The Complete Beginner’s Guide to DAOs

A comprehensive overview of the trends, technologies, important sectors, key players, important tools, problems and potential of DAOs.

This article is intended to provide a somewhat thorough introduction to DAOs for beginners. It’s over almost 18K words (~1 hour to read) and is organized into 8 parts, which are summarized below for the tl;dr crowd:

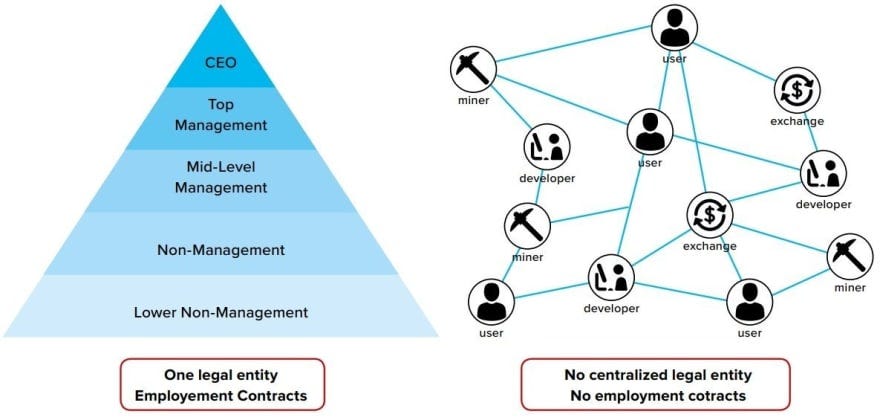

1. What is a DAO? A DAO – or decentralized autonomous organization – is a blockchain-based organization that may replace the modern corporation. Unlike a traditional corporation, no single person or group owns or controls a DAO and they rarely have executives or managers. Instead, they are owned and operated by members who make decisions democratically (much like a modern-day cooperative).

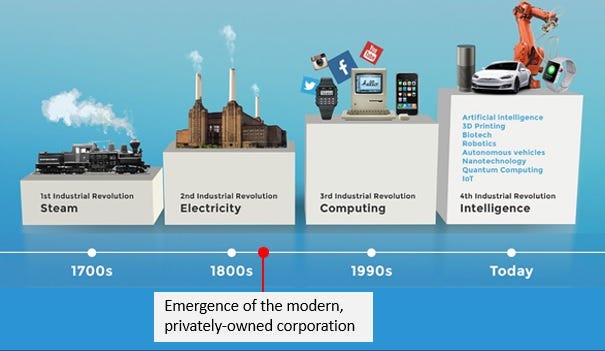

2. The Problems with Traditional Corporations: While they have greatly benefited society in several ways, corporations are relatively inefficient – multiple layers of management make them slow, bureaucratic, unimaginative, opaque and wasteful. In addition, they are generally constrained with a myriad of financial and legal regulations.

3. The Benefits of a DAO: Proponents argue that DAOs will retain all of the benefits of a traditional corporation – namely trust, security and growth – while being much more open, efficient, flexible, transparent and democratic (in fact, Mark Cuban called them the “ultimate combination of capitalism and progressivism”).

4. How Does a DAO Work? DAOs use blockchain technology to store their own funds and smart contracts to enforce their own laws – meaning that they don’t have to rely on traditional intermediaries such as banks or courts. As such, DAOs largely operate outside of the purview of the existing financial and legal ecosystem, allowing them to eliminate many of the costs, restrictions and regulations imposed on conventional organizations.

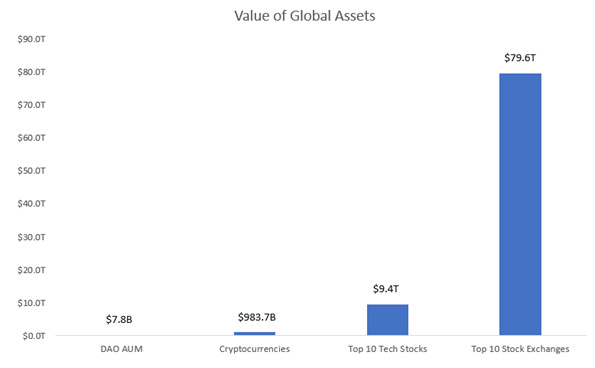

5. DAO Ecosystem: There are nearly 5,000 DAOs today representing almost 4 million members. In aggregate, these organizations hold nearly $8B in their treasuries and span a wide variety of use cases including investments, charity, entertainment, worker collectives and social clubs.

6. DAO Tooling: DAOs rely on a variety of communication, fundraising, governance, treasury management and compensation tools to operate efficiently.

7. Problems with DAOs: Critics argue that DAOs will be inefficient, expensive, prone to crime and represent a legal and regulatory nightmare.

8. Why DAOs will Eat Corporations: DAOs are a truly disruptive innovation that have the potential to grow 10,000x.

What is a DAO?

A DAO is a blockchain-based organization that may replace the modern corporation.

Unlike a traditional corporation, no single person or group owns or controls a DAO. They do not have CEOs, Boards or managers. Instead, they are owned and operated by members who make decisions democratically (much like a modern-day cooperative).

This allows for many exciting innovations such as user-owned social networks, vendor-owned eCommerce sites, player-owned games and driver-owned ride sharing companies.

DAOs Eschew the Hierarchy of Traditional Corporations

Furthermore, DAOs use blockchain technology to store their own funds and smart contracts to enforce their own laws – meaning that they don’t have to rely on traditional intermediaries such as banks or courts. As such, DAOs largely operate outside of the purview of the existing financial and legal ecosystem, allowing them to eliminate many of the costs, restrictions and regulations imposed on conventional organizations.

The term stands for “decentralized autonomous organization”, as DAOs are sovereign entities with:

No Headquarters: DAOs have no physical location – they are composed of members from all over the world who coordinate through internet chatrooms

No Hierarchy (or Limited Hierarchy): Decisions are made democratically, and each member can propose, discuss and vote on initiatives

No Employment Contracts: Anyone can contribute and get paid and workers are free to come and go as they please

No Governing Law: DAOs aren’t incorporated in any particular location and, as such, operate outside of the purview of the existing legal system

No Banks: DAOs raise their own capital through cryptocurrency or NFT sales and self-custody these funds in a treasury

Proponents assert that DAOs are superior to traditional corporations because they retain all of their benefits while being much more flexible, transparent and democratic (in fact, Mark Cuban called them the “ultimate combination of capitalism and progressivism”). Critics argue that DAOs will be inefficient, prone to crime and represent a legal and regulatory nightmare.

Whatever side of the argument one falls on, the popularity of DAOs is undeniable. There are nearly 5,000 DAOs today representing 3.7 million members (up nearly 300x from January 2021). DAOs have been formed to manage a variety of initiatives including investment funds, charity organizations, entertainment studios, worker collectives, social clubs and operating businesses.

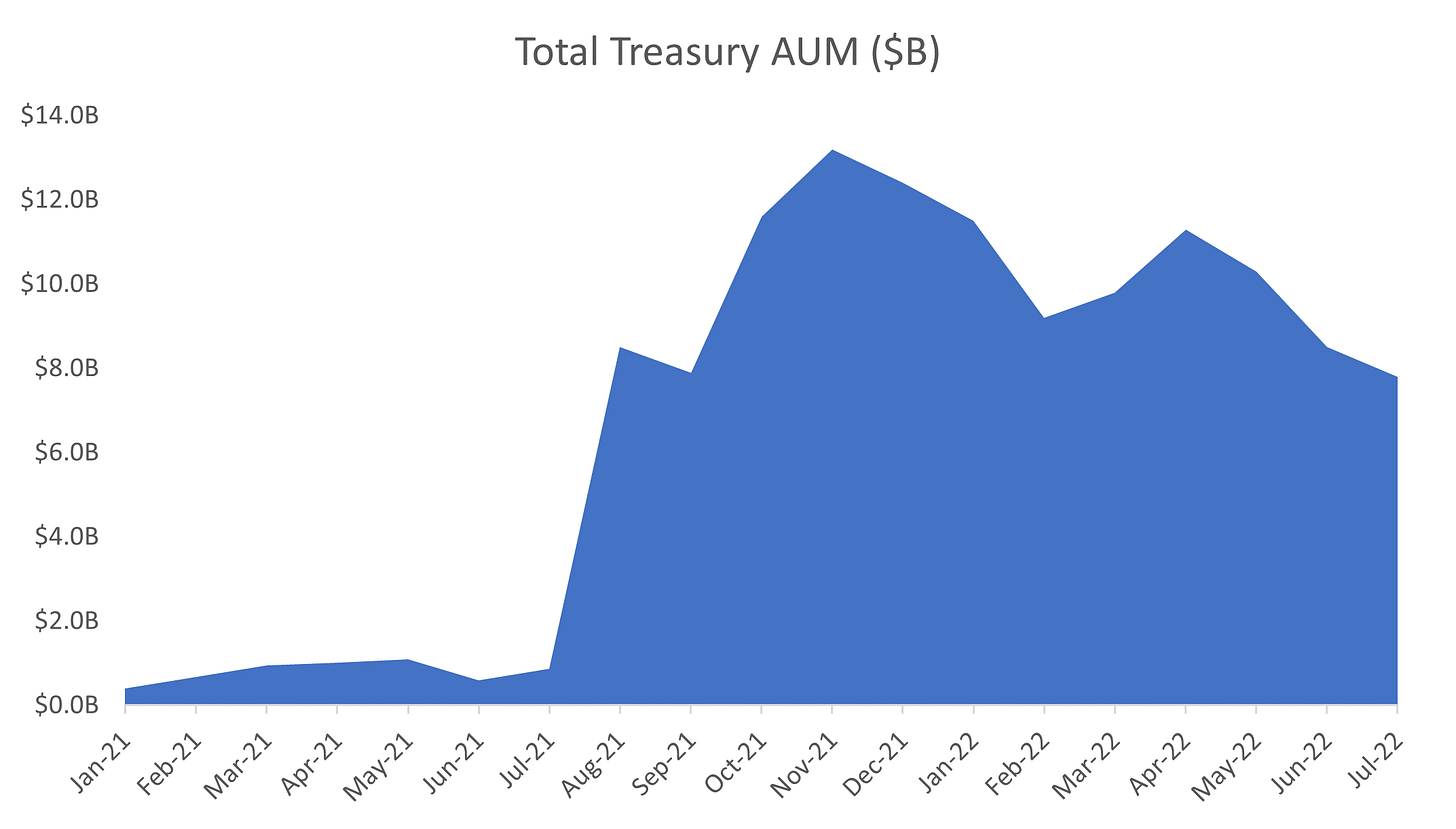

Total assets under management exploded in 2021, growing from $400 million in January 2021 to a peak of $16 billion by December 2021 (40x growth). Even today, during what many are calling a bear market, DAO treasures hold nearly $8 billion in funds (> 20x growth from January 2021).

DAO Treasuries Hold $8 Billion in Funds (up 20x from 2021)

What is driving this popularity? Let’s dig a little deeper…

The Problems with Traditional Corporations

Unlike many in the crypto space I don’t hate corporations. In fact, I think that they are one of the most important economic innovations in history as they enable large groups of people to work together to accomplish a common goal.

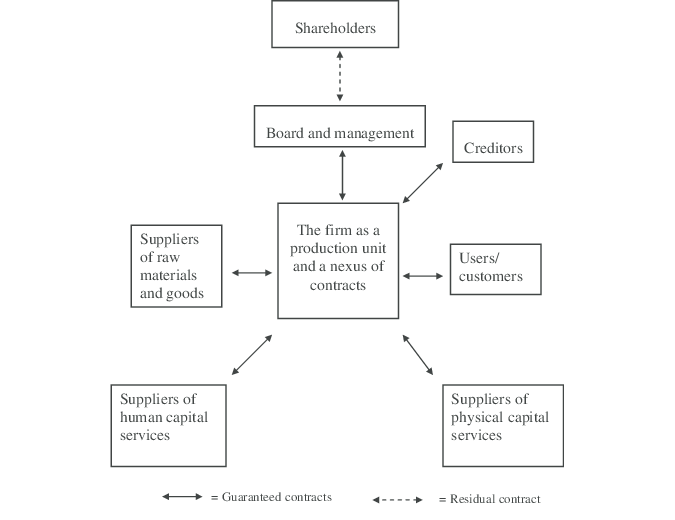

One of the ways they do this is by serving as a “nexus of contracts”. Corporations help coordinate the vast array of contracts that exist between the disparate (and often adversarial) group of stakeholders required to run a sizable business. This includes owners, management teams, employees, customers, suppliers, investors, creditors, etc…

Because these contracts are backed by a well-developed system of laws and enforced through the courts, they essentially allow a diverse group of strangers to trust one another and do business in a complicated, and often global, business environment.

Corporations Form the “Nexus of Contracts” That Allows Diverse Stakeholders to Trust One Another

Indeed, corporations work closely with the banking and legal system to provide covenants that protect:

Owners: Partnership agreements guarantee that each of the owners of a business will receive his or her fair share of the profits. In modern corporations, they also provide limited liability protection, meaning that an owner’s personal assets can’t be seized in a judgement against the entity

Investors: Investor agreements protect both corporations and sponsors by clarifying the amount of investment, key terms and conditions, the percentage of ownership received and the requirements of both parties to consummate the transaction

Employees: Employment contracts ensure that workers will get paid for labor performed and that management will have recourse in the case of negligence or bad faith

Customers and Suppliers: Customer and supplier agreements guarantee that the product will be delivered as promised and at the agreed upon price

Funds: Corporations serve as the legal entity that interacts with the banking system and the only “person” that can access an organization’s funds and transfer capital. In addition, corporations also serve as a fundraising vehicle – instead of each individual raising money separately, they provide a single point of contact for financial markets

Technology: Intellectual property agreements protect the intangible assets of a corporation such as trademarks, copyrights, patents and trade secrets

With all these stakeholders, it’s no surprise that the average Fortune 2000 company has 20,000 to 40,000 active contracts at any given time!

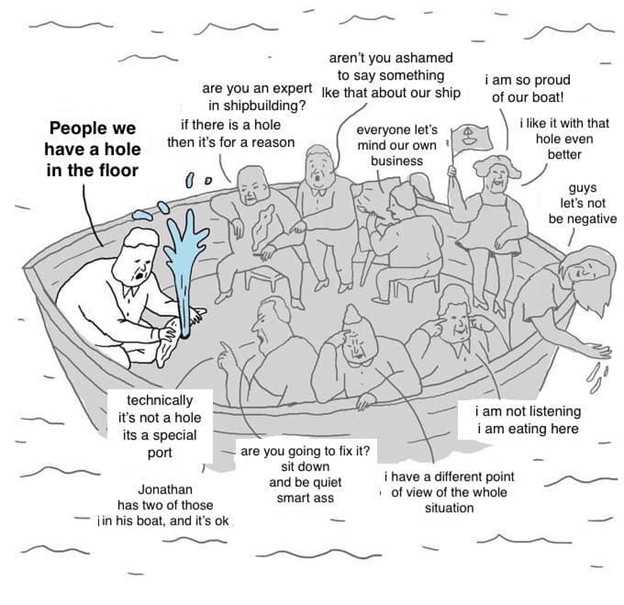

Unfortunately, managing the administrative, legal and regulatory requirements of all of these contractual relationships requires a lot of bureaucracy and overhead, and this makes corporations quite inefficient. In particular, they are often:

Slow: Hierarchical layers slow communication and new ideas must often pass-through multiple rounds of approval before being implemented

Expensive: Upper and mid-level managers can be very expensive, often comprising the bulk of payroll cost while representing a relatively small portion of the total employees

Unimaginative: Top-down decision-making reduces innovation, often spurring a viscious cycle where employees lose motivation as their interests depart from the firm

Restrictive: Corporations are often subjected to strict regulatory requirements for hiring and retaining talent (especially international talent), contributing to a “sticky” labor market

Opaque: Most businesses tightly guard internal information and financial results, and public corporations are only forced to report on a quarterly basis

Disjointed: The larger a corporation gets; the less employees align with the vision

Highly Regulated: Larger firms are much more vulnerable to regulation by governments, banks and other third parties

Together, these concerns represent a major problem – not only do they curb economic growth, but they also limit access for workers and contribute to inequality.

Unfortunately, we are all but forced to accept these consequences as corporations – in close partnership with banks and governments – have historically represented the best (if not only) way to provide the level of trust needed to organize a globally diverse group of economic actors.

So while some may call corporations “evil”, up until now they have been a “necessary evil”.

The Benefits of a DAO

This all changed in 2015 with the launch of Ethereum and its “smart contracts”.

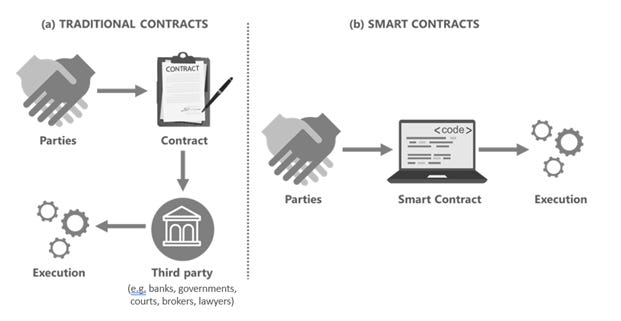

Smart contracts are digital agreements that execute automatically when pre-determined conditions are met. For instance, you could program a smart contract to automatically pay an employee each time she launched a new product or feature, or automatically pay a supplier each time a product is delivered.

Unlike traditional contracts, smart contracts don’t rely on corporations, banks, lawyers, courts or local laws to guarantee their enforcement. Instead, users trust the technology and its pre-programmed code to automatically execute when they’ve upheld their end of the deal.

Smart Contracts Don’t Need Lawyers, Brokers, Banks, Courts or Governments

The terms of a smart contract are fully transparent and accessible to all parties, and they will always execute exactly as programmed. Because they are created using blockchains, no one can alter these terms without consent from everyone involved. For a more detailed explanation of how smart contracts work, check out the following article: )

Smart contracts make it possible – for the first time in history – to organize a global and diverse group of economic actors without relying on third parties such as corporations, banks, governments and courts to establish trust.

The effect of this cannot be overstated and requires a bit of tabula rasa thinking. Imagine for a bit, how you would design a corporation if you no longer needed traditional contracts or intermediaries:

After all, what’s the point of registering as a legal entity if you can enforce your own laws through smart contracts?

What’s the point of partnership agreements if you know that ownership is fairly distributed?

What’s the point of employment contracts if workers are guaranteed to get paid when they complete their work?

What’s the point of entering into a banking relationship if you can hold your own funds and pay your workers directly?

What’s the point having investment banks draft complicated Private Placement Memoranda if you can raise your own capital?

What’s the point of a CEO and management team if there’s no legal and regulatory bureaucracy to manage?

If you’re like me, you’re probably envisioning something much simpler and more elegant than what we have today…

In short, a “corporation” without managers, employment contracts, banks or legal and regulatory restrictions.

That entity is known as a DAO, and it may allow us to reap all the benefits of a traditional corporation – namely trust, security and growth – while removing most of the downsides. Indeed, DAOs are:

Global: DAOs are composed of individuals with different backgrounds, skills and viewpoints from all over the world

Democratic: Decisions are made democratically, and each member can propose, discuss and vote on initiatives

Aligned: In an ideal DAO, every member is an owner. Unlike traditional hourly or salaried workers, DAO contributors are all incentivized to contribute to a common goal – the overall growth of the enterprise

Open: Many DAOs don’t have a hiring process, anyone can join, work and get paid

Flexible: DAO “employees” are free to come and go as they please, work for multiple DAOs and work as little or as much as they want

Transparent: All of a DAOs rules and transactions are recorded on a blockchain and its smart contracts, making them easy for anyone to audit and review. In addition, unlike traditional corporations, this information is accessible in real-time

Sovereign: DAOs exist outside of the purview of the traditional financial and legal systems. While this may not seem very important in certain parts of the world, it can be a huge benefit to citizens of developing nations who face a very real threat of arbitrary regulation (e.g. because they hold political views that oppose the current administration)

Self-Custodied: In the current financial system, corporations don’t really hold their funds – the banks do. This means that they can shut down, freeze and even seize an organization’s asset at will. While this may seem far-fetched, consider that in 2013, the Government of Cyprus seized 47.5% of all bank accounts over €100,000 to bail-out its failing banking system

Faster: Because smart contracts execute instantly, they can save hours of various business processes

Cheaper: Smart contracts remove the needs for lawyers, bankers and brokers, making them much cheaper

I know this is a lot to take in. Crypto is so unique, so transformative, so unintuitive that I’ve been studying it for years now and sometimes I feel like I only partially get it.

But to help you understand more about how DAOs can transform the world, let’s go a bit deeper down the rabbit hole…

How Does a DAO Work?

In many ways, DAOs operate the same as a traditional organization.

“For-profit” DAOs must define their mission, raise capital, create a strategy, build a product or service and then sell it for a profit. Investment DAOs need to find LPs, identify promising projects and invest in them.

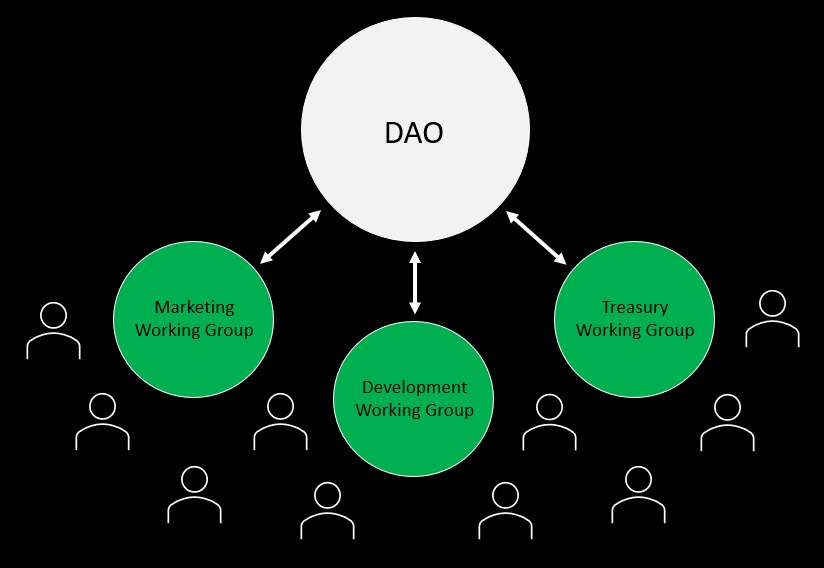

As such, many DAOs are beginning to organize similarly to traditional corporations, and divide themselves into working groups corresponding to the primary functions of the business (e.g. strategy, sales & marketing, operations and finance).

Larger DAOs are Often Organized into Functional Divisions

The most apparent difference between a DAO and a traditional organization is its decentralized nature. Unlike traditional organizations, DAOs are fully-remote entities – they have no headquarters, office or physical location and members often live all over the world.

In addition, they rarely have CEOs, Boards or managers. Instead, they are owned and operated by members who make decisions democratically.

While this may seem progressive, it’s not exactly novel, as this system has existed for quite some time in the form of a cooperative. In fact, many prominent organizations today – including Nationwide, Land-o-Lakes and the Green Bay Packers – are organized as coops.

What truly makes a DAO disruptive then, is its autonomous nature. While many people disagree on the meaning of this term – some believe it describes an entity almost fully administered by machines or AI – a more modest take is that it simply means that the organization has automated away unnecessary internal and external bureaucracy by replacing traditional contracts with smart ones.

Indeed, from a technical standpoint, a DAO is essentially little more than a collection of smart contracts built on the blockchain of a decentralized platform such as Ethereum (click the following link to understand more about how smart contract platforms work).

These contracts can be programmed to replace several processes in an organization and are used to:

Define Rules: DAOs don’t need to register as a corporation, domicile in a particular jurisdiction or create an operating agreement. Instead, ownership percentages, member rights and responsibilities, voting rules and allocation protocols are coded directly into a smart contract

Raise Funds: Unlike traditional corporations, who generally raise capital through private placements or IPOs, DAOs don’t use investment banks or the financial markets to raise funds and distribute ownership. Instead, they typically raise funds by creating and selling their own cryptocurrency token or NFT

Store Funds: DAOs don’t use banks to hold their funds. Instead, they custody and manage their own assets on a blockchain, and the community democratically makes decisions on how to employ this “treasury”

Govern: As mentioned, most DAOs don’t use a Board, CEO or Executive team to define strategy or make decisions. Instead, they power their non-hierarchical, democratic governance structure with a smart contract designed to tally voting results, record them onto the blockchain and sometimes even execute the decision

Attract Workers: Unlike traditional corporations, many DAOs don’t have employment agreements and instead rely on smart contracts to compensate workers in cryptocurrency tokens or stablecoins. In theory, this allows anyone to join a DAO, come and go as they please, work as little or as much as they want and even choose to remain anonymous

Pay Workers: Many DAOs are using smart contracts to develop innovate new compensation structures such as bounties (payment per task), peer-based compensation (where team members collectively vote on the allocation of the DAO’s budget) and “streamed” salaries (automated payments made in real-time)

Distribute Funds: DAOs can use smart contracts to transfer cryptocurrencies and stablecoins for virtually any purpose they deem necessary. This includes making distributions to owners, providing grants to developers, incentivizing customers, paying suppliers and partners, etc…. Because these payments bypass the traditional banking system, they theoretically aren’t subject to local regulations or restrictions on international currency transfers

Execute Operations: Some DAOs – notably “protocol DAOs” such as the decentralized exchange Uniswap – run a significant portion of their business using smart contracts. In these cases, the DAOs could program one smart contract to interact with the others (for instance, a successful vote to increase the take rate made through the voting protocol would automatically update the smart contract responsible for administering fees)

In practice, not every DAO satisfies all of the above conditions – many today are not fully decentralized nor autonomous.

But proponents are quick to remind us that we are still very early, and thousands of entrepreneurs are experimenting to find the perfect form that blends: 1) the strengths of a traditional organization, 2) the democracy of decentralized ownership and 3) the efficiency of autonomous execution through smart contracts.

In fact, the marriage of these three features is where DAOs get their name – Decentralized Autonomous Organizations.

For more detail on how DAOs are used in practice, let’s head to the next section…

DAO Ecosystem

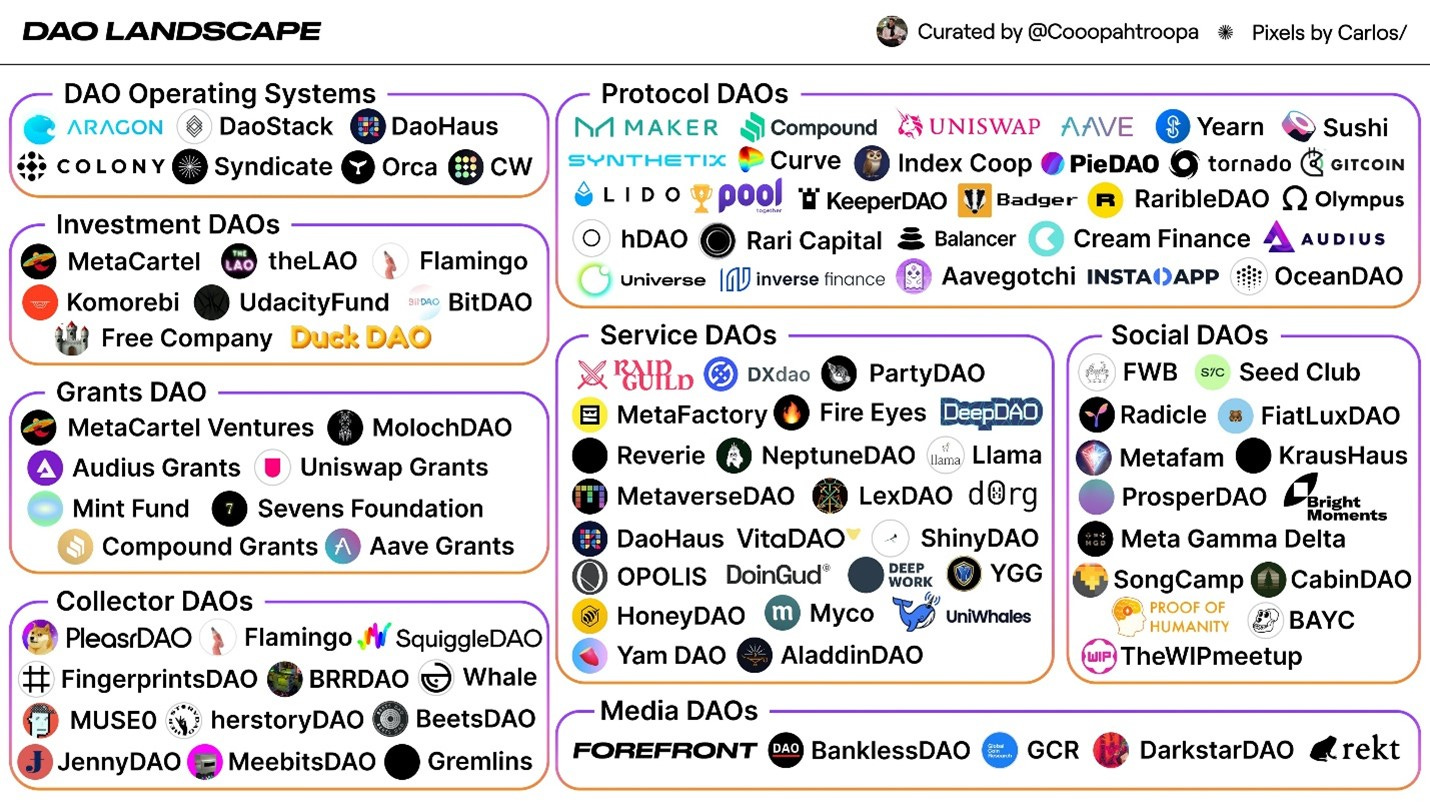

The DAO landscape is flourishing – there are currently almost 5K DAOs representing nearly $8B in capital and 3.7 million members. DAOs have been created for a variety of purposes including the management of companies, investment funds, collector groups, charities, media studios, talent agencies and social clubs.

One DAO even tried to buy the US constitution and almost did it!

A Small Sample of the DAO Landscape

The core argument for DAOs is that they present a better way to for human beings to organize. As such, they may soon begin to replace some of our longest standing institutions. Notable types of DAO include:

Protocol DAOs: “For-profit” DAOs that operate a business (could replace traditional corporations)

Investment DAO: DAOs that focus on pooling and investing capital (might disrupt VCs, PE shops and Hedge Funds)

Charity DAOs: Provide grants to charitable organizations and projects (may become an online version of the United Way or Salvation Army)

Collector DAOs: Focus on pooling capital and investing in digital assets such as NFTs (might undermine the current gallery and museum set)

Media DAOs: Creator-owned DAOs that produce entertainment products (could subvert film studios, publishers, news organizations, record labels and game developers)

Service DAOs: Member-owned freelancer networks (have the potential to supersede unions, consulting firms and talent agencies)

Social DAOs: Virtual social clubs (may replace country clubs and member’s clubs like Soho House)

Let’s take a deeper dive into each of these categories below…

Protocol DAOs

What is a Protocol DAO?

“Protocol” DAO is a bit of a nebulous term, but it’s generally used to refer to a for-profit, operating businesses organized under a DAO structure. In short, it’s a decentralized version of a traditional corporation.

While protocol DAOs can theoretically govern any type of business, in practice they are generally used for crypto-focused projects such as decentralized exchanges and borrowing / lending protocols.

They are currently the largest category in the space and represent 7 out of the top 10 DAOs.

How does a Protocol DAO Work?

To understand how a protocol DAO functions, let’s take a look at Uniswap DAO – the organization responsible for managing Uniswap, the largest decentralized cryptocurrency exchange.

Decentralized exchanges (or DEXs) are peer-to-peer marketplaces where users can directly trade with one another without the need for banks, brokers or any other financial intermediaries. Unlike centralized exchanges such as Coinbase, they can’t restrict users or decide what tokens are traded. In fact, they don’t even require KYC, meaning that anyone can use a DEX from anywhere in the world and trade anonymously (provided they have a VPN).

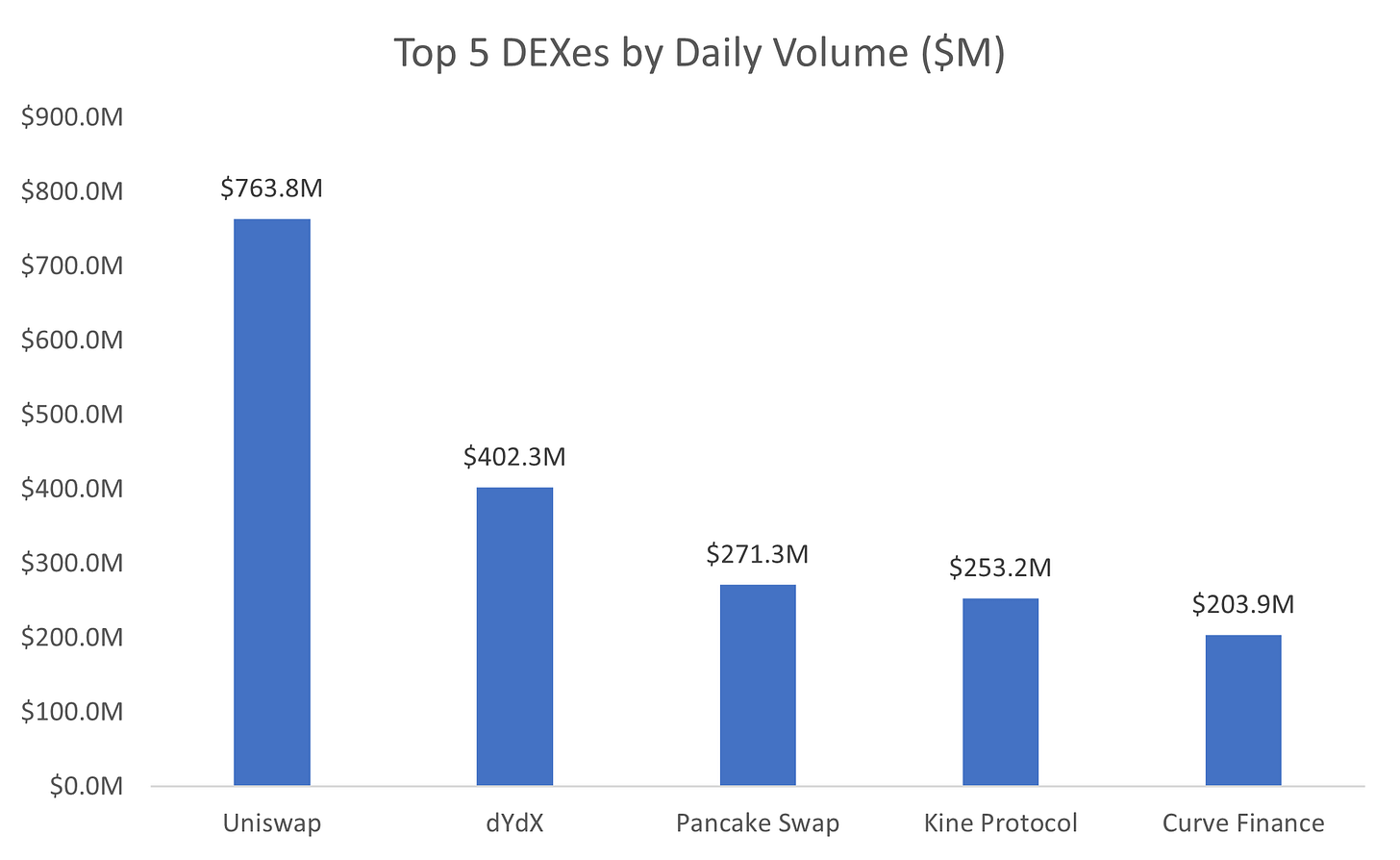

Launched in 2018, Uniswap has become the largest DeX, and is currently generating nearly $1 billion in volume per day.

Uniswap is the Largest DEX with Nearly $1 Billion in Volume Per Day

The protocol became a DAO in September 2020 when it issued 1 billion UNI tokens to its users, effectively transitioning management from the founders to the community. With the Uni governance token, users have full control over the project and are responsible for all decisions including how much it will charge and how it will spend its treasury

To wit, any UNI holder can submit a proposal to change the protocol or introduce new features and have it approved by other DAO members. For instance, let’s say that a member wanted to increase Uniswap’s fee from 0.3% to 1.0%. She would follow a three-step proposal process that includes:

Temperature Check: In the first phase, known as a “temperature check”, members ask a simple question to the community on gov.uniswap.org and submit it to a vote in Snapshot. For example, a member may ask “should we increase our fee from 0.3% to 1.0%”. If the proposal gets a majority vote with a 25K threshold, it proceeds to the next stage.

Consensus Check: The second phase – the “consensus check” – requires members to create a more formalized proposal, incorporating any feedback from the first stage and submit it for a vote. This new proposal requires a minimum of 50K yes votes to proceed.

Governance Proposal: In the last phase, known as the “governance proposal”, members must submit a finalized pitch which includes the actual code. The code must be reviewed by a professional auditor, and members must have a minimum of 2.5 million UNI to submit.

After a proposal reaches the final stage it is put to a vote. Any proposal that passes is ratified and the code is automatically updated.

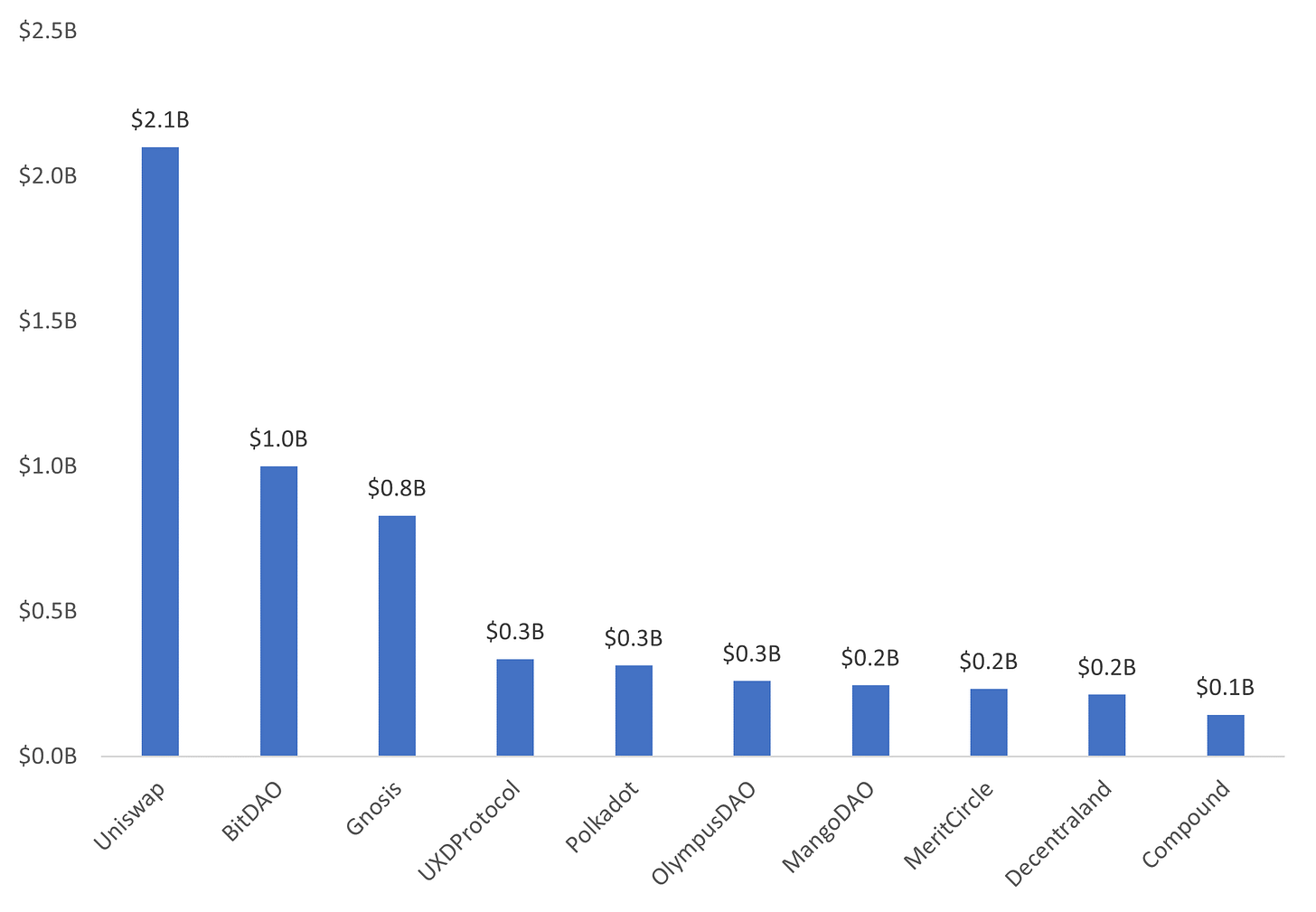

Uniswap has been very successful under the DAO structure, it holds over $2 billion in assets and is the largest DAO today.

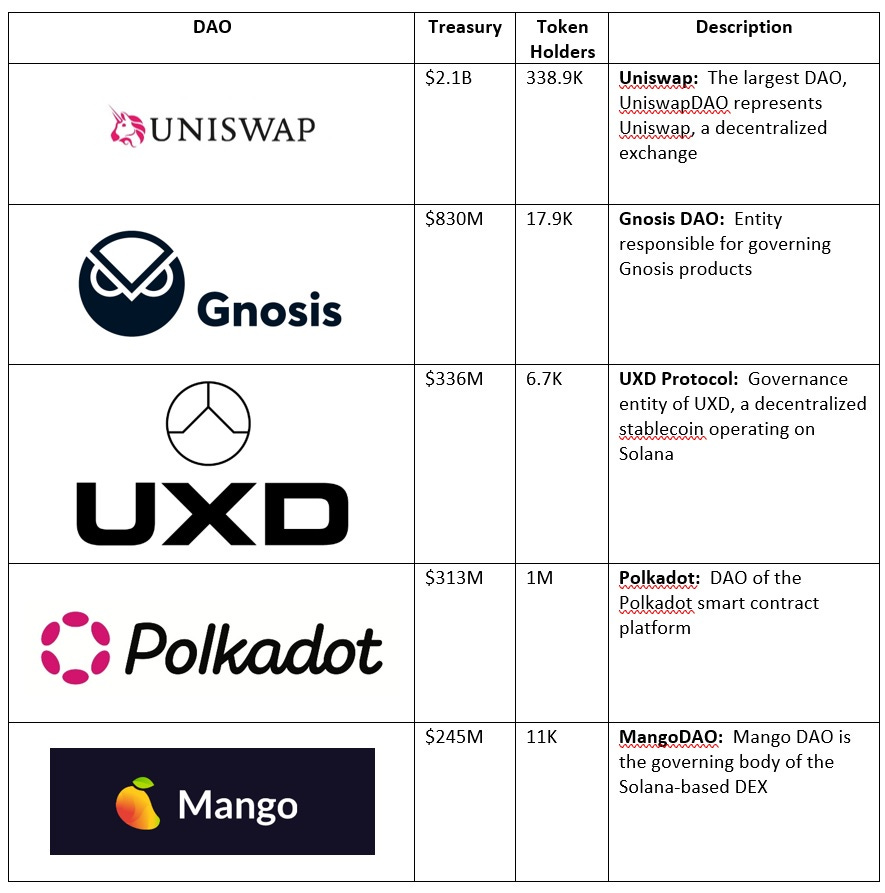

Notable Protocol DAOs

In addition to Uniswap, other notable Protocol DAOs include Gnosis, UXD, Polkadot and MangoDAO.

Source: DeepDao as of 7.2.22

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

Investment DAOs

What are Investment DAOs?

Investment DAOs are collectives of investors who pool their capital to invest in early-stage crypto projects. Proponents argue they represent the ideal form of capital allocation and, as such, will replace VCs, PE shops and hedge funds.

Typically, membership in an investment-focused DAO involves an upfront buy-in in the form of the DAO’s governance token in exchange for access to private spaces – e.g. invite-only Discord chats, Telegram groups or in-person events – where deals can be sourced and checks written.

They offer several benefits over traditional funds including:

Better Due Diligence: Unlike traditional investment funds, who are generally limited to a small team of professionals, Investment DAOs can leverage a wide variety of expertise to gain insight into potential investment decisions. Membership is generally global, and these organizations are often composed of specialists from different disciplines including macroeconomics, business strategy and operations, sales & marketing, development and finance

Superior Decision Making: Given their diverse nature, Investment DAOs can leverage the “wisdom of the crowds”, gaining unique perspectives and avoiding potential blind spots. This stands in stark contrast to traditional investment funds, who often are forced to rely on a small group of advisors

Increased Deal Flow: Members are incentivized to find and research deals, recruit talent and find partnerships and opportunities for portfolio companies. This effectively gives an Investment DAO a global sourcing network

Less Risk: Unlike traditional funds which often require long lockups, Investment DAOs are often extremely liquid, allowing any investor to leave at any time with their pro rata share of assets

How do Investment DAOs work?

To understand how investment DAOs work, let’s take a look at BitDAO, the largest investment DAO. The project was launched by ByBit, a decentralized exchange operating out of Singapore.

The project looks to further the development of decentralized technologies such as smart contract platforms, Layer 2 solutions, NFTs, DeFi, etc… They can do this by making direct investments, performing token swaps, building products and / or providing grants to research teams.

With $1 billion in AUM, BitDAO boasts the second largest treasury of any DAO.

BitDAO holds $1 Billion in its Treasury

BitDAO raised nearly $600M in a series of token sales in the summer of 2021 (one private, one public). The tokens – trading under the symbol BIT – come with both ownership and governance rights, allowing holders to vote on a variety of initiatives including:

Investments: Direct investment in projects

Partnerships: Partner with projects through token swaps and co-development efforts

Development: Build core products that allow decentralized organizations to function more effectively, such as governance and treasury management tools

Grants: Grants to research teams, R&D organizations, educational programs, blockchain technology projects and other public goods

Protocol Upgrades: Changes to the BitDAO core code

This is not an exhaustive list by any means. Like any DAO, members have the ultimate flexibility to evolve with market conditions and find new ways to support the projects vision of an open and decentralized economy.

BitDAO is backed by several notable investors including Peter Thiel, Founders Fund, Pantera Capital, Polygon and ByBit.

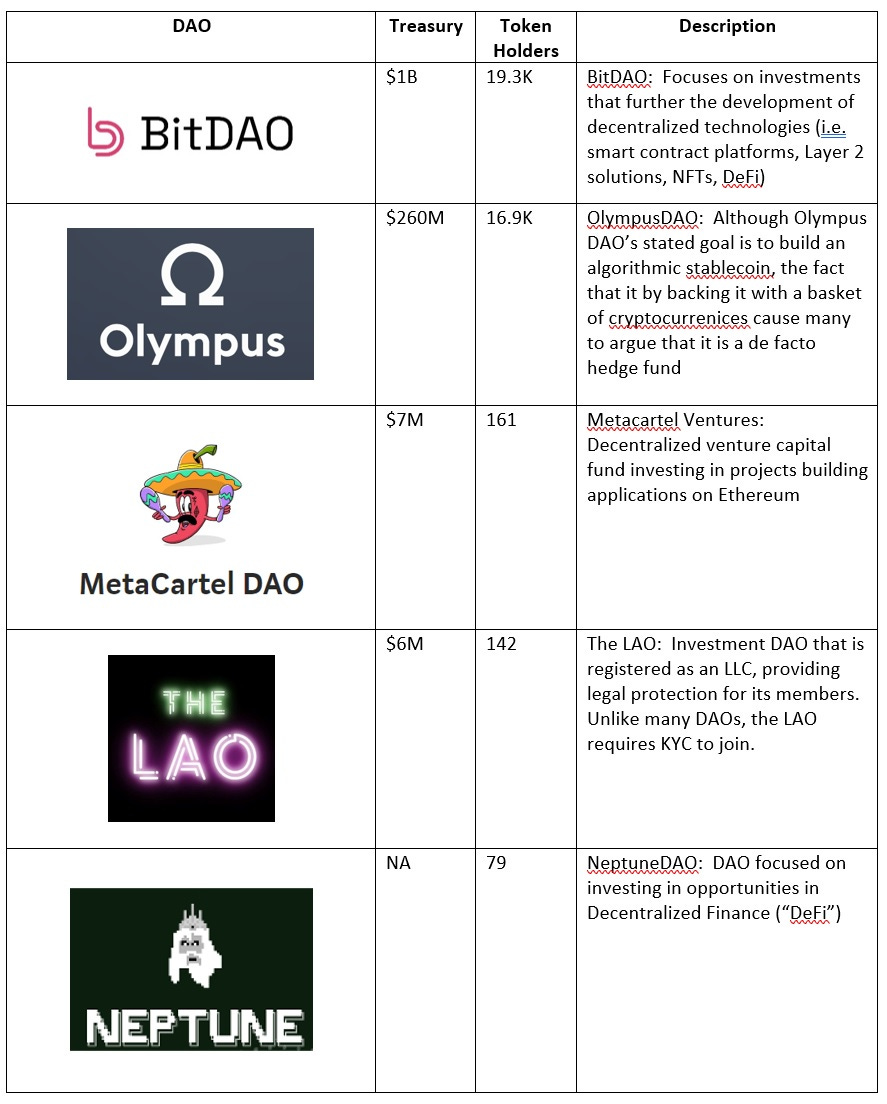

Key Players

Source: DeepDao as of 7.2.22

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

Charity DAOs

What are Charity DAOs?

One of the earliest use cases of the decentralized autonomous organizational structure, charity DAOs could replace traditional charities such as the United Way or Salvation Army, or traditional grants institutions such as the NIH.

In a charity DAO – also known as a grants DAO – the community pools their capital into a blockchain-based treasury and then collectively votes on how to distribute these funds.

Charity DAOs have almost an unlimited number of potential use cases. They can be used to fund children’s and family services, homeless services, education, food banks, social services, youth development, environmental efforts, animal welfare, education, international NGOs, etc…

They offer several benefits over traditional charities such as:

Lower cost: On average, charities spend 25% on administrative and fundraising costs – the automated nature of DAOs can largely eliminate this

Governance: Unlike traditional grant / charity organizations, members have a direct say in the governance of the DAO, meaning that they can direct it to issue funds to projects they are passionate about

Transparency: It is estimated that over $40B of charitable donations are stolen each year. Because every transaction in a grants DAO is recorded on a blockchain, it will be easy to identify theft and fraud

How do they Work?

To understand how grants DAOs work, let’s take a look at Gitcoin – a crowd-sourcing platform that provides grants to developers working on open-source software projects. The project was founded in 2017 by Kevin Owocki, has 26K members and $75 million AUM. It is advised by Balaji Srinivasan, Naval Ravikant and Joe Lubin (founder of ConsenSys).

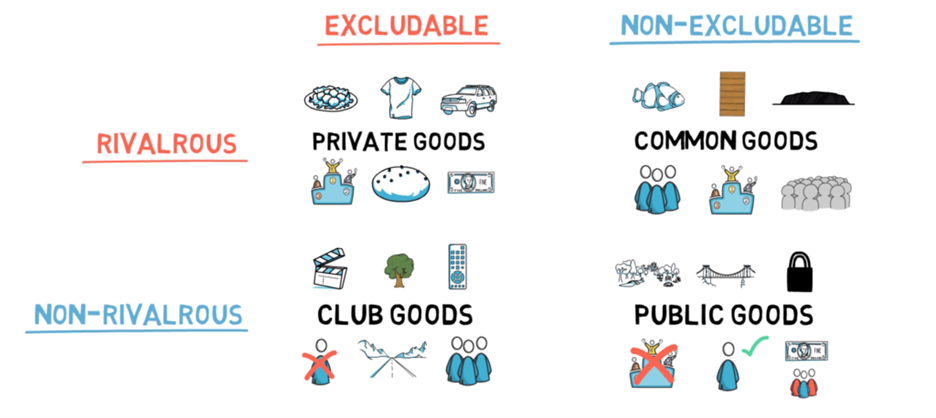

Gitcoin focuses on funding developers working on “public goods” projects. From an economic standpoint, the two features that distinguish a public good is that it’s: 1) “non-rivalrous” (i.e. it doesn’t decrease in supply if more people use it) and 2) “non-excludible” (i.e. it’s available to everyone). Common examples of public goods include clean air, better infrastructure and privacy.

Gitcoin Funds “Non-Excludable” and “Non-Rivalrous” Public Goods

Like many charitable organizations, Gitcoin uses “matching” – a process where individual donations are matched from a larger pool of funding supplied by bigger donors.

Unlike traditional charities, which match funding dollar-per-dollar or by a percentage of the total amount given, the platform uses a process called “quadratic funding”. Quadratic funding is mathematically-based scheme that rewards the number of contributions over the dollar amount of these contributions (incentivizing people to make many small donations vs. a few large ones). In theory, this creates a more democratic process and gets people more involved in the ecosystem.

Feel free to skip this section if you’re not interested in the math behind this, but if you are – quadratic funding works by taking the square root of each contribution to a project, summing and squaring that total and then comparing the result to similar projects.

This probably seems a bit confusing, so let’s explain with an example. Imagine that there is a $10,000 matching pool and three projects that each raise $5,000, but from a different number of donors (let’s say 5, 2 and 10 donors). In a traditional matching scheme, because each project raised the same amount, they would split the matching pool equally, getting $3.3K (33%) each. Under quadratic funding, however, we would get a different result:

Project A: If the first project raised $1,000 each from 5 donors, we would take the square root of all the donations (√$1,000 = $31.62), sum them up to get $158.12 and then square this to get $25,000

Project B: If the second project raised $2,500 each from 2 donors, we would take the square root of all the donations (√$2,500 = $50.00), sum them up to get $100.00 and then square this to get $10,000

Project C: If the third project raised $500 each from 10 donors, we would take the square root of all the donations (√$1,000 = $22.36), sum them up to get $223.61 and then square this to get $50,000

We would then sum all three totals to get $120,000. While this figure doesn’t represent an actual funding amount, it will be used to calculate the percentages of the matching pool given to each project. Based on these numbers, we can see that project A garnered 21% of the new total ($25,000 / $120,000), project B garnered 8% ($10,000 / $120,000) and project C garnered 71% ($85,000 / $120,000).

As such, out of the original matching pool of $10,000, project A would receive $2,083.33, project B $833.33 and project C $7,083.33.

Again, it’s not really necessary to understand the math, only that the even though each project raised the same amount, the one with the most donations received a lot more total funding.

Who are the Key Players?

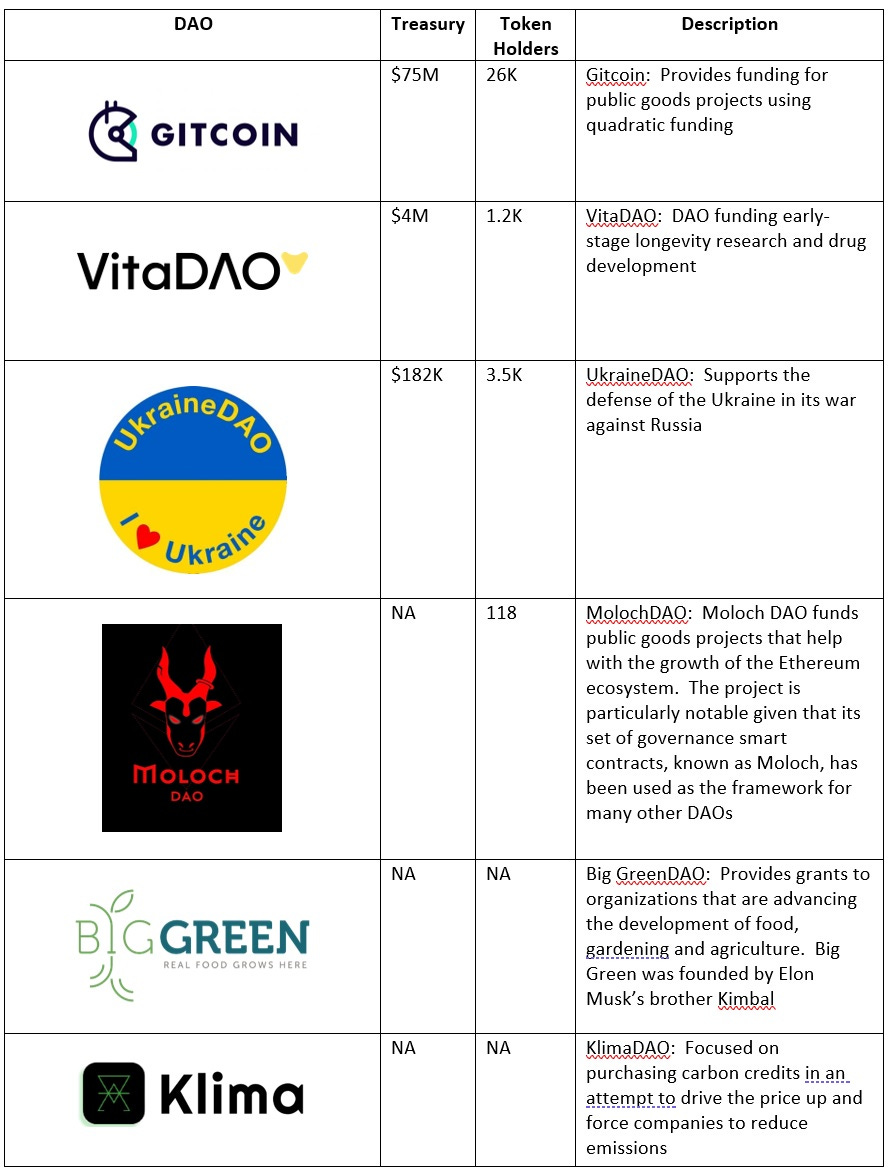

In addition to Gitcoin, other notable Grants DAOs include Moloch, VitaDAO, Big Green, UkraineDAO and KlimaDAOSource: DeepDao as of 7.2.22

Source: DeepDao as of 7.2.22

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

Collector DAOs

What are Collector DAOs?

Collector DAOs are the close cousin to investor DAOs in that they pool money together to purchase and co-own digital assets such as NFTs.

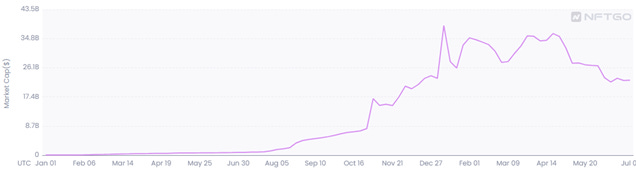

These DAOs became popular in response to the NFT boom of 2021, which saw average prices increase from $128 to $6,900 (including several high-profile sales such as Beeple’s Everydays for $69.3 million). As asset prices became out of reach for the average person, collector DAOs offered a logical way to preserve access to the most desirable NFTs.

The NFT Market has grown over 300x since 2021

Collector DAOs provide members several unique benefits including:

Shared costs: Sharing the cost of expensive NFTs dramatically lowers the barrier to entry for the average user (as well as the risks)

Collective Intelligence: Like investment DAOs, collector DAOs can leverage a diverse set of viewpoints and experiences to help them make decisions into what projects to invest in

Flexibility: In addition to pooling funds to purchase art, collector DAOs can choose to make angel investments with the goal of growing the entire digital art community

How do Collector DAOs work?

To understand how collector DAOs work, let’s take a look at PleasrDAO, an organization that focuses on the collective purchase of expensive NFTs. The project was founded in 2021 and is backed by Andreessen Horowitz.

The DAO pools capital from potential investors, uses this money to purchase an NFT and then returns each investor a token representing their pro-rata share of the NFT.

For example, if Alice contributed $1,000 to the purchase of a $100,000 NFT, she would get 1% of the tokens issued by Pleasr. These tokens can generally be traded on the open market, giving investors liquidity and allowing them to speculate on asset prices.

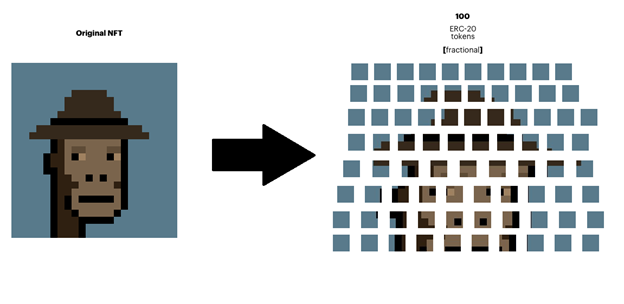

Shares are created through a process known as “fractionalization” – a method of economically splitting up the ownership of an NFT into smaller pieces which can be bought, sold, traded and held by multiple users.

The term “economically” is key here as NFTs can’t actually be divided (much like you couldn’t cut a physical piece of art into little pieces without destroying its value). Instead, the process of fractionalization involves the issuance of tokens that represent a claim on the original asset.

Fractionalization of a CryptoPunk

PleasrDAO often uses a platform known as Fractional to distribute tokens to the community. To issue a token via Fractional, PleasrDAO would need to:

Create a Vault: PleasrDAO would deposit their asset as collateral in a “vault” on Fractional and specify the number of tokens they want to create

Mint Tokens: Once the collateral is deposited, Fractional issues the PleasrDAO 100% of the fractional ownership tokens

Distribute Tokens: PleasrDAO would distribute each investor their pro-rate share of tokens.

Fractionalization yields several benefits in that it: 1) allows the average user access to extremely expensive works (such as CryptoPunks or Bored Ape Yacht Club), 2) facilitates price discovery and 2) provides liquidity allowing members to sell a portion of their assets (which can’t be done with traditional NFTs)

To date, PleasrDAO has purchased several notable works such as the “DOGE” meme NFT for $4million, an NFT from Edward Snowden for $5.5 million and the only copy of an album from the Wu-Tang Clan for $4 million.

Key Players

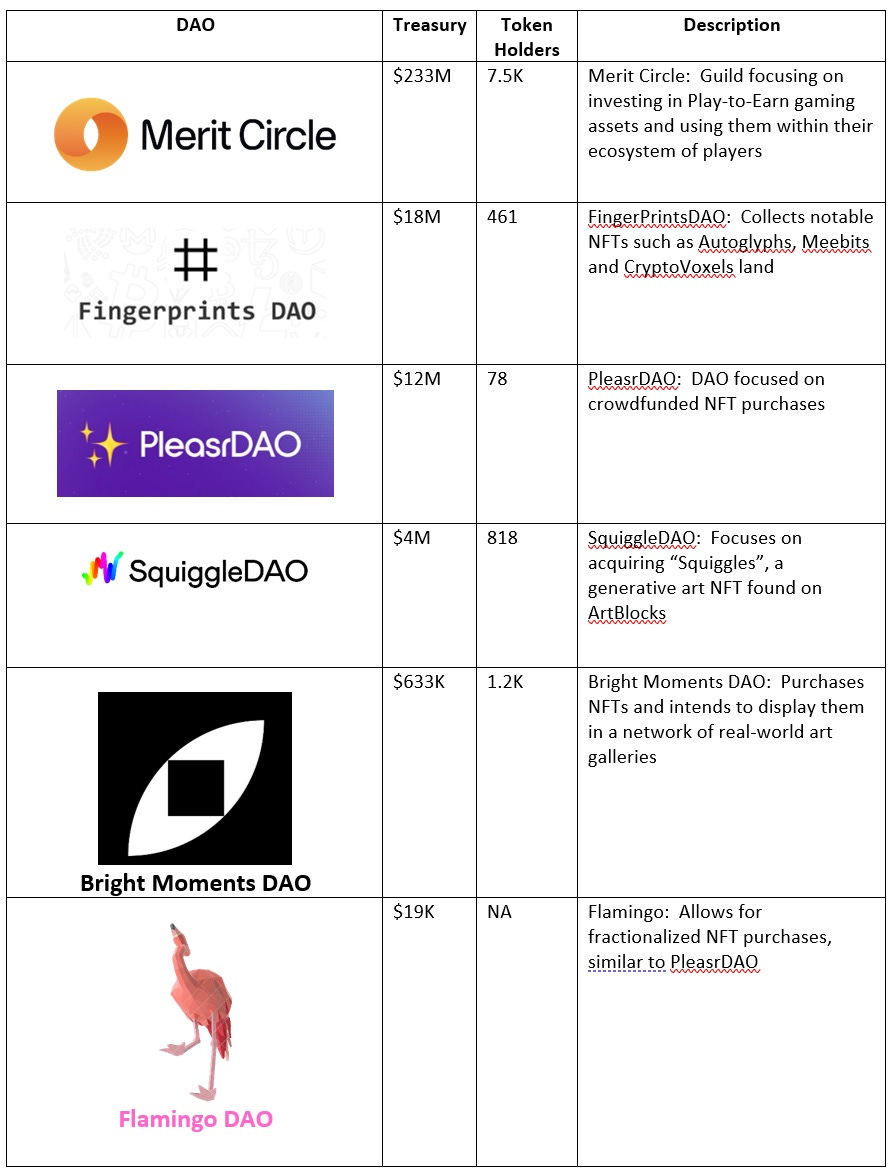

In addition to PleasrDAO, other notable collector DAOs include FingerprintsDAO, Bright Moments DAO, Flamingo DAO, Squiggle DAO, Constitution DAO and Yield Guild Games.

Source: DeepDao as of 7.2.22

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

Media DAOs:

What are Media DAOs?

Media DAOs are decentralized information and entertainment companies that are directly owned by creators and consumers.

Musicians, artists, game developers, independent journalists, podcasters, bloggers, YouTuber’s and social media influencers could all transition their communities to a DAO structure. By “cutting out the middleman”, Media DAOs have the potential to subvert film studios, publishers, news organizations, record labels and game development studios.

Media DAOs offer both creators and consumers substantial benefits, including:

Increase Profits: Intermediaries take a large cut out of an artist’s revenue. After accounting for record labels, producers and streaming platforms, artists earn fewer than 12% on platforms such as Spotify. Removing these intermediaries could significantly increase profit (some decentralized music services are offer a 90% share!)

Less Censorship: Companies such as Twitter frequently ban users, and Apple banned Epic Games, the creator of the multi-billion dollar game Fortnite, from its App Store after a revenue dispute. Media DAOs could free creators from this restriction, allowing them to upload any content, no matter how controversial, to any platform they so choose

Enhanced Fan Involvement: Finally, Music DAOs will likely increase the incentives for collaboration between creators and their fanbase. For instance, members could gain economic benefit from creating derivative works and remixes, or even building decentralized applications that incorporate a piece of work

The combination of NFTs – which allow personal ownership of intellectual property -- and Media DAOs is particularly exciting. One could imagine a world where a group of individual rights holders collectively organize to build the next Marvel.

How do Media DAOs work?

To understand how Media DAOs work, let’s take a look at Bankless – a digital media company that focuses on crypto education and infotainment through its flagship podcast and newsletter.

The Bankless organization was originally founded in 2020 by David Hoffman and Ryan Sean Adams. In 2021, they decided to shift the structure to a DAO by creating and distributing over 1 billion BANK tokens (30% to community members retroactively, 30% to the DAO’s treasury and 40% for future grants).

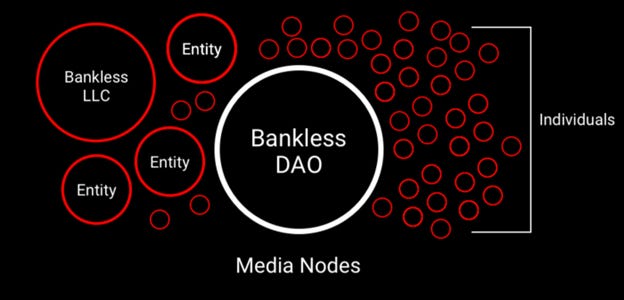

The DAO was formed to expand on Bankless’s original mission by evolving into a diversified entertainment studio. As such, BanklessDAO and Bankless LLC are technically separate entities, with the original company being just one player in a larger ecosystem (although it does own 25%).

Bankless LLC is Just One Part of a Broader Ecosystem

In many ways, the BanklessDAO runs similarly to a traditional media studio. It is organized into departments, called Guilds, that perform the basic functions that you would find in any media organization. Some of the more prominent Guilds include:

Content Creation: Writer’s Guild, AudioVisual Guild and Translator’s Guild

R&D: Research Guild and Education Guild

Sales: Marketing Guild and “DAOlationships” Guild

Operations: Operations Guild and Analytics Guild

Tech: Developer’s Guild and Design Guild

Finance: Treasury Guild

Legal: Legal Guild

Contributors to the DAO are paid in BANK tokens using a blend of bounties and reputation-based compensation methods.

Unlike traditional publishers, BanklessDAO is owned by the community. Anyone can become a member for 35K BANK tokens (~$350 at the time of writing) and make proposals, participate in discussion and vote on key issue.

Currently, there are 6.8K members of the Bankless DAO managing $2.1 million.

Key Players

In addition to Bankless, other notable media DAOs include Global Coin Research, Mirror and Rekt.

Source: DeepDao as of 7.2.22

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

Service DAOs

What is a Service DAO?

Service DAOs are modern-day labor aggregators – similar to decentralized unions, consulting firms or talent agencies.

They are generally composed of freelancers from Web3-related fields, such as design, development, marketing, sales, operations and treasury management. Members collectively own the DAO and work is often compensated in stablecoins or the DAO’s native token.

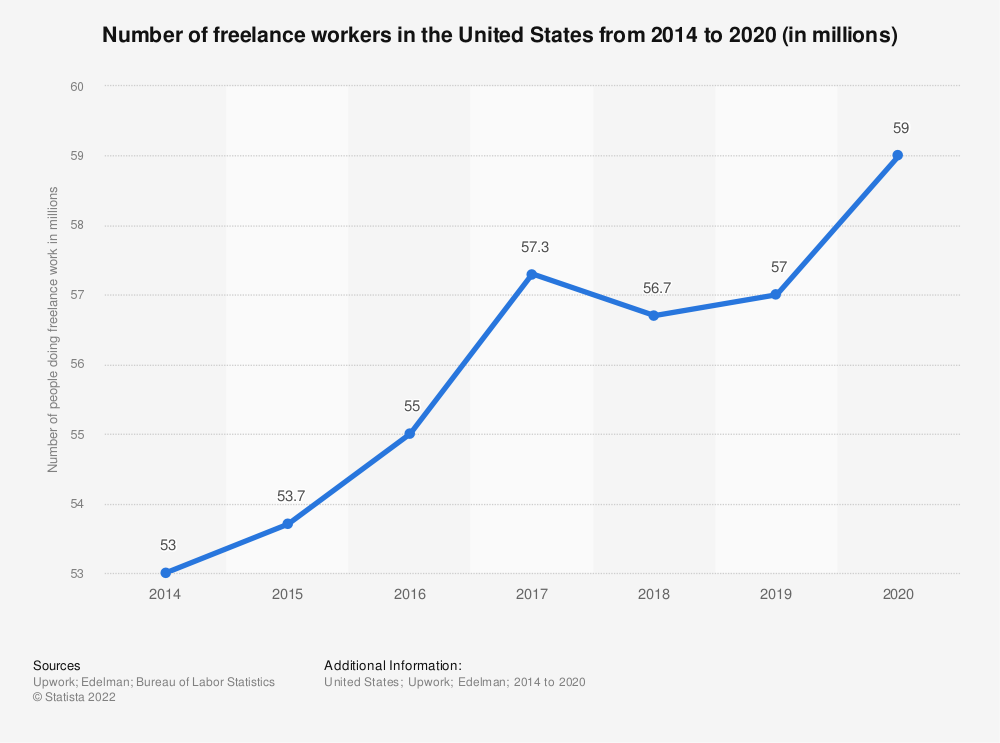

Virtual talent platforms are not a new phenomenon. As the number of registered freelancers has ballooned to over 150, million several companies such as Upwork and Guru have launched.

These companies help freelancers find clients and then take a percentage of the profits. Using a virtual talent platform has several benefits: freelancers don’t have to spend time finding clients and employers get faster recruiting times, access to a global network of talent and cheaper labor.

Service DAOs retain all these benefits and add a few more, including:

Lower Fees: Commissions for many freelance matchmaking services can range between 20% to 40% of the work performed. ServiceDAOs can “cut out the middleman”, lowering costs for customers and increasing payouts to freelancers

Interoperability: A freelancer’s work history, namely his or her reputation or reviews on a specific platform, generally can’t be imported to another freelance service. ServiceDAOs have the potential to change this, allowing freelancers to share their reputation broadly

Ownership: Historically freelancers haven’t had any ownership stake in virtual talent platforms or the ability to change the parameters of the platform (e.g. fees, review moderation). Service DAOs change that, aligning incentives and increasing engagement

How do Service DAOs work?

To understand how Service DAOs work, let’s take a look at RaidGuild – a design, development and marketing agency focused on Web3 projects.

Clients who wish to hire RaidGuild must deposit 500 DAI and will have an initial call with an account manager (known internally as a “Cleric”) to discuss the project. If the initial call is successful, the client will submit funds in escrow, the account manager will assemble the appropriate team of subject matter experts and the “raid” will begin.

The team is primarily composed of developers, designers and marketers and has completed several projects to date. The DAO has completed several projects including a metrics dashboard for Aragon, front and backend for Stake On Me, community tracking for 1Up World and strategic consulting to help Senary Blockchain Ventures design a DAO.

RaidGuild Team Members on the Aragon Metrics Dashboard Project

RaidGuild currently offers clients the following services:

Consultations: Offers strategic consulting services, helping clients validate ideas and implement operational tactics to build, ship and grow their product

UX / UI Design: Designers provide consulting in user experience, feedback and testing

Full Stack Development: Engineers deliver both front and back-end development solutions for dApps.

Marketing: Members provide consulting in marketing, social media and growth hacking

As it grows, the DAO hopes to expand into related, non-technical fields and add expert writers, sales professionals, business development specialist, community managers, economists, treasury management experts, etc…

Who are the Key Players?

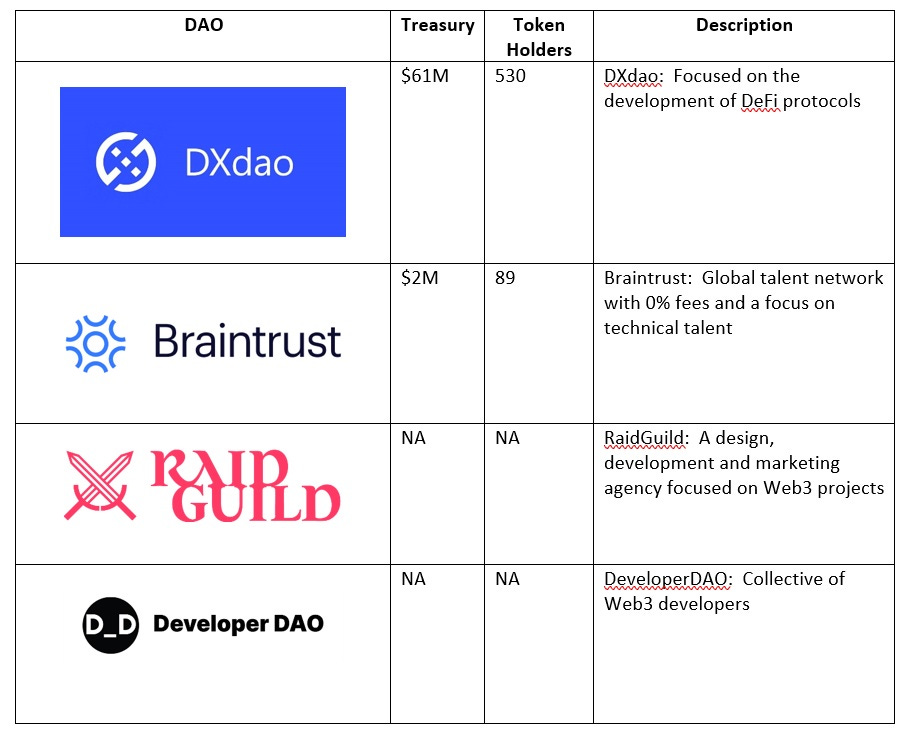

In addition to Raid Guild, other notable Service DAOs include Developer DAO, Braintrust and DxDAO.

Source: DeepDao as of 7.2.22

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

Social DAOs

What is a Social DAO?

A social DAO is an online social club, generally organized to bring like-minded people together around a common purpose.

Social clubs are obviously not a new phenomenon. For most of history, we’ve been joining guilds, salons, country clubs, exclusive houses, etc… as they offer several benefits such as networking, knowledge sharing, status, etc…

Social DAOs take this a step further, offering members several benefits including:

Global Exposure: As remote-first entities, social DAOs can access members from anywhere in the world

Investment Opportunities: Social DAOs often invest in projects that benefit the community or further its mission

Governance Rights: Social token holders have the right to vote on the direction of the organization and how the treasury is managed

Discounts: DAOs often provide members with exclusive access to merchandise, events, NFTs, etc…

Financial Reward: Membership tokens are extremely liquid and easily traded on the open market. In addition, social DAOs can offer members the ability to “stake” their tokens to generate passive income

How do Social DAOs Work?

To understand how Social DAOs work, let’s take a look at Friends with Benefits – an online social club for “creatives” in the Web3 space (e.g. creators, developers and artists) . It has over 3,000 members and was founded by Trevor McFedries in 2020.

The DAO’s mission is to promote a “web3 world where prosperity is abundant…technology acts as a communal connective tissue… and data and payments are fluid and controlled by the creators”.

While there are some real-world events (such as exclusive parties, after-parties and meetups), most of the DAO’s communication is conducted online via a Discord server composed of over 2,000 members. The Discord includes channels covering a variety of interests including art, games, music, films, food and technology.

What makes FWB so difficult from traditional social or country clubs is the fact that it also acts as an investment fund. Members have $18M in funds at their disposal to invest in activities that they believe will further the community and creative side of Web3. To date, they have invested in a:

Virtual music studio

NFT gallery

App that allows “token-gating” for real world events

Web3-focused blog

Real-time community dashboard

Series of parties around the world

Membership in the Friends with Benefits DAO is highly exclusive – fewer than 20% of applicants are accepted. To become a member, one must submit a written application, receive approval from the community and purchase 75 tokens (valued at ~$1K today). Fortunately, the DAO offers scholarships for applicants from underrepresented communities.

Key Players

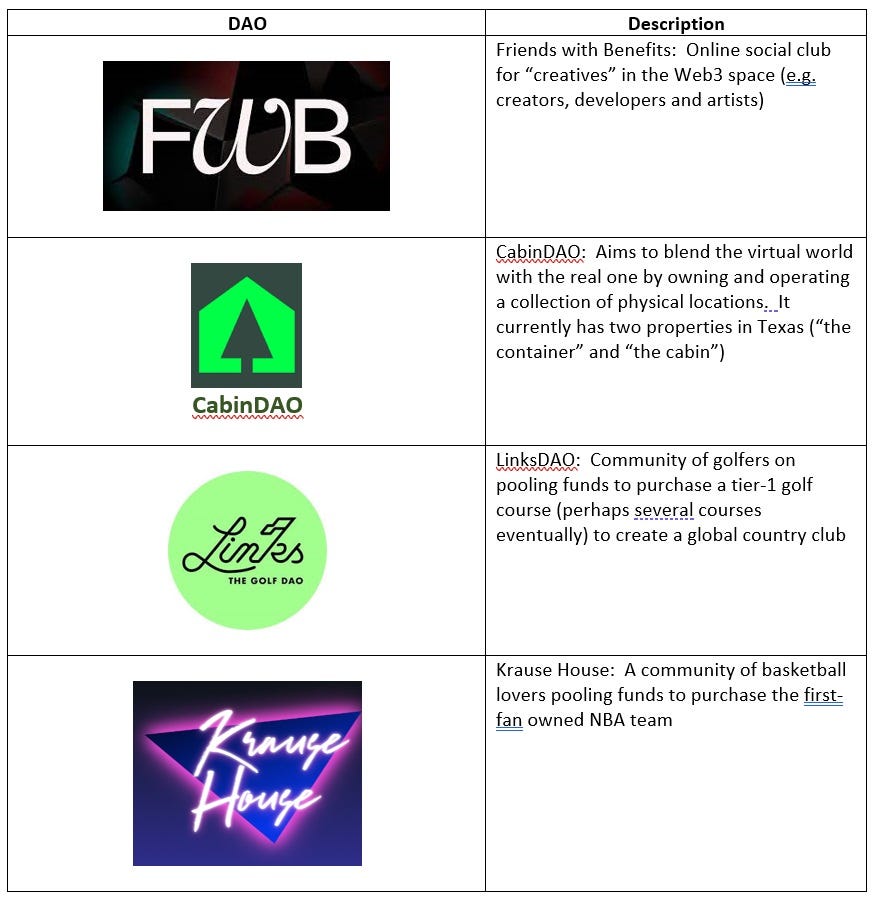

In addition to Friends with Benefits, other notable Social DAOs include CabinDAO, LinksDAO and Krause House

Note: The above list is not exhaustive. Although generally ranked by size, some smaller projects may be included for illustrative purposes. In addition, while DAOs often span multiple categories, they were only included once in the vertical that is believed to represent the best fit

DAO Tooling

DAO tools are products, platforms and software applications that help communities coordinate operations.

Traditional corporations have long relied on a variety of tools to improve the efficiency of their operations. Popular products in Web 2.0 include SalesForce for sales, HubSpot for marketing, Trello or Asana for product management, GitHub for development, Quickbooks for finance, Gusto for payroll and Slack and Zoom for communication.

DAOs are no different, as they too will require solutions to help them balance efficiency and decentralization as they grow. In fact, they may need even more assistance as they are dealing with challenges that traditional organizations rarely face, including:

How do you build culture and maintain productivity and enthusiasm in a remote-only workplace?

How do you distribute ownership of the enterprise without relying on financial markets and investment banks?

How do you coordinate democratic decision making between hundreds to thousands of stakeholders spread across the globe?

How do you compensate an inherently unpredictable workforce that can come and go as they please?

How do you manage a treasury that’s potentially worth billions without relying on a bank?

Given these challenges, there is an increasing demand for DAO tooling.

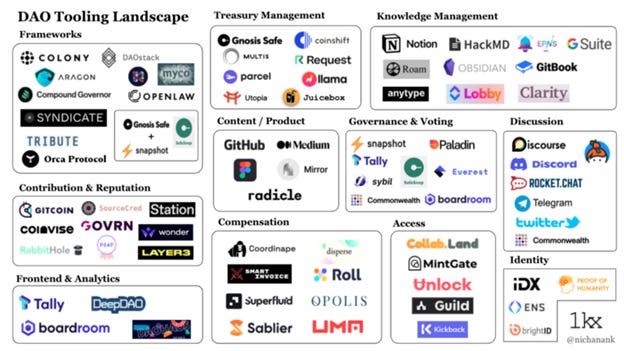

The DAO Tooling Landscape

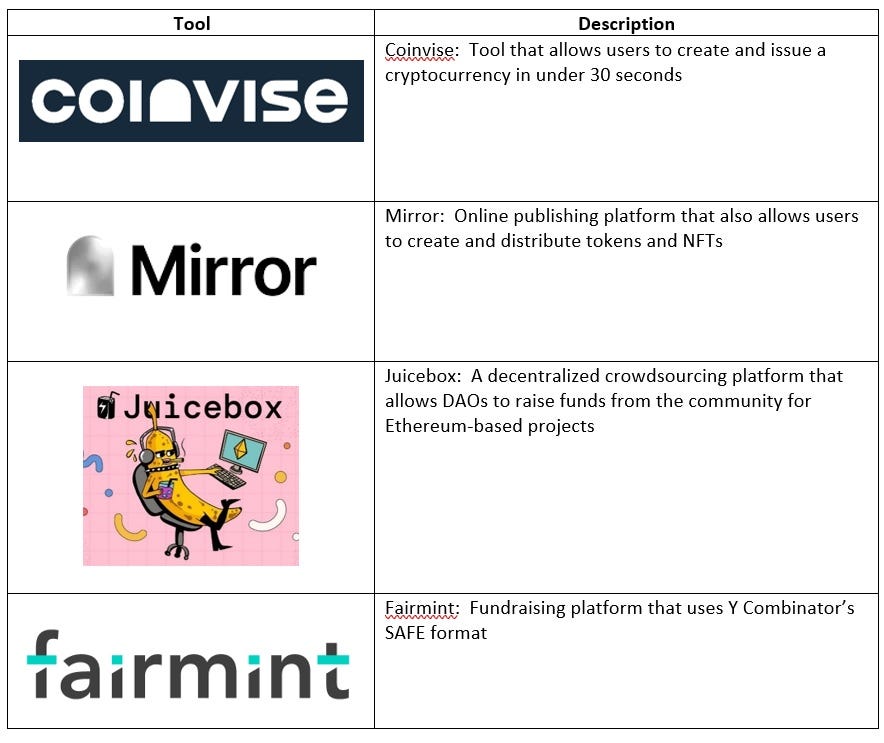

Despite being a relatively nascent space, the DAO tooling landscape has blossomed – as of early 2022, there are dozens of tooling solutions on the market. While these solutions vary in their utility depending on the size, scope and mission of the organization, most DAOs – at a minimum – would benefit from tooling in five key areas:

Communication: Tools, such as Discord, that provide a forum for discussing strategy and governance, facilitate remote work and help keep the community active and engaged

Fundraising: Products, such as Coinvise, that help DAOs launch tokens, coordinate airdrops and customize vesting schedules

Governance: Solutions, such as Snaphot, that facilitate voting and keep accurate records of the results

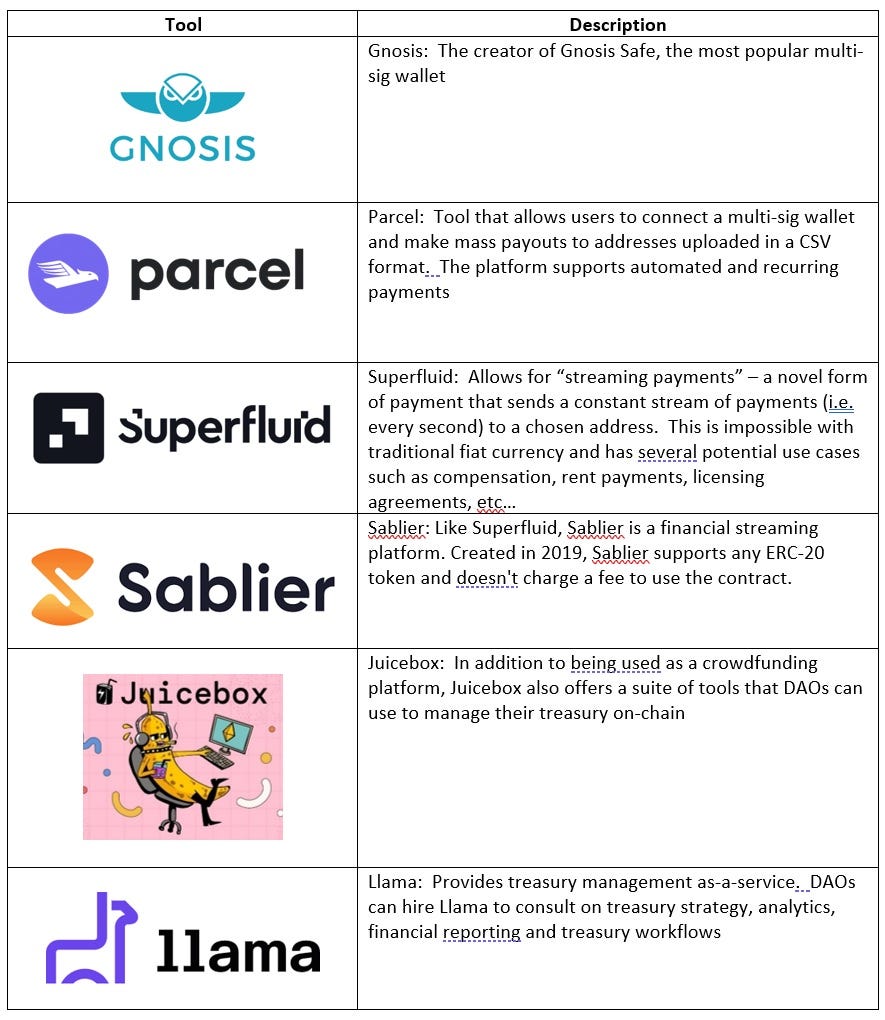

Treasury Management: Tools, such as a Gnosis Multi-Sig, that hold the DAOs funds in a safe manner

Compensation: Products, such as Coordinape, that help determine fair and equitable contribution for DAO members

In addition, there are several multi-tool frameworks, such as Aragon, that aim to provide most of these solutions in one product.

Let’s dive a bit deeper into some of these solutions…

Communication Tools

What are Communication Tools?

Strong communication is critical to the success of any organization. It is needed to spread the mission, brand and values, ensure employee engagement, solve customer problems, define strategy and coordinate work between multiple departments.

Unfortunately, it’s rarer than one would expect, even in the corporate world. Often referred to as “herding cats”, successful organizations must harmonize team members with different skills, personalities, strategies and motivations. This exercise becomes even more difficult when dealing with multi-generational and geographically diverse workforces.

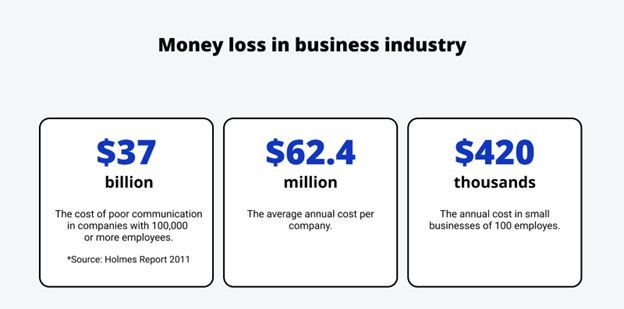

According to David Grossman, poor communication cost businesses nearly $40B a year, with an average cost of $62.4 million.

Poor Communication Results in Billions in Losses

This does not bode well for DAOs who are already at a disadvantage in this area as they have no formal management structure, no physical location and a transient workforce.

In order to get ahead of these challenges, DAOs need to adopt accessible and scaleable communication platforms. The best of these will offer:

Communication Tools: Tools that allow members to share files and communicate remotely via text messaging, voice chat and video chat

Shared Workspaces: Cloud-based storage solutions that workers can use to save files online and access them from anywhere

Knowledge Repositories: Shared storage spaces to file key organizational documents including the onboarding procedures, tribal knowledge, key analytics, FAQs and the DAOs mission, vision and values

Project Management Software: Tools used for project planning, scheduling, resource allocation, metric tracking and product delivery

While not every tool has all these benefits, one that is becoming very popular in the DAO world is Discord – a communication platform that allows members of an organization to communicate over chat, voice and video.

How do Communication Tools Work?

Founded in 2015, Discord is quickly becoming the tool of choice for many DAOs and web3 organizations to facilitate internal discussions, interact with their communities and coordinate operations.

The platform is organized into servers – invite-only spaces for users to chat, hang out, do business and have fun. An organization can create a server for virtually any type of community – from a company to a non-profit to a book club.

The BanklessDAO Discord

Each server is broken up into several channels, each focusing on a functional area of the organization. For example, the BanklessDAO Discord has over 100 channels, including:

Announcements: Pertinent information related to the DAO

General: Includes general information about the DAO, FAQ and a book club

Governance: Forum to discuss ideas and proposals

Developers Guild: Space for developers to work together and solve problems

Marketing Guild: Channel for marketers to plan, coordinate and execute strategies

Treasury Guild: Forum to discuss key issues related to treasury management

Water Cooler: Open forum to discuss anything, hang out with other DAO members and have fun

There are also dedicated voice channels and a function to allow private messaging.

In theory, Discords are “invite only”, but in practice many DAOs make their communities easily accessible by posting an open invite link on their twitter. For example, you can join Bankless DAOs Discord simply by clicking the discord.gg/bankless link provided on their Twitter.

The platform is particularly useful for DAOs when paired with Collab.Land, a tool that provides “token-gating”, allowing DAOs to restrict access to token and / or NFT holders.

Discord has 150 million MAUs and generated $130 million of revenue in 2020.

What are Popular Communication Tools?

In addition to Discord and Collab.Land, some of the most popular communication tools include Telegram, GitBook, Notion, GSuite and Asana.

Fundraising Tools

What are Fundraising Tools?

Unlike traditional corporations, who generally raise capital through private placements or IPOs, DAOs don’t use investment banks or the financial markets to raise funds and distribute ownership.

Instead, they must create and issue their own cryptocurrencies (or NFTs) by creating a smart contract on a blockchain such as Ethereum.

In addition to physically creating a token, DAO founders must also determine its “tokenomics” – a portmanteau of “token” and “economics” which refers to the incentives and economic characteristics of a cryptocurrency (i.e. the things that make it valuable to investors and community members).

When launching a token, founders must consider the following:

Supply: How many tokens will initially be issued? How many will ever exist? What’s the schedule for releasing them?

Monetary Policy: Is the token inflationary or deflationary? Is there a mechanism to burn (destroy) tokens?

Allocation: How much of the token will be distributed to founders and investors, and how much will be available to the community? Will there be a vesting or lockup schedule?

Distribution: How will the token be distributed – ICO, IDO, airdrop? How will the founders prevent a “gas war” and ensure a fair and equitable distribution?

Utility: How can users generate passive income from the tokens? Can they stake, mine or yield-farm them?

Like any disruptive technology, the field of tokenomics is constantly evolving. Communities are demanding more sophisticated monetary policy, fairer allocation, more efficient distribution and more utility.

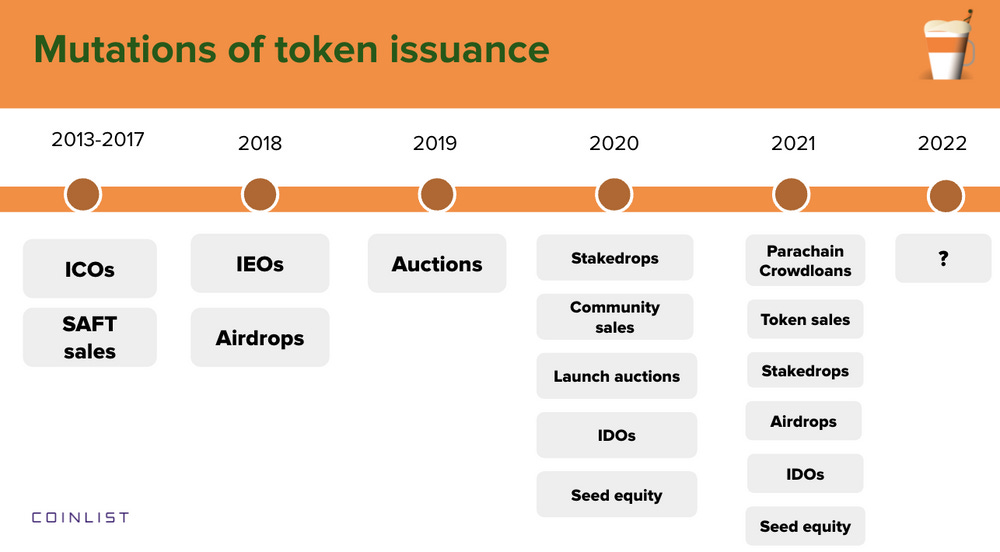

For instance, from 2013 to 2017, the primary mechanism for token distribution was the Initial Coin Offering (ICO) – a method where startups would sell tokens directly to the public, often from their website. As the ICO began to run into legal and regulatory troubles, a new model, known as the Initial Exchange Offering (IEO), became popular. IEOs involve launching the token on a centralized exchange, such as Coinbase or Binance. This soon became prohibitively expensive for many (there were rumors of exchanges charging a minimum of $5 million to list), and we saw this morph into the IDO (similar idea, but for decentralized exchanges). Fast forward to 2021, and we see a variety of distribution methods such as airdrops, parachain crowdloans and seed investments. Some projects have even avoided traditional tokens altogether and opted to launch NFTs with governance rights instead.

The Rapid Evolution of Token Distribution Methods Since 2017

The full scope of tokenomics is well out of the purview of this article, but the important takeaway is that it’s a rapidly evolving field, and successful founders must do all they can to stay ahead of the market and maximize value for their communities.

While this may seem daunting, there are fortunately several tools, such as Coinvise, available to help.

How do Fundraising Tools Work?

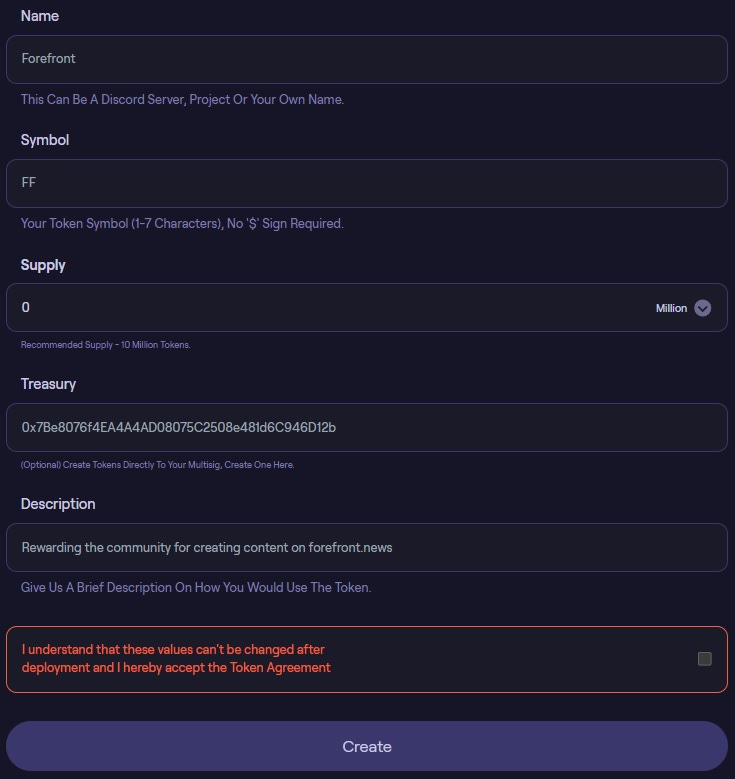

To understand how fundraising tools work, let’s take a look at Coinvise – a platform that makes it extremely easy for users to launch their own cryptocurrency token.

To mint a token, users need to navigate to coinvise.co, connect their wallet and enter the proposed name, symbol, supply and description of the token. Once that information is provided, users simply click “Create”, approve the transaction, and receive the funds in their wallet!

The entire process takes about 30 seconds, requires zero technical knowledge and is effectively free (other than gas costs, the platform does not charge a fee or take a percentage).

Coinvise Allows Anyone to Create a Cryptocurrency in Under 30 Seconds

Coinvise currently supports tokens on the Ethereum and Polygon blockchains, and also comes with a variety of additional features to help manage the token’s ecosystem including:

Token Metrics: Coinvise provides an informational dashboard that lets DAOs view key token metrics such as the price, market cap, fully diluted market cap and trading volume and also see a list of the top stakeholders by percentage held

Airdrops: DAOs can send tokens directly to thousands of users at once via a unique link, QR code, email list or list of wallet addresses. This has a variety of benefits and is often used to either reward supporters (such as ENS’s airdrop of over $500M of tokens to NFT holders) or serve as a fundraising tool (e.g. LooksRare airdropped 120 million tokens to anyone with a history of using OpenSea, instantly creating a market value of over $300 million).

Vesting Schedules: Coinvise allows the creation of vesting schedules which “lock” tokens up for a specified period of time, making them unable to trade. This is a helpful practice that is common in the corporate world as it allows organizations to retain employees, prevent early investors from sharing and show that founders are in it for the long haul.

Rewards: DAOs can create rewards (also known as “quests” or “bounties”) to compensate users for performing specific actions, such as creating a website, launching a marketing campaign or fixing a bug. Reward programs are helpful in that they incentive community members, benefit early adoptors and attract new members.

Coinvise is quickly becoming a popular tool in the Web3 landscape, and has attracted over 15,000 members and 500+ creators.

What are Popular Fundraising Tools?

In addition to Coinvise, some of the most popular fundraising tools include Mirror, Juicebox and Fairmint.

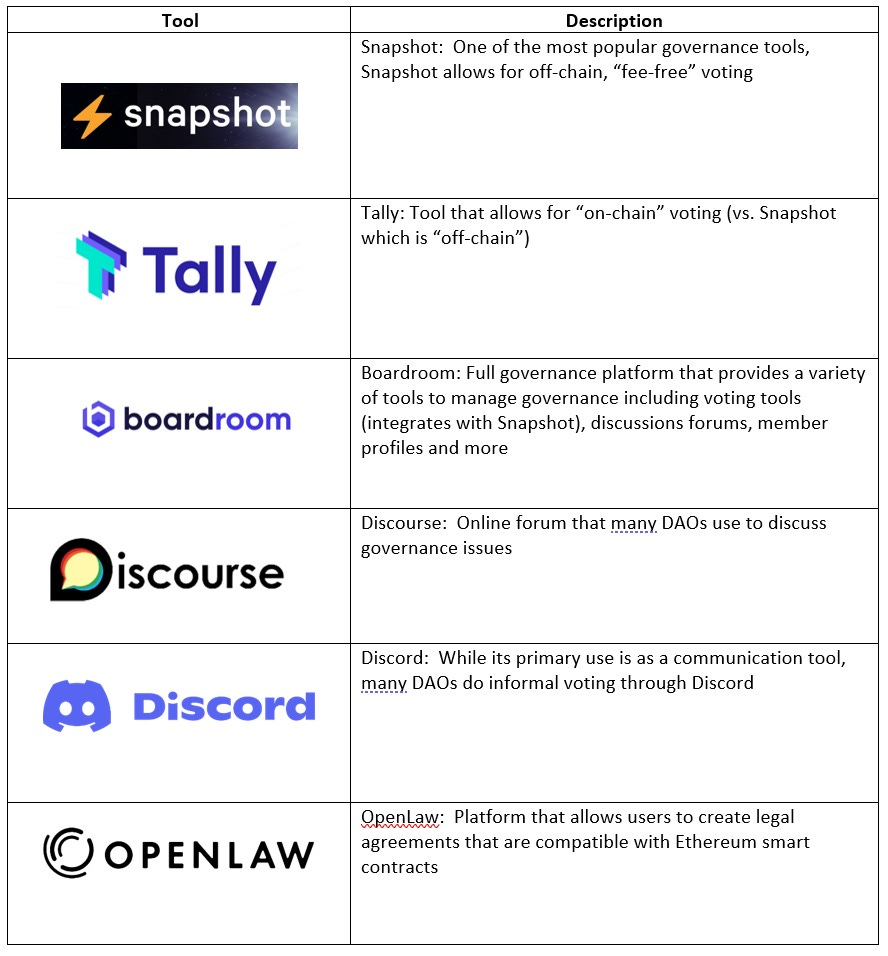

Governance Tools

What is DAO Governance?

Corporate governance refers to the system of rules, processes and practices by which companies are controlled – in short, it’s how decisions get made.

Traditional corporations rely on hierarchical governance structures. Key decisions are made by the Board, CEO and Executive Team, passed down to middle managers who then relay orders to the rank-and-file workers.

DAOs, on the other hand, adopt a non-hierarchical, democratic governance structures, meaning that every member has a say in decision making. In practice, this is often decided by token ownership (i.e. “one token = one vote”).

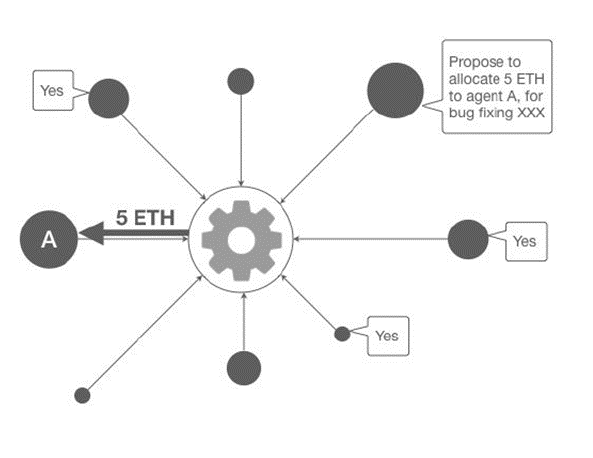

While there are thousands of options for governance protocols, one of the simplest is a propose-discuss-vote-execute architecture:

Propose: Anyone who owns tokens can make a proposal such as “we should lower our fee from X to Y”

Discuss: Proposals are often discussed thoroughly amongst the team and amended based on feedback. To avoid unnecessary noise, many DAOs require proposals to pass several internal checkpoints before being finalized

Vote: Once a proposal is ratified, it is sent to the community to vote on. Communities can decide whether votes need a majority, supermajority, etc… to pass

Execute: If the vote passes, the decision is encoded in the smart contract to execute

A Simple Approach to DAO Governance

While the above graphic represents a good mental model for DAO voting, in practice, the process is often much more complicated as there are as many structures for governance as there are DAO types. For example, DAOs can choose several different voting mechanisms such as:

Weighting: Should voting be based strictly on the number of tokens held (risking plutocracy and bribery) or should additional factors – such as a member’s time in the DAO, reputation or past performance – be taken into account?

Delegation: Can users delegate their votes to other members?

Type: Should voting be based on a simple “one token – one vote” model, or should the DAO employ a more exotic mechanism as Quadratic Voting (where members can allocate all of their votes to one or several choices, but each additional vote will count less)

Dispute Resolution: In the event of a dispute, should the organization allow members to quit at anytime and leave with their proportional share of the assets (a process known as “rage-quitting”)?

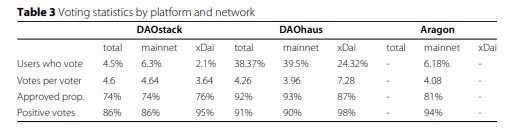

In addition to the voting method, DAOs must decide how they will mechanically record and execute the results. There are currently two main ways of doing this, known as “on-chain” voting and “off-chain” voting:

On-Chain Voting: Votes are recorded directly on the blockchain

Off-Chain Voting: Votes are submitted to a third-party, who calculates the results and then executes the transaction on the blockchain

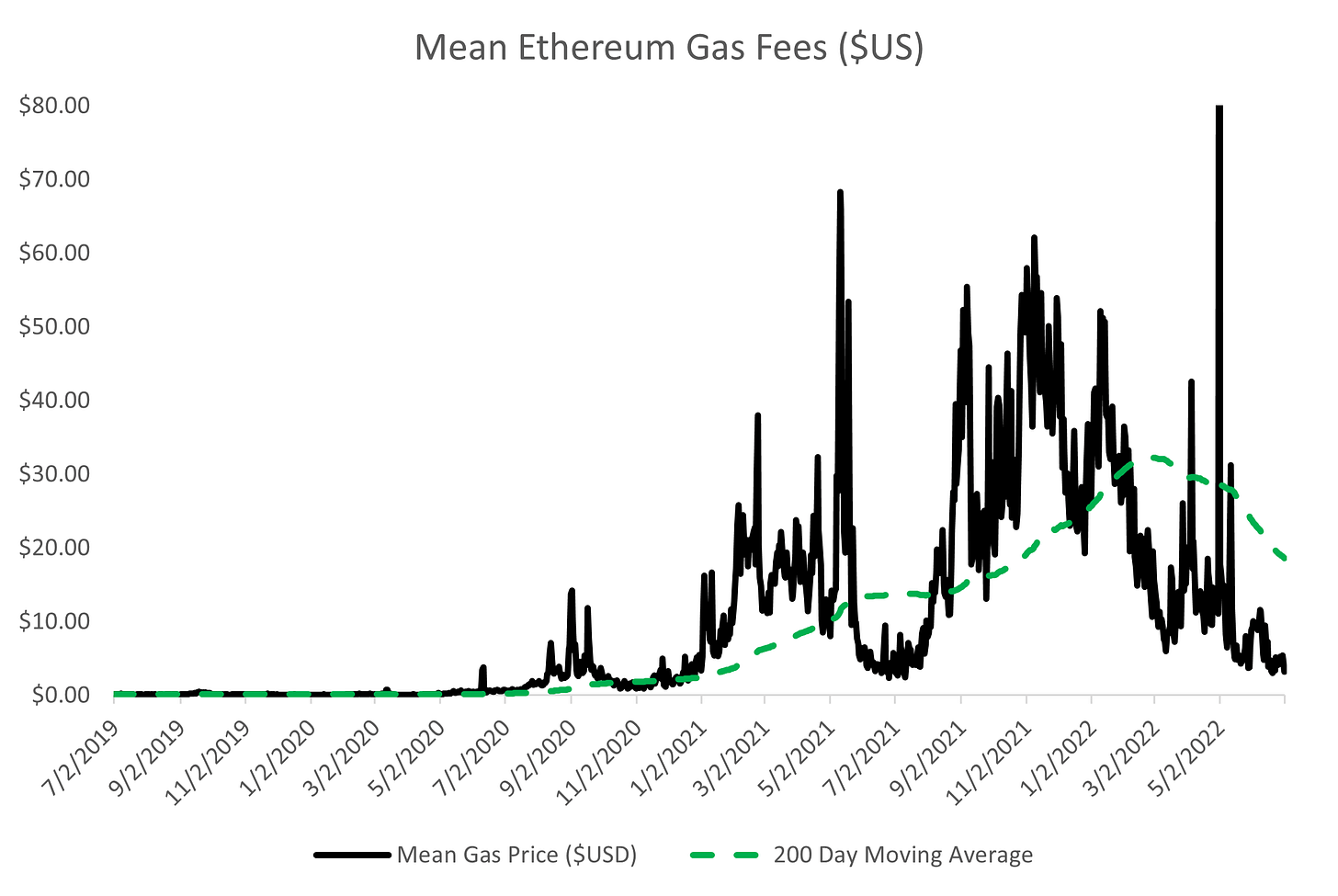

Both methods have pros and cons. On-chain voting is much safer and more secure, but often comes with a high cost because every transaction on a blockchain requires a fee (and the average fee across all transactions on the Ethereum network is ~$20.00). This risks lowering participation, especially among smaller token holders.

While off-chain voting solves this problem, it is much less secure as it relies on a third-party, which cuts against the Web3 ethos and ultimate goal of decentralization.

As you can see, DAO voting is a complex challenge, forcing members to weight the pros and cons of several options. Fortunately, there are several tools that exist to address these challenges and help organize and motivate participants.

How does DAO Governance Work?

To understand DAO governance better, let’s take a look at one of the most popular tools – Snapshot, a tool for off-chain, “fee-free” voting.

To use this platform, a DAO can link their ENS domain to Snapshot to create a “space” – a place where they can host all of their outstanding proposals. Members can then navigate to this space to find the proposal they want to vote on, connect their wallet and cast their vote.

Instead of recording the results directly on the blockchain, Snapshot aggregates these votes and stores them in a decentralized database hosted by IFPS.

Not only does this eliminate fees, but the use of decentralized storage also addresses some of the biggest concerns of off-chain voting. While not perfect, it’s relatively transparent (as anyone can easily access the database and verify the results) and secure (as decentralized databases can’t be manipulated).

Snapshot Spaces

Snapshot offers significant flexibility to users – it allows them to delegate votes, choose different weighting metrics (e.g. token-weighted vs. reputation-weighted) and supports several different types of voting methods including:

Single Choice: Each voter can select one option

Approval Voting: Each member can select (or “approve”) as many choices as they like, and the choice with the most approvals wins

Quadratic Voting: Members can allocate all of their votes to one or several choices, but each vote will “cost” more tokens (e.g. 1 vote will cost 1 token, 2 will cost 4, 3 will cost 9, etc…)

Ranked Choice Voting: Members can rank their choices. If one choice gets a majority of all of the #1 rankings, it wins. If not the lowest choice is eliminated and the process is repeated again.

The biggest problem with Snapshot – and “off-chain” voting in general – is that you still need a trusted third-party to actually carry out the decision and record it on the blockchain. As such, Snapshot is working on a solution known as “optimistic voting” which will use Layer 2 solutions known as optimistic rollups to count the votes off-chain and then automatically execute them on on-chain without any human intervention.

What are Popular DAO Governance Tools?

In addition to Snapshot, some of the most popular governance tools include Tally, Boardroom, Discourse and OpenLaw. Discord is also frequently used in governance.

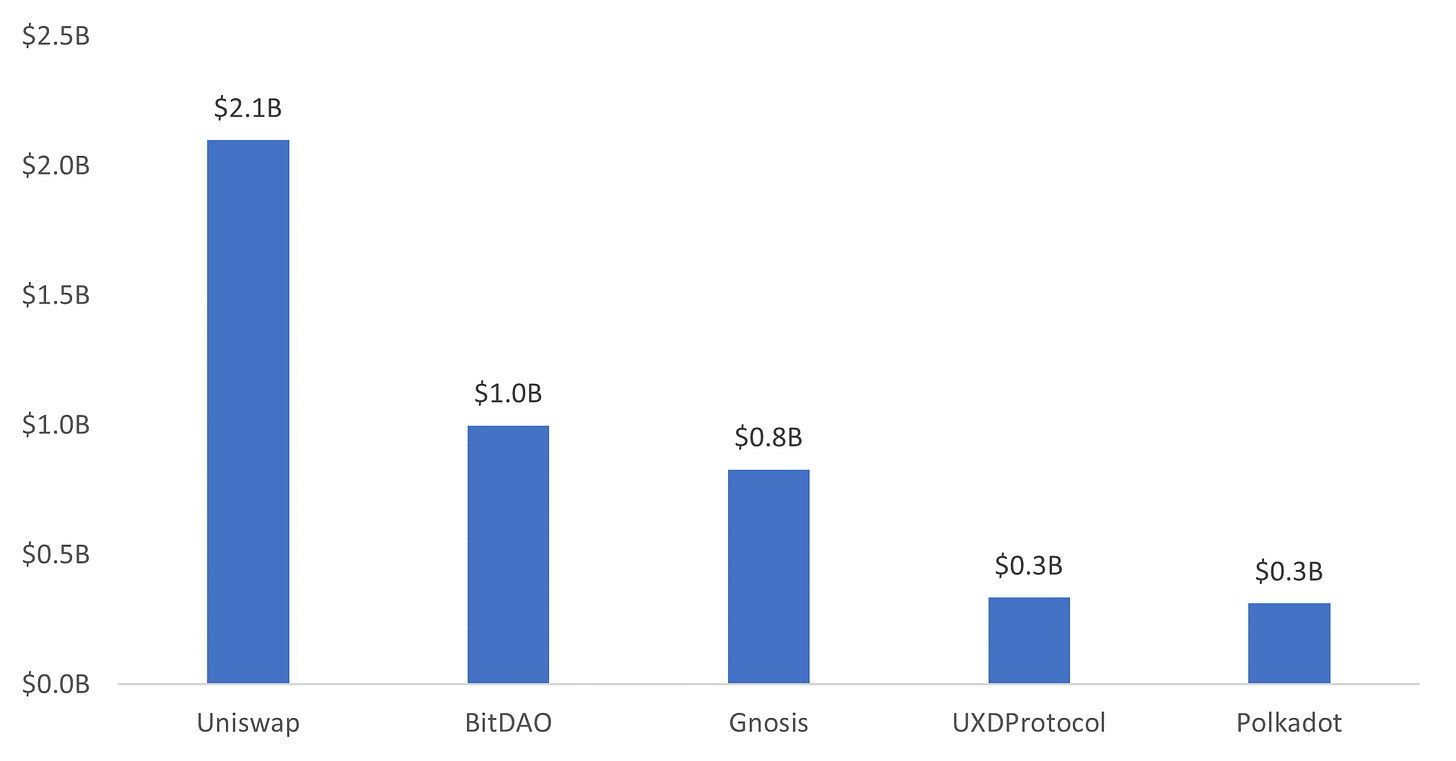

Treasury Management Tools

What are Treasury Management Tools?

Unlike traditional corporations – which hold their assets in banks – DAOs store and manage their own funds on a blockchain and access them through a crypto wallet that is known as a “treasury”. In essence, is the DAO’s “bank”.

Treasuries are built through initial token sales, follow-on investments, donations and profits generated by the organization. Many DAOs today have massive treasuries.

The Treasuries of the Top 5 DAOs Hold Nearly $5 Billion

Treasuries are managed democratically by the members of the community and used to fund operational costs, pay salaries, make investments, etc…

As one can imagine, this is a daunting task, as DAOs face the same challenges as any Fortune 500 company: how to preserve capital, ensure that cash inflows are greater than outflows and minimize risk. In particular, a DAO must decide:

Cash Flow Management: How much do we pay in salaries? How do we fund operational costs?

Fundraising: Should we raise more capital? Do we issue tokens to raise capital or borrow?

Capital Allocation: Should we perform token buybacks? Should we make investments or acquisitions?

Risk Management: Should we diversify into stablecoins? What assets should we hold?

Financial Controls: How do we ensure that no one person can steal the funds?

Reporting: How do we report what’s happening in the treasury?

Fortunately, there are several tools available to help members store and manage their funds.

How do Treasury Management Tools Work?

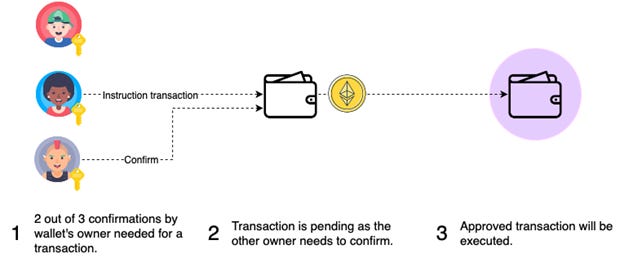

One of the most popular – albeit relatively basic – tools for treasury management is Gnosis Safe, a multi-signature crypto wallet (“multi-sig”) developed by the company Gnosis in 2016.

Crypto wallets are software programs that allow users to access their cryptocurrencies and initiate transactions. Unlike physical wallets or bank vaults which hold actual cash, crypto wallets don’t technically store cryptocurrencies. Instead, funds are stored on the blockchain and accessed via private keys (which are held in the wallet).

The main benefit to using a crypto wallet is that it gives DAOs full custody over their funds. Unlike a bank account, no external party can restrict access, block transactions or siphon funds. In addition, owners aren’t subject to “banking hours”, meaning they can access their capital 24 hours a day, 7 days a week (and from anywhere in the world).

As the name suggests, multi-sigs are a special type of wallet that requires two or more private keys to authorize a transaction. While Gnosis offers a variety of options for structuring these wallets, a common setup has 3 owners needing 2 keys to initiate a transaction.

A Gnosis Safe Requires 2 or More Users to Authorize a Transaction

Using a multi-sig wallet provides a host of benefits to a DAO:

Trust: As most multi-sigs require a majority of owners to approve a transaction, it reduces the risk that one party will steal the funds

Security: Multi-sigs reduce the risk of cyberattacks by requiring hackers to breach multiple devices

Redundancy: If one owner loses their key, the remaining two can still recover the wallet

In addition to serving as a multi-sig wallet, Gnosis Safe provides users a variety of additional features, such as an enhanced user interface, transaction tracking and the ability to access dApps directly from the wallet.

Gnosis Safe is one of the most popular treasury management solutions – as of December 2021, a total of $86 billion in funds were held in their products. Several, high profile companies including Consensys, ENS, Balancer, Aave and Sushiswap trust Gnosis Safe.

What are Popular Treasury Management Tools?

In addition to Gnosis, some of the most popular Treasury Management tools include Parcel, Superfluid, Sablier and Llama. Juicebox also offers a treasury management solution.

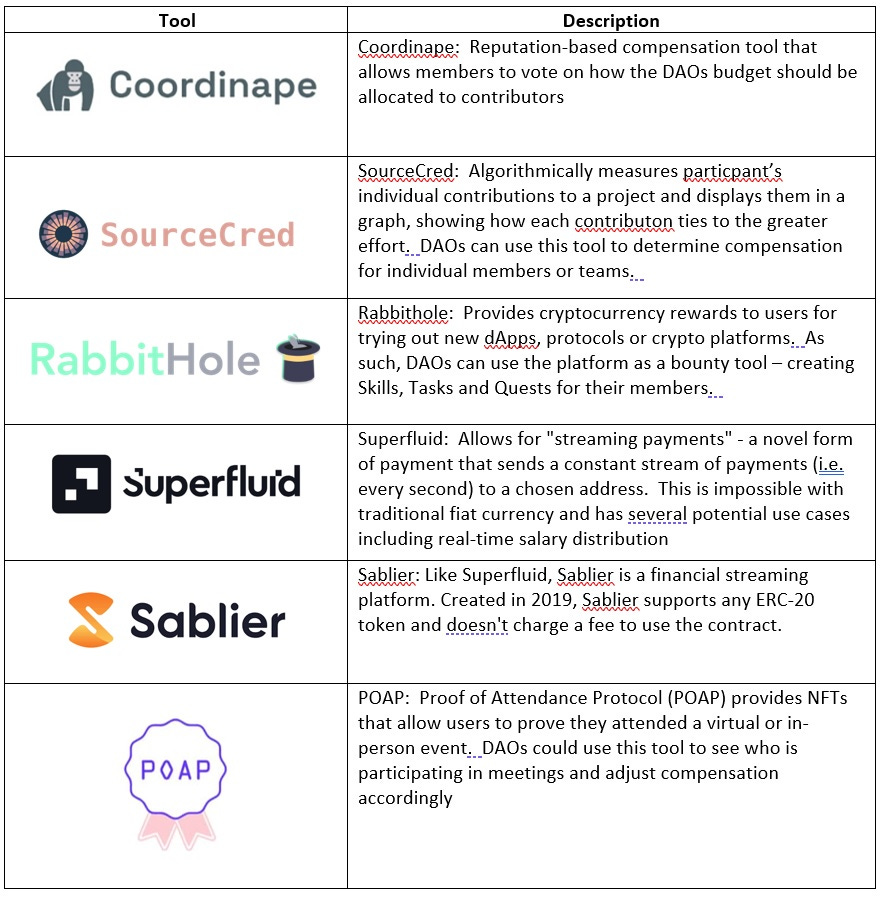

Compensation Tools

What are Compensation Tools?

Like any organization, DAOs need labor to be successful. Depending on their mission, they may require developers, designers, marketers, operators, finance professionals and / or community managers.

Working for a DAO can be extremely compelling – not only does it provide the opportunity for contributors to “own a piece of the action” and make a meaningful contribution to the development of Web3, it also offers a level of flexibility that has been historically impossible. In particular, “employment” at a DAO offers the following benefits:

No Geographic Barriers: As purely online entities, DAOs have no offices or in-person requirements. This means that anyone can choose to work for any DAO no matter where it is located. This not only benefits workers, but also provides a benefit to DAOs who can access talent from anywhere in the world.

Open: Most DAOs don’t have a hiring process, so anyone can contribute (you just have to show up and start working!). In addition, it’s possible to work for a DAO using an anonymous identity, greatly benefiting workers from marginalized groups who have historically faced discrimination (given the proven benefits of workplace diversity, this is a great benefit for DAOs as well!)

Flexible: DAOs don’t have employment contracts – contributors can choose to work as much or as little as they like and are also free to move fluidly between DAOs or work for multiple organizations at once. This not only benefits workers but also provides benefits the DAO as the workforce (and therefore compensation requirements) will naturally expand and contract based on market conditions and the amount of work that needs to be done.

In fact, one could argue that DAOs are the logical extension of the trend towards freelancing and resulting “gig” economy.

Over 1/3rd of US Workforce Performs Freelance Work

Unfortunately, this style of employment creates many challenges from a compensation perspective. After all, how do you design a compensation program for members who work erratically? Perhaps more importantly, how do you determine compensation without management? Without HR? Without contracts or negotiations?

To be fair, DAOs are still figuring this out. To date, there are a variety of popular compensation methods including:

Salaries: In contrast to what was previously discussed, some DAOs – especially well-funded protocol DAOs – still hire full-time workers and follow the standard model that’s prevalent in traditional organizations (e.g. base, bonus, equity). Compensation is generally voted on by the DAO and these workers are often subject to employment contracts.

Equity: Given that DAOs are member-owned, it’s possible to not offer any compensation and just hope that contributors are purely incentivized by their ownership stake. While great in theory, this may prove difficult in practice due to the “free-rider problem” (i.e. the tendency for people to let others do the work while still reaping the benefits)

Bounties: Many organizations are utilizing “bounties”, compensation schemes which pay for the completion of a specific deliverable. Under this method DAOs can choose a task – such as creating a new website – specify the price and allow members of the community to nominate themselves. Some DAOs don’t even have a nomination process, and simply pay the first person who completes the work.

Point-based Compensation: Some DAOs are experimenting with the use of determining compensation through specific actions. For instance, a DAO could create a formula where attending meetings is worth a certain number of points, completing a task a different number, etc… At the end of each period, the DAO would add the totals and tie this to pay.

Reputation-based Compensation: Reputation-based schemes put compensation in the hands of the community. Each team within the DAO is allocated a compensation budget and then members of the team vote on whom should achieve what. This can be done subjectively (i.e. by simple votes) or objectively (in combination with contribution-based schemes)

Hybrid: Many DAOs are moving towards a “blended” model, which combines a limited number of full-time, contractual employees with a flexible contributor base.

As you can see, DAO founders face a variety of challenges in determining and execution compensation. Fortunately, there are several tools available, such as Coordinape, to assist.

How do Compensation Tools Work?

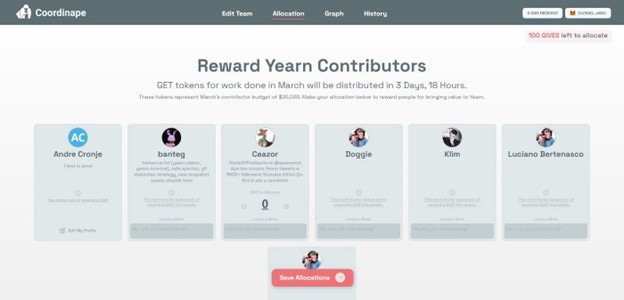

Coordinape is a reputation-based compensation tool created by Andre Cronje in 2021 to use in his own organization, Yearn Finance. The goal of the tool is to transfer the authority to determine compensation to the membership, allowing contributors to determine fair compensation for their peers.

The platform is built around “circles”, groups of members who work together on a regular basis (i.e. teams).

To use Coordinape, DAO contributors connect their wallet to the platform where they can access their circle and see all of their team members .

Each member of the circle is given a certain number of points (called “GIVE”) that they can then allocate to their co-workers as they see fit. They can choose to give all of the points to one co-worker, split them up equally or distribute based on some other method that they choose. Members don’t even to allocate all of their points (although the unallocated ones will be destroyed).

GIVE Points Allocation for Yearn Finance

After allocation, each person’s GIVE points are transformed into GET tokens, which are used to claim a proportion of the group’s allotted compensation budget.

For example:

The DAO sets the monthly budget for the marketing team at $100,000 USD (in the form of USDC)

There are 10 members of the marketing circle, and each receives 100 GIVE tokens to allocate (1,000 in total)

Alice has had a great month, so she receives 250 GIVE tokens from her peers (25% of the total)

At the end of the period, everyone’s GIVE tokens convert to GET tokens, which can be redeemed for USDC

Because Alice received 25% of the total allocation of tokens, she will exchange her GET for $25,000

Point allocations and the resulting compensation are transparent, meaning that every member of the DAO can see who is getting points, who is giving them and how much everyone is getting paid.

This process occurs once every “epoch” – a time period that can vary from DAO to DAO but is often a month.

Coordinape is establishing itself as one of the premiere reward-based compensation tools, and is used by Yearn, MetaCartel, BanklessDAO, Sushiswap, Gitcoin and DAOhaus.

What are Popular Compensation Tools?

In addition to Coordinape, some of the most popular compensation tools include SourceCred, RabbitHole, Superfluid, Sablier and POAP

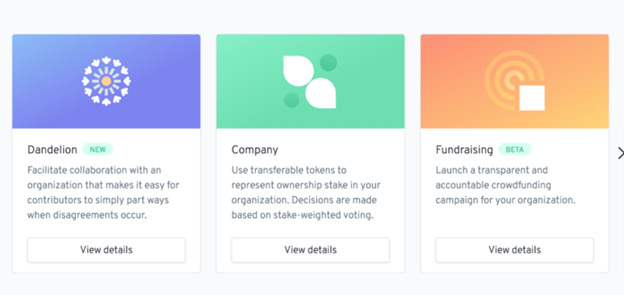

DAO Frameworks

What is a DAO Framework?

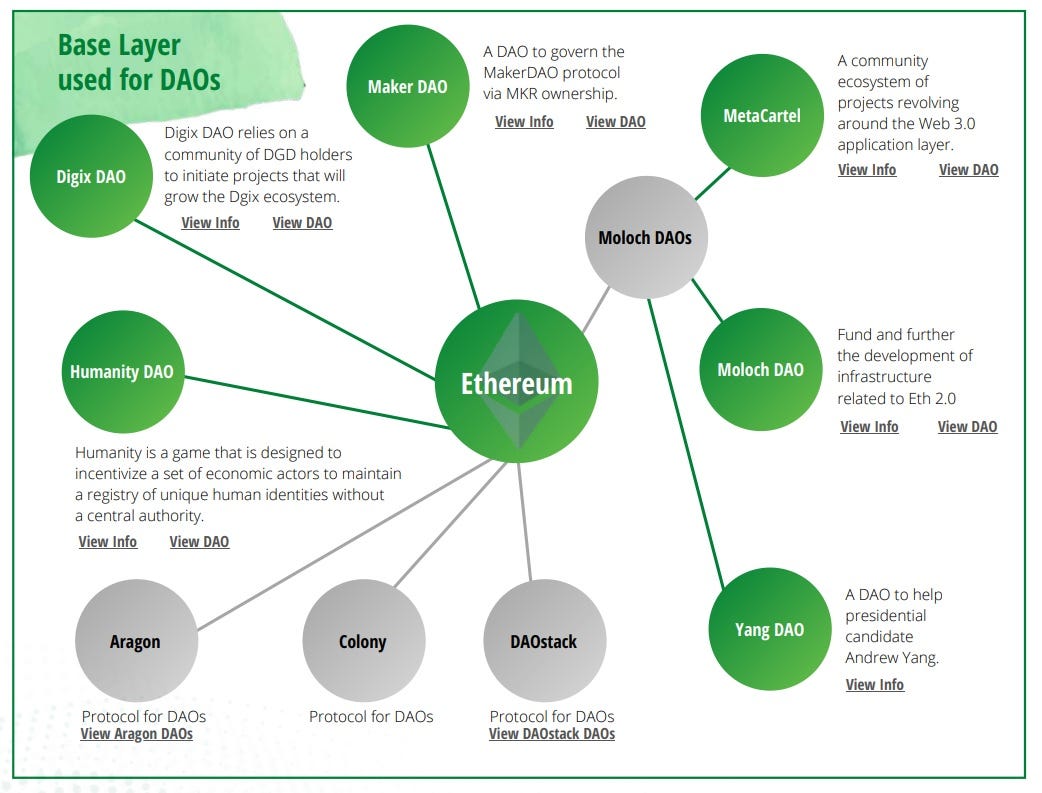

From a technical standpoint, a DAO is essentially a collection of smart contracts built on a decentralized platform such as Ethereum. One smart contract may issue tokens, another would coordinate voting, a third could set treasury protocols, etc…