The Complete Beginner's Guide to DeFi

A comprehensive overview of the trends, technologies, important sectors, key players, problems and potential of Decentralized Finance.

This article is intended to provide a somewhat thorough introduction to DeFi for beginners. It’s almost 12K words (a 30+ minute read) and is organized into 8 parts, which are summarized below for the tl;dr crowd:

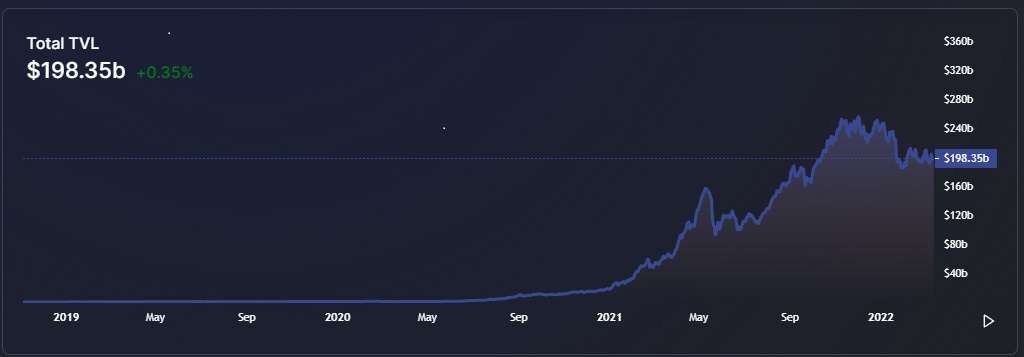

What is DeFi?: DeFi refers to a global network of computers that allow users to transact directly with other users to borrow, lend, earn interest and buy insurance without ever using (or needing) traditional intermediaries such as banks, brokers, exchanges, lawyers and / or regulators. The space is worth almost $200B and has grown over 10x in 2021.

The Problems with Centralized Finance: Our current financial system has several flaws – banks can seize our assets, deny us access and demand reams of personal data to open a checking account or take out a loan. They are also expensive, inefficient and not particularly trustworthy.

The Solution – Decentralized Finance: DeFi uses blockchain technology to fix this, creating a much more efficient system that’s open to anyone with internet access and doesn’t even require you to give your name.

What’s Different About DeFi?: Although DeFi has many of the same categories as traditional finance (e.g. banking, exchanges, borrowing and lending, insurance and derivatives) the elimination of intermediaries makes the mechanics quite different and the resulting systems are generally better, faster and much cheaper.

What’s New in DeFi?: DeFi has introduced innovative new financial products that offer triple-digit interest rates, allow multi-million dollar loans without collateral and allow anyone to start a bank, hedge fund, currency exchange or insurance company without obtaining regulatory approval.

DeFi Infrastructure: The space has also created the need for new enabling technologies such as smart contract platforms, oracles, data aggregators, decentralized storage providers and interoperability protocols (great section for pick-and-shovel investors).

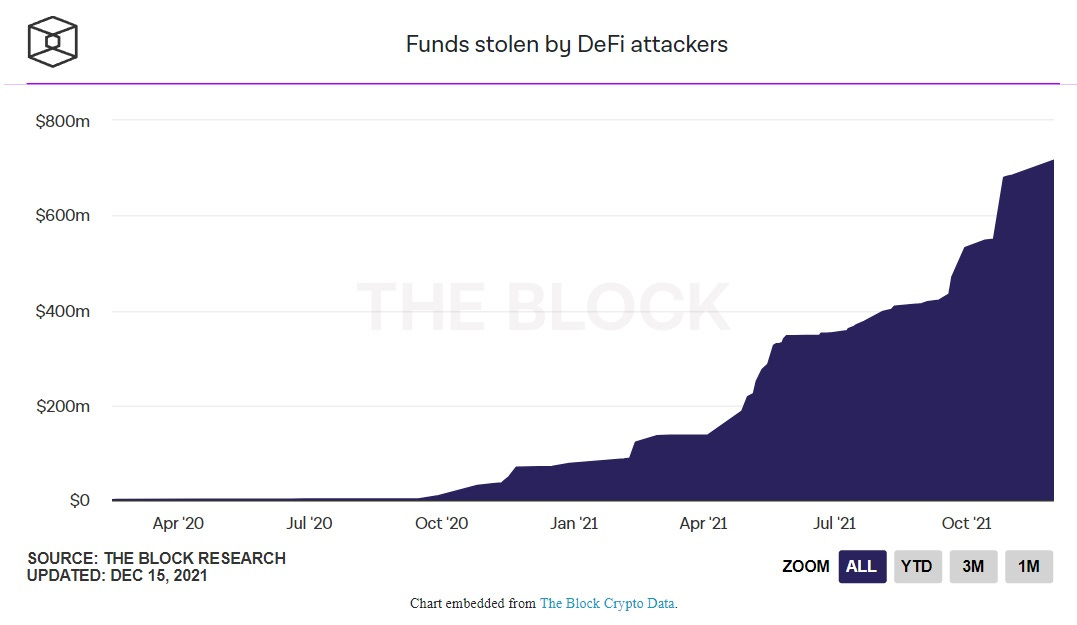

The Dark Side of DeFi: The space has several problems, including extremely high fees and rampant scams that have costs users nearly $2 billion (some say this number is as high as $8 billion).

Why DeFi Will Eat Wall Street: DeFi is a truly disruptive technology that has the potential to grow 10,000x.

What is DeFi?

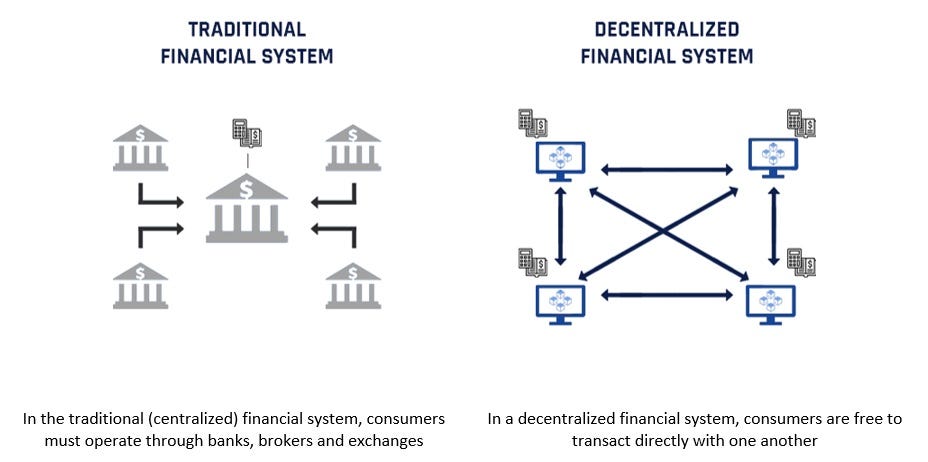

DeFi, or Decentralized Finance, refers to a global, peer-to-peer network that is built to replace the traditional banking system.

Using blockchain technology, consumers can store their own assets and freely transact directly with other users without relying on traditional intermediaries such as banks, brokers, exchanges and insurance companies. This eliminates many of the costs, restrictions and regulations associated with our legacy financial system.

Proponents assert that DeFi is superior to traditional finance because it retains all the benefits of conventional banking while being cheaper, faster and much more accessible and transparent. Critics argue that it represents an existential threat to the global financial system, a serious danger to the community and must be regulated at all costs.

Whatever side of the argument one falls on, DeFi’s popularity is undeniable. The market has grown 10x in 2021 alone to a current value of ~$200B in deposits.

What is driving this popularity? Let’s dig a little deeper…

The Problem with Centralized Finance

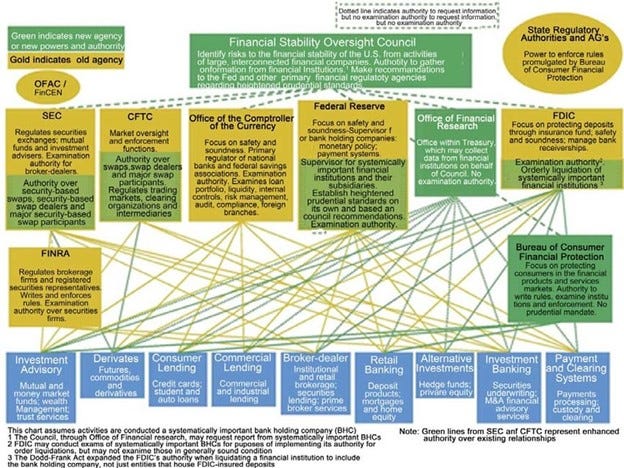

Our current financial system is highly centralized and quite complex – central banks such as the Federal Reserve issue and control the money supply, borrowing and lending is conducted through the banking system, trading is done through exchanges and the system is supported by a host of national and international regulatory bodies.

Overview of the financial system in the United States

Note: No need to analyze this – the entire point is that it’s very complex…

Unlike many in the crypto space I don’t hate banks or international financial systems. In fact, I think that our current system has served us remarkably well and has undoubtedly been a key driver of the prosperity we’ve seen over the last century. It facilitates growth via trade and the international flow of investment capital, provides security and helps establish trust through regulation, legal frameworks and the certification of formal and informal economic actors.

But, like any centralized system, our current infrastructure has become bloated, byzantine and draconian. This leads to numerous problems for the consumer including:

Third-Party Custody: In the current financial system, you don’t really hold your funds – the banks do. This means that they can freeze and even seize your assets at will (while this may seem far-fetched, consider that in 2013, the Government of Cyprus seized 47.5% of all bank accounts over €100,000 to bail-out its failing banking system)

Limited Access: Banks can decide whether they want you as a customer. While generally not a problem in the developed world, this is a huge issue in growing economies. Today, nearly 1.7 billion people remain unbanked simply because they aren’t profitable enough to be considered by global financial institutions

No Privacy: Banks must collect detailed personal information to adhere to KYC, AML and CFT regulations and require credit scores for borrowing

Expensive and Inefficient: The current financial system is rife with inefficiencies and unnecessary expenses. Payment networks charge up to 3% on credit card fees, cross-border remittance payments can take up to a week and cost 10%, and even in developed nations, users are faced with long transfer times and bloated fees.

Lack of Interoperability: Most banks currently operate as “walled gardens”, making it difficult to even transfer funds between entities let alone share and collaborate on new technologies and products.

Opacity: The financial crisis of 2008 made it abundantly clear that our current financial system lacks transparency, as even the droves of regulatory bodies had little idea what was sitting on the balance sheets of our largest institutions

Together, these concerns represent a major problem. Not only do they limit growth, but they also continue to drive inequality.

So why do we tolerate these inefficiencies? Well, we don’t really have a choice due to what is known as the Byzantine General’s Problem. While I’m oversimplifying a bit, this concept basically states that large groups of humans can’t trust one another or coordinate across vast distances without using third parties (such as banks) to establish trust. For example, when a stranger sends you money online, you must rely on your bank to ensure that 1) they are whom they say they are and 2) they have the money they say they have and 3) they actually send it.

In short, while some may call the banking system “evil”, up until now it has been a “necessary evil”.

Enter DeFi

This all changed in 2009 when Satoshi Nakamoto invented Bitcoin, solving the Byzantine General’s Problem and setting off a chain of events which made the concept of “decentralization” possible.

While the mechanics of this invention are a bit outside of the scope of this article, the key thing to remember is that he (or she) combined three technologies - blockchains, public and private key cryptography and consensus mining – to create a system that could autonomously authenticate economic actors, verify their funds and guarantee the completion of a transaction.

In effect, for the first time in history, Satoshi made it possible to perform direct, peer-to-peer transactions without relying on third parties to establish trust.

The effect of this cannot be overstated and requires a bit of “tabla rasa” thinking. Imagine for a bit, how you would design a financial system if you no longer needed intermediaries. After all, what’s the point of banks if you can safely hold your own assets? What’s the point of financial intermediaries if you can make loans directly? What’s the point of lawyers if everything is executed in code? What’s the point of exchanges if you can trade directly? What’s the point of regulators in an industry that can’t be regulated?

If you’re like me, you’re probably envisioning something much simpler and more elegant than what we have today…

That system is DeFi, and it may allow us to reap all the benefits of centralized banking – namely trust, security and growth – while removing most of the downsides. Indeed, DeFi offers:

Self-Custody: Instead of relying on a bank or brokerage to hold your assets, you control all of your funds with your own wallet. As such, there’s no one to seize your assets, limit withdrawals or tell you where you can and can’t spend your money. Want to send all your life savings to a sketchy gambling website? Go for it!

Permission-Less: Users don’t need permission from third-parties. Anyone with money and an internet connection can access any DeFi service and trade coins, create derivatives, lend and borrow, buy insurance, etc… in markets that are open 24 hours a day, 7 days a week and 365 days a year

Private: Users can choose to (and often do) remain anonymous. As Coindesk so eloquently stated: “On the normal web, you can’t buy a blender without giving the site owner enough data to learn your whole life history. In DeFi, you can borrow money without anyone even asking for your name.”

Efficiency: DeFi operates almost entirely via computer programs which automate the execution of financial transactions. As such, there’s no need for intermediaries such as bankers, regulators, lawyers, accountants, escrow agents, etc… making the system much faster and much cheaper

Interoperability: DeFi protocols are built to be composable, that is, they can be programmed to work with one another allowing users to build increasingly complex and novel financial products

Transparency: Every transaction in DeFi is broadcast to the public allowing for real-time monitoring and maximum transparency. In addition, protocols are built with open source code allowing any user to audit them

I know this is a lot to take in. Crypto is so unique, so transformative, so unintuitive that I’ve been studying it for over five years now and sometimes I feel like I only partially get it.

But to help you understand more about how DeFi can transform the world, let’s go a bit deeper down the rabbit hole…

What’s Different About DeFi?

Decentralized Finance offers many of the same products as Traditional Finance, including loans, savings accounts, exchanges, insurance, etc…

What’s shocking though is that many of these familiar products work in very unfamiliar ways. To see what I mean, let’s look at a few examples including decentralized cash, exchanges, lending and borrowing, insurance and derivatives.

Decentralized Cash (aka “Stablecoins”)

What are Stablecoins?

While DeFi has enormous potential to disrupt traditional finance, one thing limiting its development is price volatility. After all, how can we use cryptocurrencies as a medium of exchange if the value is so unpredictable? What good are double-digit interest rates if the value of the underlying assets can decrease by 50% overnight?

Stablecoins help mitigate this volatility. In a sense, a stablecoin is nothing more than a cryptocurrency pegged to a (relatively) secure asset such as the US Dollar. They can be used to buy things, lend and borrow, collect interest and even hold as a store of value. In effect, anything you can do with cash you can do with a stablecoin.

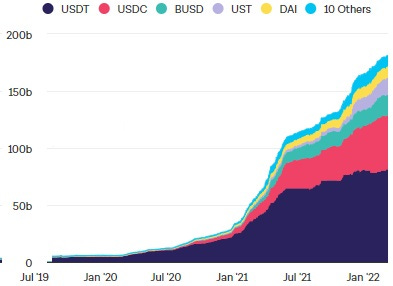

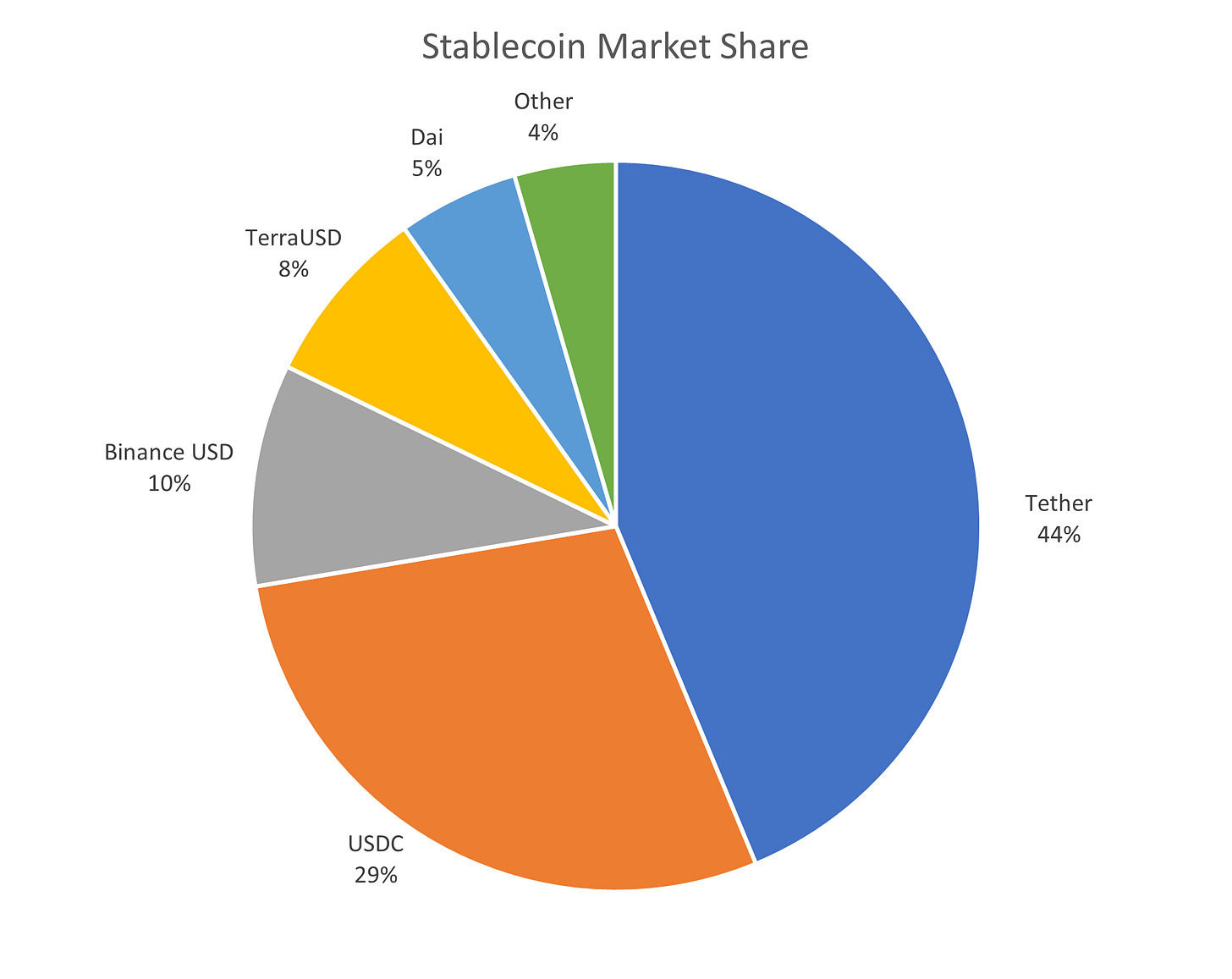

Total Stablecoin Supply

The stablecoin market has grown more than 500% in the past year alone, and currently stands at nearly $200B.

How Are Stablecoins Different from Traditional Cash?

While on the surface stablecoins might seem very similar to the digital money we use today, under the hood they are very different animals. Perhaps the most glaring distinction is in the ownership and control of the assets. The dollar is owned by the United States government – the Fed sets the rules and controls the supply, commercial banks distribute the funds through fractional reserve banking and depositors receive interest.

Stablecoins on the other hand, are a form of private money. They either are governed by a corporation or a DAO (to keep things simple you can think of this as a collective), users create and distribute the funds by depositing collateral and token owners claim the interest.

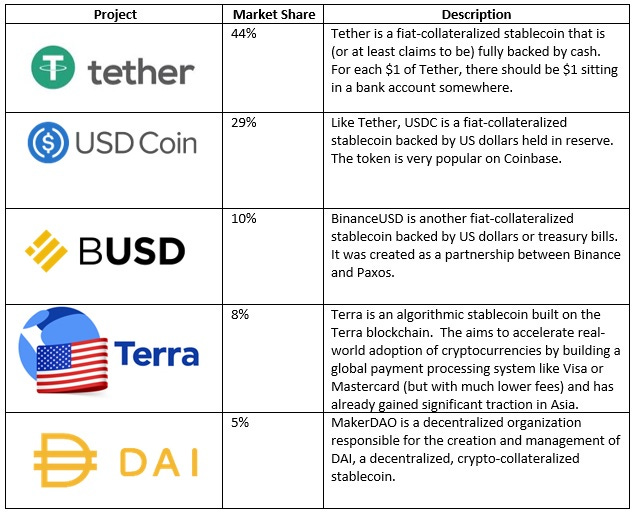

Today, there are three main types of stablecoins:

Fiat-Collateralized: Fiat-collateralized stablecoins such as Tether and USDC are (or at least claim to be) fully backed by cash. That is, for each $1 of Tether, there should be $1 sitting in a bank account somewhere.

The problem with these coins is that, by definition, they are still centralized, relying on banks and other third-parties to keep custody of the collateral. This goes against the decentralized ethos of DeFi, as any centralized point in the chain makes the entire system vulnerable and serves as a magnet for regulators.Crypto-Collateralized: Crypto-collateralized stablecoins such as Dai are, as the name suggest, backed by a basked of cryptocurrencies and use autonomous protocols to maintain the peg.

While promising, crypto-collateralized stablecoins are currently very inefficient, requiring huge amounts of overcollateralization. That’s why the holy grail of DeFi has long been the creation of an Algorithmic Stablecoin.Algorithmic: Algorithmic stablecoins are decentralized and do not require collateral. The peg is maintained through a complicated incentive program. In essence, when the price goes above $1, more coins are issued, diluting the supply and lowering the price. When it goes below $1, coins are bought back to raise the price.

While algorithmic stablecoins are great in theory, they may not be possible in practice. Economists are quick to point out that they violate the “impossible trinity”, which states that you can’t have a free capital flow, sovereign monetary policy and a fixed exchange rate at the same time.

Indeed, virtually every experiment in this space has failed because incentives stop working if people don’t believe there’s inherent value in the currency. Once trust is loss, everyone sells contributing to a “death spiral” that quickly reduces the value of the coin to zero.

Whether or not this problem is solved by the current batch of market participants, stablecoins will likely continue to play a major role in DeFi as they offer several core benefits:

Permissionless: Anyone can access stablecoins and use them to freely move assets across international borders

Cheaper: Although Ethereum is currently experiencing a significant fee problem, many competing networks offer near-zero fees for using stablecoins (much less than the 2-3% charged by Visa and Mastercard)

Faster: Stablecoin transactions and transfers are near instant and can be performed at any time

Programmable: It’s helpful to remember that stablecoins are software and, as such, can be easily programmed into smart contracts, creating a variety of potential use cases

Transparent: Anyone can view the underlying code and all transactions are easily discoverable on blockchain explorers

Who are the Key Players in the Stablecoin Market?

The market for stablecoins is currently dominated by the fiat-collateralized model, with Tether, USDC and BUSD holding a combined 82% market share.

Decentralized Exchanges

What are Decentralized Exchanges?

Decentralized exchanges (or DEXs) are peer-to-peer marketplaces where users can directly trade with one another without the need for banks, brokers or any other financial intermediaries.

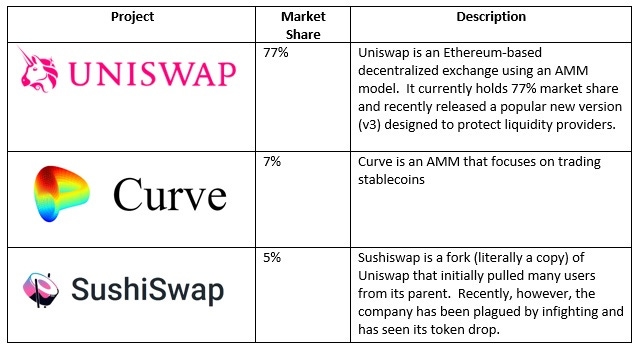

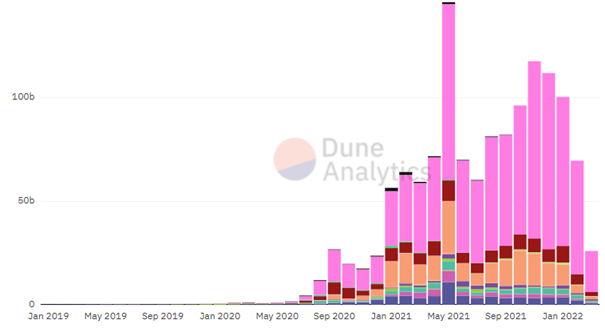

Monthly DEX Volume

They have hosted nearly $1T of trades over the last 12 months, and are even catching up to centralized exchanges, with Uniswap recently averaging over 50% of Coinbase’s volume and 10% of Binance’s volume.

How Are Decentralized Exchanges Different from Traditional Exchanges?

Traditional exchanges, such as the NYSE, Nasdaq or Coinbase, provide a platform to match buyers and sellers of securities. This begs the question, what happens if there’s a temporary imbalance between the two?

Enter market makers. Market makers, who are often brokerage houses, hold onto a “reserve” of assets that they are always ready to buy or sell. Instead of trying to profit on the movement of a security, they profit from the difference in the buying price and the selling price, known as the bid-ask spread.

These professionals are essential because they ensure that traders can always immediately buy or sell during trading hours, providing much needed liquidity to the markets.

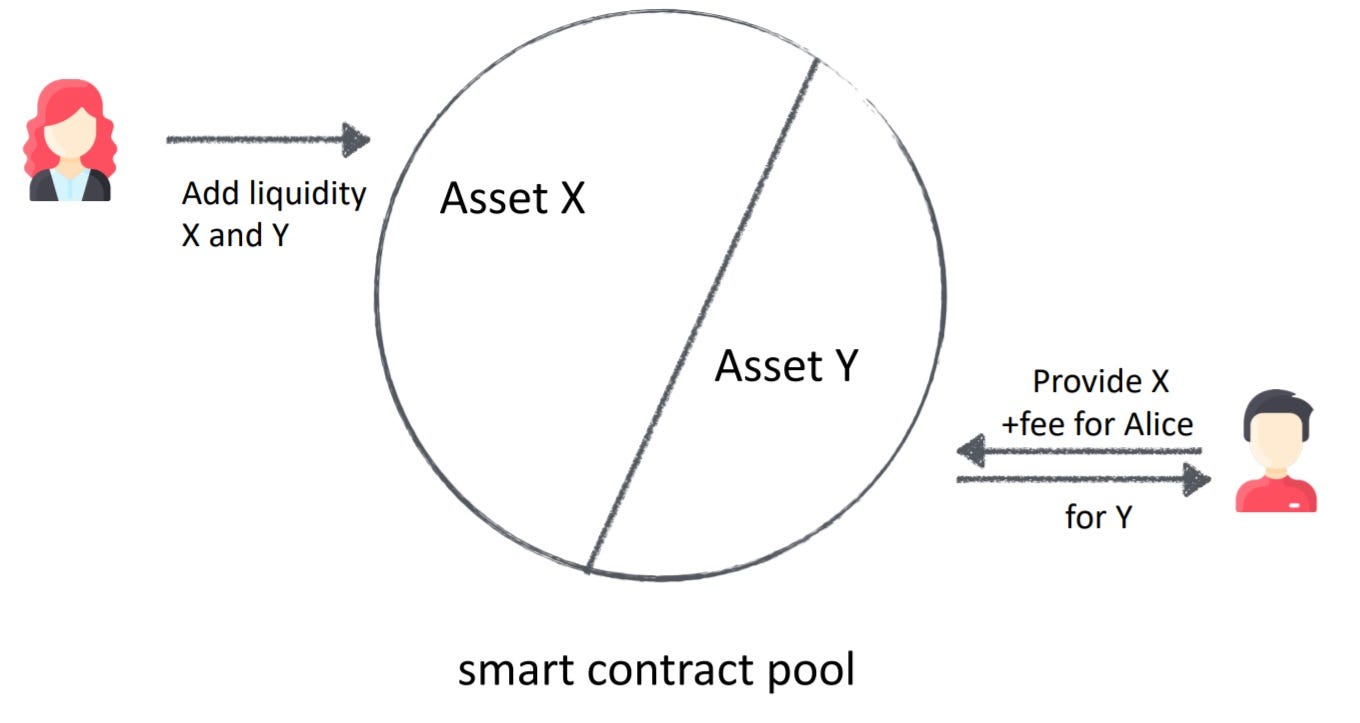

A new breed of decentralized exchanges, however, is removing the need for these middleman and allowing direct peer-to-peer trading through what is known as an Automated Market Maker (“AMM”).

Instead of needing to match buyers and sellers in real-time, the participants of an AMM contribute their tokens to a centralized reserve known as a liquidity pool. This eliminates the need for a market maker as prospective traders can now directly through that pool, depositing what they want to sell and taking what they want to buy.

For example, let’s say you wanted to trade ETH for UST on Uniswap. You would simply go to the site, access the ETH-UST pool, send in your ETH and receive UST in return. The price is controlled by a simple algorithm that raises the price of a token when demand increases, and lowers it when demand falls.

The decentralized nature of these AMMs have several unique benefits:

Anonymity: DEXs don’t require sign-ups, KYC information or any customer information at all

24/7/365: The unique liquidity pool structure of AMMs means that trading never shuts down

Deep liquidity: Although DEXs have not yet caught up to their centralized competitors, the fact that anyone can provide liquidity creates huge potential for the market

Personally, I believe that one of the most beneficial aspect of DEXs today is that they’re not subjected to the limitations of Coinbase and Binance. Unfortunately, the two largest centralized exchanges often have arbitrary and stringent rules for listing coins, so it’s not uncommon to be blocked from purchasing a popular token. With over 50,000 trading pairs listed on Uniswap, however, you can almost always find what you are looking for!

While extremely elegant and seemingly much more efficient than traditional exchanges AMMs are not without their risks, which include:

Smart Contract Risk: It’s vital to remember that these AMMs are nothing more than lines of code, and code can be very vulnerable. For instance, if there’s a bug or if a hacker finds an exploit, participants could easily lose all of their funds. That’s why some of the largest exchanges hold reimbursement funds.

Impermanent Loss: Impermanent loss is a complicated concept whose mechanics are outside the scope of this article. But in essence, it’s a form of opportunity cost, where a liquidity provider loses out on potential gains because his or her funds are locked in a liquidity pool

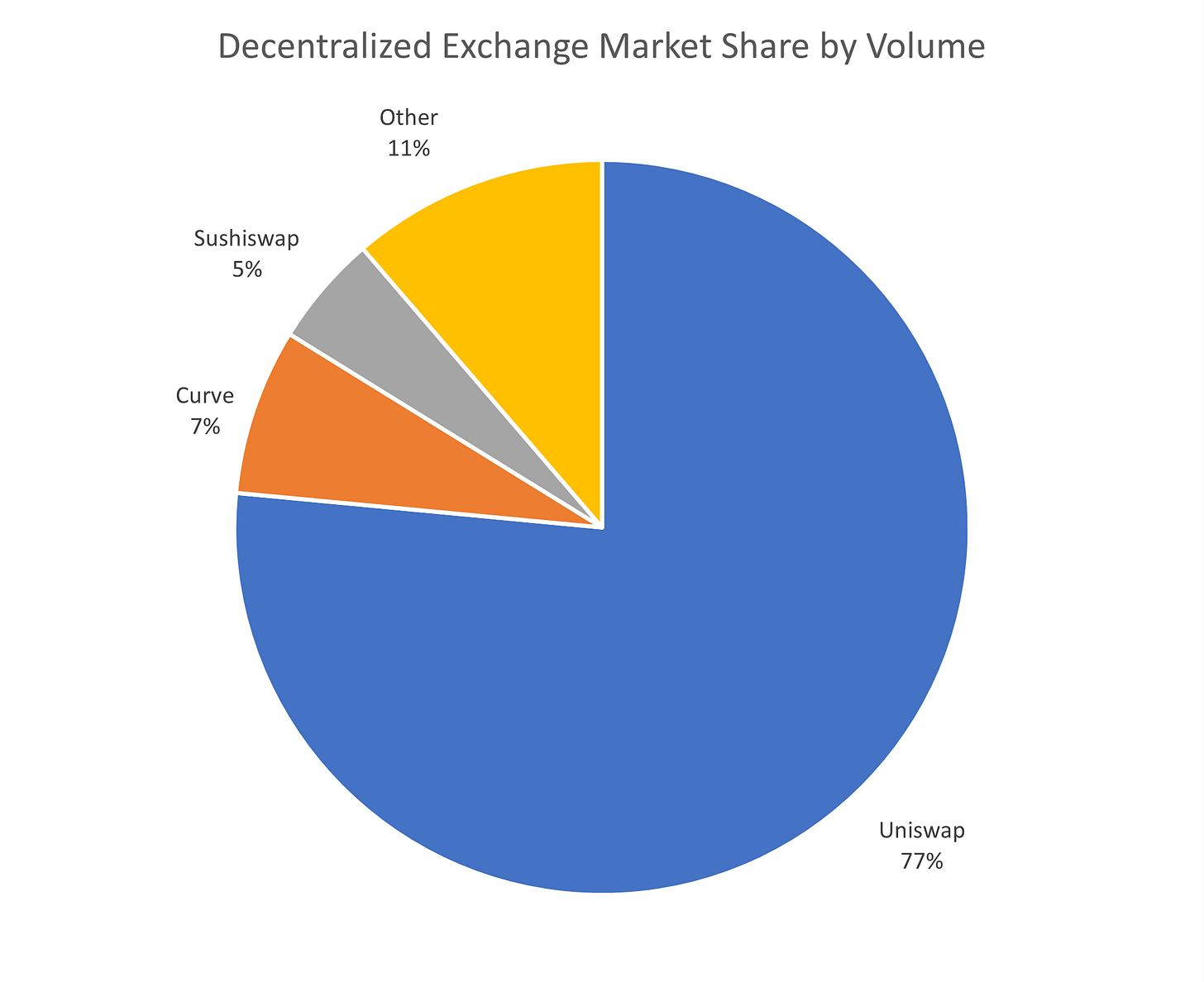

Who are the Key Players in the DEX Market?

At the time of writing, the three largest by volume are Uniswap, Sushiswap and Curve.

Decentralized Lending and Borrowing

What are Decentralized Loans?

Decentralized lending operates on peer-to-peer lending platforms that allow anyone to give and receive loans without using a bank or other third-party intermediary.

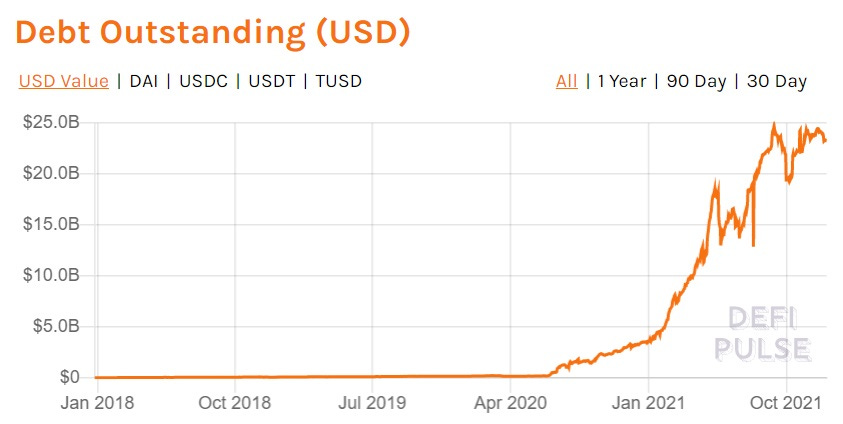

Outstanding DeFi Loans as of Late 2021

According to Defi Pulse, as of late 2021 there were $23.25B outstanding DeFi loans, up over 500% from the previous year.

How Are Decentralized Loans Different from Traditional Loans?

In traditional finance, borrowing and lending is facilitated by banks or other financial institutions. While some Fintechs have introduced peer-to-peer lending, the mechanics are largely similar, as both methods rely on centralized parties and require detailed onboarding, credit checks, KYC and underwriting.

Once again, DeFi does things in a totally different way.

Instead of relying on a bank or third-party platform to serve as a matching agent, DeFi lenders contribute their assets to a pool and encode the rules of the loan into a smart contract. These pools use a mathematical formula to calculate interest rates.

When a borrower wants to take a loan, all they have to do is deposit some cryptocurrency for collateral (generally overcollateralizing by 133% to 150%) and they are free to take the loan. This process requires no KYC, no credit checks and no legal documentation. In fact, you don’t even have to give anyone your name!

Once they’re done with the loan, borrowers can simply pay back the principal plus interest and get their collateral back.

The fact that these loans are collateralized with such a liquid instrument has a few unique consequences:

Lenders have zero default risk – if the borrower fails to repay or if the collateral goes below a certain threshold, it’s immediately liquidated and paid to the lender

There are no repayment schedules or any obligation to repay at all. Borrowers can keep the loan as long as they want providing that the collateral remains in good standing

Indeed, decentralized loans offer several advantages over their traditional counterparts. They are:

Permissionless: Anyone with collateral can get a loan, and they can do it anonymously

Faster: Decentralized loans are settled instantly

Cheaper: As there is no need for loan documentation, underwriting, KYC, etc… decentralized loans often cost a fraction of their traditional counterparts

All this said, decentralized loans are not without risk, as they are still susceptible to the smart contract risk and rug pulls that we’ve discussed above.

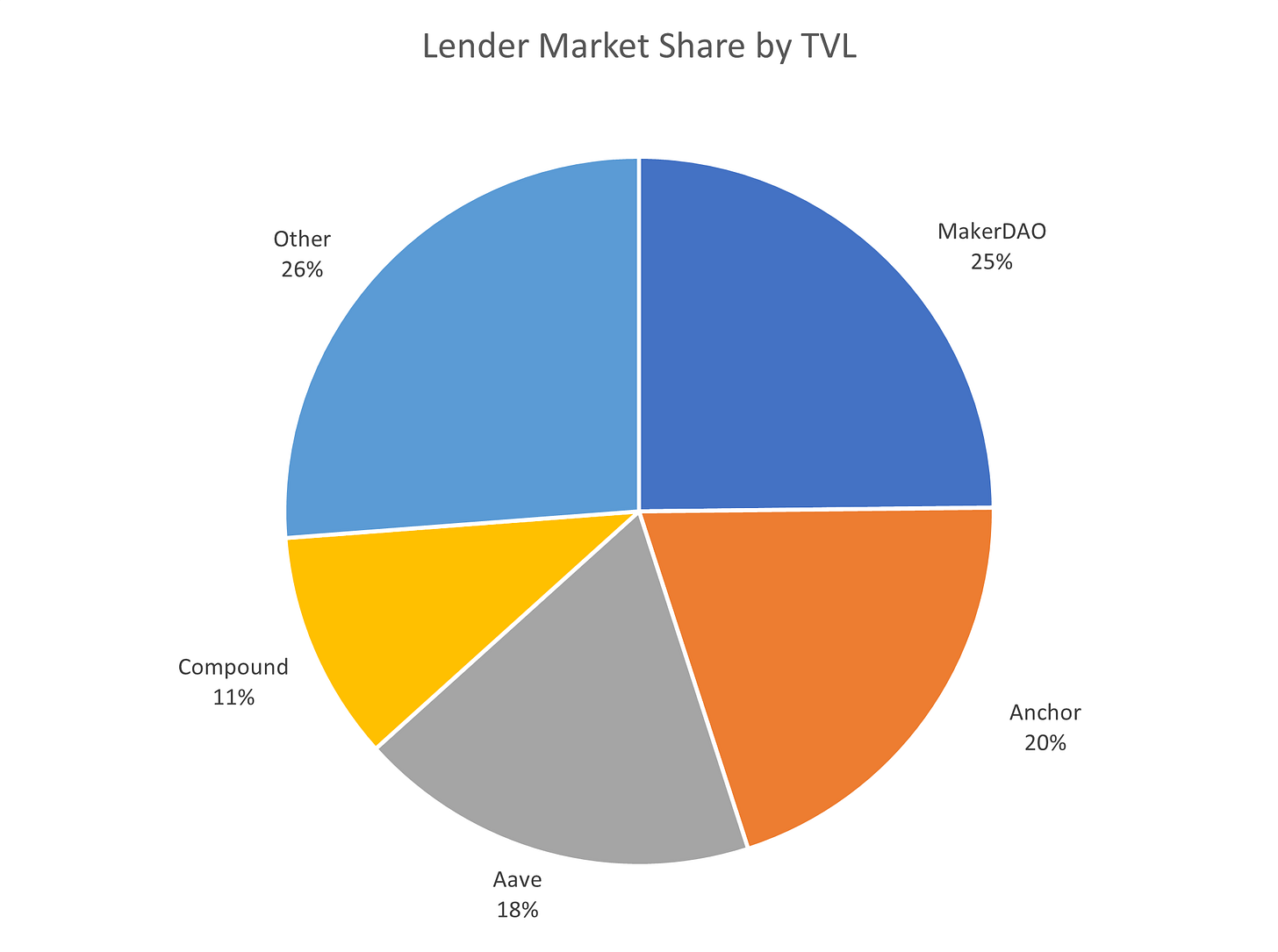

Who are the Key Players in the Decentralized Lending Market?

The three largest players – MakerDao, Anchor and Aave – control over 63% of the lending market’s Total Value Locked (the value of assets deposited into smart contracts pools by lenders and borrowers).

Decentralized Insurance

What is Decentralized Insurance?

Decentralized insurance utilizes the power of blockchain technology and smart contracts to offer users cover against black swan events, wallet hacks, smart contract exploits and much more.

The space is still in its infancy – while there have been over 75 documented hacks and exploits representing over $1.7B in losses (with some estimates putting this figure as high as $8B), the TVL of decentralized insurance remains under $1.5B. This pales in comparison to the $6.3T traditional insurance industry.

How Is Decentralized Insurance Different from Traditional Insurance?

At a fundamental level, insurance is a way to pool risk:

Customers pay premiums, which go into a community pool owned by the insurance company

If something bad happens, the insurance company will hire claim adjustors to validate and pay out the claim.

The insurance company will keep amount of the pool as a “reserve” to pay out claims, but often invest the rest

There are two main problems with this model: 1) administrative expenses can be very high and 2) the principal-agent problem (i.e. the insurance company is responsible for validating the claims, which means that they are incentivized not to pay them out)

Decentralized insurance protocols are designed differently, with the aim of solving both of these issues.

To understand how decentralized insurance differs, let’s look at an example from Nexus Mutual, one of the leading insurers that specializes in smart contract risk.

There are three main actors in the Nexus Mutual ecosystem:

Customers: Customers purchase insurance from Nexus Mutual and pay premiums

Risk Assessors: Members who are confident in their ability to assess the vulnerabilities of smart contract code may volunteer to be a Risk Assessor

Claims Assessor: Members may also volunteer to be Claims Assessors and vote on claims (i.e. “has a breach occurred?”)

Now that we know the players, let’s see how this works in practice:

Let’s say that Alice is lending money on Compound. She wants to insure against a smart contract breach (i.e. someone hacking Compound and stealing all of the funds), so she buys Smart Contract insurance on Nexus Mutual

Like in traditional insurance, Alice will purchase the insurance and deposit the premiums into a pool

Risk assessors who believe that Compound is safe will underwrite her insurance by putting tokens up as collateral

If no breach occurs, then the Risk Assessors get their collateral back plus part of the premium pool

If Alice believes a breach does occur, then the issue is sent to Claims Assessors who will research and vote on the issue. Claims Assessors also provide collateral

If a majority of the Claims Assessors agree that a breach has occurred, then Alice will get paid and the any Claims Assessor who voted with the majority will receive their collateral back plus some portion of the premium (Claims Assessor who vote the opposite way will lose their collateral)

In the case of a breach, the Risk Assessor will lose their collateral

By effectively pitting the Risk Assessor and Claim Assessors against one another, Nexus Mutual is able to remove the principal-agent problem and massively reduce expenses.

The genius of this method is that it removes the principal agent problem, greatly reduces expenses and offers near-immediate claim payouts.

Decentralized insurance protocols are not without risks, however, and Claims and Risk adjustors that don’t have a deep knowledge of their craft can lose a lot of capital.

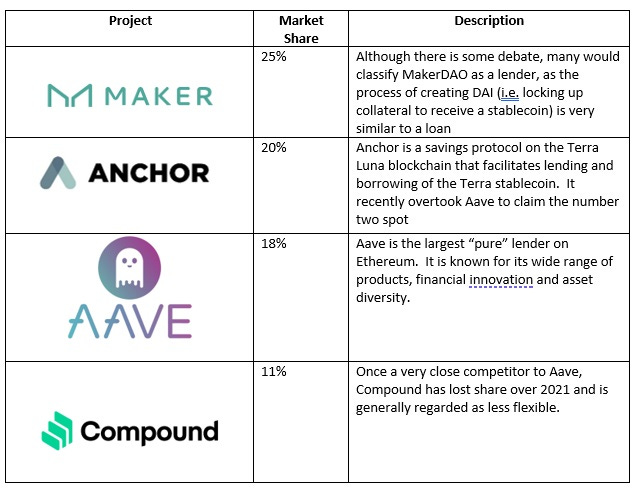

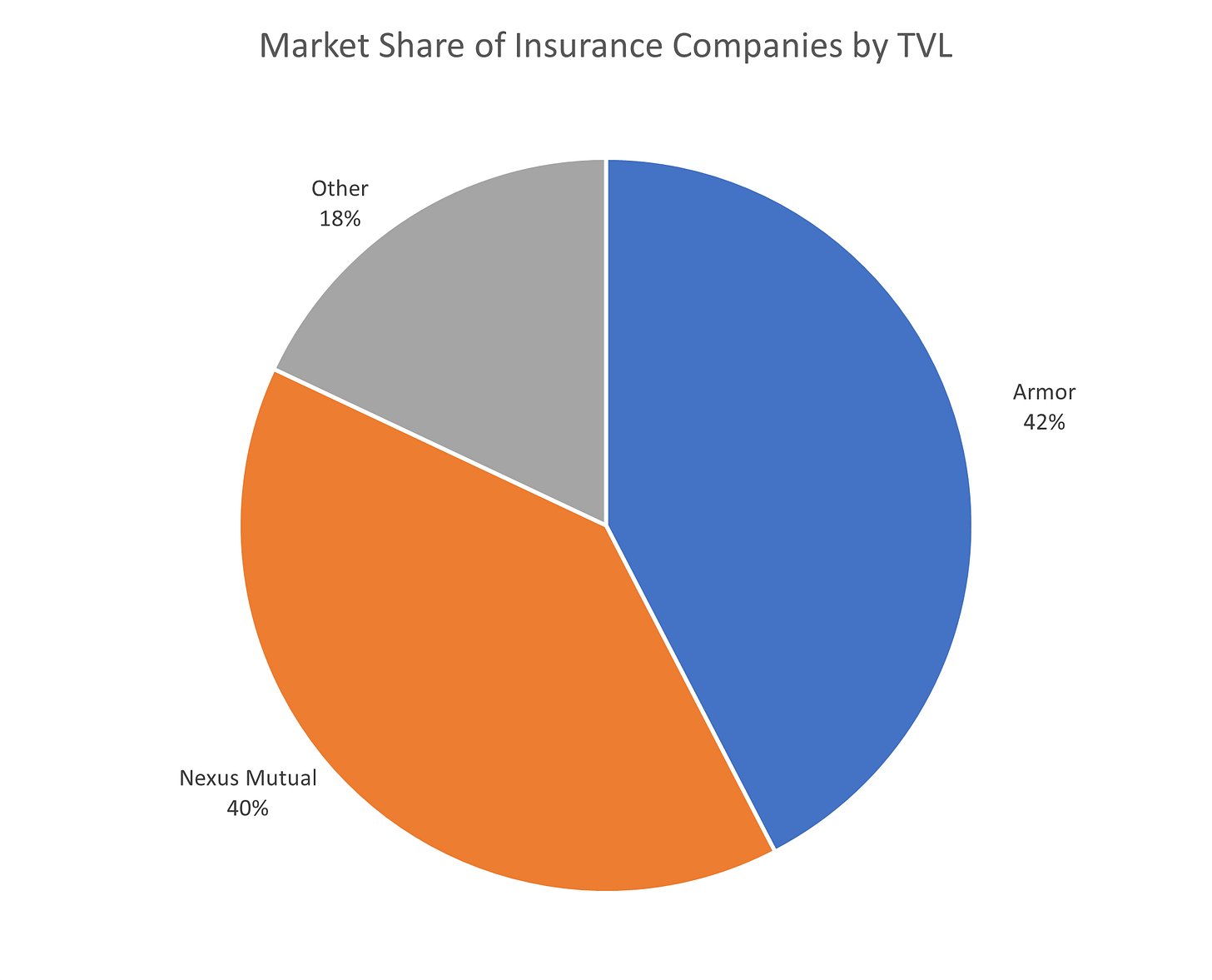

Who are the Key Players in the Decentralized Insurance Market?

At the time of writing, Armor and Nexus Mutual control over 80% of the TVL in insurance. The two are currently partnered in a broker (Armor) – underwriter (Nexus) relationship.

Decentralized Derivatives

What are Decentralized Derivatives?

Derivatives are financial instruments that derive their value from an underlying asset such as a stock, bond, commodity, market index or currency. Most traditional derivatives are traded on conventional exchanges such as the Nasdaq or CME, and crypto derivatives are traded on centralized exchanges such as Binance and FTX.

As the name would suggest, decentralized derivatives refer to the exchanges and protocols that facilitate the creation and trading of derivatives without using a centralized party.

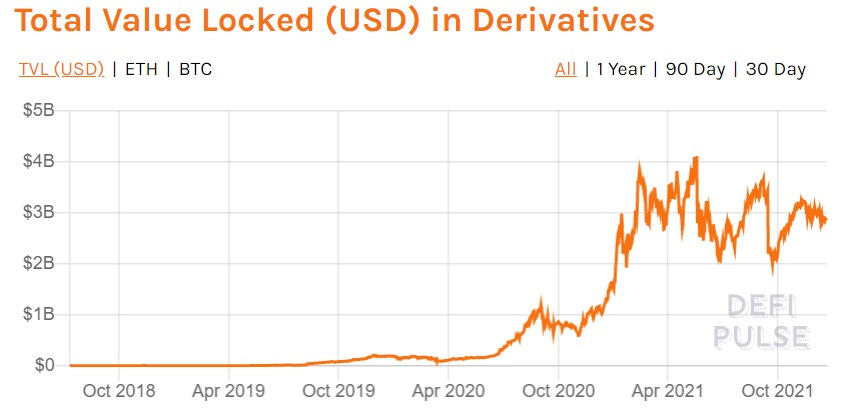

Although it has grown over 120% in the last year, the space is still very small. According to Defi Pulse, as of late last year less than ~$3B was locked in derivatives. This is less than 3% of the centralized crypto derivative markets and barely a speck of dust when compared to the $1 quadrillion traditional derivatives market.

While the potential of decentralized derivatives is immense, the technology has yet not caught up to the promise. In particular, current offerings suffer from high fees, capital inefficiencies, poor pricing and a general lack of the level of sophistication needed for professional users.

How Are Decentralized Derivatives Different from Traditional Derivatives?

There are currently three major classes of crypto derivatives:

Perpetuals: Futures with no expiration date

Options: Calls, puts, etc…

Synthetics: Instruments designed to mimic the value of other assets

Of these, the most novel may be synthetics.

Although synthetics do exist in the traditional financial world, they are often extremely expensive, complicated, opaque and limited to select clients. An infamous example of this is synthetic CDOs, a particularly convoluted instrument that many blame for financial crash of 2008.

On the contrary, crypto synthetic are relatively cheap, simple to design, easily auditable and – best of all – anyone can create and use them! For example, let’s say that you wanted to design a token that tracks the price of oil, you would:

Deposit your collateral into a platform

Design a synthetic that tracks the price of oil through an off-chain data feed known as an oracle

Create and issue the synthetic to a liquidity pool

Allow traders to trade your newly created asset

Collect trading fees

There are already many tokenized synthetics that track assets such as gold, coins such as BTC and ETH and stocks such as Tesla or GameStop.

While there’s definitely a huge opportunity for synthetics in finance, “non-financial” use cases may be even more exciting.

Indeed, as Bankless points out in its writeup on The Wild Future of Synthetic Assets, the fact that you can create a synthetic asset out of nearly anything that is measurable opens up a world of options beyond traditional finance. For instance:

Politicians could incentivize public action by designing a token that rewards a desired behavior – for instance, one that increases in value with the vaccination rate

Bookies could create “celebrity betting markets” that track the popularity of public figures by measuring their Twitter followers (and this would be difficult to regulate because of the decentralized and anonymous nature of synths)

The potential use cases are virtually endless, and the introduction of synthetic assets could spur a revolution in “user-generated finance”, potentially transforming Wall Street in the same way that “user-generated content” disrupted Hollywood.

While synthetic assets offer an enormous amount of long-term potential, there are several kinks that need to be ironed out. One of the biggest issues today is capital efficiency, as the average synthetic requires over 600% collateralization.

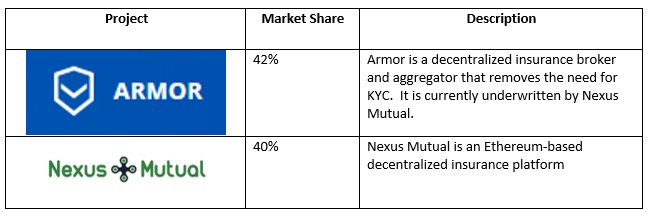

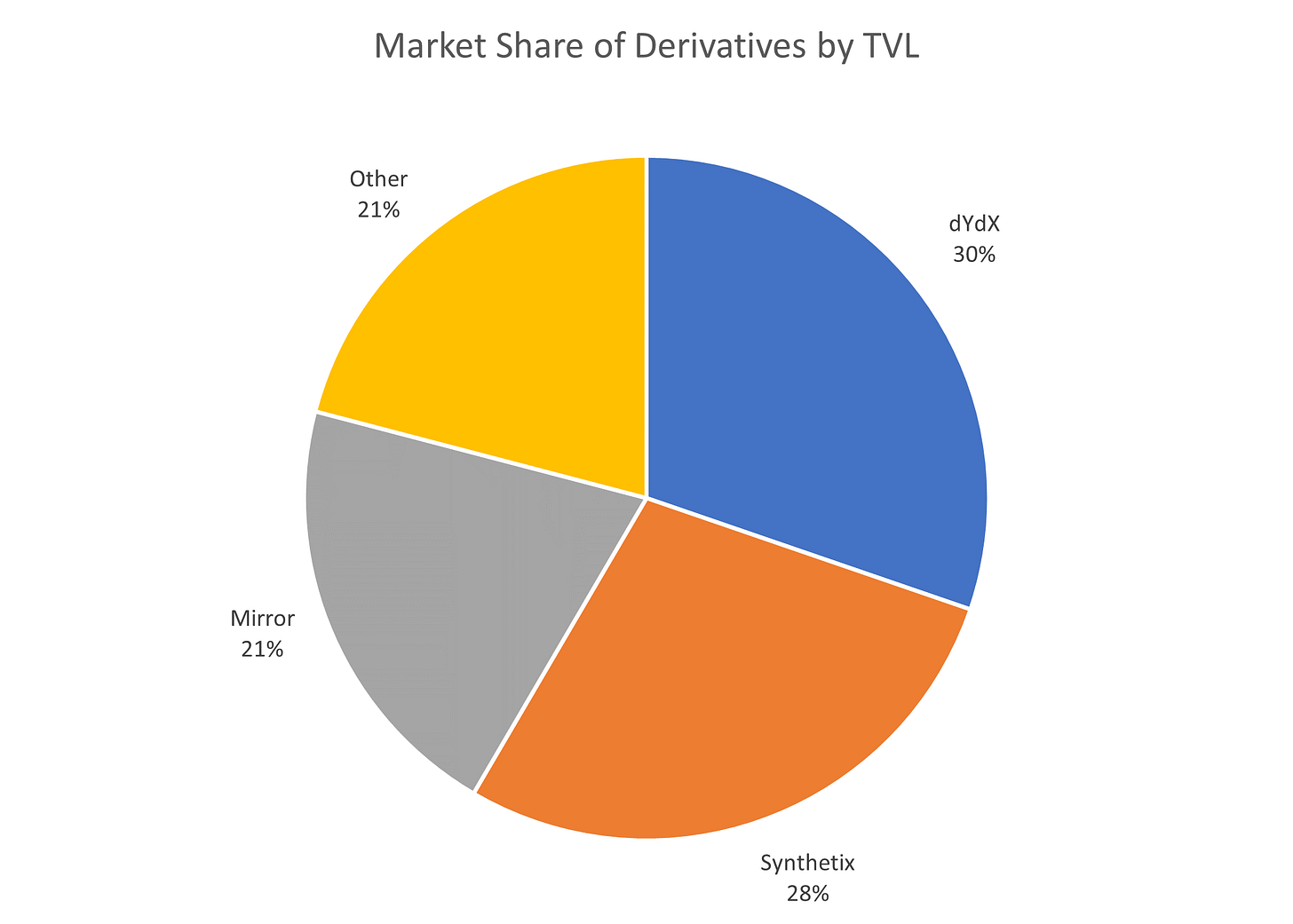

Who are the Key Players in the Decentralized Derivatives Market?

What’s New in DeFi?

In addition to a novel take on existing financial primitives, DeFi is also inventing new ones such as yield farming, flash loans and “money legos”.

Yield Farming

Tokens don’t offer dividends and few banks will let you put them in your savings account. So what’s an investor seeking passive returns to do?

As usual, the DeFi community has created their own unique ways of earning interest, and they call these strategies “yield farming”.

Four of the most popular strategies include:

Staking

Lending

Liquidity Mining

Incentive Programs

Airdrop Farming

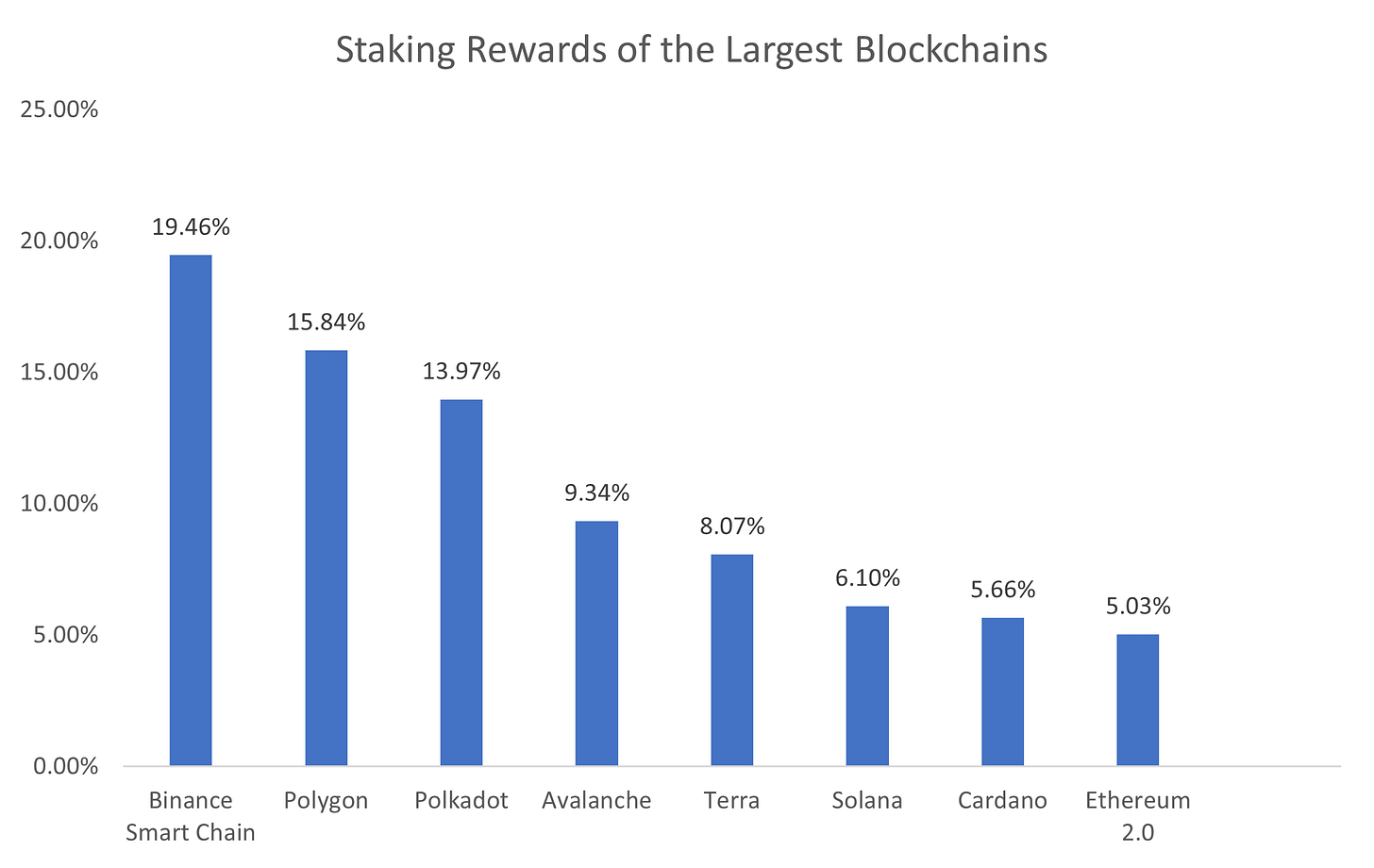

What is Staking?

Many modern blockchains use a system known as “Proof of Stake” to maintain security. In this system, “validators” (who are effectively auditors) verify transactions, review data and confirm what needs to be added to the ledger. Validators receive rewards for doing this, but they must also put up collateral that may be seized if they are malicious or negligent. The act of putting up collateral is known as “staking”, and if a Validator is competent and honest, it’s a relatively risk-free way to earn interest on crypto

While running a validator node is generally way too complicated for the average user, there are many services such as Coinbase, Binance and Lido that allow users to lend their crypto to Validators for a piece of the fees.

Staking is generally considered the safest method of Yield Farming and rates generally range from 5% to 20% for established projects (and can exceed 50% for riskier projects).

How is Lending Used in Yield Farming?

Despite having different mechanics, the results of lending crypto are similar in both the CeFi and DeFi worlds - you lend someone money and they pay you back with interest.

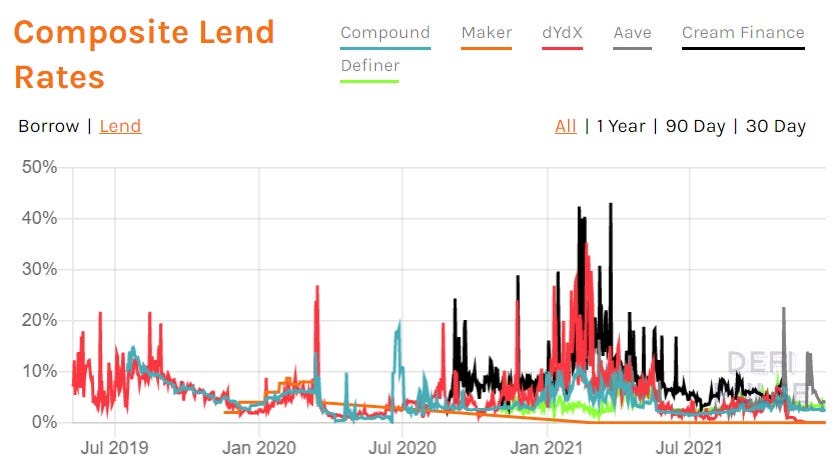

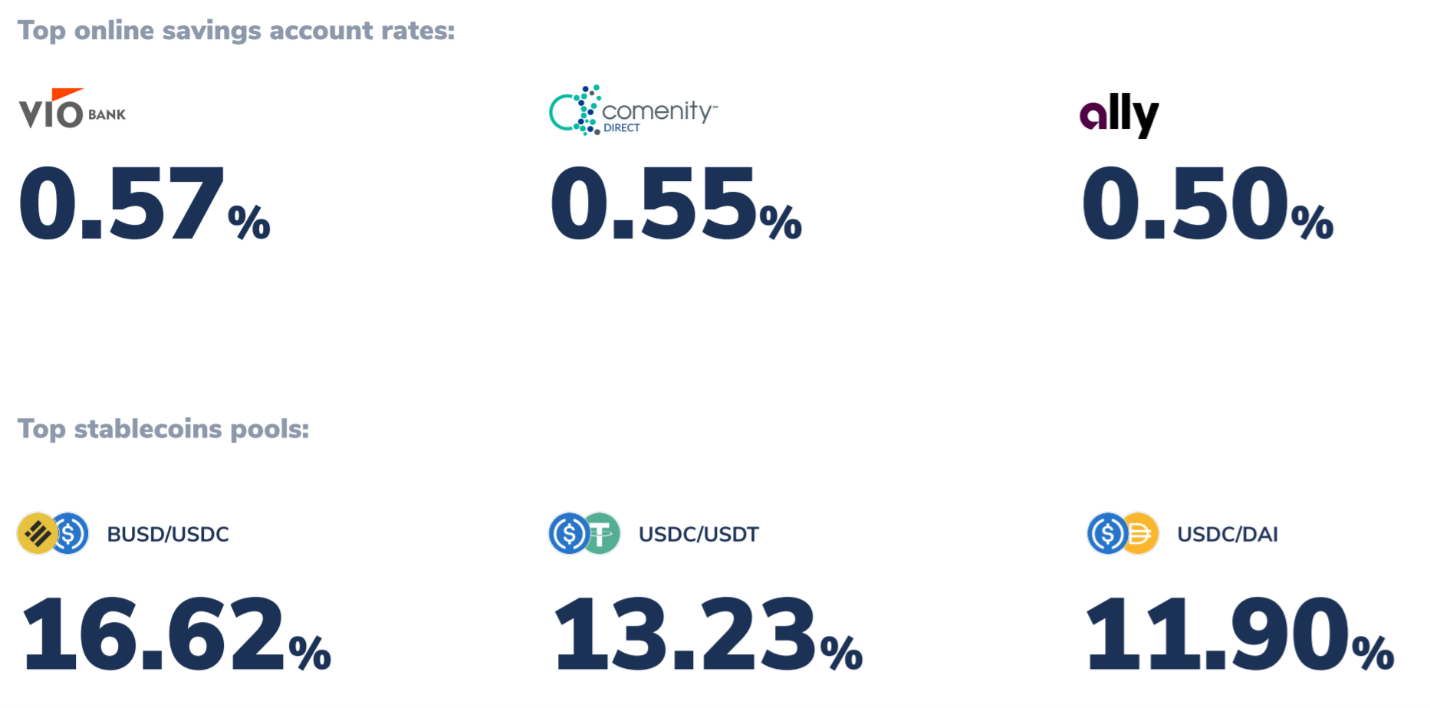

What is dramatically different is the rates. While a traditional savings account offers <1%, you can easily get 5% to 10% today for lending one of the top three stablecoins.

These numbers were even more favorable earlier in the year, when we saw rates frequently spike to 20% and above!

Lending Rates Exceeded 40% During Early 2021!

What is Liquidity Mining?

Liquidity mining is yield farming’s “high risk - high return” strategy.

Remember those liquidity pools we discussed earlier? In an AMM-based decentralized exchange, “liquidity providers” (also known as LPs or liquidity miners) deposit coins into a liquidity pool so that traders can trade them. As compensation for their deposit, LPs split the trading fees equally.

For example, let’s say that 100 LPs deposit $1M of USDT and ETH into a liquidity pool on Uniswap. If there are $30M in trades over the next month, then the pool will generate $90K in profit at a 0.30% take rate. If an LP wants to exit at that time, she’ll receive a 9% return in a month (>100% APR).

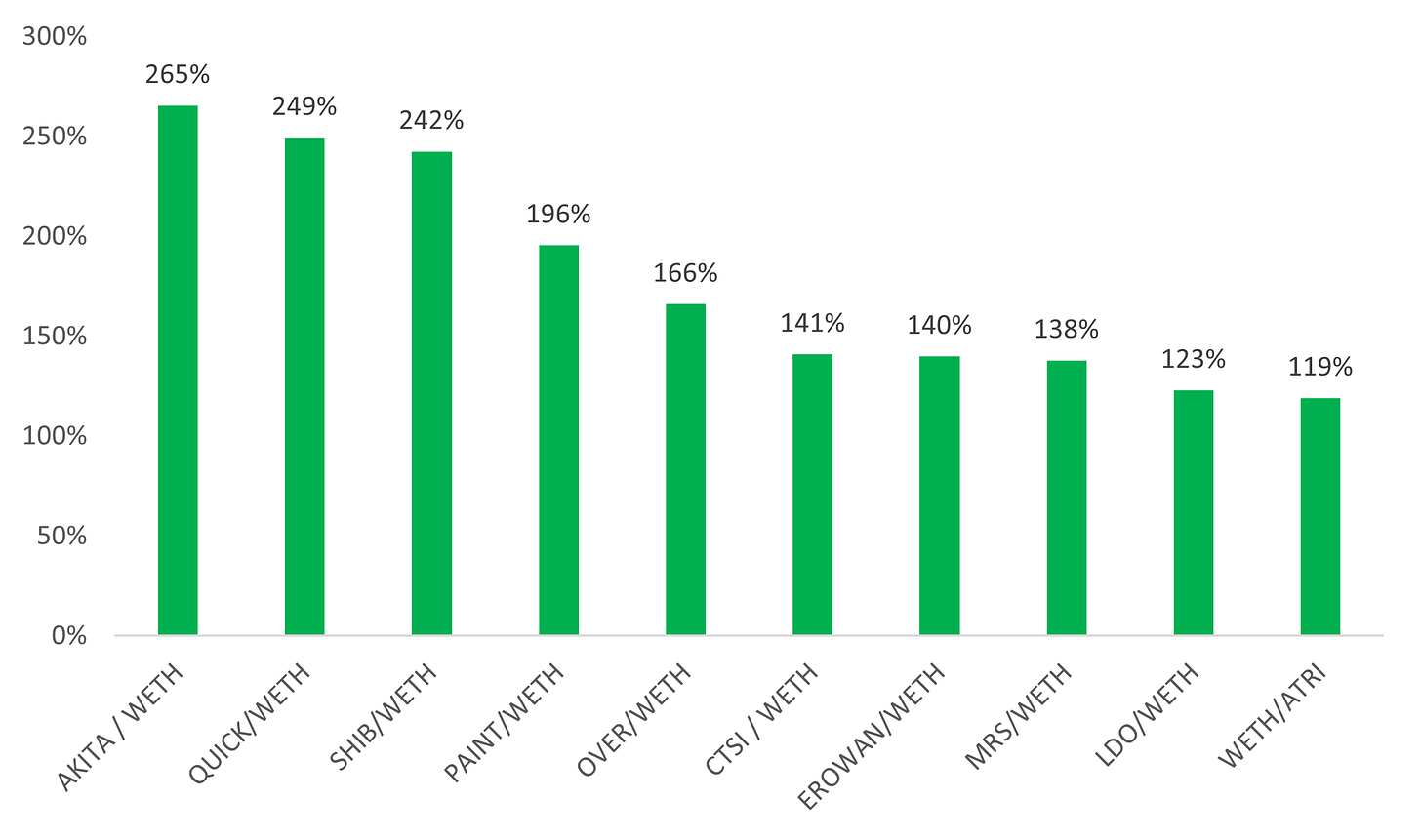

Return rates on liquidity mining vary wildly – stable pools on stable exchanges can have APRs ranging from 0% to 50%, while risky pools on risky exchanges can have short-term APRs exceeding 1,000%. Rates can also change dramatically from day to day. Finally, impermanent loss can eat into these returns, sometimes even resulting in a loss.

In the best cases though, the returns are extraordinary. In this analysis from APY Vision, we see that the top 10 pools produced an average net return of nearly 200%

Net APY (after impermanent loss) of the Top 10 Liquidity Pools in Early 2021

What are Incentive Programs?

Incentive programs can be seen as a form of marketing. New exchanges, or those that want to increase growth, often offer their native tokens as a bonus to liquidity providers. Most major DEXs, such as Uniswap, Sushiswap and Curve have all paid incentives at one time or another.

Incentives aren’t limited to exchanges though. Let’s say you’re a new project that just listed your token on Uniswap. How do you get people to provide liquidity and trade your token? Simple, you bribe them!

When you compound these two sources, you can start to see extremely high yields.

For instance, let’s say Synthetix is offering a reward program by giving free SNX tokens to anyone providing liquidity on their pool in Sushiswap, and Sushiswap is offering SUSHI tokens for anyone that provides liquidity to any of its pools. If you became a liquidity provider to the SNX-USD pool on Sushiswap then you’d earn:

Interest from being an LP

Free SNX tokens from Synthetix for supporting the project

Free SUSHI tokens from Sushiswap for supporting the exchange

In effect, you’re triple dipping!

When you hear about projects offering >100% to >1,000% APYs in DeFi, you can bet you’re dealing with an incentive program like this.

Unfortunately, these funds are almost always limited, so these deals rarely last, and token prices often crash when the music stops.

What is Airdrop Farming?

It’s debatable whether this last category actually qualifies as yield farming, but it’s an interesting topic nonetheless.

Airdrops are a hybrid IPO / marketing strategy where coins are dropped into the wallets of existing users. One of the most recent and famous examples of an airdrop was conducted by Ethereum Name Services.

Basically, anyone who had bought an ENS domain prior to the airdrop got free tokens. While most domains cost <$200 to purchase, these value of tokens shot up to almost $20,000, a 100x return. Some people that bought multiple domains made hundreds of thousands of dollars.

This strategy is unheard of in the traditional world. Imagine if Nike were a private company, but instead of IPOing they decided that they were just going to give shares to everyone that bought a pair of shoes!

As a result of ENS and other high profile airdrops, many crypto fans are using services with the hope of benefitting from the next one. Some likely contenders are Metamask, OpenSea, Arbitrum and Optimism.

What’s the Advantage of Yield Farming?

Interest is serious business when it comes to DeFi. Yield farmers can easily earn double to triple-digit interest rates, and even the safest options can offer yields that substantially exceed traditional finance.

For example, being a liquidity provider to a stablecoin pair is one of the safest plays in crypto. Because you’re holding two stablecoins, there’s no risk of loss of principal (they’re both tied to the dollar), and there’s no risk of impermanent loss (because the assets move in tandem). Outside of the threat of an exchange being hacked – which is, to be fair, a real consideration – this should have the same risk as holding dollars in a savings account. But looking at the rates below, we can see there’s no comparison in the return!

Traditional Savings Account vs. DeFi Savings Accounts

How is this all possible though? How can DeFi afford to pay out so much?

Well, there are several possible reasons, including: 1) unstated risks such as smart contract risk, impermanent loss, etc… 2) temporary arbitrage opportunities due to the immaturity of the market and 3) unsustainable, short-term incentive payments for marketing purposes.

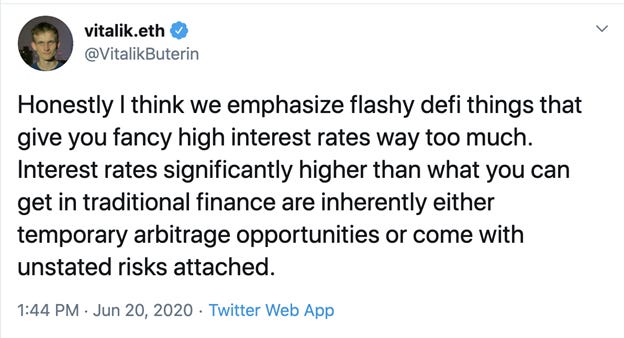

As Vitalik pointed out:

Still, it’s difficult to believe that at least some of this alpha isn’t permanent. After all, the average bank is very bloated — “non-interest” costs such as corporate overhead, legal services, occupancy costs, regulatory fees and intermediary compensation average around 60% of revenue today. By eliminating the middleman and automating transactions, it’s likely that DeFi can purge many, if not most, of these costs. This should free up more profits for the consumer which, in turn, should translate to higher rates.

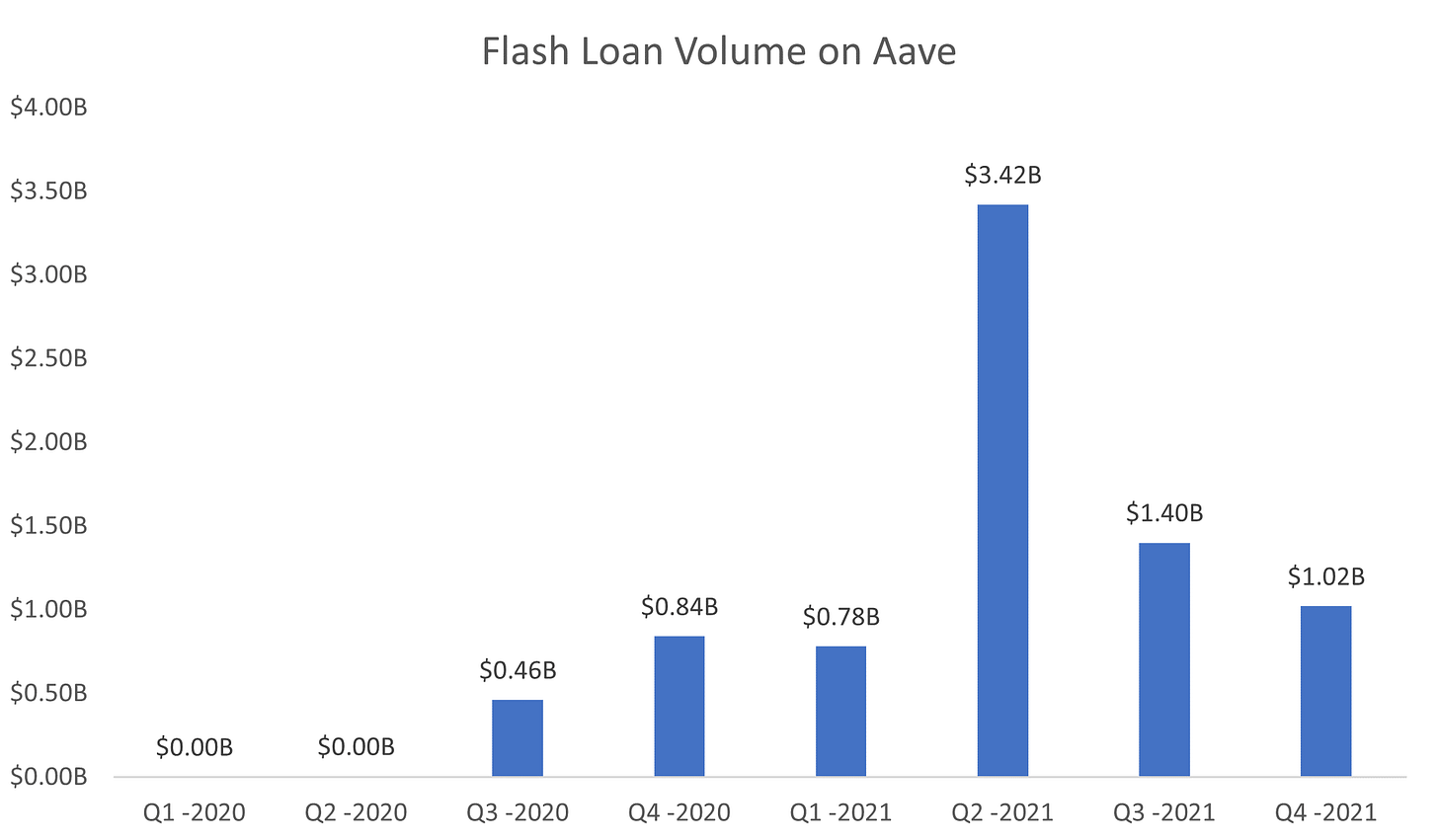

Flash Loans

Flash loans are an entirely new financial product that let users borrow substantial amounts of capital with no collateral for extremely short time periods (i.e. measured in seconds).

This new product is only possible due to the unique properties of smart contracts, which allow borrowers to execute multiple steps within the same transaction.

For example, let’s see you notice that the price of USDC is $1.00 on Uniswap and $1.01 on Sushiswap. You could code a contract to:

Borrow $100 million on Aave

Buy 100 million tokens of USDC on Uniswap for $100 million

Sell 100 tokens of USDC on Sushiswap for $101,000,000

Repay your $100 million loan on Aave

Profit a cool $1 million

This works because these steps occur almost instantaneously and within the same smart contract transaction, so there’s no execution or repayment risk. If the code determines this isn’t possible, it simply won’t execute or will return the funds to the lender as if the transaction never happened.

Since inception, Aave has issued more nearly $8B in flash loans, with > $6.5B of that coming in the past year.

Nothing close to this exists in traditional finance. Imagine walking into a bank and saying “hey, I’d like to borrow $100M for 10 minutes – I’m not going to give you any collateral and not even going to tell you my name” and getting the loan!

Money Legos

One of the most exciting applications of DeFi is a phenomenon known as composability, or in Web3 parlance, “money legos”.

DeFi protocols run using open-sourced software, which means that any of the apps listed above can be easily programmed to interact with others. As such, you can think of each individual app as a “lego brick” that can be combined with others in an infinite number of ways to create more complex and innovative financial products.

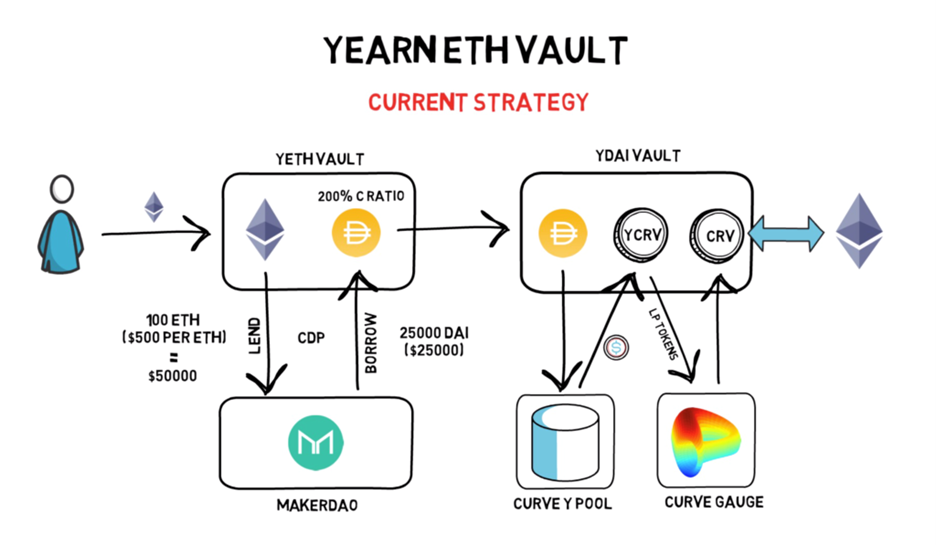

One example of the benefits of composability can be seen in the creation of Yearn Finance.

Yearn began as a passion project. The original program was designed by Andre Cronje to automate the process of identifying the lenders (e.g. Aave, Compound) with the highest returns and moving his tokens to them.

Other users noticed his success and began to contribute funds and join him, and the project soon expanded to liquidity mining on AMMs such as Curve and Balancer.

Eventually, this developed into more complicated, actively managed strategies known as vaults. One of the more popular vaults – known as Yearn ETH – uses Ethereum to create Dai, then uses the Dai to invest in Curve’s Y pool, which provides interest and rewards in the form of the CRV token, which are then staked to Curve Gauge to earn even more interest and rewards.

While the strategy eventually petered out and shut down, at one point it was earning users a 60% annual yield on ETH!

Oh, along the way Yearn also issued a token which increased to over $3B in market cap within its first year…

So Andre basically created a multi-billion dollar crypto-hedge fund without needing to register with any authorities all because he could freely access and move tokens between other protocols.

And that’s the great thing about DeFi and about composability in particular – innovation is practically unlimited as it’s no longer constrained by the imagination of a few select individuals locked deep within the bowels of the banking system.

DeFi Infrastructure

In order to achieve its potential, DeFi needs several key pieces of infrastructure including:

Smart Contract Platforms

Oracles

Data Aggregators

Storage Providers

Interoperability Protocols

Below, we’ll take a look at each category and provide some detail on the market leaders.

Smart Contract Platforms

Smart contract platforms serve as the foundation of DeFi. In effect, they operate as the computers that run all of the applications listed above. So every time that you make a trade on Uniswap or lend money on Aave, you need to use (and pay) Ethereum.

Keeping with the ethos of DeFi, smart contract platforms are decentralized and distributed, meaning that they aren’t controlled by any one party, they can never be shut down and anyone can use them at any time.

I won’t go into too much detail on smart contract platforms here as, given their extreme importance, I wrote another 10,000+ word article on them, but I will highlight some of the important players in the ecosystem.

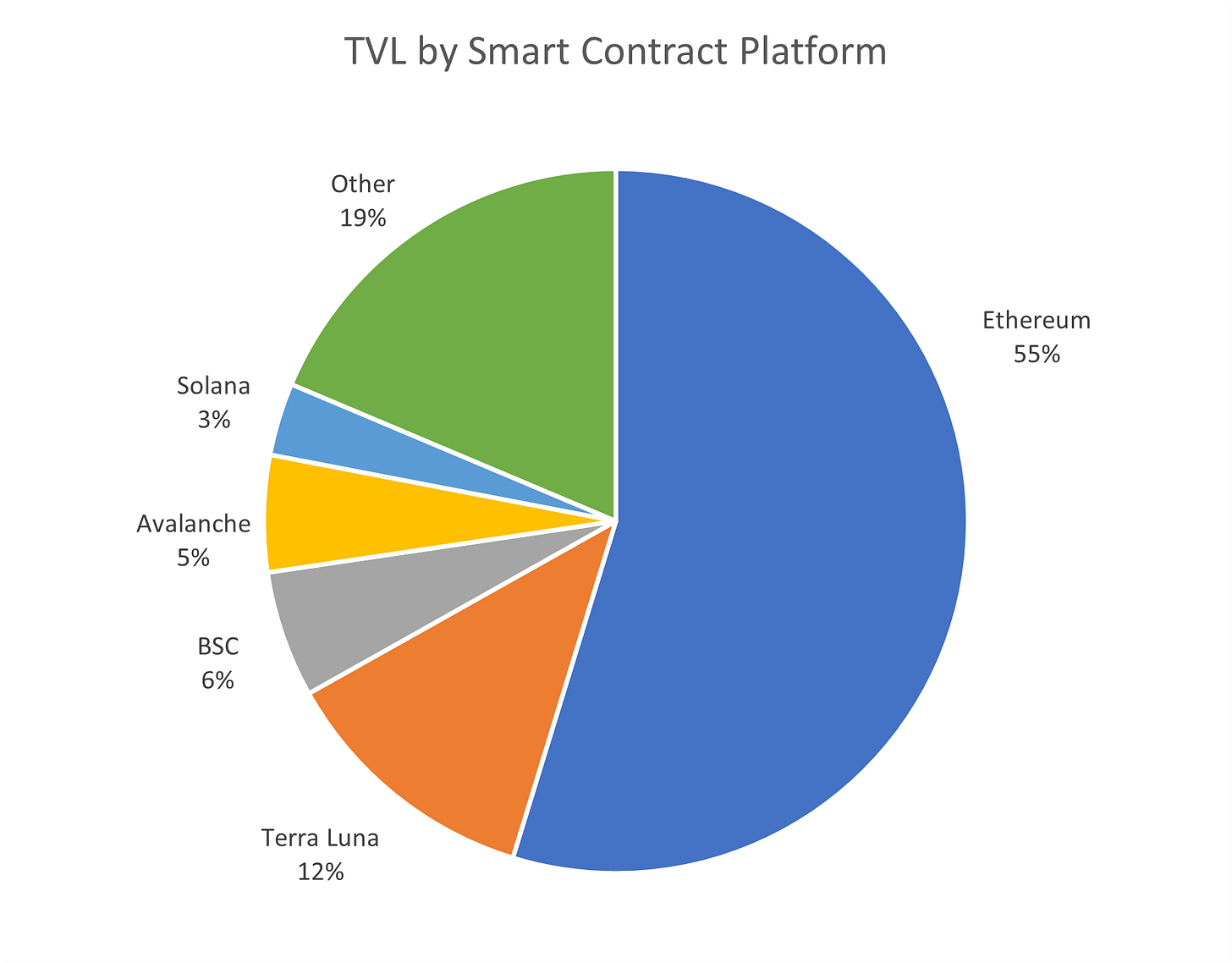

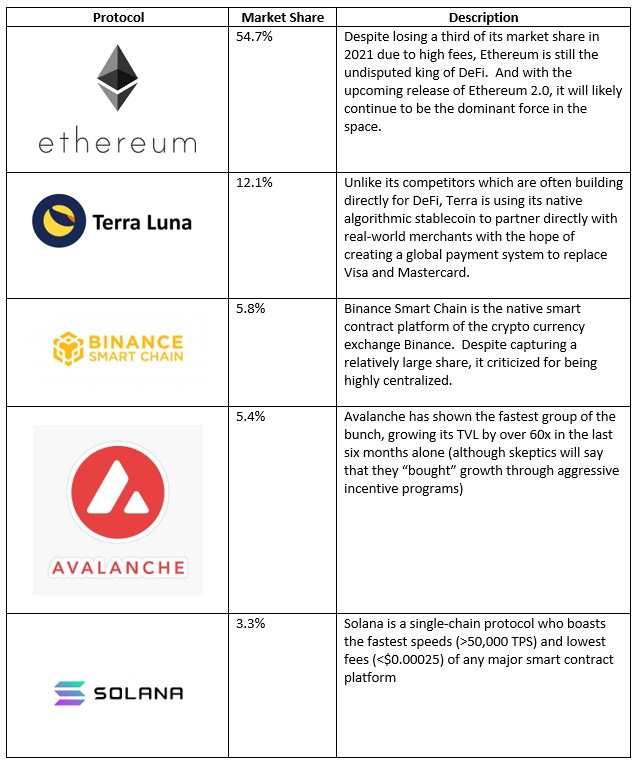

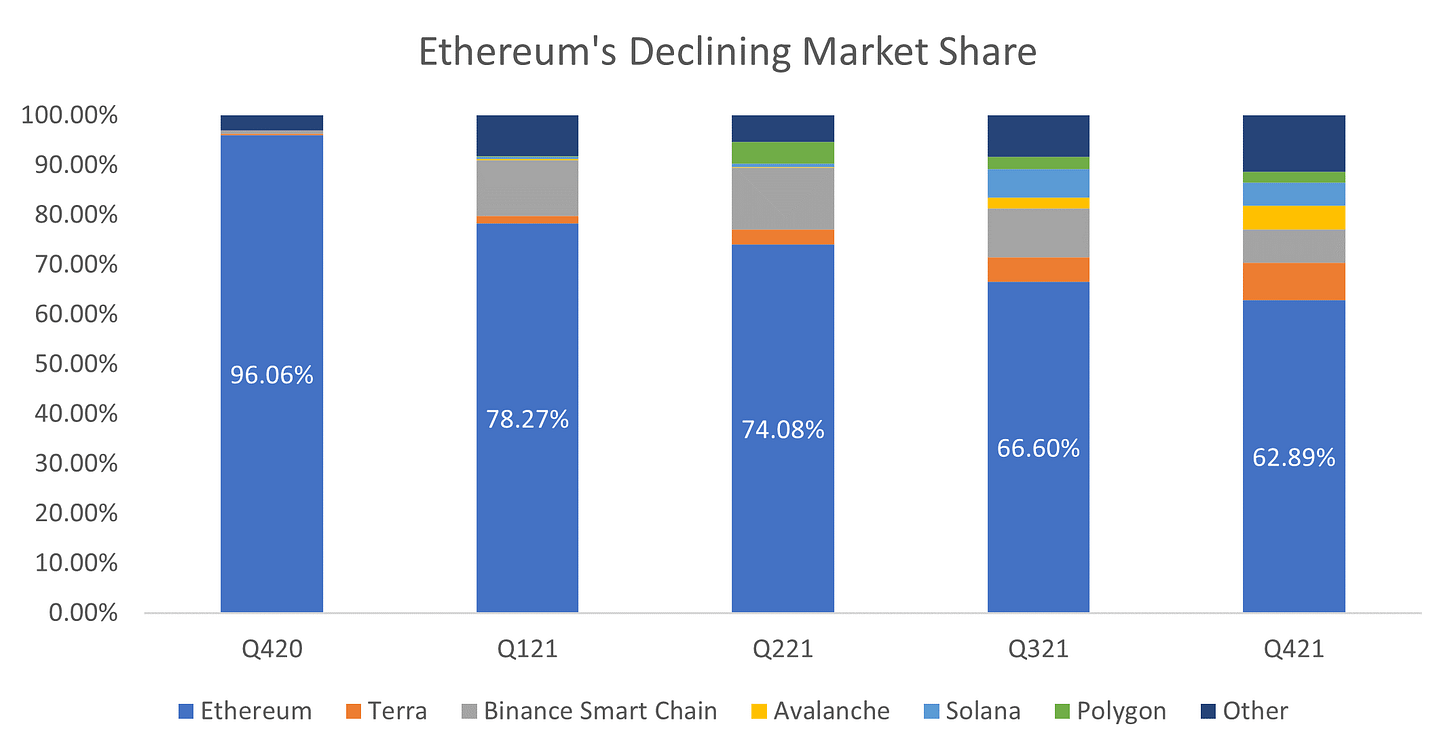

As of early March 2022, the largest smart contract platforms by Total Value Locked (a proxy for how much capital is “in use” in the ecosystem) are Ethereum, Terra, Binance, Avalanche and Solana. These five players represent over 80% of the market.

Once again, smart contracts platforms are not only extremely important to DeFi, but serve as the foundation for Web3, NFTs, the metaverse, decentralized gaming, DAOs and the decentralized economy as a whole. As such, I’d highly recommend learning more via this article, which dives into how they work, why they are important, who the key players are, how they stack up against one another and what’s next for the space.

Decentralized Oracles

What are Oracles?

Blockchains have one major limitation – they are unable to access data from external systems. This is by design, like a computer without an internet connection, they maintain their isolation to guarantee security and streamline efficiency.

Unfortunately, the vast majority of potential use cases for smart contracts require a connection to the outside world. Exchanges need accurate price information, insurance needs data to make decisions on policy payouts and many apps require market information to determine settlements.

The solution to this problem is known as an oracle, a separate piece of infrastructure that bridges a blockchain to real-world data. Oracles can source a variety of information including, price reports, weather, sporting scores, results of elections, geodata, random numbers, etc…

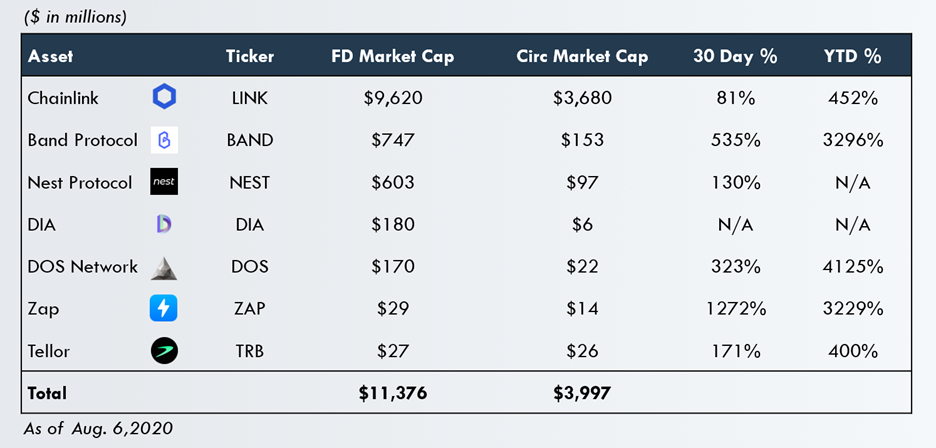

Oracles became very popular in 2020 and were among the best performing assets in crypto that year.

The main challenge with designing oracles, however, is that if any oracle is compromised, the entire system is compromised. As such, we need to leverage a decentralized oracle network to guarantee security.

How do Oracles Work?

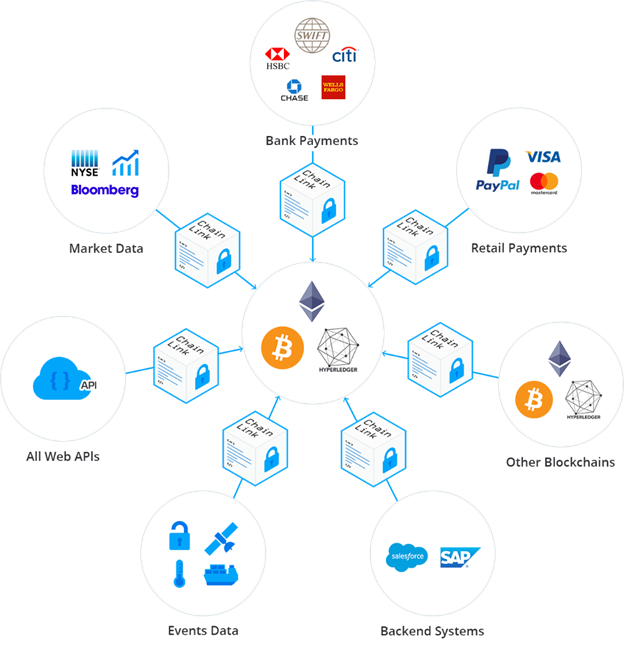

To understand how oracles function, let’s take a look at Chainlink, a decentralized blockchain oracle network built on Ethereum.

The project was founded by Sergey Nazarov in 2014 and launched an ICO in 2017 to raise $32M. The project has a very strong management team and recently onboarded Eric Schmidt as an advisor.

As a decentralized oracle network, Chainlink relies on hundreds of independent oracles to provide relevant data.

As an example, let’s say that Sushiswap wants to show the price of Ethereum on its site. They would:

Create a request for data from the Chainlink network to obtain the price of ETH.

Submit this request along with payment in the form of Chainlink’s native token, LINK.

Chainlink will then automatically select the best oracles based on 1) their reputation and 2) their ability to find the necessary data

Oracles will find the requested data (e.g. the price of ETH) and send it back to Chainlink. Oracles must stake LINK tokens as collateral to ensure proper behavior

Chainlink will aggregate the results, choose the most accurate answers and discards outliers. Oracles that are deemed to be negligent and / or malicious may face penalties and lose some or all of their collateral

The information is routed through Chainlink to the Sushiswap.

Sushiswap can then populate their site with the current price of ETH.

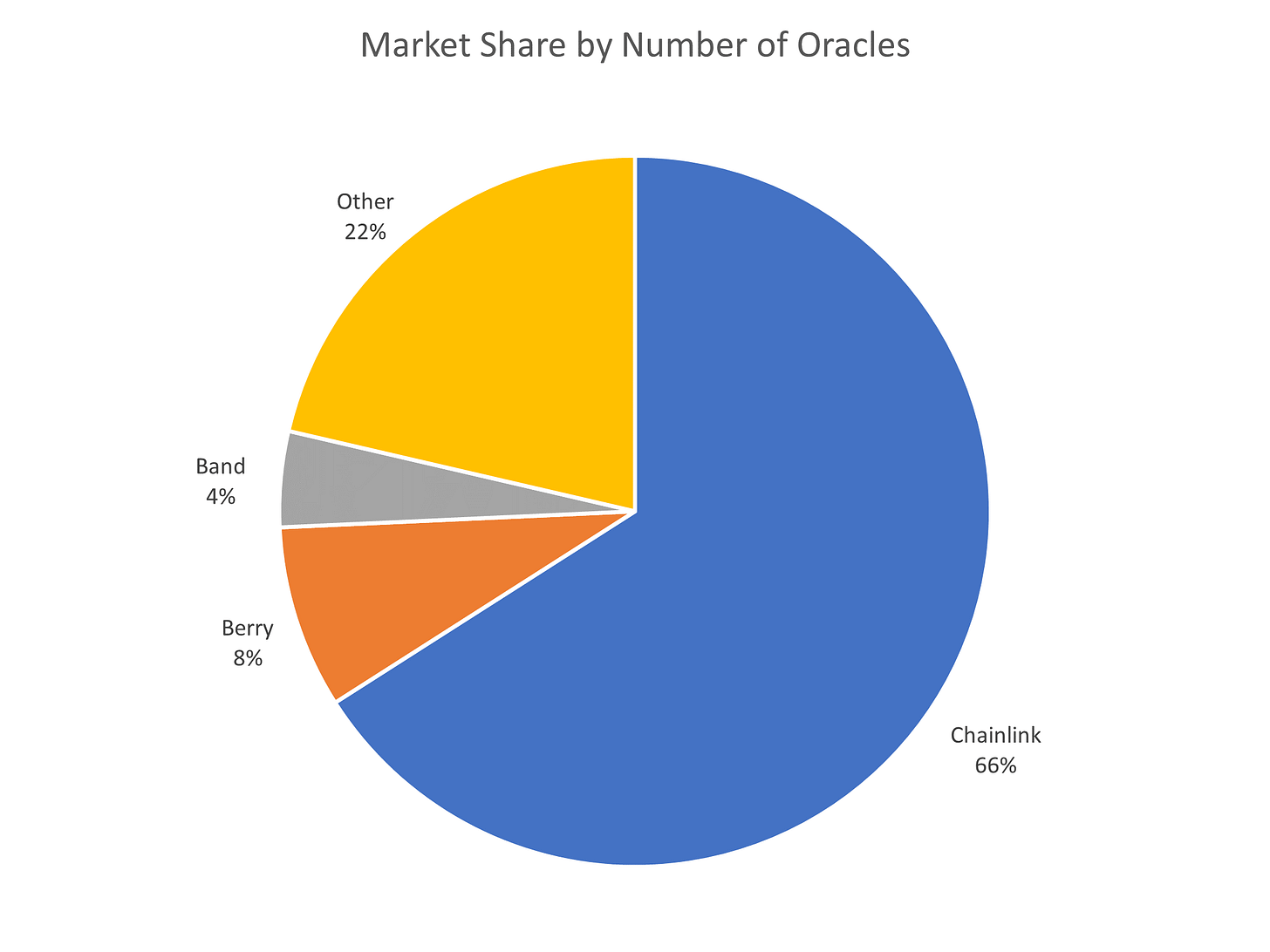

Chainlink has achieved strong traction since launching and currently dominates the oracle space with nearly 1,000 partners. For comparison, the next largest network has fewer than 150.

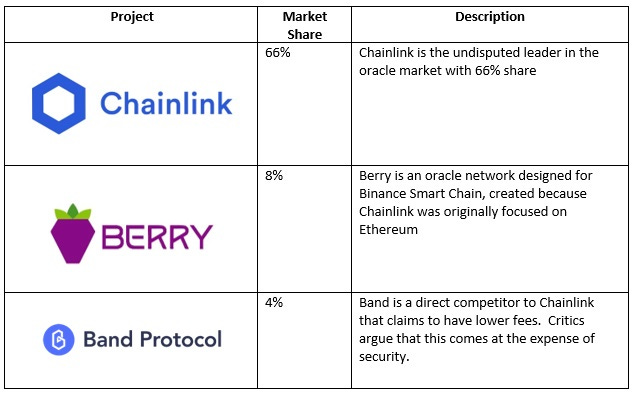

Who are the Key Players in the Oracle Market?

Chainlink dominates the oracles space with 62% market share.

Other notable players include Berry and Band Protocol.

Decentralized Data Aggregators

What is Data Aggregation?

Like a blockchain-based version of Google, data aggregators use a process called indexing to make it easy for developers and users to quickly search a blockchain for important data.

Indexing is method of organizing information to make data easier to find. As the name implies, it’s very similar to the index at the end of a book – instead of going through every page in a book, the index allows us to quickly scan an alphabetical list to find the page number of the information we need.

Google became a multi-trillion dollar company by mastering the art of indexing, and when it comes to blockchains, the process will be just as important.

Unfortunately, there are two main problems with current indexing strategies:

It can be very time consuming and redundant for blockchains to do it themselves

Many existing aggregators are centralized

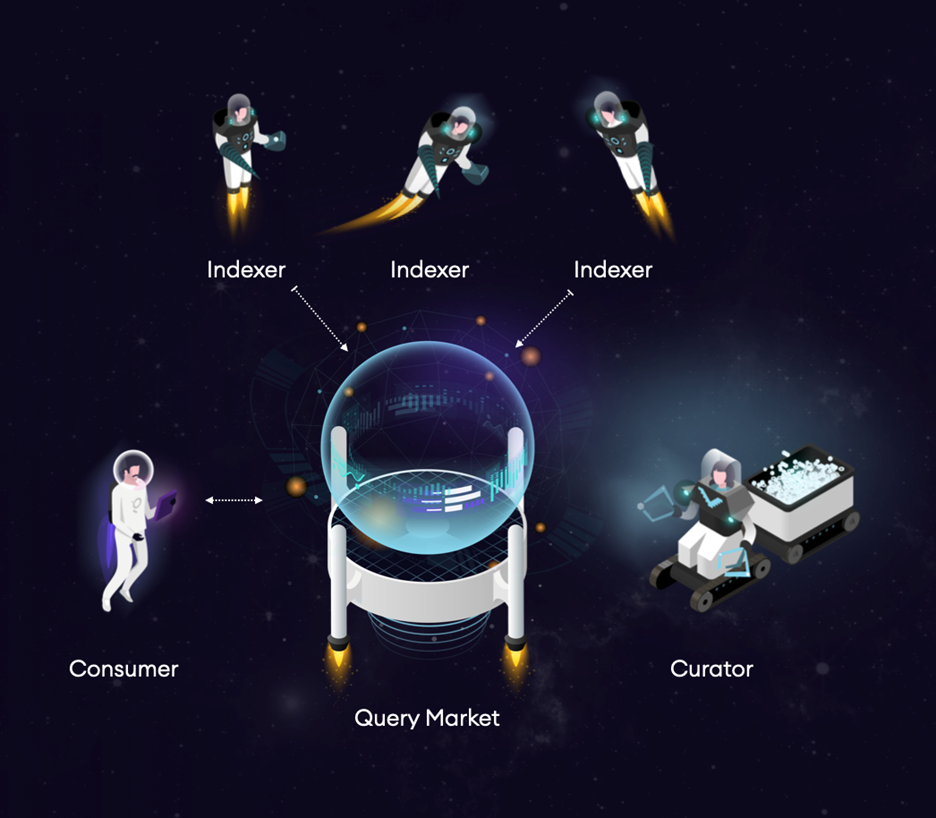

So how do we solve this problem in a decentralized manner? One possible solution comes through a protocol called The Graph.

How do Data Aggregators Work?

While the project is sometimes called the “Google for blockchains”, a better way to think about The Graph is as a decentralized network of thousands of Googles.

Created by Yaniv Tal the project is an open-source, fully-decentralized indexing protocol for blockchain data.

There are several key players in The Graph’s ecosystem:

Consumers: The end-users of The Graph that initiate search requests and pay fees to the Indexers

Indexers: These are the “workhorses” of the network that provide indexing services in exchange for a fee. Indexers are independent providers that operate in a decentralized marketplace known as the Query Market. To incentivize proper behavior, indexers must stake GRT (The Graph’s native token) tokens as collateral.

Delegators: Loan GRT to indexers to stake and receive a portion of the profits

Source: The Graph

In addition to the above, the network also hosts curators, who find promising networks to index and fisherman and arbitrators, which serve as a form of quality control.

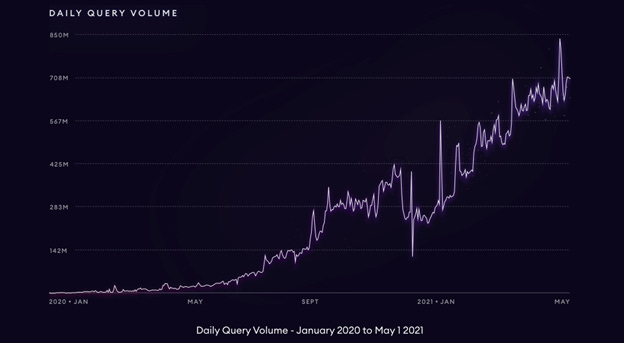

The Graph has achieved significant traction since its launch:

Developers have built over 25,000 subgraphs indexing a variety of networks such as Arbitrium, Avalanche, Celo, Ethereum, Fantom and IPFS, and this figure is growing at 10% to 15% monthly.

It is used by several major DeFi projects including Uniswap, Aave, Balancer and Synthetix

Over 20 billion queries per month were performed in April, 20x more than the previous year and roughly 10% to 15% of Google’s ~150 billion searches per month.

Who are the Key Players in the Data Aggregation Market?

While The Graph currently dominates decentralized data aggregation, its biggest competition still comes from centralized providers such as Scout, BigChainDB, Dune Analytics and Google’s BigQuery.

Decentralized Storage Providers

What is Data Storage?

We’ve discussed methods to import and read data, but another important piece of infrastructure is data storage.

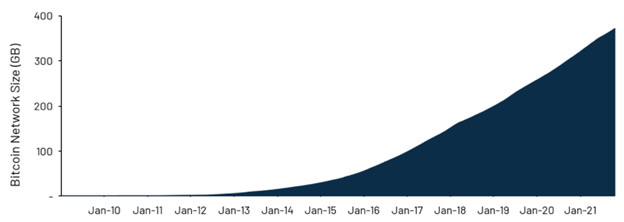

Blockchains consume enormous amounts of data – they are ledgers that grow at exponential rates and every node must possess an exact duplicate of the blockchain.

From the graph below we can already see the growing data needs of the Bitcoin network.

Bitcoin Network Size in Gigabytes

This problem is likely to become much worse in the future for two reasons:

The newer breed of high-performance blockchains consume even more data. Despite being a little over 18 months old, Solana has already produced twice the number of blocks as Ethereum Bitcoin, Cosmos, Polkadot and Algorand combined.

It’s all but certain that we will live in a multi-chain world, meaning that there may be dozens of chains sucking up massive amounts of data.

As such, DeFi needs a reliable method of storing data, and to maintain security, that method must be decentralized.

How Does Decentralized Storage Work?:

When it comes to decentralized storage, there are two competing approaches:

Subscription-Based: Users pay monthly fees for storage. This model is used by Filecoin, Sia and Storj and mirrors most existing cloud storage offerings on the market today.

Permanent Storage: Users pay a one-time fee to store their data forever. This model was pioneered by Arweave, and is only possible due to the unique properties of cryptoeconomics.

Both methods have their pros and cons, so let’s dive in a bit more below.

Case Study: Arweave

Founded by hacker and PhD dropout Sam Williams and backed by prominent investors such as a16 and, Union Square Ventures, Arweave is a decentralized network that allows permanent, low-cost and censorship-free storage.

Like many decentralized storage solutions such as Filecoin and Storj, Arweave relies on an independent network of miners to provide unused space on their hard drive to customers in need of data storage.

Where the project differs is in its use of a consensus mechanism known as “Proof of Access”. Proof of Access is unique because it requires miners to verify a random piece of data to receive their rewards. The fact that miners don’t know which piece will be chosen encourages them to hold as much data as possible for as long as possible.

Arweave combines its Proof of Access mechanism with a unique endowment program to incentivize miners to hold data forever. This ability to provide permanent storage is groundbreaking, as this is virtually impossible with existing storage methods. While most people think that today’s internet is timeless, it is shockingly transient. Even now, 70% of Harvard academic journals contain dead links and researchers estimate that over 20 years, 98.4% of links will rot and become totally inaccessible to future generations.

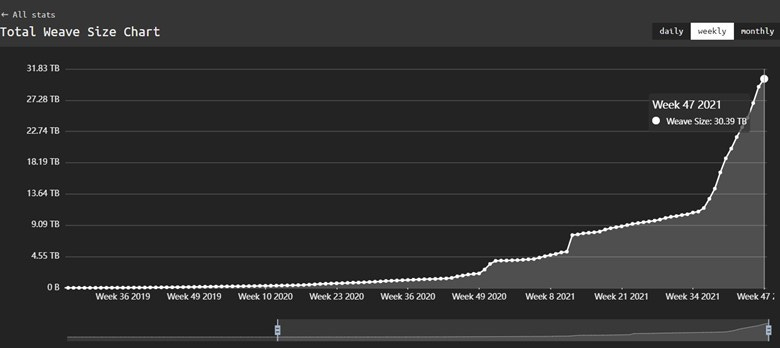

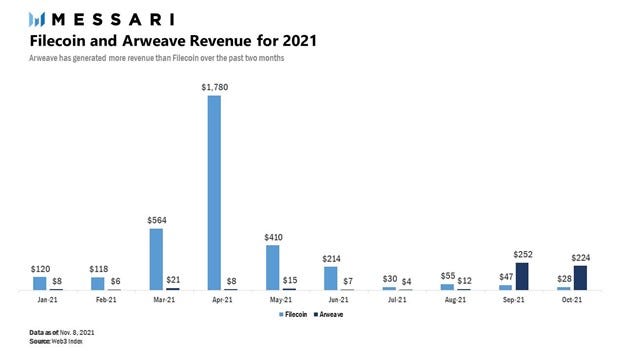

Given it’s unique value proposition, Arweave has achieved significant traction to date, and according to research firm Messari has:

Experienced exponential growth, storing 30TB of data

Generated the second highest network-usage revenue of any Web3 protocol in Q3

Increased the number of developers from 247 in 2019 to 627 in 2021

Growth of Arweave Storage

Ultimately, Arweave hopes to become a modern day “Library of Alexandria” – a global, permanent, community-owned internet that anyone can access, contribute to or get paid to maintain.

Case Study: Filecoin

Founded by Stanford Computer Scientist Juan Benet and backed by Sequoia, Union Square Ventures and Digital Currency Group, Filecoin is a decentralized data storage network.

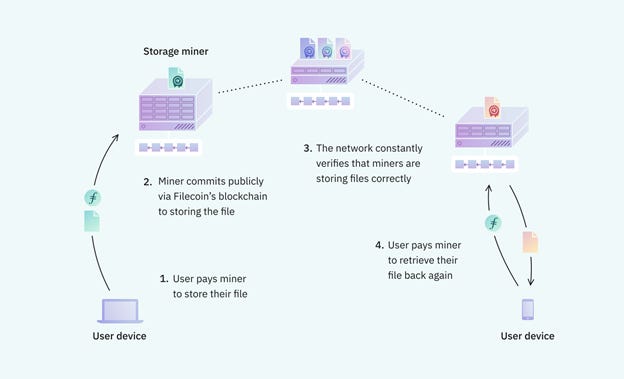

To maintain the system, the protocol relies on an independent network of three different types of miners:

Storage Miners: Are paid in Filecoin’s native token, FIL, to lend their unused hard drive space to store customer data

Retrieval Miners: Earn FIL by retrieving files from the network

Repair Miners: Responsible for the maintenance and health of the network (at the time of writing, Filecoin has yet to implement this program)

The protocol has had a strong year, and according to their website, as of November they had:

3,362 storage providers

230+ organizations building on the network and 465+ new projects entering the ecosystem

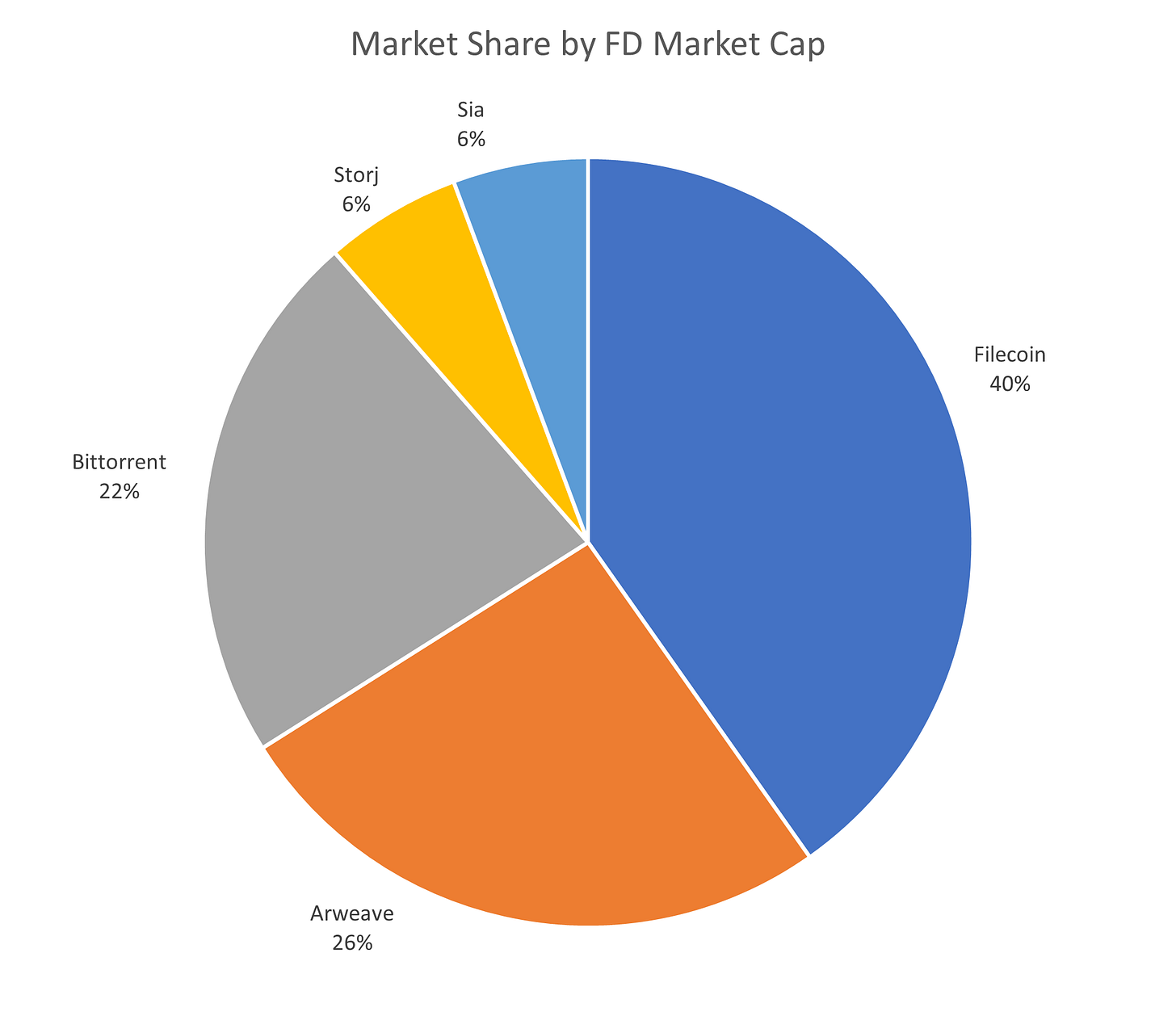

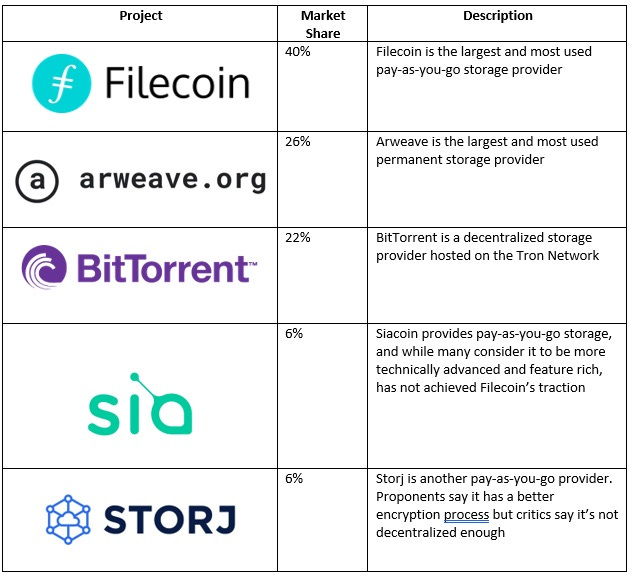

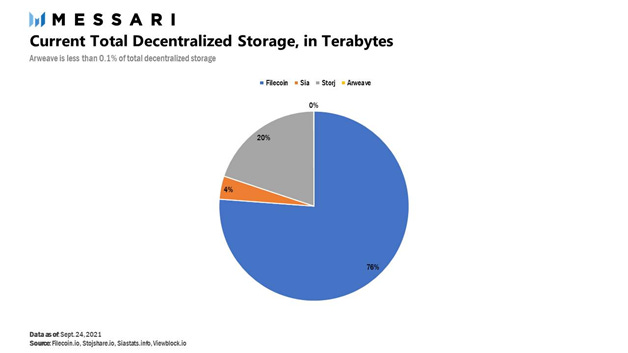

Who’s Winning the Data Storage Wars?

In terms of network capacity, Filecoin is head and shoulders above everyone else with 76% of the market and Arweave is in dead last with <0.1%.

However, it’s extremely important to remember that this represents capacity, and not usage. When it comes to actual usage, we see a very different story with Arweave recently flipping Filecoin in revenue to become the market leader.

The truth is, it’s probably not a competition as both firms offer very different products. Filecoin will likely be the winner for high-volume, ephemeral storage, where Arweave will likely be the preferred choice to secure highly important files that need to last forever. As such, it’s very likely that the two players will exist in harmony.

Who are the Key Players in the Decentralized Data Storage Market?

In addition to Filecoin and Arweave, BitTorrent, Storj and Siacoin also provide decentralized storage options.

Interoperability Solutions

What are Interoperability Protocols?

While Ethereum remains the dominant chain in DeFi, its share has declined from over 95% to under 55% (as of early March 2022) due to the emergence of several “alternative L1s” such as Solana, Binance Smart Chain, Avalanche, and Terra.

While arguably good for the long-term health of the ecosystem, this explosion of smart contract platforms has created significant short-term problems. Perhaps most pressing is the problem of interoperability.

Because blockchains have different protocols, they cannot communicate with each other. While this independence has many benefits, it also creates significant challenges for users that want to move tokens and / or data between chains.

Interoperability protocols are systems designed to solve this problem by allowing the transfer of information and assets between two or more blockchains.

How Do Interoperability Protocols Work?

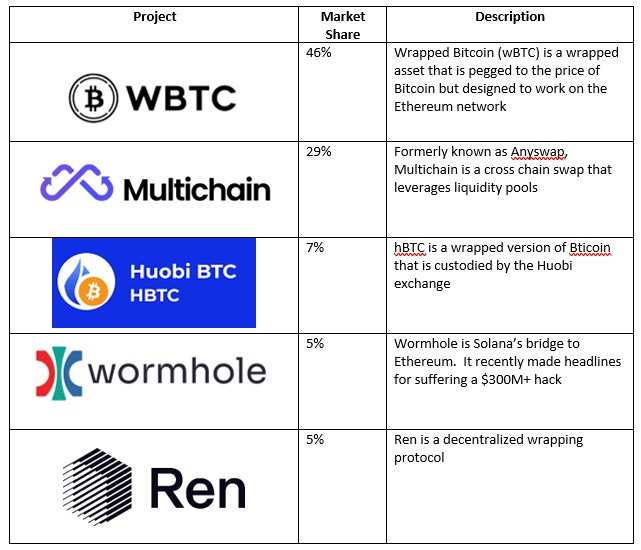

There are four main types of interoperability solutions:

Atomic Swaps: Atomic swaps allow two parties to directly trade tokens from different blockchains via a virtual escrow account

Wrapped Assets: Wrapped assets are a synthetic version of one blockchain’s token designed for use on another blockchain. For example, wrapped Bitcoin is an Ethereum token that represents Bitcoin on the Ethereum blockchain

Cross-Chain Bridges: Cross-Chain bridges transfer tokens directly from one blockchain to another

Cross-Chain Swaps: Like an interoperable version of Uniswap, cross-chain swaps use liquidity pools to trade assets between different blockchains

To understand these solutions better, let’s look at some of the most popular interoperability protocols:

What are Atomic Swaps?

Atomic swaps were one of the earliest interoperability solutions.

These swaps use smart contracts to allow two parties to directly trade tokens from different blockchains without using a centralized intermediary.

To perform an atomic swap, each user locks their tokens up in a virtual safe known as a Hashed Timelock Contract (HTLC), and when both tokens have been received the trade is executed. The HTLC is also time-based, meaning that both parties must satisfy their end of the deal within a predefined time frame.

While the direct nature of atomic swaps ensures that they are decentralized, they are extremely inefficient as potential users need to find a willing counterparty for every trade.

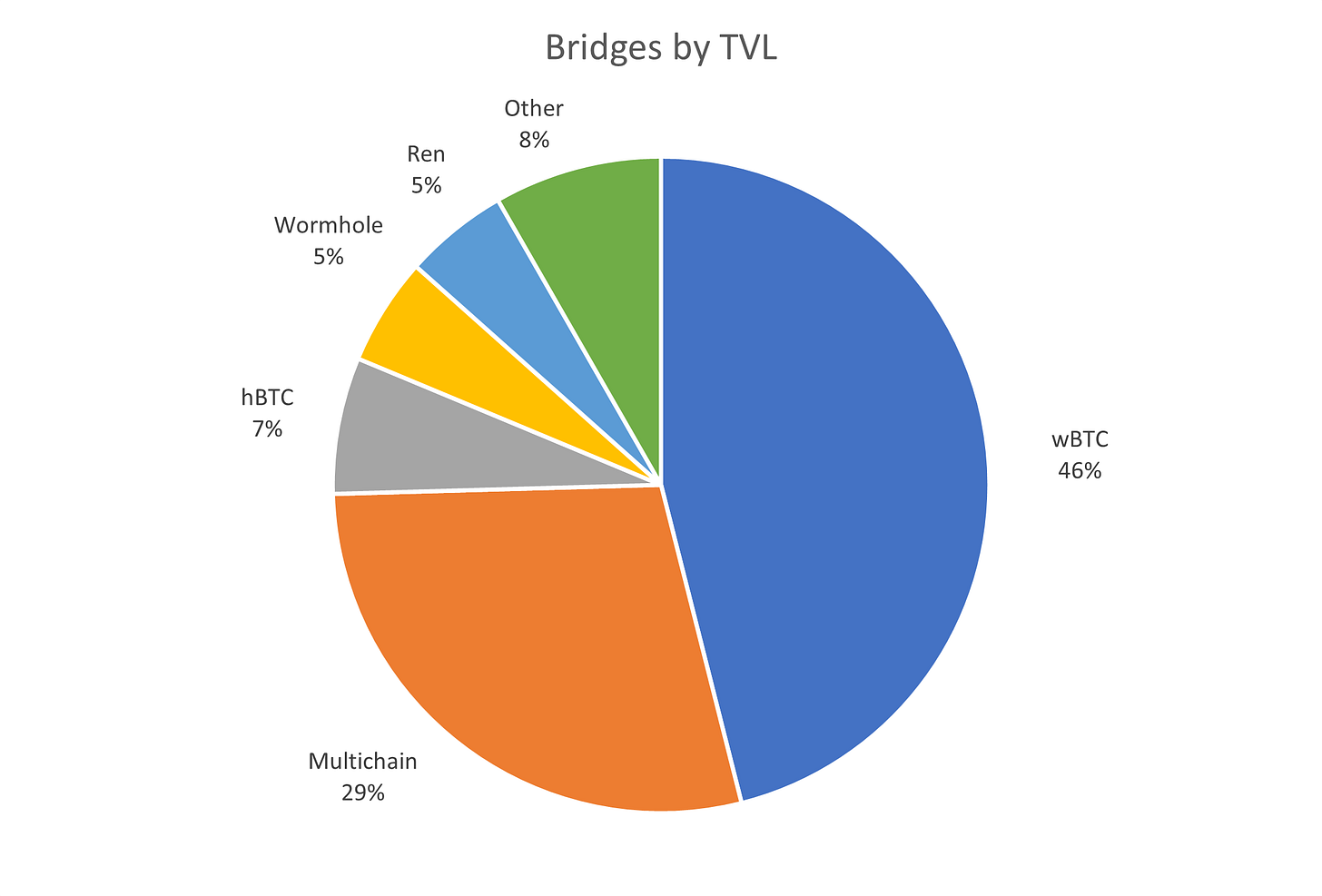

What are Wrapped Assets?

A wrapped token is simply a synthetic version of a token designed for use on another network. Wrapped Bitcoin (wBTC), for example, is pegged to the price of Bitcoin but designed to work on the Ethereum network.

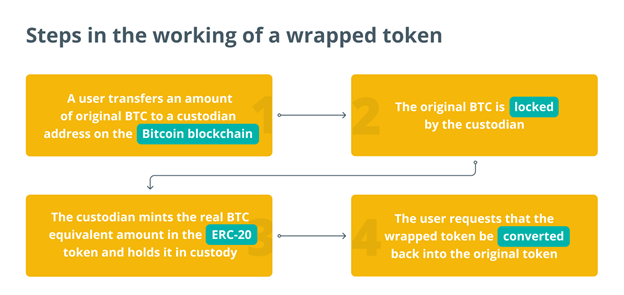

The process of wrapping uses a “lock and mint” system. When a user transfers assets from Blockchain A to Blockchain B, those assets are “locked” on Blockchain A via a smart contract. Once locked, identical copies of these tokens are “minted” (i.e. created) on Blockchain B. If the user wants to get her original tokens back, then the copies on Blockchain B are destroyed and she can resume using the tokens on Blockchain A.

Unfortunately, many existing wrapping services require a third-party custodian to orchestrate the “lock and mint” system and, as such, are centralized.

One project trying to fix this is Ren Protocol, which is attempting to create a decentralized wrapping service by relying on a network of 10,000 nodes to provide storage space and custody user assets.

What are Chain Specific Bridges?

Chain-specific bridges are dedicated bridges that operate directly between two blockchains. For example, Polygon’s PoS bridge allows users to transfer assets from Ethereum to Polygon and vice versa.

Like wrapped assets, the PoS bridge uses a “lock and mint” system. When you deposit funds into a bridge, they are locked on Ethereum and copies are created on Polygon.

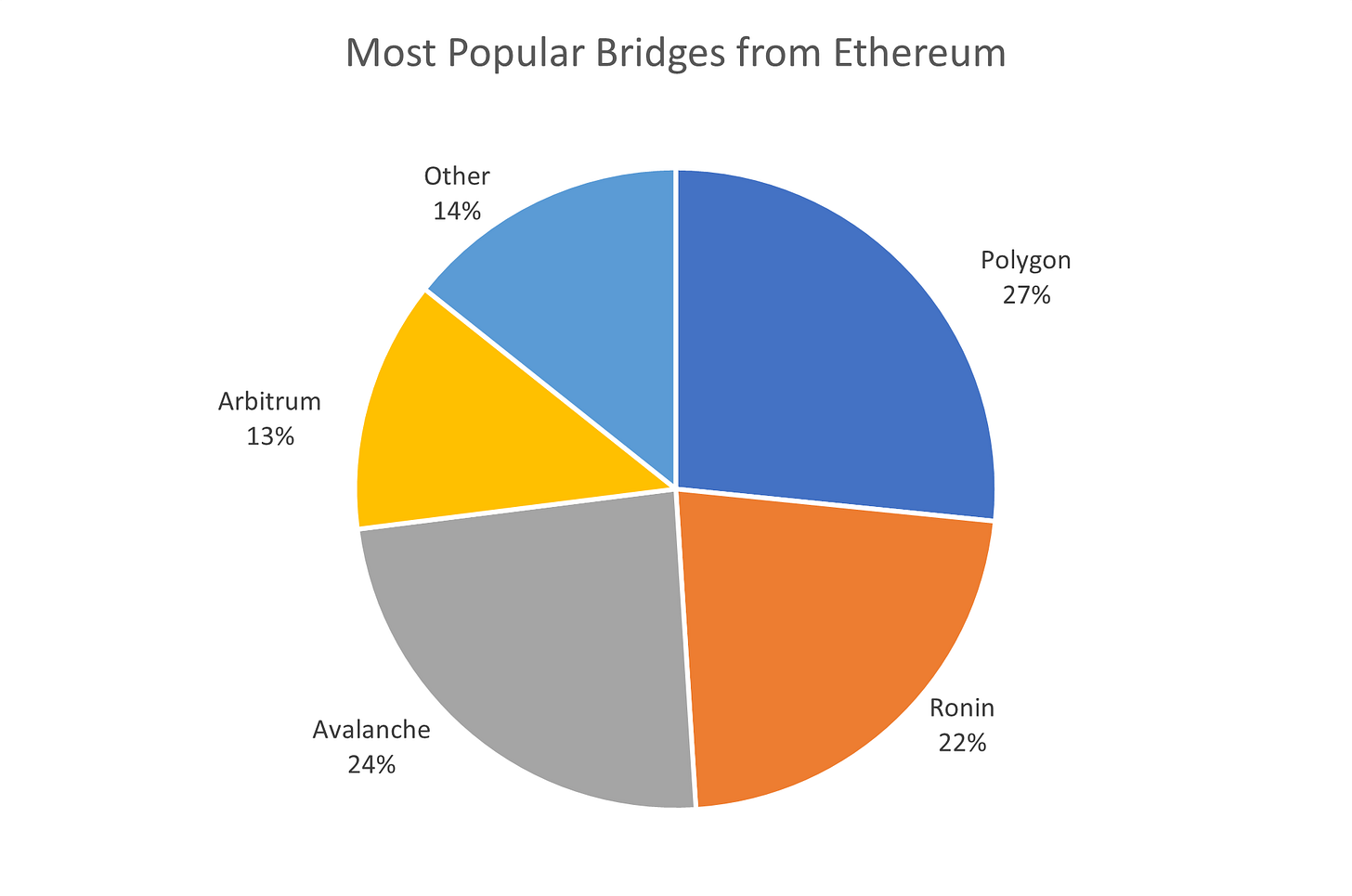

Most major blockchains have chain specific bridges, with Polygon, Avalanche, Ronin (the chain for the game Axie Infinity) and Arbitrum being the most popular bridges for Ethereum.

The main drawback to chain specific bridges is that they are generally limited to the two chains in question, making them difficult to scale.

What are Cross-Chain Swaps?

Much like an interoperable Uniswap, cross-chain swaps use a series of liquidity pools to trade native assets between different blockchains.

One prominent example of such a protocol is Thorchain. Thorchain’s pools are composed of three assets – the tokens that a user wants to trade and RUNE, the network’s native token.

So if a user wanted to swap Bitcoin for Ethereum, the trade would first go through a Bitcoin-RUNE pool, and then a RUNE-Ethereum pool.

There are a few downsides to this method, however:

Swaps can take a long time because they effectively require three transactions: Asset A to the A-Rune liquidity pool, the A-Rune liquidity pool to the B-Rune liquidity pool and the B-Rune liquidity pool to asset B

Unlike Uniswap, where swaps can be bundled into large transactions, trades on Thorchain lack composability

Who are the Key Players in the Interoperability Solutions Market?

Wrapped Bitcoin and Multichain are the most popular bridges today, representing almost 75% of the total value locked in interoperability solutions.

What is the Future of Interoperability Solutions?

Interoperability remains an unsolved problem – the market is nascent and there are several potential solutions. Unfortunately, all have tradeoffs and none have achieved escape velocity.

Given the likelihood of a multi-chain future, however, this is an area to keep a close eye on. In the coming months, it is likely that we will see an influx of new players, and will also see existing solutions continue to evolve.

Many would argue that this is one of the holy grails of the space, as a protocol that can efficiently solve this problem will likely garner a 12-figure enterprise value.

The Dark Side of DeFi

While DeFi definitely has its promises, it also comes with its share of downsides. Among the most notable of these are:

High Fees

User Error

Usage by Criminals and Terrorist

Exploits, Hacks and Attacks

Regulation

High Fees

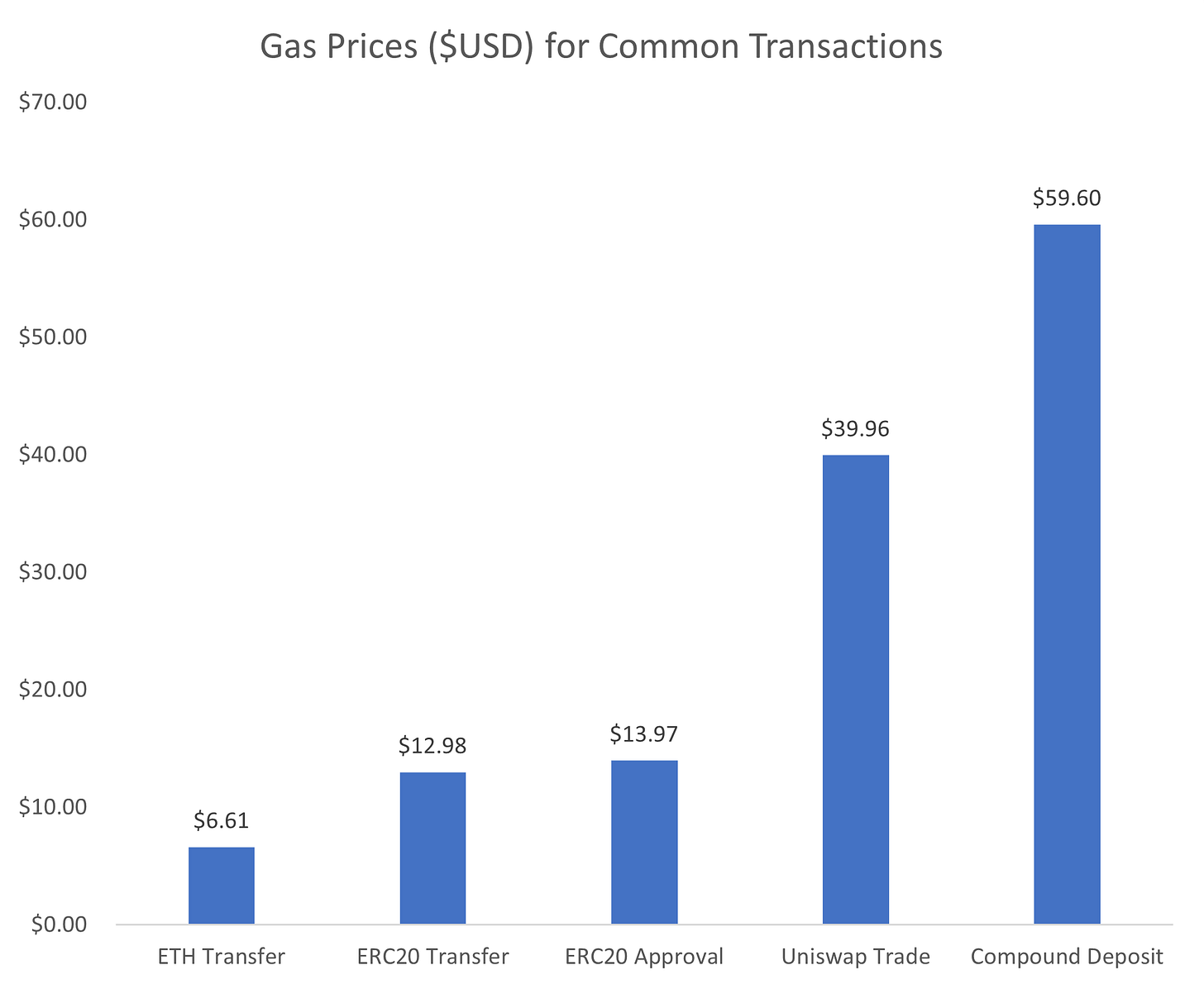

“Gas” refers to the fee required to execute a transaction on the Ethereum network. Whether you want to transfer a token, loan your assets on Ethereum or mint an NFT, you must pay gas to incentive the miners to approve your transaction and include it on the blockchain.

Because space on the Ethereum network is limited – it can only execute around 15 transactions per second – priority is determined by an auction process. This means that gas can get very expensive when the network is busy.

Unfortunately, lately the Ethereum network is always busy, so average gas fees have ballooned across the board.

Keep in mind these are average fees – in times of extreme congestion it’s not uncommon to pay $500+ to perform a complicated action such as mint an NFT.

Unlike in traditional finance, transaction fees are independent of the transaction amount (i.e. it costs the same to send $1 or $1 million), so while this may not effect high-dollar users, it’s effectively crowding the average consumer out of the market.

These high fees have spawned the creation of many alternative blockchains – such as Avalanche, Solana, Cardano, Polkadot, Binance Smart Chain and Terra – that offer significantly lower feeds and transaction times. For this reason, they are often known as “Ethereum Killers”.

User Error

Because there isn’t any centralized party to correct errors, funds transferred by mistake or to the wrong address are effectively gone forever. Combine this with the fact that schemes such as phishing are rampant, we can be sure that a lot of people will continue to use a lot of money by not being careful.

Usage by Criminals and Terrorists

The anonymity of DeFi has a dark side as well. Not having to go through KYC and AML means that DeFi will likely provide the ideal venue for nefarious actors looking to raise and move funds. Although current reports show that fewer than 3% of Bitcoin transactions are used for illegal activities this will still continue to represent a threat in the future.

Exploits

Like any piece of software, smart contracts with poorly written code have significant vulnerabilities. In the DeFi space, these weaknesses generally manifest in two ways:

Hacks – an illegal practice where someone breaks into a smart contract to steal funds

Exploits – a legal, but arguably unethical, practice where users figure out a weakness in a contract’s economic model and exploit that for economic gain (imagine a DeFi version of George Soros’s infamous attack on the Bank of England)

While estimates on the scope of these losses vary wildly (Chainalysis pegs them at almost $8 billion), research firm The Block has been able to confirm over 70 exploits in the DeFi space as of November, stealing over $1.4 billion. Of these, 34 were “flash loan attacks”, where assailants used flash loans to raise millions of dollars to exploit economic weaknesses.

In an ironic twist, $611 million was returned by Poly Network’s hacker, who said that he or she only did it to expose a vulnerability in the network.

Perhaps more nefarious that hacks or exploits though are scams known as “rug pulls” – when an anonymous founder raises funds through a token issuance and then simply disappears with the money.

In late October a group of scammers leveraged the hype of the popular Netflix series to create a Squid Game token, listed the token on decentralized exchanges, raised millions from retail investors and then vanished.

These rug pulls can be devastating to the ecosystem, and research firm Chainalysis reports that they caused losses of nearly $3 billion in 2021 alone.

Regulation

Risks such as these have made DeFi a target for regulators. SEC Chief Gary Gensler labeled the space as the “wild west” and Elizabeth Warren recently called it “one of the shadiest parts of the crypto world”.

Given the growing sentiment of the establishment, it’s all but certain that regulation is inevitable., but it’s not entirely clear how that would work or if it’s even possible.

This could greatly impact centralized systems such as Coinbase or Tether, but it’s not clear how regulation would work for the broader ecosystem or if it’s even possible.

After all, blockchains are decentralized systems -- that is, they’re run by thousands to tens of thousands of computers across the world – so there’s no central point authorities can use to enforce rules or shut them down.

The perfect example of this is China’s “Bitcoin ban”, which sounded scary but had little effect on the space as most local traders simply switched to Uniswap, a decentralized exchanged, and continued business as usual.

Why DeFi will Eat Wall Street

What is Disruption?

The concept of “disruption” is overused and often misunderstood — many writers, consultants and researchers use the word to refer to any situation where a new player enters a market and starts to displace incumbents.

But the academic theory is much more nuanced — disruptive technology isn’t necessarily “better” (in fact, it’s often worse), it’s just so fundamentally different from the status quo that it can’t be replicated by incumbents or competitors. This gives it the ability to gain a foothold in an industry and, as technology improves, gradually eviscerate the market.

For a real-world example, we need to look no further than AT&T — one of the original disruptors.

In the late 1800s, Western Union dominated communications with a huge infrastructure of network cables and a massive consumer base. Although early telephones were largely inferior to the telegraph because their signals only traveled a few miles, the technology was much cheaper for short-distance communication and was therefore rapidly adopted by local businesses.

In a textbook case of disruption theory, Western Union couldn’t react because serving these local businesses would be unprofitable. This gave AT&T the niche they needed — as telephone technology gradually improved they were able to continue to take share from Western Union, eventually rendering the incumbent all but obsolete.

Why Wall Street Won’t Survive

I believe that DeFi represents a classic case of disruptive innovation and has the potential to change our lives in ways we can’t even imagine.

Like most disruptors, it definitely has a ton of problems today – such as smart contract risk, rug pulls, irreversibility and the potential for abuse. But it also has several advantages that traditional finance simply cannot replicate, such as:

Unmatchable Rates: The almost total elimination of intermediaries such as bankers, brokers, lawyers, regulators, accountants, etc… will allow DeFi to offer customers rates that are orders of magnitude greater than traditional banks.

Unprecedented Customer Experience: Instant, permissionless, 24/7 access to financial products and markets and the ability to remain completely anonymous create a banking experience that no one alive has ever seen. And while this compelling on its face, I believe that like smart phones, ATMs or the internet, we won’t truly understand the utility DeFi can bring to our lives until we’ve experienced it at scale.

New Sources of Innovation: Not only is DeFi unburdened by regulation, knowledge is freely shared and there’s an ability to crowdsource the ideas of millions of users to rapidly create and test better financial products. As such, it’s not inconceivable that DeFi could catalyze a user-driven financial “renaissance”. If you don’t think this is possible, consider how a bunch of kids recently used Reddit to beat world’s biggest hedge funds at their own game…

Perhaps most importantly, Wall Street can’t replicate DeFi without cannibalizing itself, and regulators can’t stop its progress due to its decentralized nature.

As such, like the telegraph industry in the 1800s, I simply don’t see how traditional banking can survive.

Almost Unmeasurable Potential

It’s difficult to describe the potential impact of disruptive technologies without sounding hyperbolic at best and insane at worst.

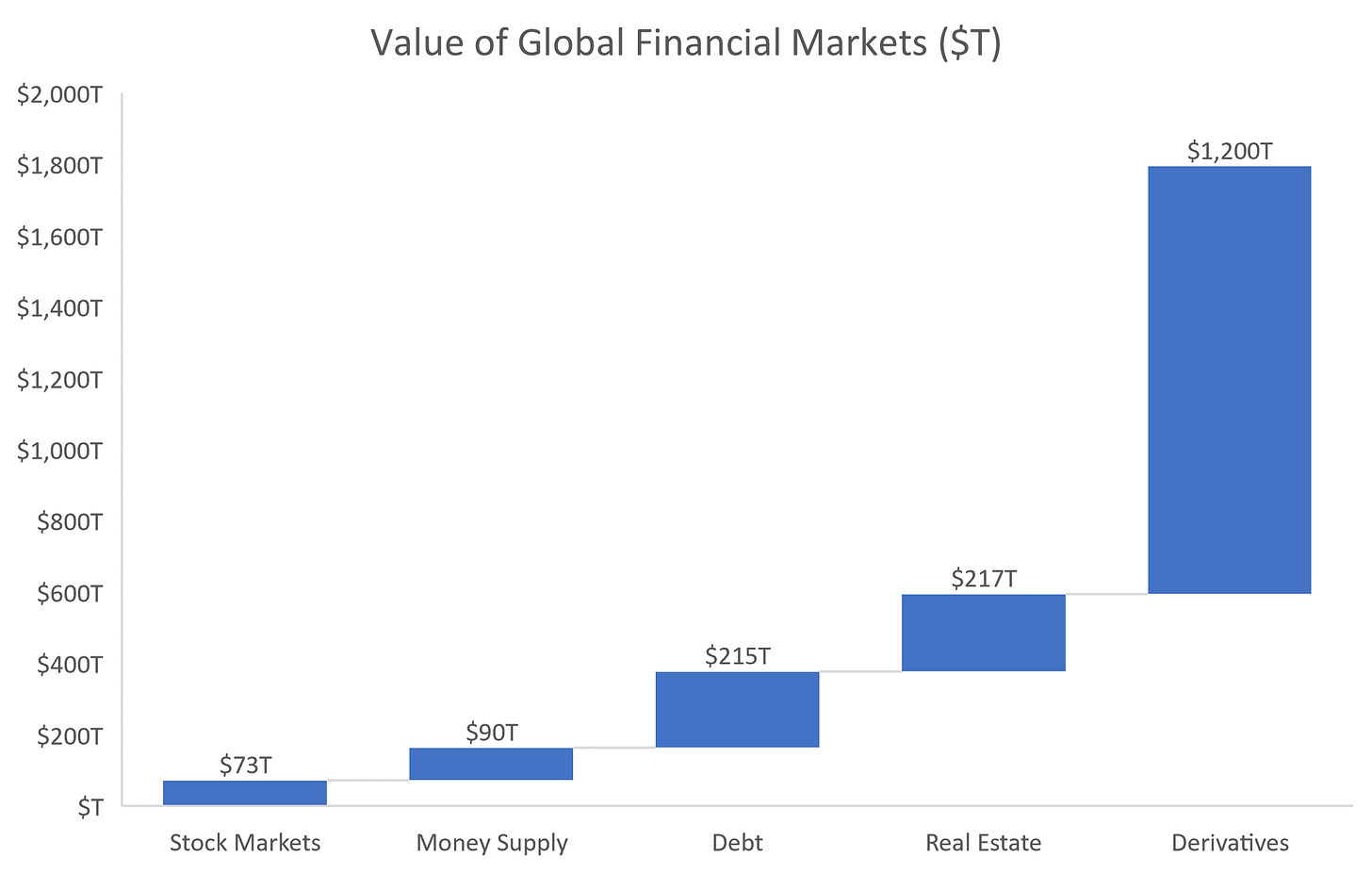

But at the time of writing, DeFi’s Total Value Locked of ~$200 Billion is a mere fraction of the ~$1.8 Quadrillion financial market.

As such, DeFi could grow 100x from here (to $20T) and still be a fraction of the stock market…

…it could grow 1,000x from here (to $200T) and be roughly equivalent to the global debt market…

…it could grow ~4,500x from here (to $866.9T) to match the World Economic Forum’s estimate for the DeFi space…

…it could grow 10,000x from here ($2.0Q) and be slightly larger than the market today...

…and while I’ll admit that 100,000x growth (to $20Q) is probably ludicrous, I’m sure that a telegraph operator in 1880 would say the same about the smartphone market today.

Wherever this thing ends up, it’s important to watch as it has the potential to be both an existential threat to Wall Street and a road to almost unlimited potential for investors.

Note: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.