The Complete Beginner's Guide to Smart Contract Platforms

A comprehensive overview of the trends, technologies, key players, problems and potential of "Layer 1s"

This article is intended to provide beginners with a somewhat thorough introduction to smart contract platforms. Although I’ve endeavored to simplify things as much as possible, the material is still quite dense at times and the article is over 10K words (a 30+ minute read). There are 8 parts which are summarized below for the tl; dr crowd:

1. What are Smart Contract Platforms?: Smart contract platforms are similar to computers in that you can use them to run programs and access digital businesses. The main difference from traditional computer platforms is that they i) can’t be shut down, ii) aren’t controlled by any one entity and iii) anyone can use them.

2. The History of Smart Contract Platforms: Ethereum was the first smart contract platform, but it has recently seen its dominance decline as competitors such as Solana, Binance, Solana, Avalanche, Tron and Polygon take share.

3. Why are Smart Contract Platforms Important?: They have the potential to create a decentralized economy, which will allows users to own their own data and assets, eliminate censorship, and maintain their privacy. In addition, these platforms will likely be much cheaper than traditional alternatives.

4. How do Smart Contract Platforms Work?: Smart contract platforms store data on a blockchain, run programs via smart contracts and secure the network using consensus mining protocols (all are explained below).

5. What are the Problems with Smart Contract Platforms?: The main problem with existing platforms is high transaction fees due to the “scalability trilemma” – the idea that one can’t create a system that is decentralized, secure AND cheap.

6. How do we Solve these Problems?: There are three proposed solutions to creating cheaper platforms: i) changing from Proof-of-Work to Proof-of-Stake, which is a much faster consensus protocol (consensus protocol improvements), ii) adding additional chains which will allow the processing of parallel transactions (sharding) and iii) reducing the load on the network by hosting data and / or performing transactions “off-chain” (Layer 2 solutions)

7. Who are the Key Players?: Important players to note include Ethereum 2.0, Binance, Cardano, Solana, Avalanche, Polkadot, Polygon, Tron, NEAR and Cosmos.

8. What’s Next? The Multi-Chain World: While it’s unclear whether there will be two, three, ten or one hundred smart contract platforms, it’s almost certain that this won’t be a “winner take all” market

Without further ado, let’s jump into the analysis!

What are Smart Contract Platforms?

From a consumer standpoint, a smart contract platform is a bit like your iPhone – it’s a computer that you can use to run programs and access applications. Much like your iPhone can host Airbnb, Uber, Facebook, Tinder and Netflix, these platforms can also host almost any type of digital business.

Unlike traditional computers, however, smart contract platforms are decentralized and distributed, meaning that instead of being owned by a company like Apple and hosted on server controlled by Apple, they are hosted on multiple computers located all over the world and aren’t controlled by any one entity.

This structure makes smart contract platforms akin to a “shared world computer”. Because ownership is shared by multiple parties (i.e. “decentralized”), no one party can control the network and tell users what they can and can’t do. Because they are hosted over multiple locations (i.e. “distributed”), no one can ever turn them off or shut them down.

In addition, smart contract platforms are:

Open to Everyone: You don’t need permission to use smart contracts and you can’t be blocked – anyone can use them at any time and from any location

Permanent: They can’t be changed or manipulated

Transparent: Unlike most corporations today, which choose what users can and cannot see, everyone can see every transaction on a smart contract platform and easily audit things when necessary

As potential world computers, smart contract platforms have the potential to become the fundamental infrastructure layer of a decentralized economy. As such, they are also known as “Layer 1” platforms.

The History of Smart Contract Platforms

Bitcoin was the predecessor to smart contract platforms. Invented in 2009 by a person or persons identifying themselves as “Satoshi Nakamoto”, it introduced the world to the concept of “decentralization” by creating a currency that didn’t need the banking system to function.

Although Bitcoin revolutionized the concept of money, it had limited use outside of its core function as a peer-to-peer payment network.

Vitalik Buterin would build upon this foundation with his creation of Ethereum in 2015. Ethereum retained many of the benefits of Bitcoin, such as decentralization, but added the ability to run programs, making it the first true smart contract platform.

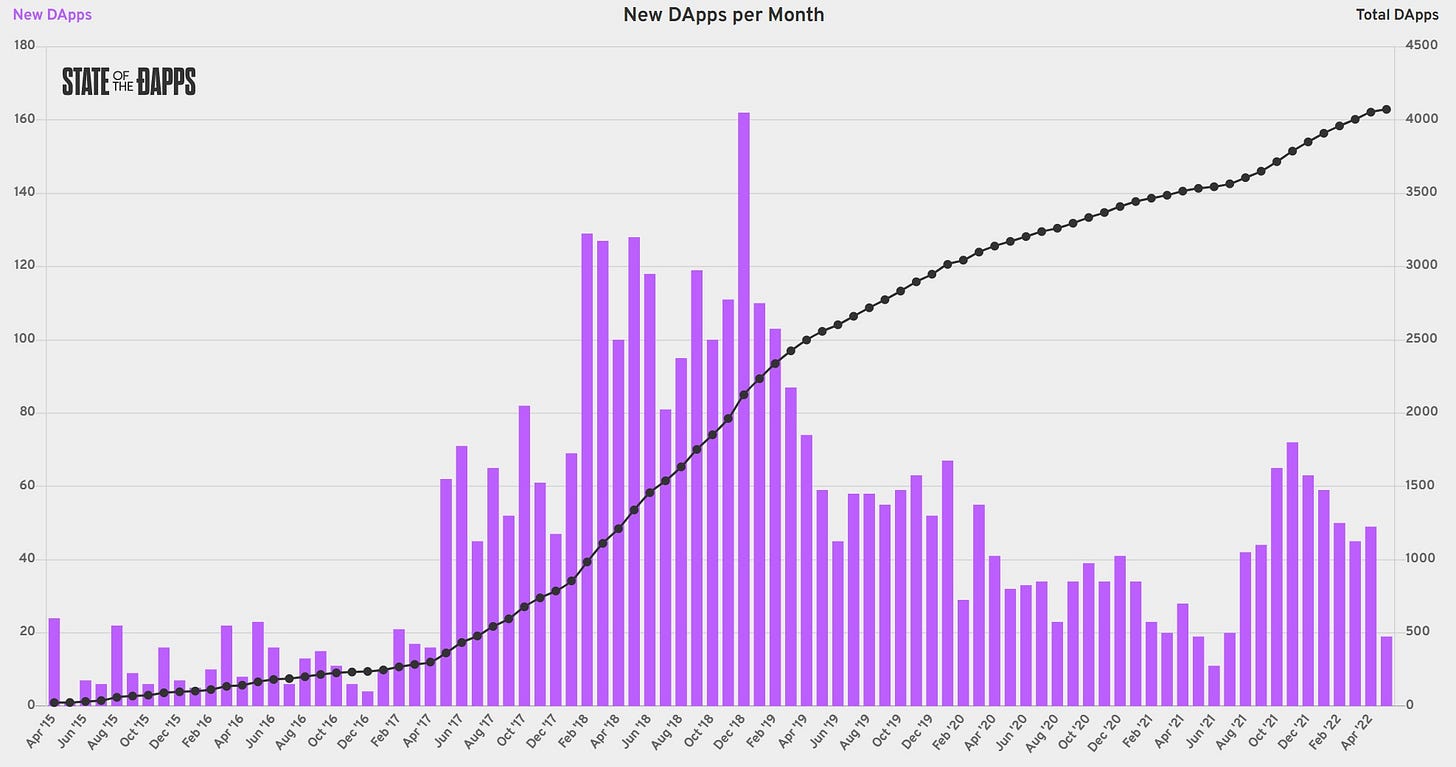

Developers quickly realized the potential of this “world computer”, and began to build decentralized applications, known as dapps, on Ethereum. 2017 and 2018, in particular, witnessed an explosion in development with the ecosystem growing almost 10-fold during that period (from 247 dapps in January of 2017 to 2,235 dapps in January of 2019).

Notable dapps launched in 2017-2018 include:

Uniswap, a cryptocurrency exchange

Aave, a lending and borrowing protocol

Nexus Mutual, a decentralized insurance broker

Cryptokitties and Cryptopunks, early NFTs

Axie Infinity, a blockchain-based game

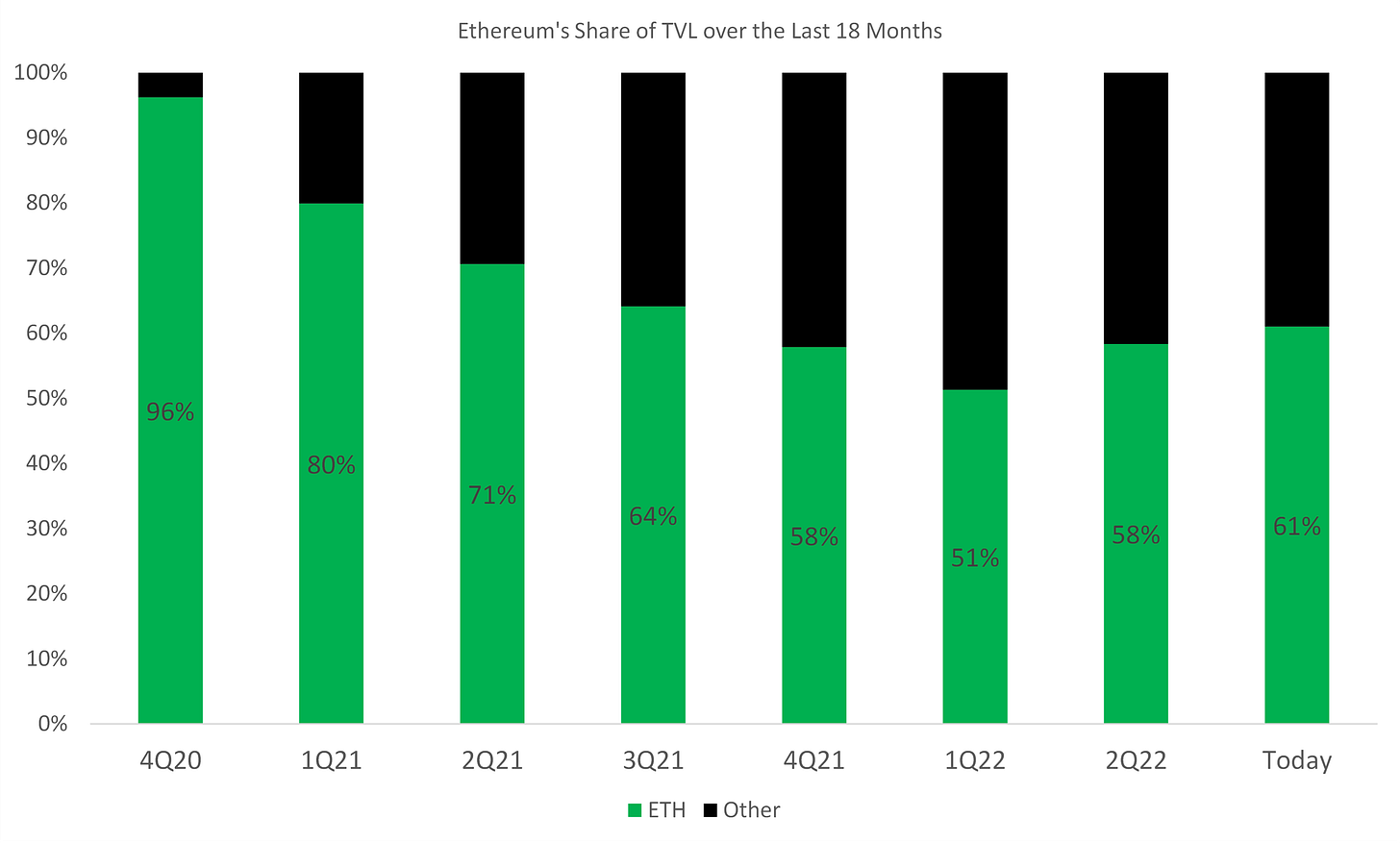

As demand for these dapps grew, we began to see an explosion in new smart contract platforms. 2021, in particular, was a year of robust development as projects such as Binance Smart Chain, Solana, Terra and Avalanche began to gain traction, reducing Ethereum’s market share from over 95% to almost 60%.

Why are Smart Contract Platforms Important?

On their own, smart contract platforms are actually terrible computer networks. They are very slow, require more resources than centralized systems and don’t have customer support.

But they do one thing well that no other network in existence can do – smart contract platforms can operate without being controlled by a centralized third-party, and this is extremely important.

The Problems with Centralized Economies

Our economy is currently dominated by centralized institutions:

Central banks, such as the The Federal Reserve have sole control over the money supply

Banks, brokers and exchanges regulate the financial system and control the flow of capital

National and local governments are the only entities with the power to create and enforce laws

Companies such as Apple, Amazon, AT&T, Comcast, Disney, Electronic Arts, Facebook, Google, Netflix, Spotify and Sony dominate entertainment, with over 60% market share in a variety of verticals such as publishing, music, gaming and video

Amazon, Microsoft, Google and Alibaba rule the internet and control over 67% of cloud infrastructure

While these institutions have historically benefited us in several ways, they also cause several problems including:

Third-Party Ownership of Assets: In our current financial system, you don’t really hold your funds – the banks do. This means that they can freeze and even seize your assets at will (while this may seem far-fetched, consider that in 2013, the Government of Cyprus seized 47.5% of all bank accounts over €100,000 to bail-out its failing banking system)

Censorship: Our economy is ripe with censorship. Social media platforms such as Facebook and Twitter can deny you access and / or censor your content and ISPs can choose to remove websites that they disagree with. In one of the worst examples of a centralized entity abusing its power, Instagram co-opted a woman’s “metaverse” username for themselves (Instagram’s parent company, Facebook, had recently changed its name to Meta), and only returned it after the press got involved

No Privacy: Banks must collect detailed personal information to adhere to KYC, AML and CFT regulations and require credit scores for borrowing. The internet giants constantly collect data on our income, behavior, interests, location and online activities. To make matters worse, this data is often sold to third parties

Expensive and Inefficient: Companies such as Netflix and Spotify take the majority of profits from artists. For example, at the turn of the century, a musician could expect to earn over $1.20 for each CD she sold (and that is with the 47% cut taken by her label). But entrance of digital distributors such as Spotify has now plunged this share to between $0.006 and $0.0084 per stream

Central Point of Failure: Centralized services are vulnerable to hacks and denial or service attacks, and also vulnerable to government intervention, regulation or outright banning. This could prove to be a major risk for the “gig economy” as an interruption in service could cost millions of lost wages and a government ban could eliminate millions of jobs

The Benefits of Decentralized Economies

Smart contract platforms such as Ethereum offer the promise of a decentralized economy – one where users can deal directly with one another without needing middlemen.

This can yield a host of benefits, including:

User Ownership of Assets: In a decentralized economy, users control their assets. As such, there’s no one to seize their funds, limit withdrawls or tell them where they can and can’t spend their money. This is a very important development and forms the basis of DeFi, which we cover in depth in the article: LINK

Censorship-Resistant: Blockchains are permissionless, which means that anyone with an internet connection can use them. You can’t be denied based access based on income, geography, gender, etc… You also can’t be censored – since there is no central authority that controls blockchains, you can post anything you want at any time you want

Privacy: In the decentralized economy, users can remain completely anonymous. No personal data is required to make payments, receive money or access any website or service

Cheap and Efficient: Innovations such as NFTs will allow artists to deal directly with their consumers, cutting out middlemen like Netflix and Spotify and greatly increasing profits. For example, an artist could create an NFT of a song, sell that to fans and write a contract that distributes the profits from song streaming directly to the owners of the NFT

No Central Point of Failure: Because blockchains are hosted across multiple computers around the world, service disruptions are very unlikely and important data is backed up multiple times. In addition, because there is no central authority or access point, governments will not be able to shut down sites

The above benefits aren’t just theoretical, as we have already seen them play out in several industries. As of August 2022, there’s nearly $60 billion flowing through the DeFi space (with a peak of almost $200 billion in 2021), NFT sales are approaching $40 billion, and there has been a flight of talent from Silicon Valley to Web 3 companies.

Smart Contract Platforms Will Lead the Next Wave of Disruption

The concept of “disruption” is overused and often misunderstood — many writers, consultants and researchers use the word to refer to any situation where a new player enters a market and starts to displace incumbents.

But the academic theory is much more nuanced — disruptive technology isn’t necessarily “better” (in fact, it’s often worse), it’s just so fundamentally different from the status quo that it can’t be replicated by incumbents or competitors. This gives it the ability to gain a foothold in an industry and, as technology improves, gradually eviscerate the market.

For a real-world example, we need to look no further than AT&T — one of the original disruptors.

In the late 1800s, Western Union dominated communications with a huge infrastructure of network cables and a massive consumer base. Although early telephones were largely inferior to the telegraph because their signals only traveled a few miles, the technology was much cheaper for short-distance communication and was therefore rapidly adopted by local businesses.

In a textbook case of disruption theory, Western Union couldn’t react because serving these local businesses would be unprofitable. This gave AT&T the niche they needed — as telephone technology gradually improved they were able to continue to take share from Western Union, eventually rendering the incumbent all but obsolete.

I believe that smart contract platforms will follow the same path of disruption. Although they currently have several problems, their ability to free us from the problems of centralized control will continue to carve out an important niche in the economy. This foothold will create room for further technological innovation, allowing entrepreneurs to improve the technology and create a system that is infinitely better than the one we have in place today and change our lives in ways we can’t even imagine.

How do Smart Contract Platforms Work?

Smart contract platforms perform three basic functions:

Data Storage: Store important data such as account balances on a blockchain

Execution: Run programs via smart contracts

Consensus: Provide consensus mining to secure the network and validate state

So if Alice and Bob wanted to use the Ethereum blockchain to trade U.S. dollars for Ethereum tokens, the process would look something like this:

The Ethereum blockchain stores Alice and Bob’s original account balances (i.e. Alice has 2ETH and Bob has $8,000)

Bob would open a trading dapp, such as Uniswap*, which would read these balances

Uniswap’s smart contracts would determine the price of Ethereum, let’s say it’s $4,000, and execute the trade

he results of the trade along with the updated balances would be sent to miners to verify

Miners would verify this transaction using a Proof-of-Work consensus protocol

Miners would then update the Ethereum blockchain with the new balances – (i.e. Alice now has 1 ETH and $4,000 and Bob now has 1 ETH and $4,000)

*This is actually a vast oversimplification of the process and also not how Uniswap actually works. That said, I believe it is helpful in getting a general idea of the flow of a smart contract platform. If you’re interested in learning more about how a decentralized exchange operates, you can check out my paper on DeFi (link).

What are Blockchains?

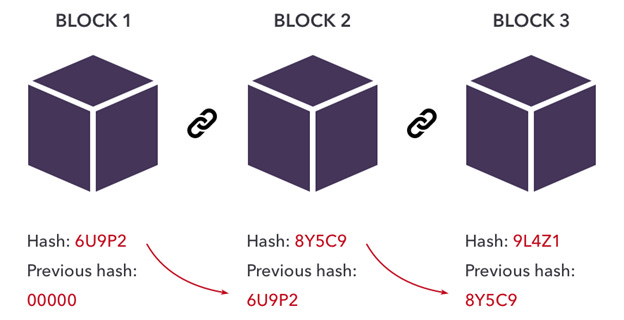

Smart contract platforms store their data on a blockchain. At its core, a blockchain is little more than an electronic database – i.e. a collection of information – that is shared across many different computers.

Unlike a traditional database, blockchains organize data into groups known as blocks. These blocks have limited storage capacity, so when they become full they are locked and linked to the previous block with a “hash”. This forms a chain – hence the name, blockchain.

These hashes are extremely important because they make blockchains immutable, that is, data (such as your Bitcoin or Ethereum balance) can’t be deleted, tampered with or changed once it is locked into the chain.

Hashes are created through a cryptographic process (known as hashing) that takes a given set of information and converts it into a unique code (which is basically a long string of characters). For example, the word “fox” could be hashed as DFTY786DCFJ894SUSH865AAHJAI978 and the sentence “the quick brown fox jumps over the lazy dog” could be hashed as SOIAUYA7865ASLUAN098A5489USYAN. There are three important things to note about hashes:

Virtually anything can be hashed (i.e. you can hash a word, a sentence or the entirety of War and Peace)

Hashes are always unique (i.e. if you changed a single letter in War and Peace you would get a completely different hash)

It’s impossible to guess the original data from looking at the hash (i.e. you wouldn’t know that DFTY786DCFJ894SUSH865AAHJAI9785 was “fox”)

Because all new blocks are required to store the hash of the previous block, it’s easy to see if the blockchain has been tampered with. If the hash contained in the new block matches the old, you know that the data is secure. If they are different, everyone will know that the block has been tampered with.

What are Smart Contracts?

Smart contracts are nothing more than computer programs that automatically execute when agreed-upon conditions are met. For example, let’s say that Farmer John wants to use a smart contract through Block Insurance (a fictitious entity) to insure his crops against a drought:

Farmer John and Block Insurance agree that if the temperature is above 90 degrees for 5 days in a row, his crops will die

Farmer John sends Block Insurance 1 Ethereum (ETH) token to insure his crops

The 1 ETH is deposited into a smart contract

Block Insurance would deposit 10 ETH into the smart contract as collateral in case of a drought

The smart contract monitors the temperature

If the temperature remains under 90 degrees, nothing happens and Block Insurance keeps Farmer John’s 1 ETH

If the temperature goes over 90 degrees for 5 days in a row, the smart contract pays Farmer John 10 ETH

Farmer John can offset his crop loss with the profits from 10 ETH

Smart contracts can be used for virtually any type of transaction including financial deals, trade agreements, real estate transactions, entertainment royalties, etc… They also have many benefits over traditional contracts including the fact that they are:

Instant: Because smart contracts execute instantly, they can save hours of various business processes

Accurate: Using smart contracts reduces human error, such as mistakes that can be made when filling out multiple forms

Cheap: Smart contracts remove the needs for lawyers, bankers and brokers, making them much cheaper

Transparent: Terms and conditions are pre-agreed upon and fully visible to both parties. As such there, is no way to dispute a smart contract after it has been executed

Secure: Information is stored on a decentralized and distributed blockchain, meaning that there is no risk of data loss

What is Consensus Mining?

Centralized networks, such as banks, have a small army of bookkeepers, accountants and auditors to process transactions.

While decentralized networks can’t rely on an in-house staff, they can leverage a distributed group of users known as “miners” for a similar purpose.

Miners are the de facto auditors of decentralized platforms. They are responsible for processing the output of transactions, confirming asset ownership, ensuring there is no fraud and updating the blockchain with the new results. Unlike auditors at a traditional bank, almost anyone can be a miner – there’s no hiring process, no location requirements and miners don’t even have to disclose their identity (in fact, most miners are completely anonymous).

As such, most decentralized platforms have thousands of miners located all over the world that can validate transactions.

While this seems like an elegant solution to the problem of centralization, it raises a few concerns. In particular: how can we trust the miners? How do we know that they won’t abuse their power and send a bunch of money to themselves or their friends?

The answer is surprisingly simple – we use economic incentives to reward good behavior and punish bad behavior.

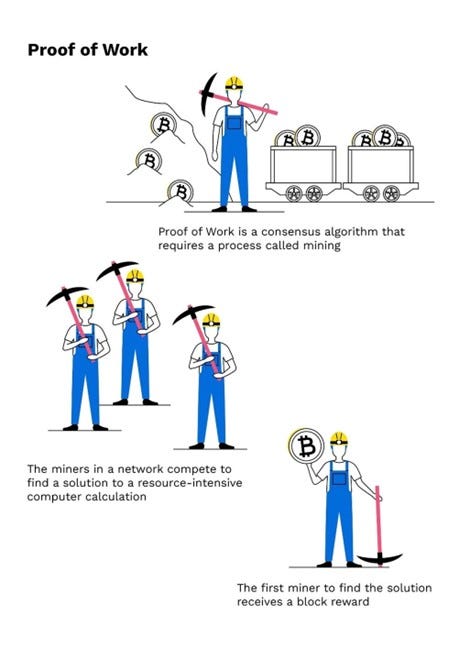

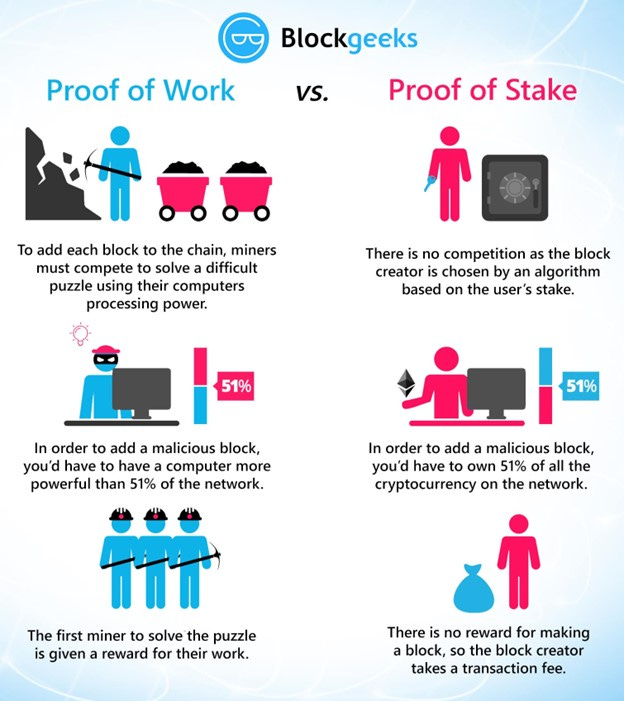

While there are several incentive schemes, the most popular– used by both Bitcoin and Ethereum – is known as “Proof of Work”.

Overview of Proof of Work Mining

Proof of Work requires miners to solve an extremely difficult math problem to earn the right to validate new blocks. This problem is so difficult that it can only be solved by random guessing. As such, miners often employ dozens to hundreds to thousands of computers to make millions of guesses, hoping that one of them gets the correct answer.

This uses a lot of electricity, and therefore effectively costs miners a lot of money to “bid” on the right to validate transactions (it’s not uncommon for a miner to spend tens to hundreds of thousands on electricity costs before successfully mining a block).

Once a miner solves the puzzle, she will then update the blockchain with the new transactions and send it to the other miners on the network for approval.

If she did everything correctly, the network will accept the new block and she will receive a reward (at the time of publication, the rewards were ~$3K for mining an Ethereum block and ~$125K for mining a Bitcoin block).

If, however, she tries to cheat the system, it would be painfully obvious to everyone – the aforementioned hash would be broken and the new block wouldn’t connect to the old one. As such, the network will reject the new block, causing the miner to not only lose out on the rewards, but also waste money on electricity costs.

So, at the end of the day, the network is secured by economic incentives and game theory – a miner who acts appropriately could receive hundreds of thousands of dollars in rewards, while one who attempts to cheat the system will almost certainly be left with nothing but a huge electricity bill.

What are the Problems with Smart Contract Platforms?

Although Ethereum represents a substantial innovation, it is not without its faults. In particular, the protocol is plagued by high gas fees.

“Gas” refers to the fee required to execute a transaction on the Ethereum network. Whether you want to transfer a token, loan your assets on Ethereum or mint an NFT, you must pay gas to incentive the miners to approve your transaction and include it on the blockchain.

Because space on the Ethereum network is limited – it can only execute around 25 transactions per second – priority is determined by an auction process. This means that gas can get very expensive when the network is busy.

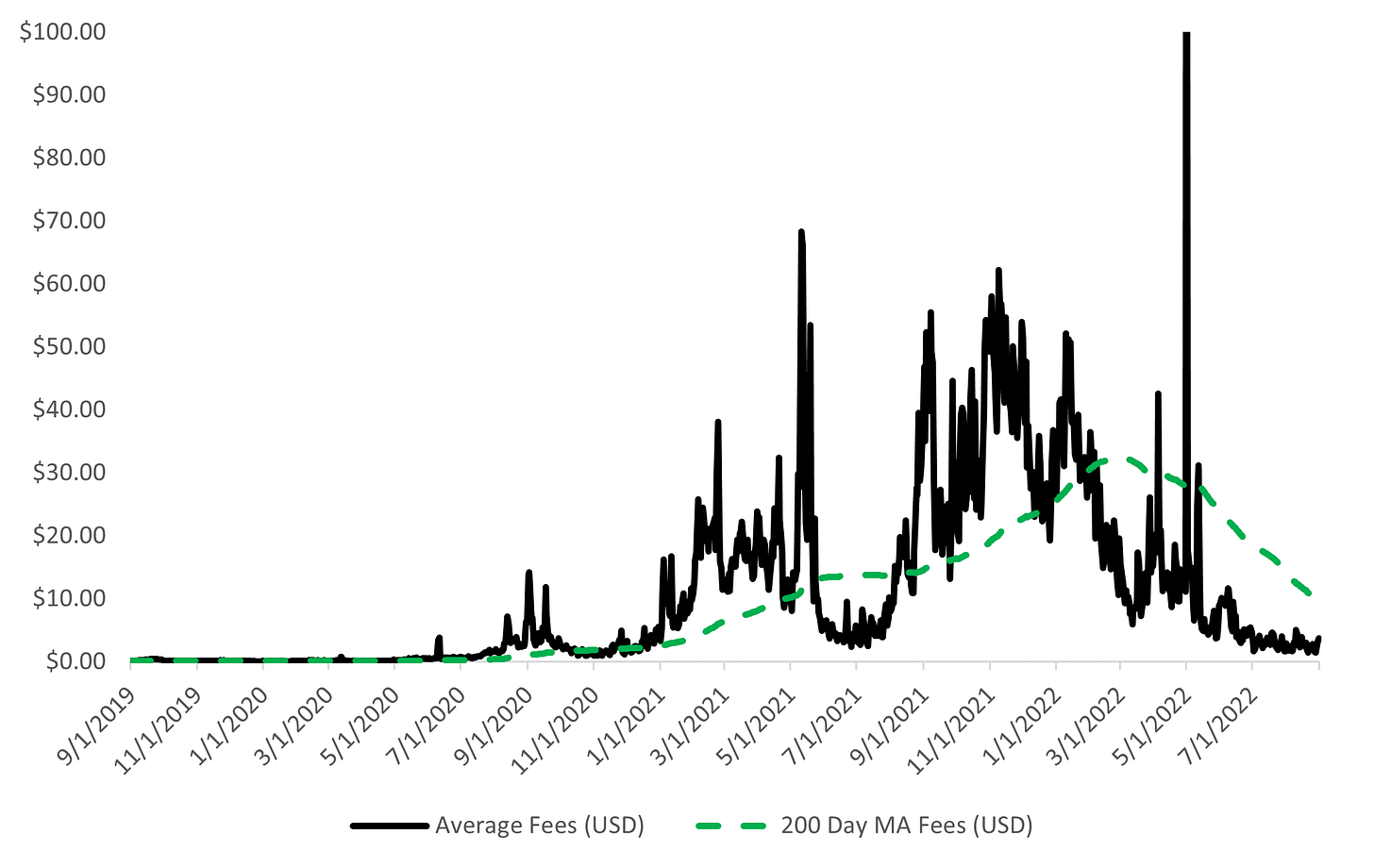

Unfortunately, lately the Ethereum network is always busy, so average gas fees have ballooned across the board. While we are in a bit of a lull at the time of writing, the 200-Day Moving Average transaction fee remains close to $10.00, a substantial increase from the $0.14 recorded three years prior.

This makes transactions impractical for the average user.

Average Gas Fees on the Ethereum Network

Keep in mind these are average fees for all transactions, including simple ones like a token ETH transfer. As some transactions – such as minting an NFT or borrowing / lending ETH – are generally much more complex, it is not uncommon to see fees of several hundred dollars.

In fact, in times of extreme congestion, commonly known as “gas wars”, fees can be in the thousands. The most notable example of this occurred during the Bored Ape Yacht Club’s April 30th launch of Otherside, where users had to pay a minimum of $6K in fees to purchase land!

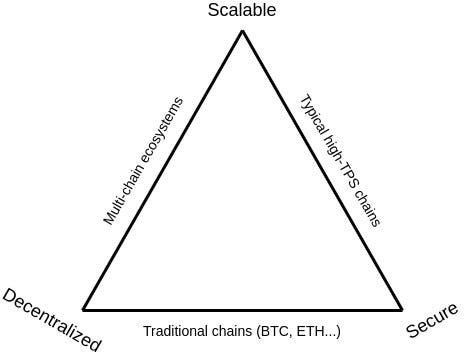

The reason Ethereum is so slow is due to a phenomenon known as the scalability trilemma.

To understand the trilemma, it’s important to note that an ideal blockchain would possess three key features:

Scalability: The ideal blockchain is very fast, can handle a high throughput and is cheap to use

Security: It would be highly secure and resistant to external attacks

Decentralization: Perhaps the core tenet of the crypto movement, the ideal blockchain would allow anyone to join and not be controlled by any central authority

Unfortunately, the prevalent theory in the development community states that you cannot have all of these at once and that:

You can develop a secure and decentralized blockchain, but it will be slow

You can develop a fast and decentralized blockchain, but it will not be secure

You can develop a fast and secure blockchain, but it will be centralized

While there’s some debate over whether the trilemma is a hard law (which we will get into later), to date we have generally seen these tradeoffs play out with existing first and second generation blockchains making compromises. For example, networks such as Bitcoin and Ethereum have chosen to focus on decentralization and security over scalability, while others such as Binance Smart Chain are fast, cheap and secure, but at the cost of being highly centralized.

So how can we mitigate the trilemma and achieve security, scalability and decentralization simultaneously?

How do we Solve these Problems?

Rest assured that the Ethereum foundation is working hard to find solutions. As Vitalik said:

Currently, there are several proposed strategies to solve Ethereum’s Scalability problem, and they can be broken into two categories:

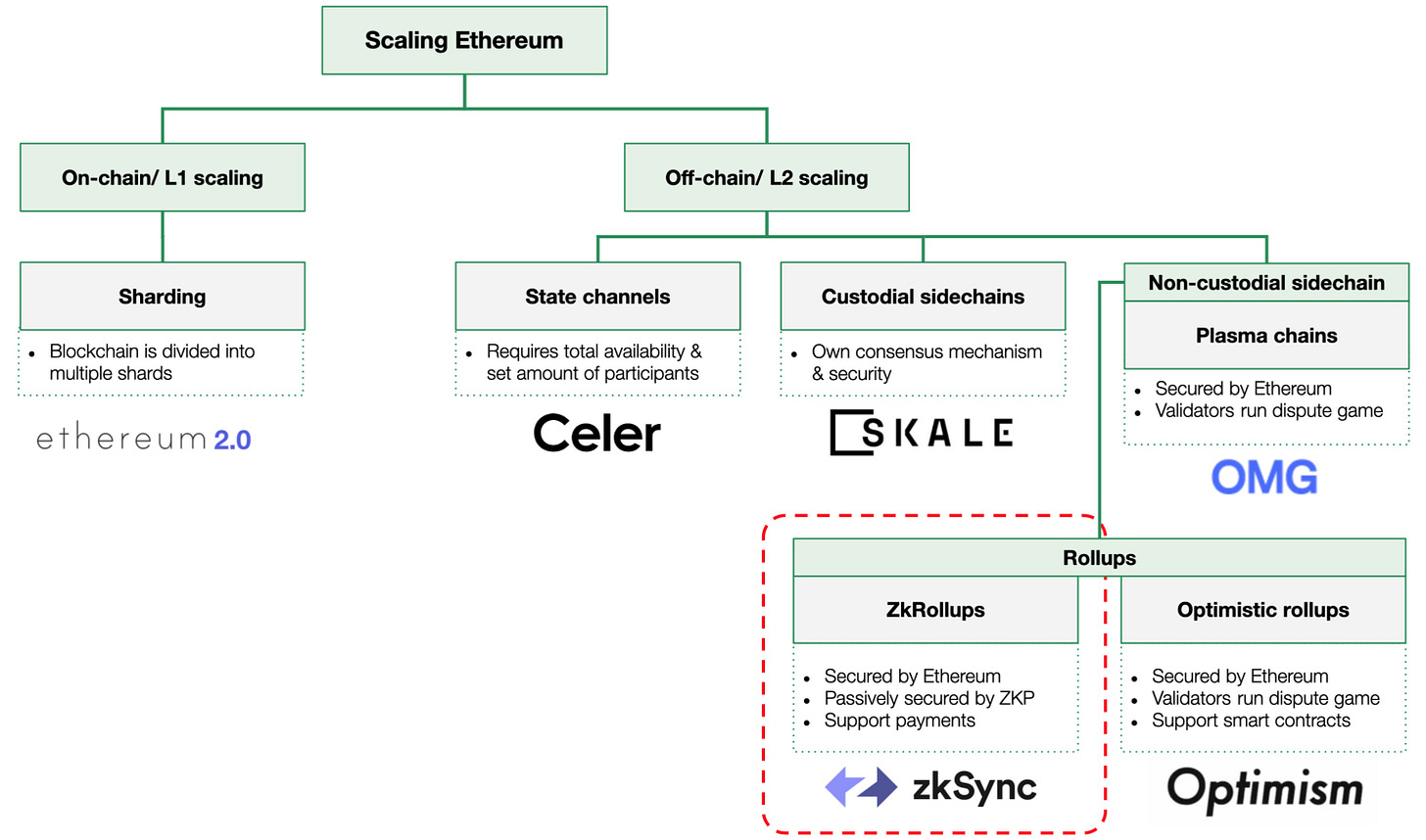

On-Chain Solutions: On-Chain solutions focus on improving the native blockchain itself. The most popular flavors are i) Consensus Protocol Improvements and ii) Multi-Chain Architectures

Off-Chain Solutions: Off-Chain solutions move transaction, data and or / security off of the native blockchain to increase efficiency. Popular off-chain solutions include Rollups, Side Chains, Plasma and Validium

On-Chain Solutions

Many of the newer blockchains such as Solana, Binance, Cardano, Avalanche, Polkadot and Terra – also known as the “Ethereum Killers” are primarily focused on solving the scalability problem by making improvements directly to their native chain. In particular, all of these projects rely on consensus protocol improvements and several leverage multi-chain architectures.

We will cover these two concepts below as well as examine their potential flaws:

What are Consensus Protocol Improvements?

Consensus protocols are one of the most important elements of a smart contract platform – they give “nodes” (who are effectively auditors) a specific method to verify transactions, review data and confirm what needs to be added to the ledger. When people say blockchains are “trustless”, they are referring to the benefit of these protocols, as they allow a distributed group of strangers to work together to agree on the network’s current state.

As discussed earlier, many first and second generation blockchains, such as Bitcoin and Ethereum, use Proof-of-Work (PoW) as their consensus protocol. While Proof-of-Work is proven and extremely secure, it’s also extremely slow (performing fewer than 20 transactions per second) and requires a lot of energy (at the time of writing, Bitcoin alone consumes about as much power as Finland, a nation with over 5 million inhabitants).

That is why virtually all newer blockchains such as are built on a much more efficient mechanism known as Proof-of-Stake.

Proof-of-Stake is similar to Proof-of-Work in many ways in that nodes are still required to validate and secure the network, and these nodes still receive rewards for doing so. Instead of spending electricity though, these nodes put up large amounts of the native cryptocurrency as collateral. If these nodes are found to be negligent (or worse, malicious) they run the risk of losing some or all of this deposit.

The main benefit to using Proof-of-Stake is that it’s generally orders of magnitude faster and cheaper. This is why nearly all newer blockchains are built using Proof-of-Stake.

One company using Proof-of-Stake in a very novel way is Solana, who combines it with a concept known as Proof-of-History to achieve the fastest speed of any major blockchain in operation today. I will discuss Solana in more detail later in the article.

What is a Multi-Chain Architecture?

Single or “monochain” blockchains such as Ethereum can only process a limited amount of traffic and can quickly become congested.

One simple solution to this is to split blockchains up into many different smaller chains, allowing the network to process transactions in parallel.

Like a freeway adding more lanes, this greatly increases the efficiency of the native blockchain and creates potentially infinite speed (i.e. adding four subchains would theoretically result in a 400% improvement in performance, ten a 1,000% increase, 100 a 10,000% increase, etc…).

Three notable projects using multiple blockchains are Cosmos, Polkadot and Avalanche.

Potential Drawbacks to On-Chain Solutions

Critics argue that smart contract platforms that rely solely on on-chain solutions will not be sufficient and will be forced to continue to make trade-offs along the trilemma. In particular, they argue that among the current batch of “Ethereum Killers”:

High-TPS chains such as Solana rely on a small number of validators and therefore sacrifice decentralization

Multi-chain ecosystems aren’t as secure because an attacker could gain majority in only one of the chains and break the entire network

They believe that a third piece of the puzzle is required, and that’s the implementation of off-chain solutions.

Off-Chain Solutions

What are off-chain solutions?

Off-chain solutions – also known as Layer 2 solutions because they are built ‘on top’ of a Layer 1 blockchain such as Ethereum – aim to increase scalability while retaining the security and decentralization of the underlying blockchain.

For the purposes of this article, I will highlight four main types of Layer 2 solution:

State Channels

Custodial Sidechains

Non-Custodial Sidechains

Rollups

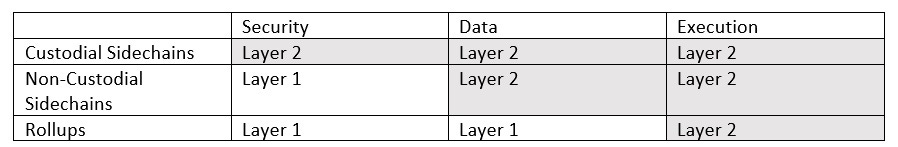

Landscape of Layer 2 Solutions

Before diving in, however, it’s important to remember the three basic functions of a smart contract platform:

Execution: Run programs via smart contracts

Data: Store important data such as account balances

Security: Provide consensus protocols secure the network

Several of these Layer 2 solutions increase efficiency by taking responsibility of at least one of these functions off of the main chain. For example:

Custodial sidechains remove all responsibility from the main chain by maintaining their own security, storing their own data and performing their own execution. For this reason, many people argue that they are not really “Layer 2” solutions at all, but are simply separate blockchains

Non-Custodial sidechains utilize the security of the Layer 1, but lessen the load by keeping their own data and doing their own execution

Rollups utilize the security and data of the Layer 1, but do their own execution

To summarize:

While most Layer 2 solutions increase speed, many still suffer from similar tradeoffs in functionality, security and decentralization. More detail on this is below:

State Channels

State channels are a very basic scaling solution where two or more users take their transactions “off-chain” and then submit the final results back to the chain. For example, if Alice and Bob frequently transact with one another, they may elect to break off into a state channel for most of their transactions to increase speed and save on fees.

While state channels can be very fast and cheap, they suffer from three main flaws:

Participants must already know and trust each other

Users must lock up a large sum of capital

State channels can’t execute smart contracts

While easy to implement, these flaws make state channels unappealing and it is expected that they will continue to lose relevance.

Popular state channels include Bitcoin’s Lightning Network and Ethereum’s Raiden Network.

Custodial Sidechains

Custodial Sidechains are Ethereum-compatible, independent blockchains that maintain their own security. These chains connect to the Ethereum network through a bridge, and users can transfer their tokens to them and process transactions in parallel.

Like the multi-chain solutions described above, adding additional blockchains is a very effective method of reducing congestion on the network, and therefore reducing fees. In addition, because they are completely separate blockchains, sidechains can choose to run protocols – such as Proof-of-Stake – that allow them to operate much faster.

The fact that they are separate blockchains are also their greatest flaw. Users are effectively trusting an entirely different entity with their assets, so if the sidechain breaks (or worse, its creators are malicious) users could lose everything they transferred to that chain.

Given that they are entirely separate blockchains, many would argue that sidechains are not true Layer 2 solutions at all.

Major sidechain projects include Polygon’s Matic Network and Skale.

Non-Custodial Sidechains

The security flaws of custodial sidechains led to the development of “non-custodial” sidechains. These solutions are also separate blockchains, but they rely on the security of the main chain.

They do this by 1) removing data from the main chain, 2) performing the necessary calculations and 3) returning the results to the main chain in regular intervals.

Unfortunately, anytime data is taken off-chain, we have to assume that there is a chance that it has been manipulated. As such, non-custodial sidechains have mechanisms designed to prove that the data hasn’t been tampered with.

There are two types of non-custodial sidechains:

Validium: When returning data to the main chain, Validium sidechains submit a cryptographically secure "validity proof" to the network, showing that all calculations are valid. The mechanics of this proof are out of the scope of this article, but for reference it is called a “zero-knowledge proof” because it can be used to prove something is true without relaying any additional data.

Plasma: Plasma takes the opposite approach. Instead of submitting a proof, it is assumed that the data is correct BUT users can easily check this through a "fraud proof", which means that there is a 7-14 day waiting period that allows validators to review and reverse the transaction if they suspect fraud.

At first glance, non-custodial sidechains seem like ideal L2 solution as they retain the important benefits of custodial sidechains (i.e. speed) while also retaining the security of the main chain. Unfortunately, they suffer from a few drawbacks:

Both Plasma and Validium have limited functionality when it comes to smart contract execution

Plasma can take weeks to complete a withdrawal

Validium is faster than Plasma (10 – 30 min), but can be expensive due to the computational requirements of zero-knowledge proofs

Major plasma projects include Polygon’s Plasma Chain and OMG and major Validium projects include Starkware and Loopring.

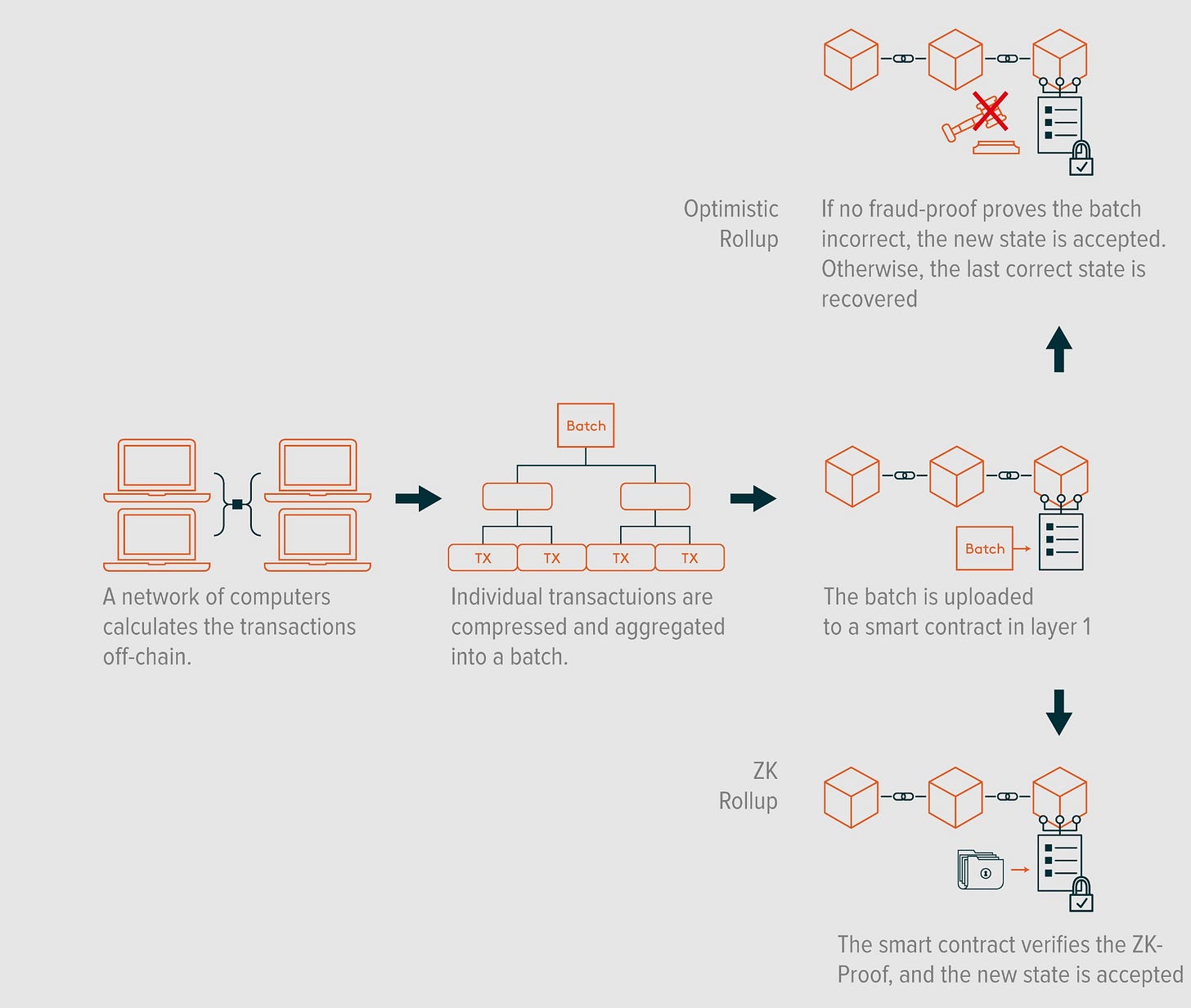

Rollups

While non-custodial sidechains move both data and computation to a separate blockchain, rollups only move computation off chain. That way, users know that important data, such as their account balance, is secured on ETH.

ZK and Optimistic Rollups Execute Transactions Off-Chain

Because rollups execute off-chain, they still need a way to prove to the main network that they’re not being malicious. In these types of proof, we find the two different flavors of rollups:

zk rollups: Like Validium, zk rollups use zero-knowledge proofs (that’s where they get the name) to show that all calculations are valid.

Optimistic rollups: Optimistic rollups use “fraud proofs” in a manner similar to Plasma – they institute a waiting period that allows validators to challenge transactions they believe might be fraudulent. This is an important role for validators, who risk having their collateral slashed if they fail to catch a dishonest submission.

In general, zK rollups are faster but offer less functionality, while optimistic rollups have more functionality but are also slower due to the potential of fraud challenges.

As zK rollups mature and more functionality is added, many expect for them to become the dominant L2 solution for ETH.

In fact, Vitalik wrote: “In general, my own view is that in the short term, optimistic rollups are likely to win out for general-purpose EVM computation and ZK rollups are likely to win out for simple payments, exchange and other application-specific use cases, but in the medium to long term ZK rollups will win out in all use cases as ZK-SNARK technology improves.”

Major optimistic rollup solutions include Optimism and Arbitrum and major zK- rollup projects include ZKSync, Loopring and Starkware.

Who are the Key Players?

Below we dive deeper into some of the top smart contract platforms. The top 10 participants in the space by fully-diluted market cap are Ethereum, Binance Smart Chain (BSC), Cardano, Solana, Avalanche, Polkadot, Polygon, Tron, NEAR and Cosmos.

Let’s dive deeper into each of these protocols below…

The most notable “Ethereum Killer” might be Ethereum itself.

The protocol has been working on its ETH 2.0 upgrade for some time now, and although the final version may not be released for years, Vitalik hopes that the eventual launch will solve the scalability trilemma once and for all.

(It’s worth noting that one of the most critical updates on the path to Ethereum 2.0 – known as the “The Merge” – is expected to be completed on September 15th, 2022)

The team at Bankless provides a great overview of Ethereum 2.0 in its article Ultra Scalable Ethereum, but I’ll attempt to summarize below.

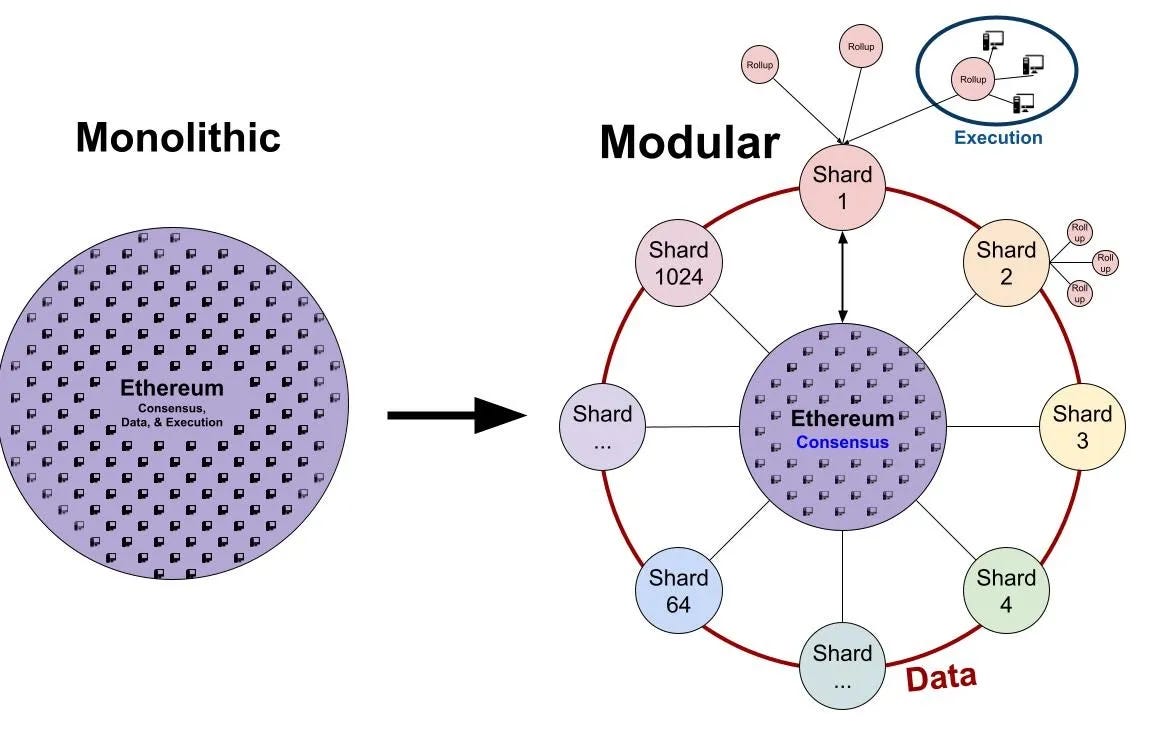

As discussed above, smart contract platforms perform three basic functions:

Execution: Run programs via smart contracts

Data: Store important data such as account balances

Security: Provide consensus protocols secure the network

Ethereum currently has a “monolithic” architecture, meaning that a single chain must perform all of these functions. As one can imagine, this can be unwieldy and slow.

Ethereum 2.0, on the other hand, aims to transition to a “modular” structure to divide the execution of these functions into three separate parts – the Beacon Chain, Shards and Rollups.

Rollups (Execution Layer)

Execution on ETH 2.0 will be handled by rollups – tools that move transactions off-chain, perform the necessary computations, and then plug the results back into the chain.

The most promising candidates for rollups are the two solutions we discussed above:

Optimistic rollups

Zero knowledge (zk) rollups

The Ethereum community is extremely bullish on rollups, and many believe that they will increase transaction speeds by up to 100x.

Shards (Data Layer)

Instead of living solely on the Ethereum Mainnet, ETH 2.0 plans to split its existing data layer into 64 smaller blockchains known as shards. This will make the entire network more efficient as:

Each validator only has to store one shard of the network instead of the whole blockchain

Shards can be processed in parallel

To combat the security risks faced by other multi-chain systems, ETH 2.0 plans to use random sampling to select validators.

Beacon Chain (Security Layer)

All shards will connect directly to the “Beacon Chain” – a “Master Chain” that will maintain security and facilitate communication between the shards.

Unlike the Ethereum Mainnet of today, the Beacon Chain is only used for consensus and can’t handle account data or execute smart contracts.

Potential Problems with ETH 2.0

While proponents believe that ETH 2.0 can achieve speeds in excess of 100K TPS without sacrificing decentralization or security, it’s important to remember that the project is far from complete and, at this point, largely unproven.

Some of the biggest questions at this time are:

Will it be composable? One benefit to Ethereum’s current monochain structure is that it’s “composable”. In other words, it’s very easy for dapps living on the same chain to communicate and “stack” together to create new products. For example, you could use an exchange dapp, lending dapp and insurance dapp all in the same transaction. As Ethereum moves to a modular model, critics worry that some or all of this composability will be lost.

Will it be secure? Vitalik himself points out the multi-chain architectures may be less secure as it’s easier for an attacker to expose a weak link. While Ethereum 2.0 hopes that its random validator selection process will avoid this, it’s still unproven.

Will it actually be faster? While Ethereum 2.0 will almost certainly be faster than its predecessor, it’s not clear how much faster, as the dynamics of interchain communication are largely untested. Furthermore, the long wait times of proposed rollup solutions such as optimistic rollups may present a problem.

Should ETH 2.0 be successful, it would only deepen the moat of the smart contract platform that powers most (if not all) of crypto’s “blue chip” dApps. Indeed, Ethereum ecosystem today accounts for over 60% of the total value locked in DeFi, over 80% of NFT sales and includes such notable projects as:

The Ethereum dApp Ecosystem

Indeed, despite losing some market share, Ethereum is still the dominant smart contract platform. It commands the largest position in DeFi and NFTs, the largest social communities, the most brand awareness, has the best security score, is the most decentralized and – perhaps ironically – is one of the most undervalued on a fully-diluted market cap to TVL ratio.

Should the migration to ETH 2.0 go as planned, it would almost certainly help solidify this position for years to come.

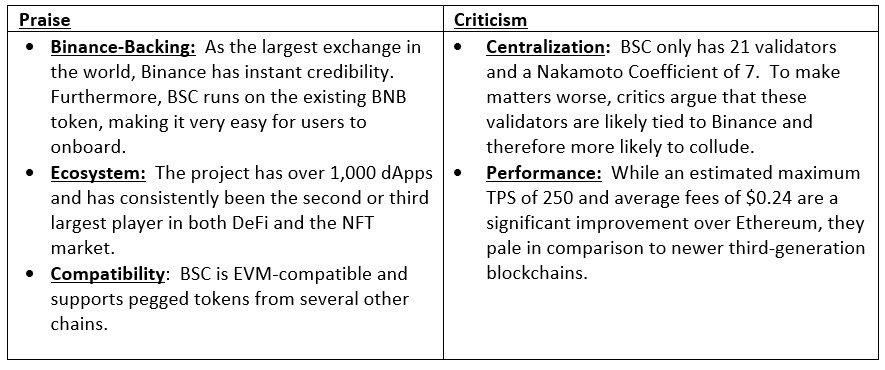

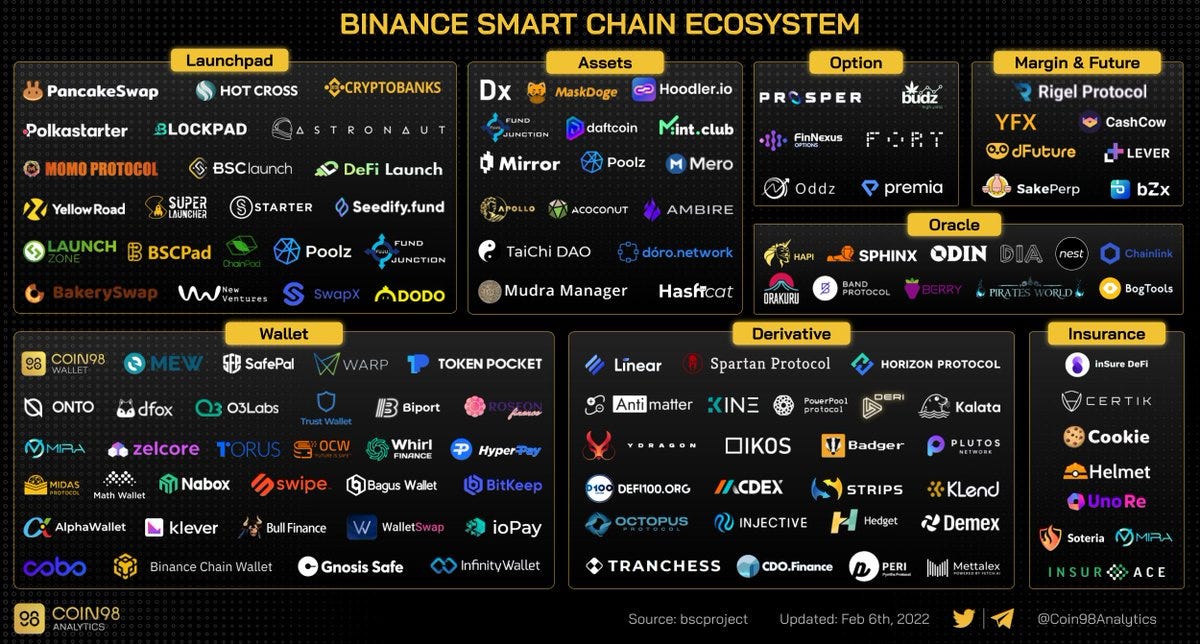

Binance Smart Chain (“BSC”) is a standalone blockchain that was launched by Binance – the world’s largest cryptocurrency exchange – in late 2020 to provide smart contract capability that was not available on the original system.

The project leverages a monochain model that combines Delegated Proof-of-Stake with Proof-of-Authority to achieve consensus, achieving excepted speeds of up to 250 TPS with 3 second block times. Binance Smart Chain uses the existing BNB token and is EVM-Compatible.

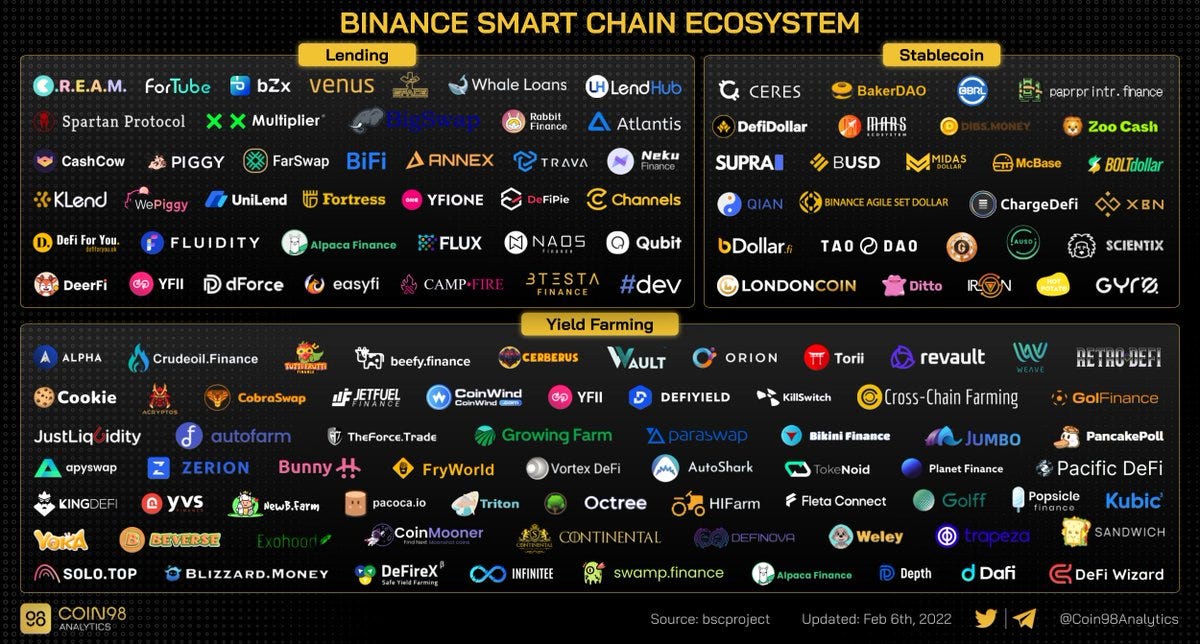

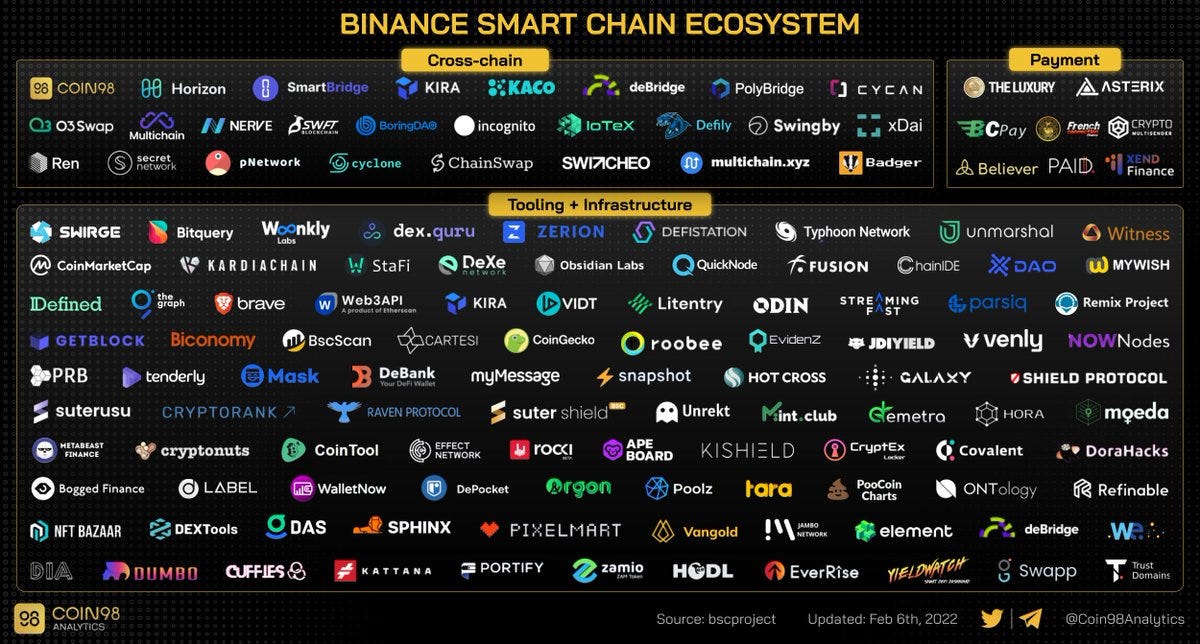

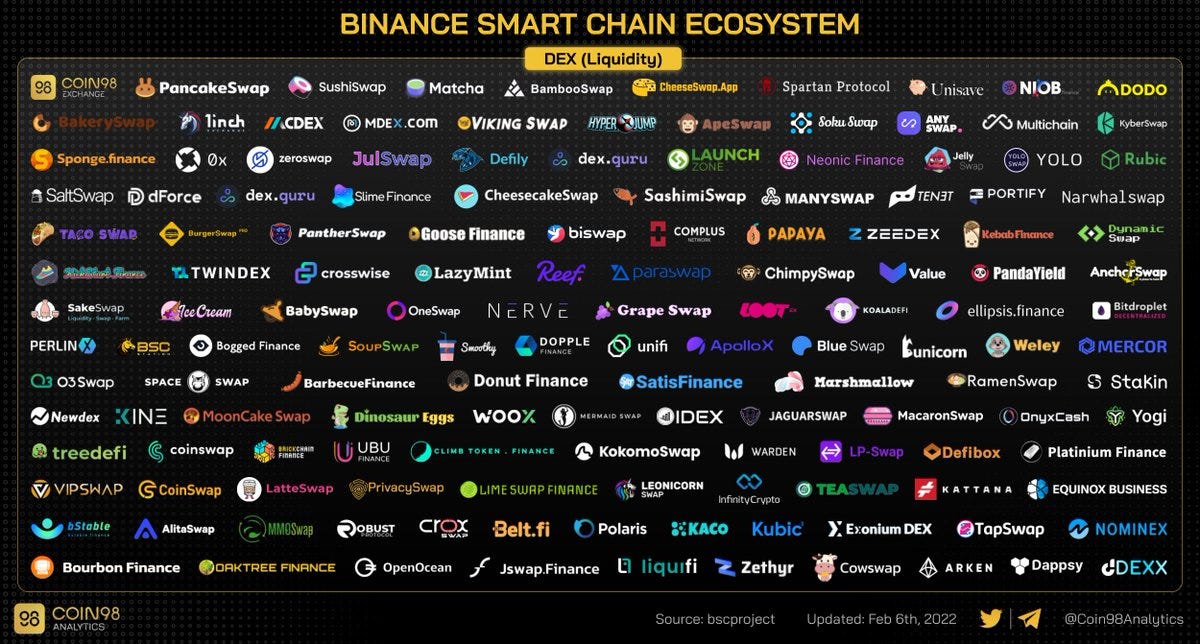

There are over 1,000 dApps in the BSC ecosystem including:

BSC Ecosystem Overview

Binance Smart Chain has its share of supporters and detractors. Some of the more common praises and criticisms are listed below:

Although Binance Smart Chain spent most of the year as the undisputed #2 project to Ethereum, it has been steadily losing share to competitors and has recently fallen behind Tron in TVL. Perhaps even more worrisome, some critics argue that its centralization effectively disqualifies it from being classified as a true smart contract platform. Again, decentralization is the only attribute that makes blockchains disruptive, so a centralized chain is little more than an extremely inefficient copy of Visa.

Often called the first “third-generation” blockchain, Cardano was conceived in 2015 by Ethereum Co-Founder Charles Hoskinson and launched in 2017. After several years of development, smart contracts started to go live in late 2021.

Cardano achieves scalability through two main methods:

Its “Ouroborous” Proof-of-Stake algorithm, which uses the random sampling of validators for consensus

A two-layer approach, which splits the blockchain into a settlement layer that holds data and a computation layer that supports contract execution

Notable dApps in the Cardano ecosystem include:

Cardano Ecosystem Overview

Although Cardano officially launched smart contracts in September of 2021, the project now claims to host over 200 dapps.

The protocol has its share of supporters and detractors. Some of the more common praises and criticisms are listed below:

While Cardano is very popular among developers (no doubt due to its academic focus), the lack of commercial traction is concerning. Silicon Valley is rife with stories of a superior technologies losing because they waited too long to go to market, and it’s starting to seem like this could be the case for Cardano as well.

Founded by former Qualcomm, Intel, and Dropbox engineers in late-2017, Solana is a single-chain, delegated-Proof-of-Stake protocol whose focus is on delivering scalability without sacrificing decentralization or security.

Core to Solana's scaling solution is a decentralized clock that uses a process known as Proof-of-History (PoH). Although this is vastly oversimplifying the concept, the thinking behind PoH goes like this:

The concept of time is extremely important for computer networks, as it is necessary to track the passage of time accurately to put transactions in the correct order. For instance, if Alice, Bob and Charlie are all making transactions with one another, we need to know the order in which they occurred to route the funds correctly and ensure that Bob didn’t send all his Ethereum to Alice and then try to send it again to Charlie.

Centralized networks resolve this issue by maintaining a central clock and timestamping all transactions. Unfortunately, decentralized systems cannot rely on a centralized clock, and because we can’t trust the actors, it’s surprisingly difficult to agree on time (after all, Bob could create fake timestamps if he wanted to trick the network).

Many argue that the most important benefit of traditional consensus mechanisms such as Proof-of-Work is that they act as a de facto “clock” for decentralized systems, relying on validators to arrange transactions in the correct order. Unfortunately, this wastes a lot of time, as validators and miners need to chat back and forth until they agree on the order of transactions.

Solana’s Proof-of-History function steals a page from the centralized playbook by allowing each validator to maintain their own clock and timestamp their transactions. To prevent the problems discussed above, the accuracy of this clock is verified through a cryptographic proof.

This saves validators from wasting time on ordering transactions – they can simply check the timestamp, organize them and go

This innovation allows Solana to be unbelievably fast and cheap, boasting a theoretical TPS of 65,000 to 710,000 and fees under $0.00019 without resorting to sharding.

Notable dApps in the Solana ecosystem include:

Solana Ecosystem Overview

While growth and market share has recently declined, the project showed incredible transaction in 2021, growing from 70 to over 500 dapps and generating almost $12B in TVL. In addition, the market cap of NFTs sold on Solana’s platforms was nearly $1 billion, and the project partnered with high profile personalities such as Michael Jordan and Snoop Dogg.

Like most smart contract platforms, Solana has its share of supporters and detractors. Some of the more common praises and criticisms are listed below:

Solana is unique among the “Ethereum Killers” in that it has chosen to eschew sharding and retain its single-chain structure. While critics argue that so called monochains are inferior and risk becoming irrelevant, this might ultimately prove to be Solana’s biggest long-term competitive advantage. As discussed above, monochains allow for very efficient communication between dapps and may be able to support products and uses cases -- such as flash loans – that wouldn’t be possible in a modular architecture.

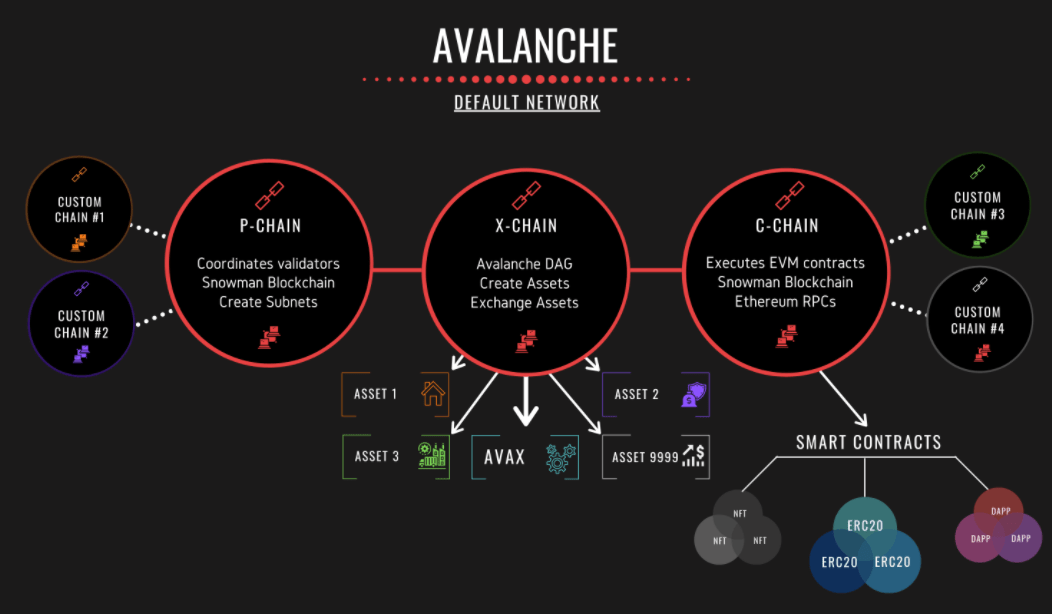

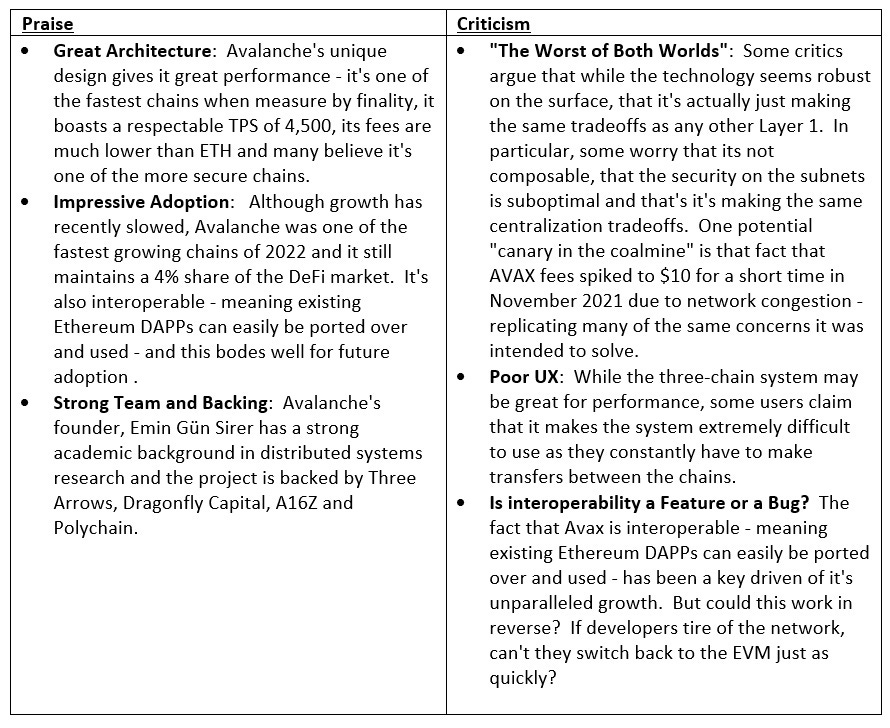

Avalanche (AVAX) is a smart contract platform focused on transaction speed, low costs, and composability. It was launched in 2020 by Emin Gün Sirer, a computer science professor at Cornell University.

The protocol claims two unique innovations:

A novel consensus mechanism that purports to have the “best of both worlds”, combining the speed and finality of Classical Consensus with the security and decentralization of Nakamoto Consensus.

Like ETH 2.0, it uses a modular – three blockchain architecture – that allows each chain to specialize in a task.

While Avalanche is fast (up to 4,500 TPS per chain and theoretically infinite with the addition of more subnets) and relatively cheap ($0.01 per transaction), its core focus has always been on “finality”, which is the time it takes to finalize a transaction. The project claims it will be able to complete transactions in <1 second, making it much quicker than Bitcoin (60 minutes), Ethereum (6 minutes) and even rival Solana.

Notable dApps in the Avalanche ecosystem include:

Avalanche Ecosystem Overview

What truly sets Avalanche apart, however, is its focus on DeFi and historical recent growth in that sphere. Although growth has declined, the protocol increased its TVL from $191 million at the start of Q32021 to $11 billion by the end of the year. That’s over 50x growth in six months!

Avalanche is also highly compatible with Ethereum, making it relatively easy for developers to move their apps between the two chains.

Some of the more common praises and criticisms of Avalanche are listed below:

At first blush, Avalanche seems like a strong project – solid performance, extreme growth and a loyal community. That said, I’m having trouble identifying the “moat” – I get that it’s clearly a sustaining innovation (i.e. potentially a better version of ETH) but I can’t see what’s disruptive about it (i.e. what ETH 2.0 can’t replicate).

Furthermore, given that Avalanche gave out over $180 million in developer incentives in the second half of 2021, it’s difficult to tell how much of their growth is organic and how much is “bought-and-paid-for” (always a risk because developers tend to leave when the money dries up).

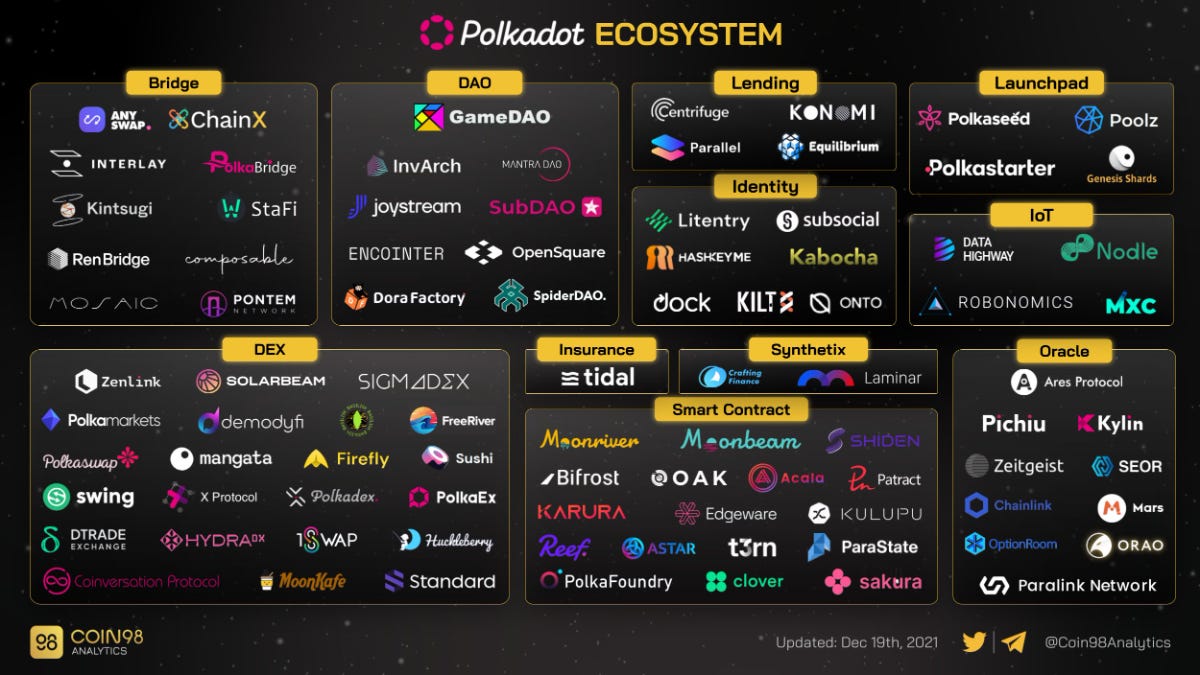

Polkadot was created by Ethereum co-founder Gavin Wood in 2016. The project is unique in that it is taking a different approach than many of its competitors – instead of primarily focusing on speed like many of the other “Ethereum Killers”, the project is betting on interoperability.

One of the key problems with the crypto landscape today is that smart contract platforms generally have little to no ability to communicate with one another. Polkadot’s goal is to connect all of them, creating an “internet of interoperable blockchains.”

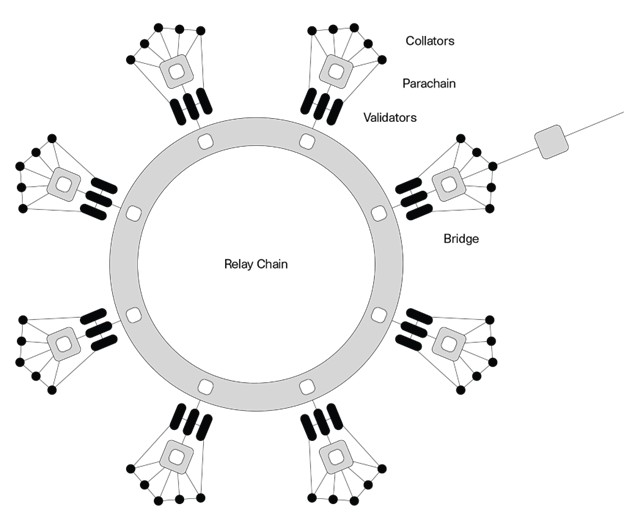

To do this, it utilizes a “hub and spoke” structure, where different Layer 1 blockchains (called “parachains”) can share data via Polkadot’s central chain, known as the “Relay Chain”.

As you’ve probably noticed, this structure is similar in many ways to Ethereum 2.0’s beacon chain and shard architecture. The key difference is that while all chains in Ethereum 2.0 are subchains of Ethereum, Polkadot’s parachains are all independent Layer 1s. In Polkadot’s ideal world, this could even mean that Ethereum, Cardano, Avalanche, Solana, BSC, etc… all connect to and communicate through the DOT network. For this reason, the project often calls itself a “Layer 0” protocol.

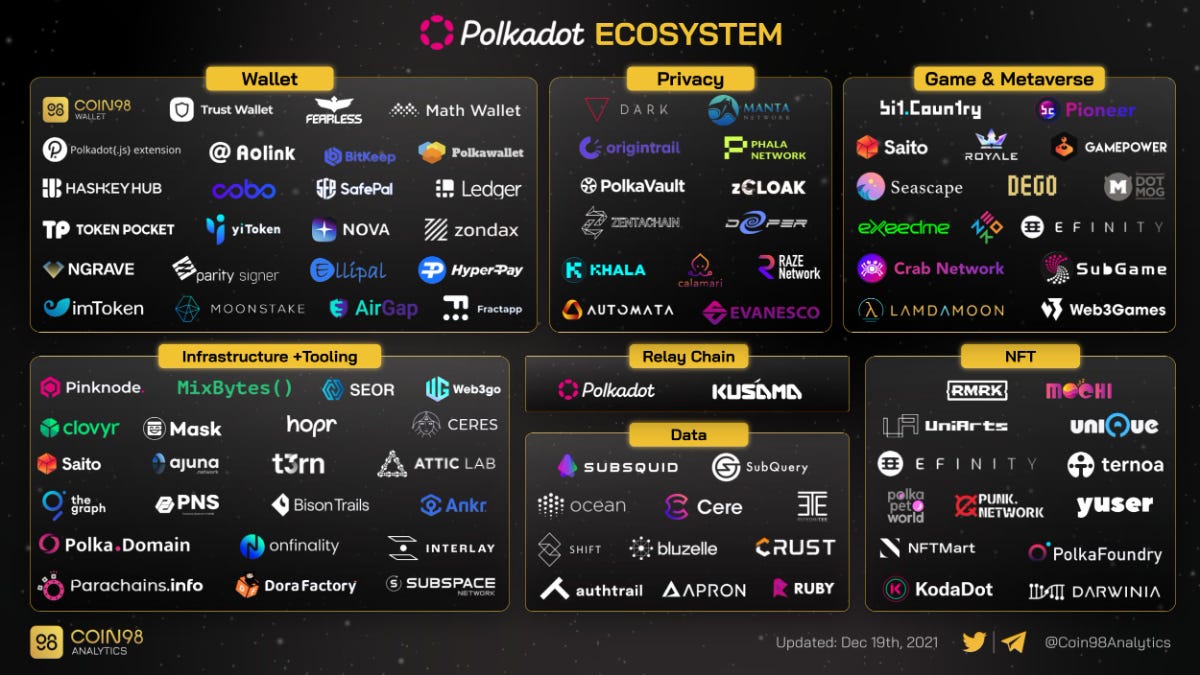

Notable dApps in the Polkadot Ecosystem include:

Polkdadot Ecosystem Overview

Like Cardano, Polkadot got off to a slow start, preferring to focus on internal research and development before launching. That said, the project went live in December, and it is already showing 150 dapps on its website.

Polkadot has its share of critics and fans. Some of the more common praises and criticisms of the protocol are listed below:

It’s not clear to me that Polkadot is vastly superior or differentiated to ETH 2.0, and without any real traction, it’s tough to make a solid argument otherwise.

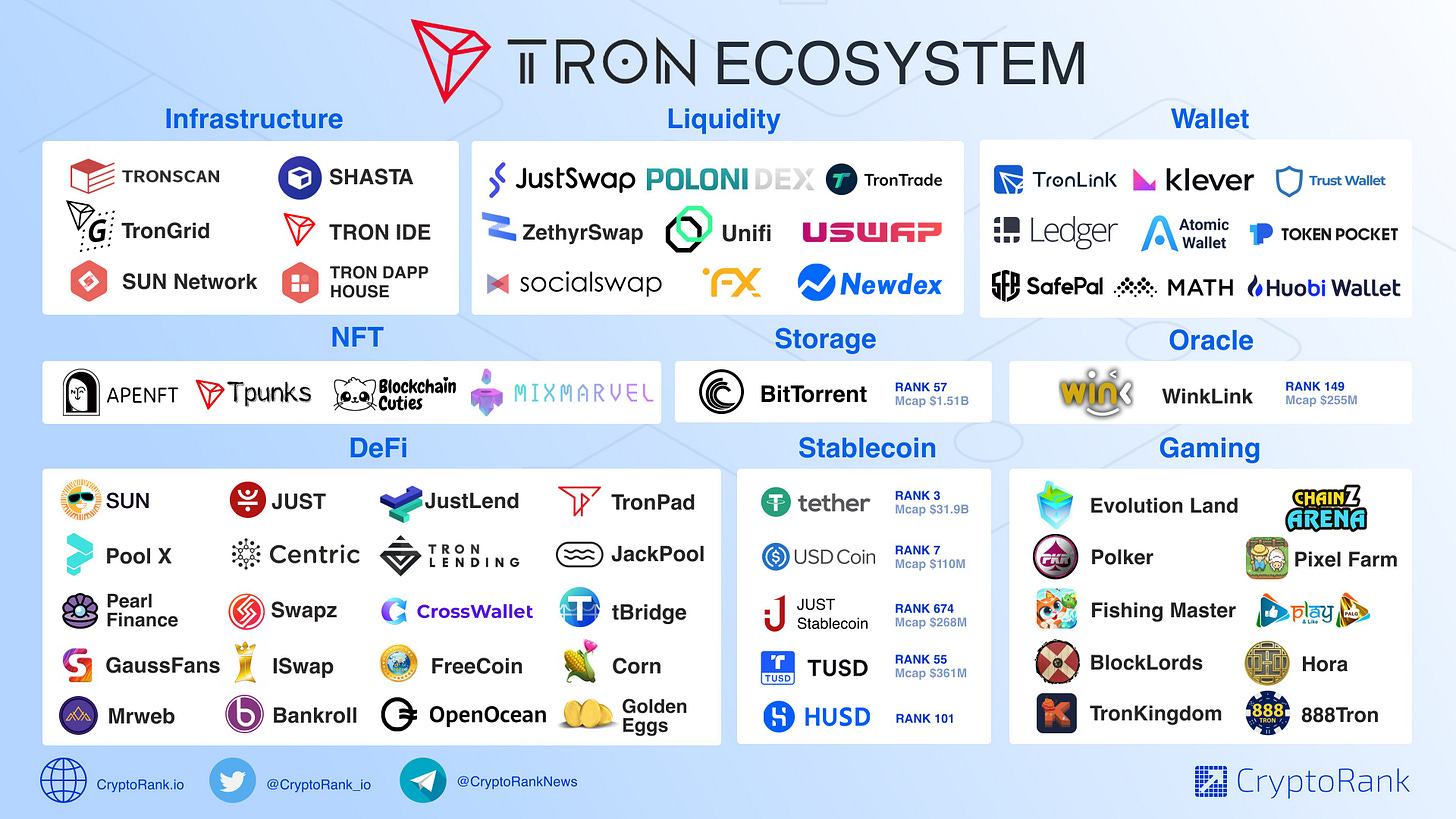

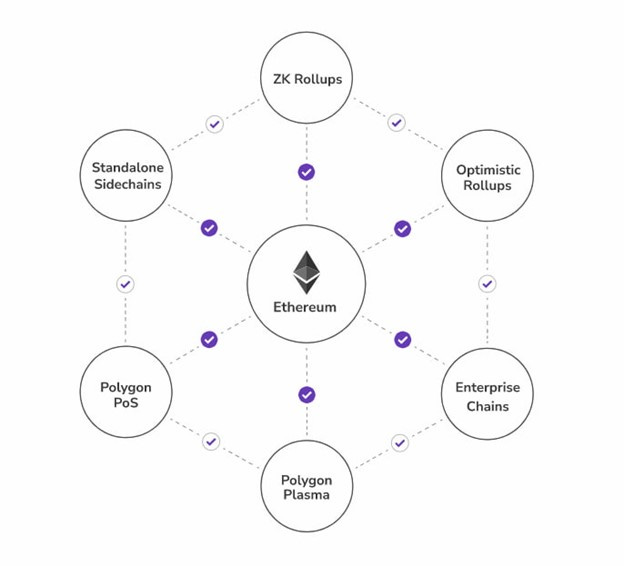

Polygon was founded by Sandeep Nailwal and Anurag Arjun in October 2017. The project’s original name was Matic, and it initially provided two Layer 2 scaling solutions to Ethereum – its PoS custodial chain and Plasma chain.

Since launch, however, Polygon has significantly expanded its vision, and now hopes to be Ethereum’s “internet of blockchains”, allowing developers to build their own sidechains, rollups and plasma chains and connect them to the Ethereum blockchain. As such, it is currently building:

A “library” of Layer-2 solutions such as standalone sidechains, plasma chains, zk-rollups and optimistic rollups that projects can use to scale

A software development kit to help developers create their own chains

To further their mission, Polygon has made a host of acquisitions in 2021 including zK-rollup providers Miden, Hermez and Mir.

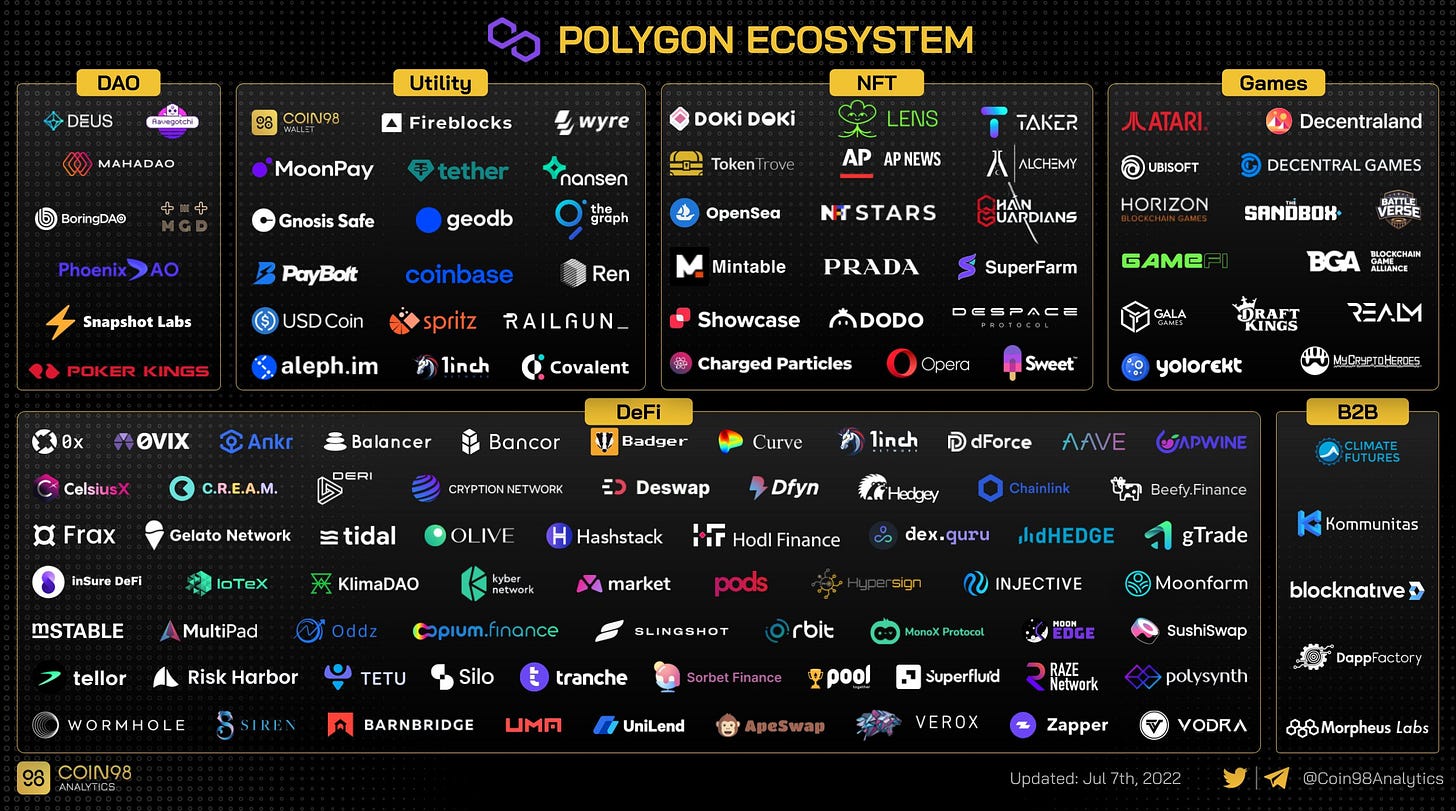

Notable dApps in the Polygon ecosystem include:

Polygon Ecosystem Overview

Polygon has achieved significant traction in the last year. According to Coindesk, it hosted almost 3,000 dapps on the network at the end of 2021 – a 100x increase from the prior year – and 62% of these were deployed exclusively on the network. It also executes nearly 3x as many transactions as Ethereum (although at significantly less revenue per transaction).

Some of the more common praises and criticisms of the Polygon are listed below:

As it becomes clear that L2 solutions will play a significant role in improving the scalability of smart contract platforms, Polygon is well positioned to be a market leader. Furthermore, the project has demonstrated “hustle”, in both its successful courting of developers and aggressive acquisition schedule.

Critics would argue that one of the biggest concerns around the future of the project has to do with the utility of its token. As we will see below, many rollups (such as Arbitrum and Optimism) function perfectly fine without one, so that begs the question – as Polygon becomes a network of Layer 2s, is its token really necessary?

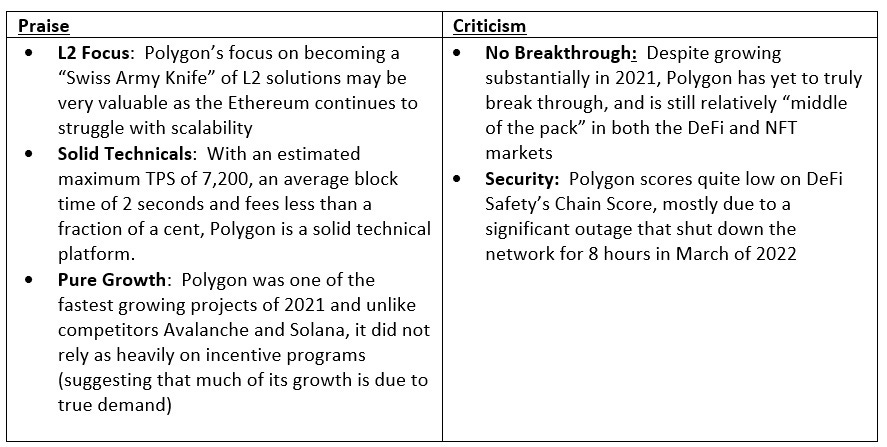

Tron was founded in 2017 by billionaire Justin Sun, a controversial figure in the crypto space that nevertheless has a penchant for marketing and a history of entrepreneurship (he previously founded Peiwo, a live chat app in China with over 10 million registered users and was one of the early representatives of Ripple in China).

The blockchain uses a modified form of the Proof-of-Stake consensus mechanism (PoS) known as Delegated Proof-of-Stake (DPoS). Unlike traditional PoS systems, which randomly select a new set of validators for each and every block, members of DPoS-based systems vote to elect a limited number of “representatives” (called delegates) that are responsible for validating all blocks over a given time period.

In Tron’s case, the network elects 27 “super representatives” to serve for a period of six hours (after which voting begins anew).

Proponents of DPoS networks such as Tron argue that limiting the number of validators make the chains more efficient, faster and cheaper. There appears to be some merit to this claim as Tron is theoretically able to achieve a TPS of up to 2,000 and fees that range from zero to a fraction of a cent.

Notable dApps in the Tron ecosystem include:

Tron Ecosystem Overview

While the project is often heavily criticized, it has demonstrated remarkable staying power. As one of the oldest smart contract platforms, Tron maintains a loyal cadre of fans and has recently elevated to the number two position in DeFi, increasing its market share in TVL from 3% in February to almost 10% today.

Some of the more common praises and criticisms of Tron are listed below:

Tron is a very peculiar project. A lot of people in the crypto space really hate the protocol, claiming that both the software and the white paper were plagiarized and that the project is essentially vaporware.

Much of this may be related to Sun himself, who is a very polarizing figure with an aggressive marketing style and a personality that some find off-putting (e.g. many poke fun at the fact that his Twitter handle is now “H.E. Justin Sun” – for “His Excellency” – given his position as an Ambassador to Grenada).

That said, he’s also a notoriously entrepreneurial individual, is rumored to have an unbelievable work ethic and his marketing style has undoubtedly brought a lot of publicity to Tron.

Whatever one’s thoughts are on Sun, however, it is undeniable that the project has achieved significant traction across a variety of metrics – it is one of the cheapest chains, ranks #3 in achieved TPS, ranks #2 in the number of daily average transactions and, perhaps most importantly, is now the second largest player in DeFi with nearly 10% market share.

NEAR Protocol was founded in 2018 by Alexander Skidanov and Illia Polosukhin. It is backed by Notation Capital, Coinbase Ventures, Multicoin Capital, Pantera, A16z and was a participant in Y-Combinator’s accelerator.

The project incorporates a number of features to enhance scalability, boost speed and reduce costs, including:

DPoS: NEAR uses a delegated Proof-of-Stake consensus model to reduce the time to validate a block

Immediate Consensus Mechanism: Unlike most smart contract platforms, which require multiple confirmations to reach consensus, NEAR has pioneered a novel system called DoomSlug which allows the system to finalize a block after one round of communication

Sharding: NEAR was one of the early pioneers of sharding with its Nightshade protocol

These innovations allow the protocol to theoretically process over 100,000 transactions per second with near instant finality (and fees that are a fraction of a cent).

Notable dApps in the NEAR ecosystem include:

NEAR Ecosystem Overview

While still relatively small, the project has been growing steadily since launch, increasing its share of TVL from 0.07% in February 2022 to 0.5% in August.

Some of the more common praises and criticisms of NEAR are listed below:

While NEAR has a strong team, very interesting technology and good traction to date, it has yet to achieve critical mass as its TVL market share remains below 1%. As I’m a firm believer that the market is the ultimate judge of a projects usefulness, I’d be hesitant to be too bullish until it starts to cross a tipping point.

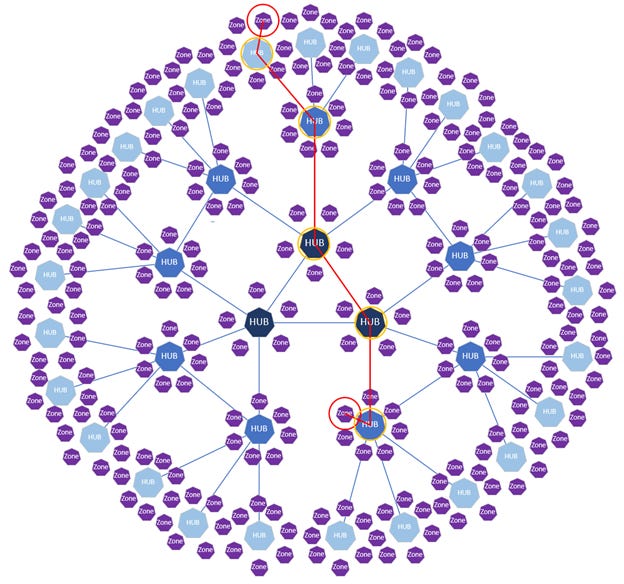

Cosmos was conceived in 2014 and launched in 2019 by founders Jae Kwon and Ethan Buchman.

Like Polkadot, the project is aspiring to be a “Layer 0” protocol that can connect multiple, independent smart contract platforms. In fact, while some call Polkadot the “blockchain of blockchains”, Cosmos is often referred to as an “Internet of blockchains”.

From a technical level, both projects use a “hub and spoke” model that connects several Layer 1 smart contract platforms (spokes) to a central chain (hub) that is responsible for security and validation.

Cosmos Uses a “Hub and Spoke” Model to Connect Multiple Blockchains

That said, there are a few key differences between the Cosmos and Polkadot:

Faster Finality: Cosmos created its own spin on Proof-of-Stake validation through its Tendermint BFT (Byzantine Fault Tolerance) mechanism. This innovation allows the protocol to reach consensus – and therefore execute transactions – faster. Tendermint is also used by several other Layer 1 blockchains including BSC.

Multiple Hubs: As discussed both Polkadot and Cosmos employ a “hub and spoke” model. The key difference between the two, however, is that Polkadot only has one hub, while Cosmos will have multiple hubs that can all communicate with each other through a protocol known as the Inter-Blockchain Communication Protocol (IBC).

Strong Developer Tools: Cosmos has created a proprietary software development kit (SDK) that allows developers to create highly customizable blockchains. One of the most attractive features of the SDK is that it can translate several popular programming languages, such as Java and C++, into a format that is readable by the Cosmos network.

These three innovations should combine to give Cosmos as high TPS (it is estimated to approach 10,000 transactions per second), fast time to finality, low fees and – most importantly – high interoperability.

Notable dApps in the Cosmos ecosystem include:

Cosmos Ecosystem Overview

Although the total TVL of chains connected to Cosmos is relatively small today (~1% of the total market), earlier this year it commanded over 15% market share, as Cosmos was the “Layer 0” base chain for Terra (an algorithmic stablecoin that infamously imploded in May, destroying over $40 billion).

Given that the protocol functions as a technology layer for independent blockchains, Cosmos obviously can’t be blamed for this collapse, and if anything, the fact that Terra used it to become the #2 chain speaks highly to the technology.

Like most protocols, Cosmos has its share of fans and detractors. Some of their most common refrains are below:

Cosmos is a project to keep an eye on. As we potentially move to a multichain world, interoperability remains one of the greatest unsolved problems.

Unfortunately, the most popular solution today — cross-chain bridges – has proven troublesome. Today’s bridges are relatively easy to hack (over $2B has been stolen in 2022 alone) and some question whether a secure bridge is even possible from a technical perspective.

Cosmos’s IBC represents a novel way to solve this problem, eliminating many of the problems with traditional bridges. Should the protocol achieve success as the preferred interoperability solution, its potential is nearly limitless.

What’s Next? The Multi-Chain World

Many argue that a “multi-chain” world is all but inevitable at this point. Due to its high gas fees, Ethereum’s market share has steadily decreased over the last 18 months.

Ethereum’s Market Share Has Declined From > 95% to ~ 60% in the Last 18 Months

While “maxis” will claim that this is temporary – that ETH 2.0 is the panacea that will bring everyone back and return the project to 90%+ market share – this is highly unlikely for three reasons:

Platform economies trend towards multiple players

Ever increasing demand will drive a constant stream of new entrants

The need for specialization will carve out an opportunity for niche players

Platform Economies Trend Towards Multiple Players

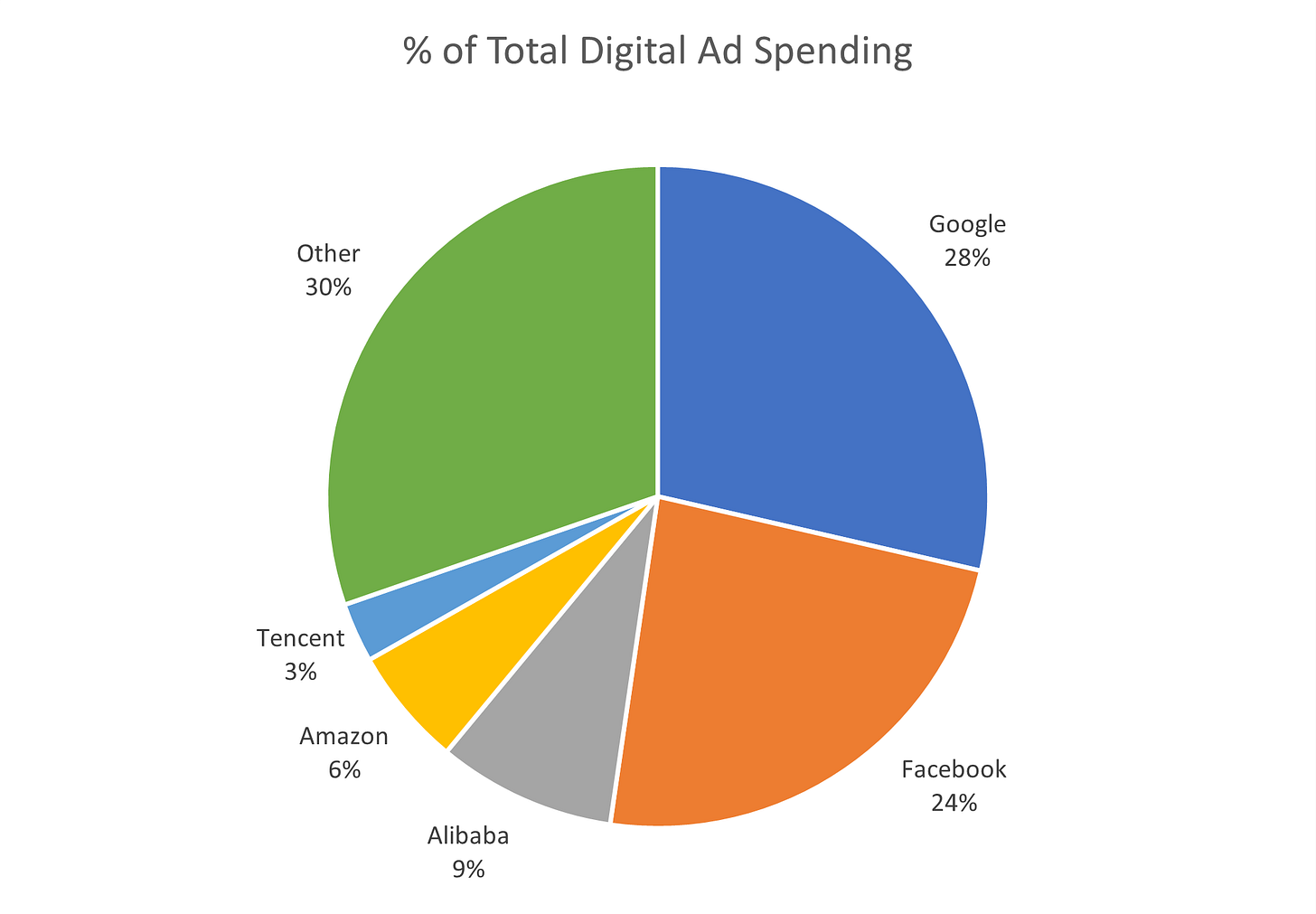

The “winner-take-all” phenomenon is one of tech’s greatest myths. It’s a forgivable mistake – after all, if you define Google and Facebook’s markets as search and social media, then they are definitely monopolies. But once you realize those are simply distribution channels, and that their real market is digital ad spend, it’s clear that’s not the case.

Indeed, virtually every platform economy has been dominated by two or more incumbents.

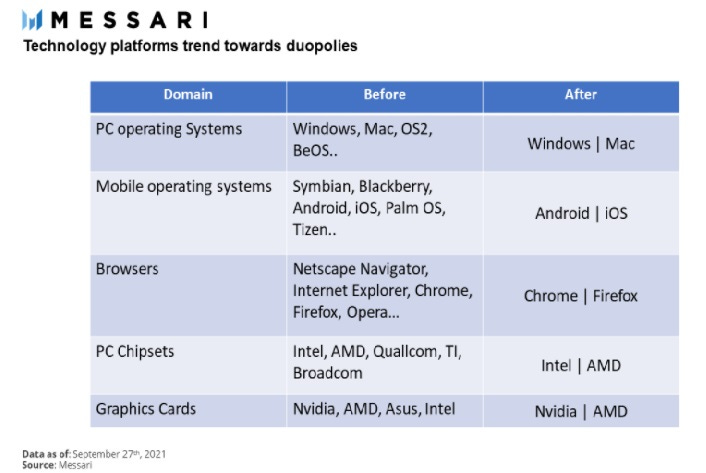

Some technology markets, such as PC and mobile operating systems, browsers, PC chipsets and graphics cards, evolved into duopolies.

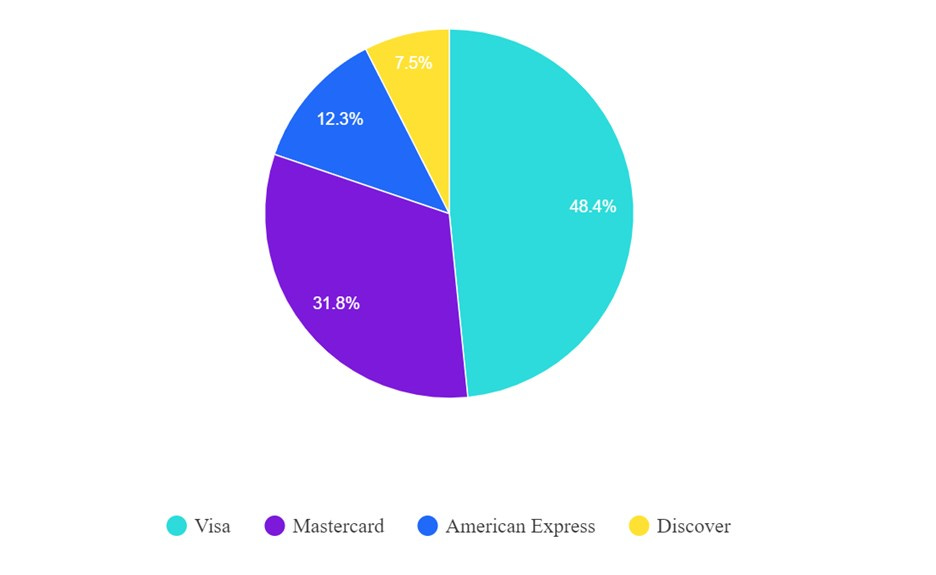

Other markets saw the emergence of three or four dominant players. For example, the cloud computing network is dominated by Amazon AWS, Microsoft Azure and Google, and the credit card processing landscape is dominated by Visa, Mastercard, American Express and Discover.

While we can debate whether there will be two, four or ten major players in the smart contract market, one thing all but certain – platform economies have historically not been “winner take all”.

Ever increasing demand will drive a constant stream of new entrants

Chris Dixon of A16Z argues that the demand for every important computing resource has always outpaced its supply and that this generates a mutually reinforcing feedback loop.

In essence, as demand increases:

New blockchains emerge to satisfy the demand

Old blockchains are forced to upgrade to compete

This generates more use functionality and uses cases

Which in turn generates more applications

Generating more users

Who generate even more demand

…and start the loop again

We’ve seen this dynamic play out across multiple industries including CPUS, GPUs, memory, storage, mobile, gaming, etc… and its all but certain to play out in the crypto space, with a constant introduction of new technologies and blockchains.

The need for specialization will carve out an opportunity for niche players

We’ve discussed the scalability trilemma previously, and to the extent that that isn’t fully resolved, it’s easy to imagine consumers making tradeoffs between decentralization, security and speed. For instance, it’s plausible to imagine a world where financial transactions happen on blockchains that prioritize decentralization and security, while gaming transactions occur on chains that value speed.

Furthermore, even when it comes to performance, there are nuances. In particular, there are two measures of “speed” and efficiency:

Transactions per second (TPS) refers to the volume of transactions that the network can process and is strongly correlated with fees

Finality refers to the time it takes to actually finish a transaction

For some use cases, high TPS and low fees might be ideal, while others might prefer faster finality times.

Finally, as discussed above, different structures (e.g. monochain vs. multichain vs. modular) may have different consequences and tradeoffs themselves. So even if ETH 2.0 eventually offers the best performance, its modular structure may have some composability drawbacks, leaving monochains such as Solana the ideal choice for those that want to maximize interoperability and utilize features such as flash loans.