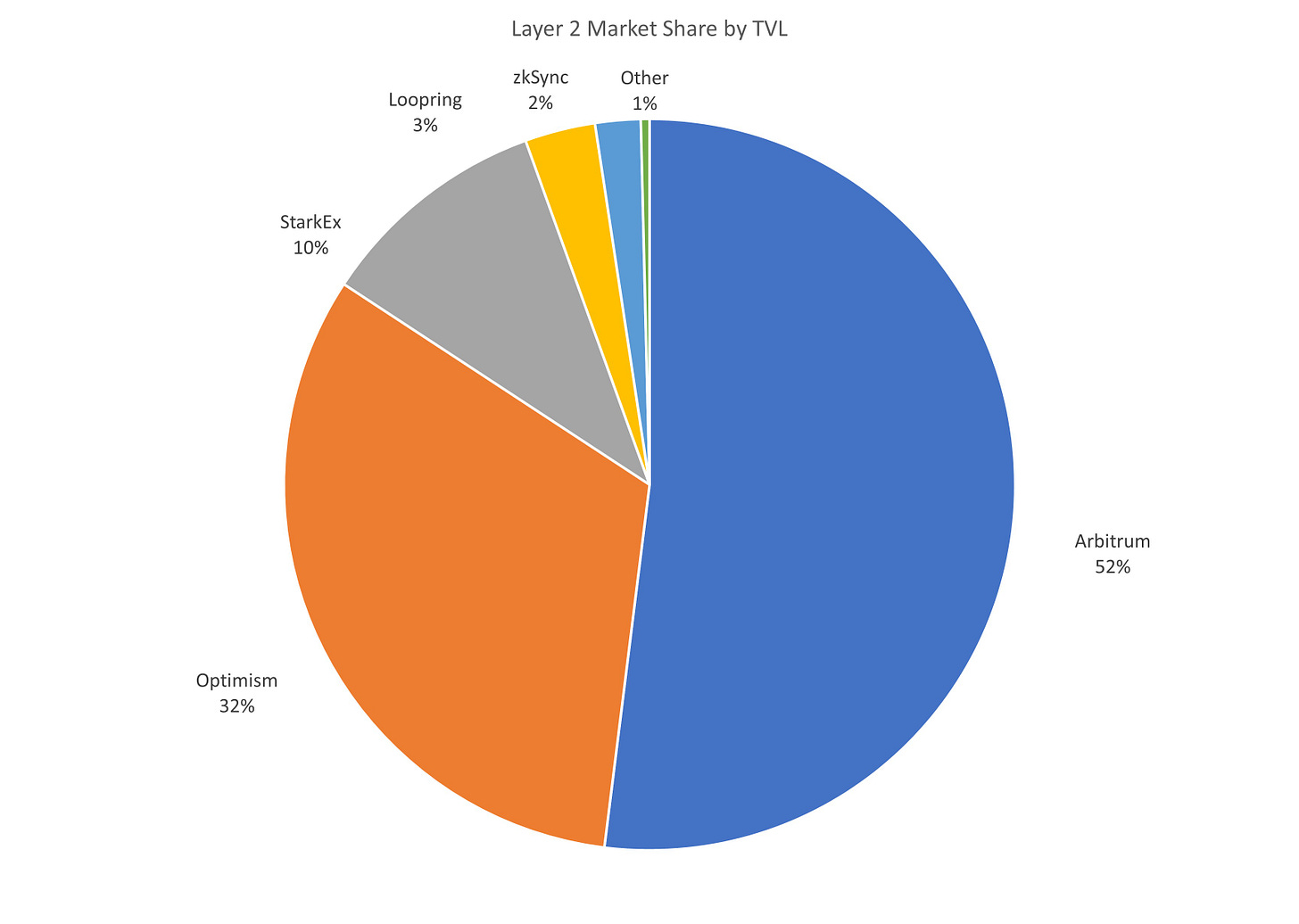

The most likely solution to these problems is the use of “Layer 2” networks – secondary protocols that are built on top of existing blockchains.

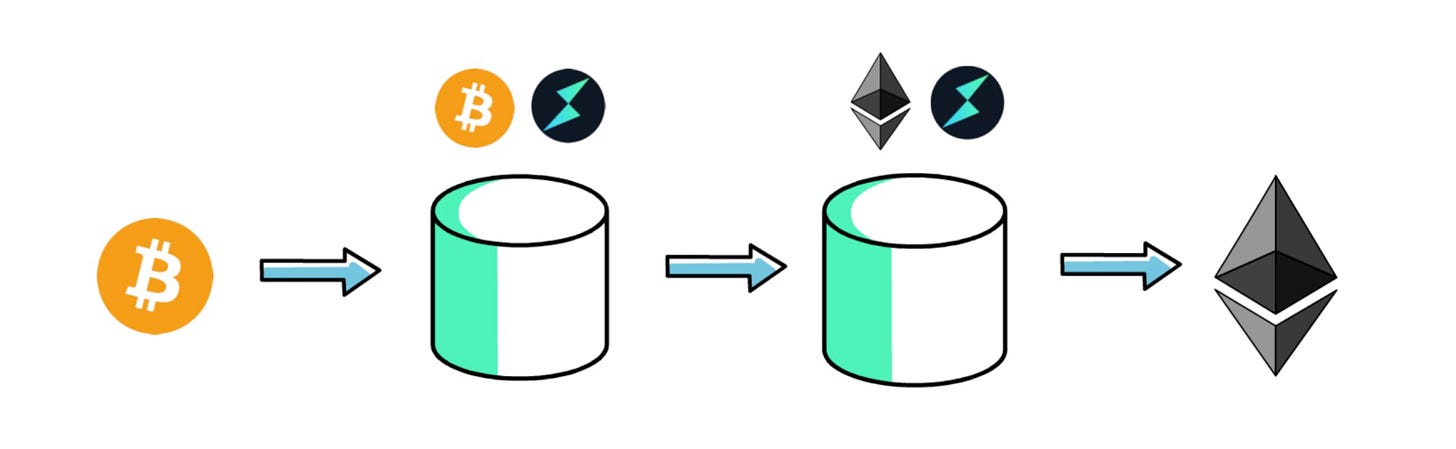

While there are many different types of Layer 2 solutions (these are discussed in much greater detail in the article “The Complete Beginner's Guide to Smart Contract Platforms”), one flavor that is showing extraordinary promise is rollups.