The Complete Beginner’s Guide to Cryptocurrencies

How cryptocurrencies work, why they’re better than traditional money, how they can improve and where they might be going.

This article is intended to provide a somewhat thorough introduction to the use of cryptocurrencies as a replacement for traditional money. As such, it will not cover their use in emerging fields such as DeFi, NFTs, Web3, the Metaverse, DAOs etc…(all of those are covered in separate articles).

This piece is over 8K words (a 30 minute read) and is organized into 8 parts, which are summarized below for the tl;dr crowd:

What is a Cryptocurrency? A cryptocurrency is a form of money that is created, distributed and owned directly by the public (as opposed to the government). The total market capitalization of all cryptocurrencies is over $2 trillion as of late March 2022

What is Money? Money has evolved from direct bartering to precious metals to currencies fully controlled and backed by the government and banking system (known as “fiat money”)

What are the Problems with Centralized Money? Government-controlled money represents several problems, most notably the fact that the State has the power to seize your funds, restrict access to your accounts or impose limitations on usage any time they see fit

What are the Benefits of Decentralized Money? Cryptocurrencies remove the need for governments and banks and give consumers full control over their funds – allowing them to store their own assets without fear of seizure, transact directly with other users without regulation, and freely move their funds anywhere in the world

How do Cryptocurrencies Work? Cryptocurrencies operate using three technologies – blockchains, digital keys and consensus mining

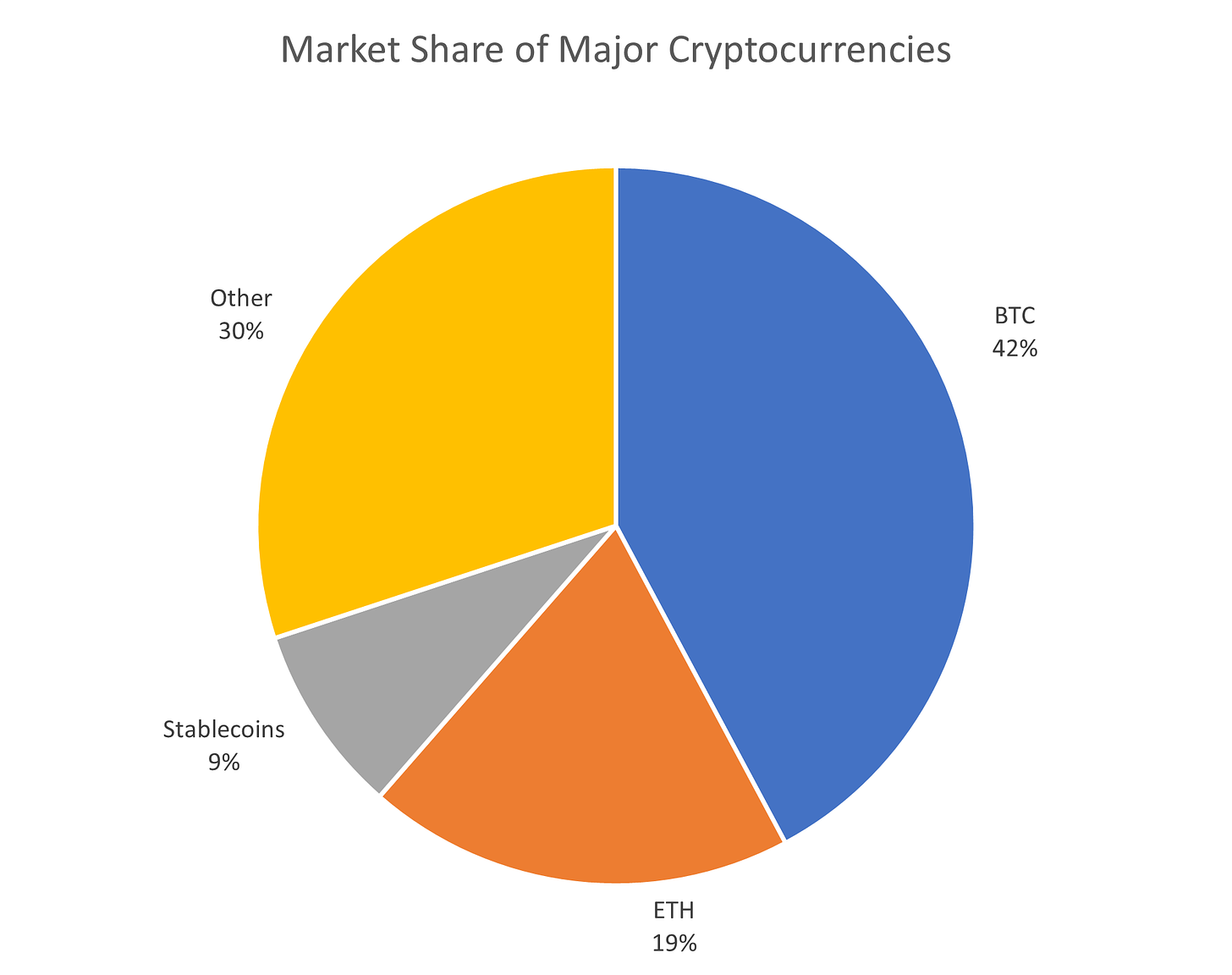

Who are the Key Players? Bitcoin and Ethereum comprise over 60% of the market while another asset class known as stablecoins (cryptocurrencies backed by fiat currencies such as the US dollar) make up an additional 10%

What are the Problems with Cryptocurrencies? Cryptocurrencies suffer from numerous problems including high fees, volatility, environmental concerns, criminal activity and MEV

What is the Long-Term Potential of Cryptocurrencies? Some analysts believe that by 2035 a single Bitcoin will be worth $1 million and a single Ether will be worth nearly $200K.

What is a Cryptocurrency?

To paraphrase Abraham Lincoln, a cryptocurrency is the money “of the people, by the people and for the people.”

Contrary to popular belief, you don’t really own your money. Traditional currencies – such as the U.S. Dollar, Euro or RMB – are owned and controlled by the government and leased to the public to use as payments for goods and services. While this model has its benefits, it also gives the State the power to seize your funds, restrict access to your accounts or impose limitations on usage any time they see fit.

Cryptocurrencies, on the other hand, are created, distributed and, most importantly, owned directly by the people. This removes the need for governments and banks and gives consumers full control over their funds – allowing them to store their own assets without fear of seizure, transact directly with other users without regulation, and freely move their funds anywhere in the world.

Proponents assert that cryptocurrencies are superior to traditional government-backed (or “fiat”) currencies because they retain all the benefits of conventional money with the added benefits of being cheaper, faster, less restrictive, more accessible and highly transparent. Critics argue that they represent an existential threat to the global financial system, a serious danger to the community and must be regulated at all costs.

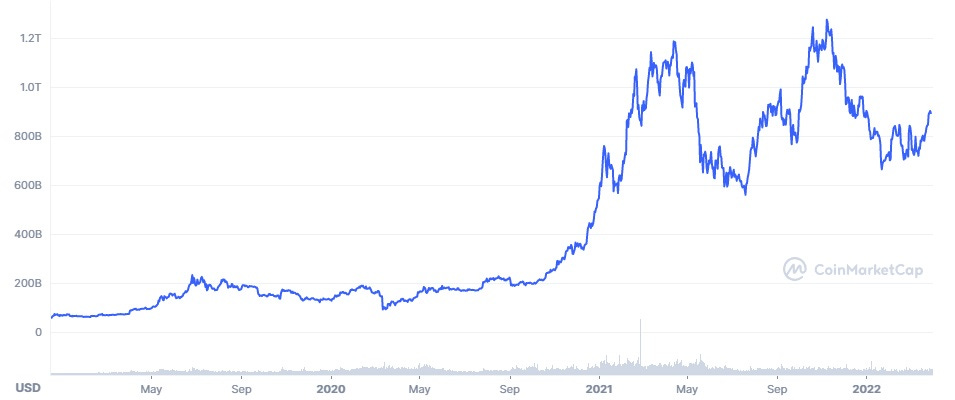

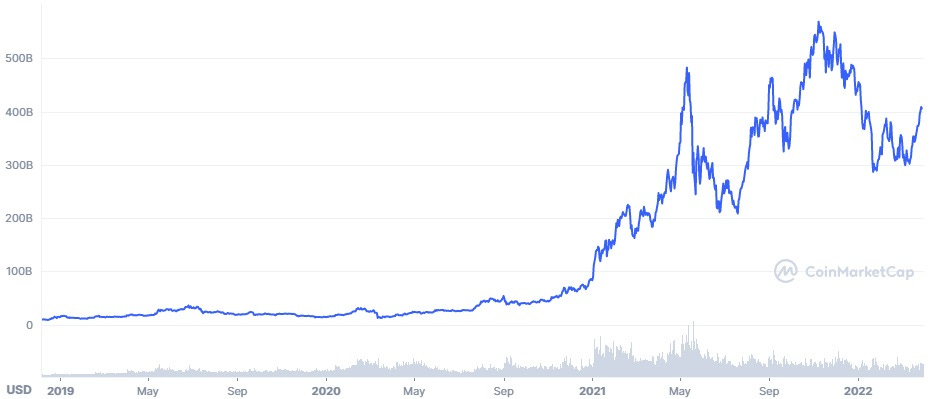

Whatever side of the argument one falls on, the popularity of cryptocurrencies is undeniable. The market has grown nearly 15x in the last three years to a total value of over $2 trillion.

The Total Market Cap of Cryptocurrencies is Over $2 Trillion

What is driving this popularity? Let’s dig a little deeper…

What is Money?

To understand the importance of cryptocurrencies, we first need to understand money.

The history of money is, in many ways, the history of civilization itself. For thousands of years, human beings have utilized various forms of currency to build economies and facilitate trade.

Indeed, money serves three important functions in our economy. It is used as a:

Store of value: Money can be saved and used for later

Unit of account: It serves as a common base for prices

Medium of exchange: Currency is used to buy goods and services

Ideally, money is durable, portable, divisible, uniform, accepted everywhere and has a limited supply.

The Ideal Properties of Money

Money has taken many forms over the years – it started with the barter of goods, progressed to trinkets such as seashells then to precious metals, and finally to paper money, plastic cards and electric money.

Today, over 90% of currency is electronic, meaning that it has no physical backing and exists only in computers owned by large banks.

The Problems with Centralized Money

While the earliest forms of money – such as seashells, precious metals and gold – were owned and controlled by individuals, money today is controlled almost exclusively by governments and banks.

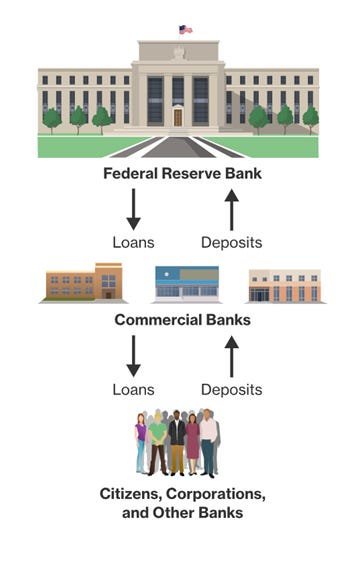

In the United States, the system is dominated by three entities:

Treasury: The Department of the Treasury is responsible for printing physical currency (i.e. notes and coins) and distributing it to Federal Reserve banks and branches

Federal Reserve: The Fed is the “banks’ bank” – it controls the overall money supply and distributes money to commercial banks

Commercial Banks: Institutions such as Bank of America, Chase and Wells Fargo put currency into circulation by lending directly to consumers

The Federal Reserve and Banking System

This centralized ownership presents five major problems:

Third-Party Custody: In the current financial system, you don’t really hold your funds – the banks do. This means that they can freeze and even seize your assets at will. While this may seem far-fetched, consider that in 2013, the Government of Cyprus seized 47.5% of all bank accounts over €100,000 to bail-out its failing banking system.

Limited Access: Banks can decide whether they want you as a customer. While generally not a problem in the developed world, this is a huge issue in growing economies. Today, nearly 1.7 billion people remain unbanked simply because they aren’t profitable enough to be considered by global financial institutions

No Privacy: Banks must collect detailed personal information to adhere to KYC, AML and CFT regulations and transactions

Expensive and Inefficient: The current financial system is rife with inefficiencies and unnecessary expenses. Payment networks charge up to 3% on credit card fees, cross-border remittance payments can take up to a week and cost 10%, and even in developed nations, users are faced with long transfer times and bloated fees.

Restrictions of Transfer: Several countries restrict or even ban the transfer of large amounts of cash internationally

So why do we tolerate these inefficiencies? Well, we don’t really have a choice due to what is known as the Byzantine General’s Problem. While I’m oversimplifying a bit, this concept basically states that large groups of humans can’t trust one another or coordinate across vast distances without using third parties (such as banks) to establish trust. For example, when a stranger sends you money online, you must rely on your bank to ensure that 1) they are whom they say they are and 2) they have the money they say they have and 3) they actually send it.

In short, while some may call the banking system “evil”, up until now it has been a “necessary evil”.

The Benefits of Decentralized Money

This all changed in 2009 when a person (or persons) using the name “Satoshi Nakamoto” invented Bitcoin, solving the Byzantine General’s Problem and setting off a chain of events which made the concept of “decentralization” possible.

For the first time in history, Bitcoin made it possible to perform direct, peer-to-peer transactions without relying on third parties to establish trust.

The effect of this cannot be overstated and requires a bit of “tabla rasa” thinking. Imagine for a bit, how you would design a financial system if you no longer needed intermediaries. After all, what’s the point of banks if you can safely hold your own assets? What’s the point of a federal reserve if you control the money supply? What’s the point of a Treasury Department if you can issue your own money?

If you’re like me, you’re probably envisioning a form of money that is much simpler and more elegant than what we have today…

Evolution of Money: From Cows to Crypto

That’s the promise of cryptocurrencies, and they may allow us to reap all the benefits of traditional money – namely trust, security and growth – while removing most of the downsides. Indeed, cryptocurrencies are:

Seizure-Proof: Instead of relying on a bank to hold your assets, you control all of your funds with your own wallet. As such, there’s no one to seize your assets, limit withdrawals or tell you where you can and can’t spend your money

Permission-Less: Users don’t need permission from a bank to access their funds. Anyone with money and an internet connection can buy any cryptocurrency in markets that are open 24 hours a day, 7 days a week and 365 days a year

Private: Users can choose to (and often do) remain anonymous

Borderless: Cryptocurrencies have no borders. Users can store millions (or more) on a thumbdrive or online wallet (not recommended) and go anywhere they please. They can send money home to relatives without anyone ever knowing

Cheap: Although fees for many cryptocurrencies are high now they’re “fixed” (vs. variable) which makes them ideal for sending larger amounts of cash. In addition, as fees continue to decline, it’s likely that transactions will be cheaper than traditional credit cards or wire transfers

Transparency: While many claim cryptocurrencies will be a haven for criminals and tax cheats, they’re actually much more transparent than traditional currencies as every transaction is permanently recorded on a blockchain

I know this is a lot to take in. Crypto is so unique, so transformative, so unintuitive that I’ve been studying it for almost five years now and sometimes I feel like I only partially get it.

But to help you understand more about how it can transform the world, let’s go a bit deeper down the rabbit hole…

How do Cryptocurrencies Work?

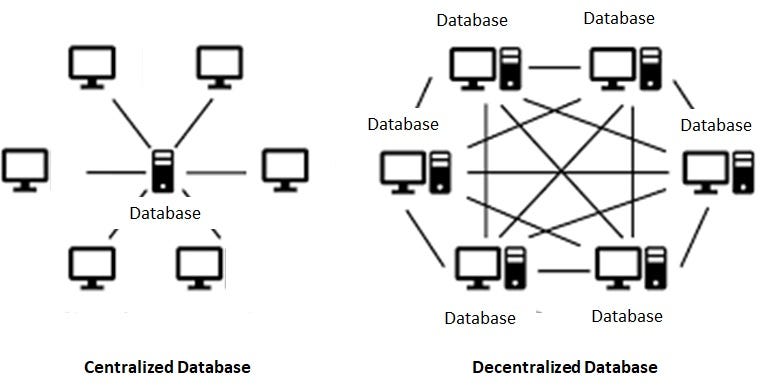

Cryptocurrencies are a form of money that lives online in distributed, decentralized databases.

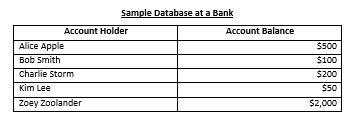

Database: Nearly all money today (92%) exists only online and is stored in databases – cryptocurrencies are no exception

Distributed: Identical copies of these databases are shared over thousands of computers located all over the world

Decentralized: Cryptocurrencies rely on a combination of blockchains, digital key cryptography and consensus mining to ensure decentralization

I know this might all seem a bit confusing, so let’s dive into each of these a bit deeper.

What are Databases?

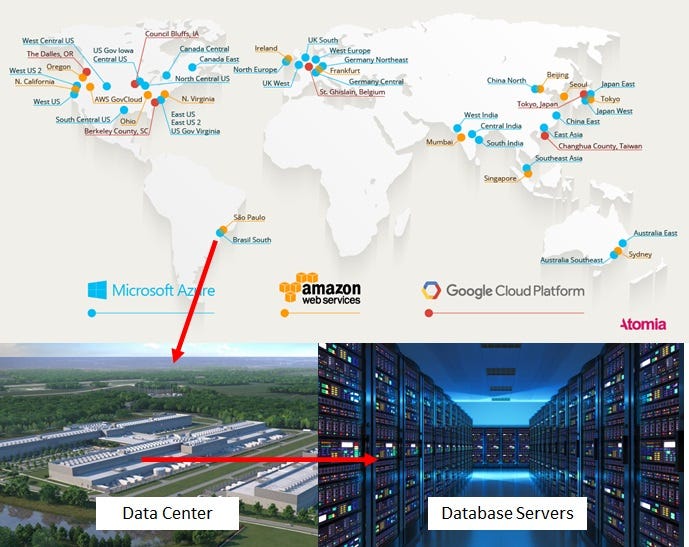

Most of the world’s data exists in database servers – giant computers that are built with the express purpose of hosting large amounts of information. Many of these servers are hosted in hyperscale data centers – multi-hectare facilities that can host thousands of computers.

Map of Microsoft, Amazon and Google’s Data Centers

Given that our modern economy runs off of data, that makes them some of the most important -- if not the most important – assets in the world.

While they are generally little more than glorified excel spreadsheets with a few columns, databases form the backbone of our modern digital economy because they store our health records, mortgage deeds, insurance records, virtually all the content we consume online and – perhaps most importantly –over 90% of our money.

☝️ Your money is little more than a collection of 1s and 0s in a database owned by Bank of America (or whomever you bank with)

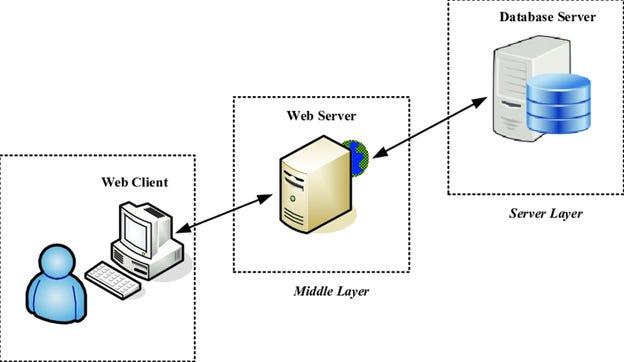

Today, we access the internet through what is known as a client-server-database architecture.

The Client – Server – Database Architecture

As the name suggests, there are three major components to this structure:

Clients: Your PC or laptop is known as a “client”, when you visit websites on a browser such a Google Chrome, it makes requests to servers

Servers: Servers are responsible for routing your request to the correct database and then sending the information from the database back to you

Databases: Almost all of the information that you find on the internet is stored somewhere in a database

So when you open your iPhone to check your balance at Bank of America, your phone sends a request to one of Bank of America’s servers, which then sends a request to one of Bank of America’s databases that then tells you that you have $X in your account.

As stated previously, the vast majority of these databases are owned by centralized companies. For instance, Microsoft, Google and Amazon own over 50% of the world’s largest data centers.

Cryptocurrencies simply swap the existing, centralized, storage layer with decentralized and distributed databases. These new databases contain both the current balance of everyone’s cryptocurrency as well as the entire transaction history.

How are Cryptocurrencies Distributed?

Cryptocurrencies are distributed because, instead of living in centralized “server farms” as they often do at Microsoft or Facebook, they are hosted across thousands of individual computers located all over the globe.

These computers are called “nodes”, and they each contain an identical copy of the account balances and transaction history of the cryptocurrency’s database.

This distribution is very important because it means that: 1) it’s almost impossible for a third party to turn them off and 2) they are extremely resilient to hardware failures.

How are Cryptocurrencies Decentralized?

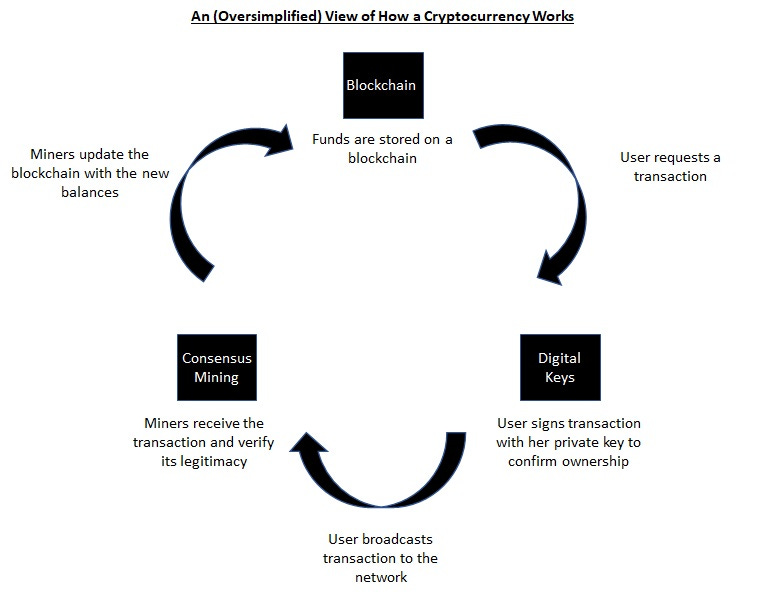

It’s been said that “innovation is what happens when ideas have sex”. When Satoshi Nakamoto created Bitcoin, they combined three synergistic technologies into a single invention that made economic decentralization possible.

As mentioned previously, governments and banks have historically controlled the creation and distribution of money. This is because it’s almost impossible to create a currency without a trusted, centralized authority. For example, when a stranger sends you money online, you must rely on your bank to ensure that 1) they have the money they say they have, 2) the money isn’t counterfeit and 3) they actually send it.

Bitcoin removed this long-standing limitation by replacing the traditional functions of banks with technology, transferring control of the money supply back to the people.

In particular, it used a combination of three interactive tools:

Blockchains: Immutable databases that record who owns what and that the currency in question is not counterfeit

Digital Keys: Verify that users own their funds

Consensus Mining: Ensures that transactions are legitimate and transfers the funds

So if Alice wanted to send Bob two Bitcoin, the process would look something like this:

The Bitcoin blockchain stores Alice and Bob’s original account balances (i.e. Alice has 2BTC and Bob has none)

Alice desires to send 2 BTC to Bob

She creates a transaction and signs it with her digital key, verifying that it is indeed her requesting the transfer

This transaction is broadcast to a network of miners

Miners receive the transaction and verify that i) it is actually Alice requesting the transaction (via her private key signature) and ii) that she has the required funds

Miners would then update the Bitcoin blockchain with the new balances – (i.e. Alice now has 0 Bitcoins and Bob now has 2 Bitcoins)

Let’s explore each of these concepts in more detail.

What are Blockchains?

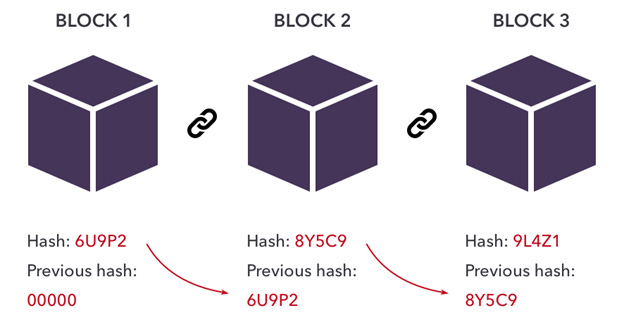

Cryptocurrency balances store their data on a blockchain. At its core, a blockchain is little more than an electronic database – i.e. a collection of information – that is shared across many different computers.

Unlike a traditional database, blockchains organize data into groups known as blocks. These blocks have limited storage capacity, so when they become full they are locked and linked to the previous block with a “hash”. This forms a chain – hence the name, blockchain.

These hashes are extremely important because they make blockchains immutable, that is, data (such as your Bitcoin or Ethereum balance) can’t be deleted, tampered with or changed once it is locked into the chain.

Hashes are created through a cryptographic process (known as hashing) that takes a given set of information and converts it into a unique code (which is basically a long string of characters). For example, the word “fox” could be hashed as DFTY786DCFJ894SUSH865AAHJAI978 and the sentence “the quick brown fox jumps over the lazy dog” could be hashed as SOIAUYA7865ASLUAN098A5489USYAN. There are three important things to note about hashes:

Virtually anything can be hashed (i.e. you can hash a word, a sentence or the entirety of War and Peace)

Hashes are always unique (i.e. if you changed a single letter in War and Peace you would get a completely different hash)

It’s impossible to guess the original data from looking at the hash (i.e. you wouldn’t know that DFTY786DCFJ894SUSH865AAHJAI9785 was “fox”)

Because all new blocks are required to store the hash of the previous block, it’s easy to see if the blockchain has been tampered with. If the hash contained in the new block matches the old, you know that the data is secure. If they are different, everyone will know that the block has been tampered with.

What are Digital Keys?

Digital keys are nothing more than long strings of numbers (256 bits long for Bitcoin) and come in pairs – a public key and a private key.

Public Key: A public key is similar to a bank account number as it serves as your address on a cryptocurrency network. For example, instead of recording that “Alice owns 2 BTCs, the Bitcoin blockchain would record that “ 1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2 owns 2 BTCs”

Private Key: A private key is similar to a secret PIN code that allows users to access and control their account.

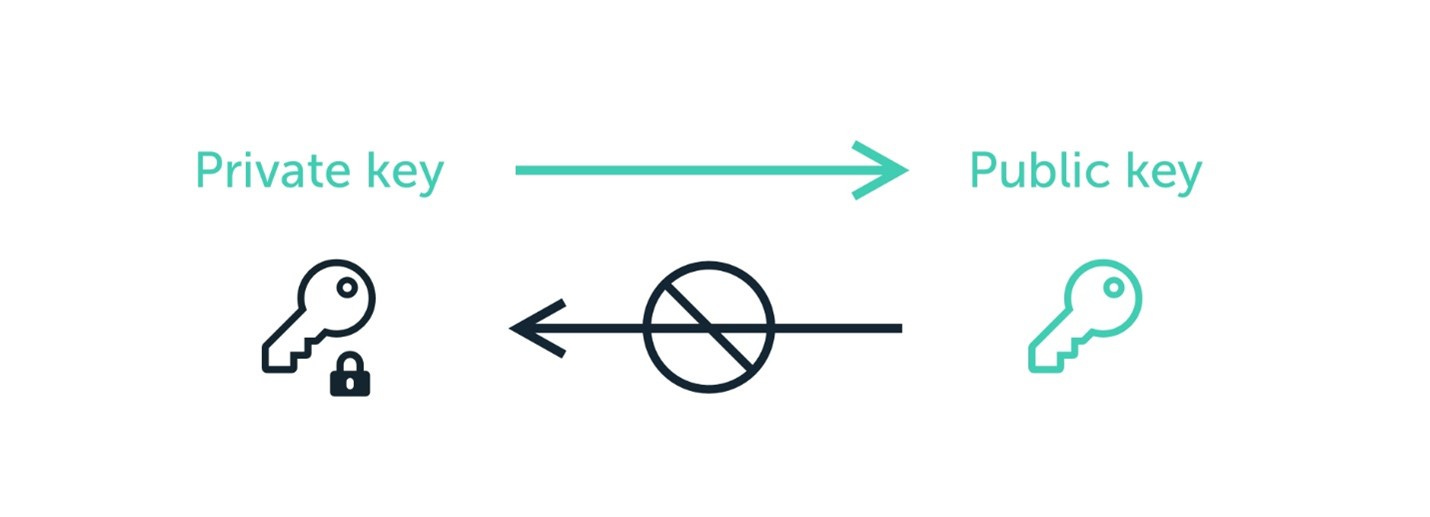

Every public key has only one private key, and – like a key and a lock – they are linked through cryptography. The important thing to note about this link is that it only flows one way. Although one can always access a public key with a private key, it’s mathematically impossible to do the reverse.

It’s Impossible to Decipher a Private Key from a Public Key

This one-way logic forms the basis of cryptocurrency transactions. For example:

To Receive Funds: In order to receive funds, a user would share his public key with the sender, who would deposit the money in that address. Because it’s impossible to decrypt a private key from the public key, this is completely safe (and necessary).

To Send Funds: In order to send funds, a user would user her private key to “unlock” her public key on the blockchain to authorize the transfer of the money. Again, because it’s mathematically impossible for anyone but the holder of the private key to do this, the blockchain can be sure that this person owns the funds.

In practice, users rarely see either their keys, as they are often stored inside digital wallets and managed by software (i.e. you just click buttons that say “send” and “sign” on a wallet such as Metamask and the application does the rest for you).

What is Consensus Mining?

Centralized networks, such as banks, have a small army of bookkeepers, accountants and auditors to verify that transactions are legitimate.

While blockchains can’t rely on an in-house staff, they can leverage a distributed group of users known as miners for a similar purpose.

Miners are the defacto auditors of a cryptocurrency. They compete to earn the right to process the output of transactions, confirm account balances, ensure there is no fraud and update the blockchain with the new results. They are, in turn, rewarded with cryptocurrency for their efforts.

While this seems like an elegant solution to the problem of centralization, there are a few major problems. Specifically: 1) miners are often anonymous and 2) as the defacto auditors of the blockchain, they have a lot of power. So how do we know that they won’t abuse this position and manipulate the results to send a bunch of money to themselves?

Cryptocurrencies employ two safeguards to prevent this:

Because of the properties of hashing discussed above, if anyone tried to manipulate the data it wouldn’t connect to the previous block, and this would be very obvious to everyone on the network.

They institute systems known as consensus mining protocols to punish bad actors and prevent fraud

The most popular consensus mining protocol today is known as Proof of Work. Proof of Work requires miners to solve a very difficult math problem to earn the right to validate new blocks. This problem is so difficult that it can only be solved by random guessing. As such, miners often employ dozens to hundreds to thousands of computers to make millions of guesses, hoping that one of them gets the correct answer.

This uses a lot of electricity, and therefore costs a lot of money. So if a miner is lucky enough to get the right answer, she is not going to risk manipulating the data and having her update thrown out, especially given that it would be so easy to get caught.

Key Players

Although there are many different types of cryptocurrencies, the market is dominated by three: Bitcoin, Ether and stablecoins.

Bitcoin: Bitcoin is the world’s first and largest pure cryptocurrency

Ether: Ether is the native token of the smart contract platform Ethereum. It can be thought of as a form of “programmable money” (e.g. it can be coded to perform functions such as automatically repay loans, hold funds in escrow, automatically execute contracts, etc…)

Stablecoins: Stablecoins are cryptocurrencies pegged to the value of fiat currencies such as the Dollar, Euro, Renminbi or Yen

We’ll dive into each of these a bit more below…

Bitcoin

What is Bitcoin?

Bitcoin (“BTC”) is the grandfather of all cryptocurrencies. It was created in 2008 by an unknown person or group of people using the alias Satoshi Nakamoto and currently has the largest market capitalization of any asset in the space.

Bitcoin’s Market Cap is Nearly $1 Trillion

Satoshi created the currency to combat what they saw as the perils of unchecked spending by the government. As such, Bitcoin famously limits its supply to 21 million coins, and often earns the moniker “digital gold” as a result.

A few local and national governments are officially using Bitcoin in some capacity, with one country, El Salvador, adopting it as a legal tender.

What are the Benefits of Bitcoin?

Bitcoin proponents believe that the currency is unique among its peers. The most extreme of them, often called “maxis”, argue that anything else is a “shitcoin”.

While that may be a bit extreme, the currency does have its strong points, including:

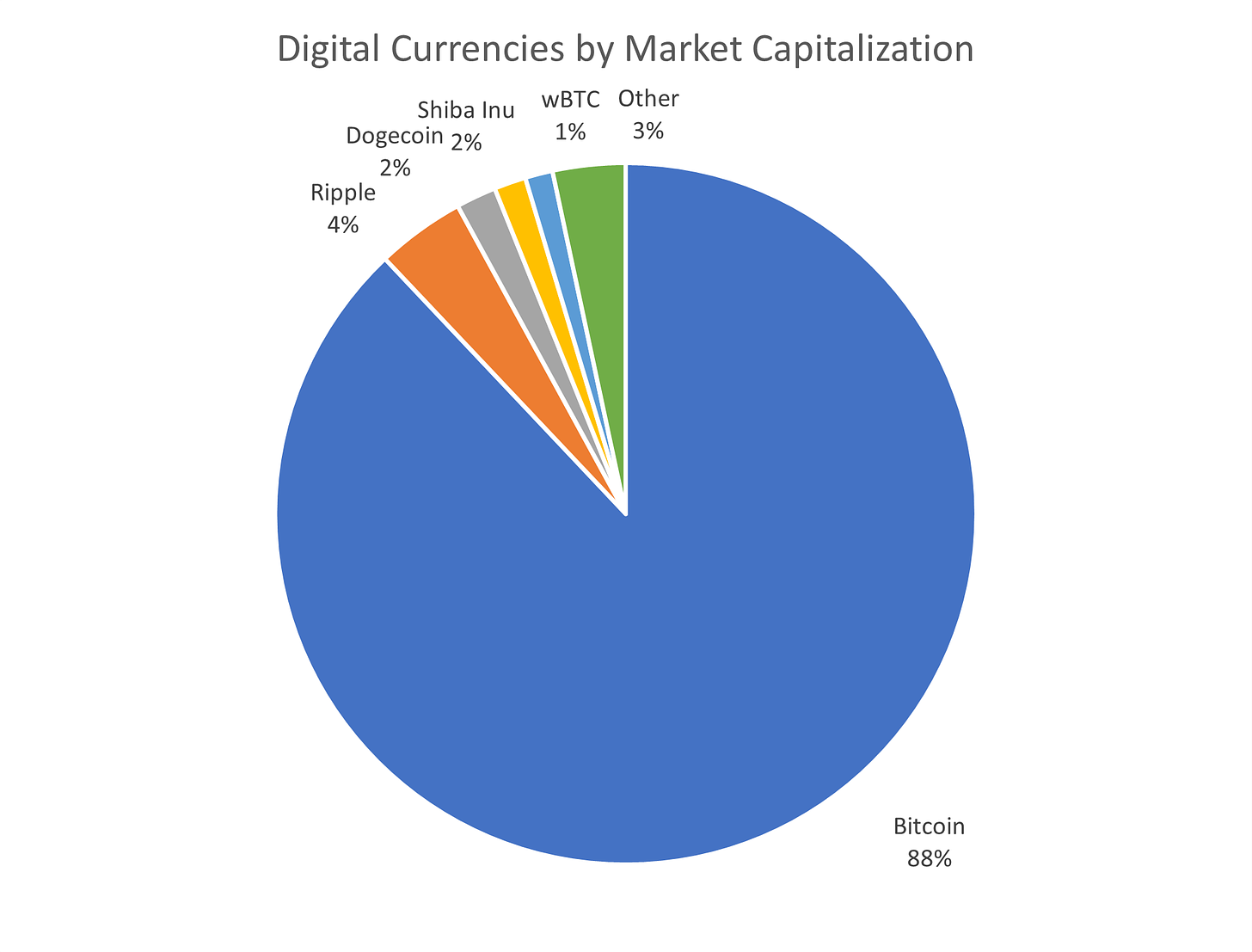

Network effect: Bitcoin is by far and away the market leader with over 40% share of all cryptocurrencies and almost 90% share of digital currencies. Although this percentage has been steadily declining, it will likely serve as one of the dominant forces in the spaces for years to come.

Decentralization: While most cryptocurrencies are migrating to a Proof-of-Stake system to lower transaction costs, Bitcoin will continue to use proof of work. While this means that the currency might be more expensive and less environmentally friendly, proponents argue that it’s the most secure and most decentralized method, as it would be extremely difficult for anyone to monopolize the supply of electricity.

Inflation resistance: Many Bitcoin enthusiasts believe its strongest benefit is lies in inflation resistance . In his book The Bitcoin Standard, Saifedean Ammous argues that fiat currencies have been “unsound money” since they went off the gold standard in the 70s. According to Ammous, unsound money leads to recessions and debt, hyper-inflation and even war! By limiting its supply to 21 million BTC, the currency reduces the threat of inflation and therefore (hopefully) mitigates these downsides.

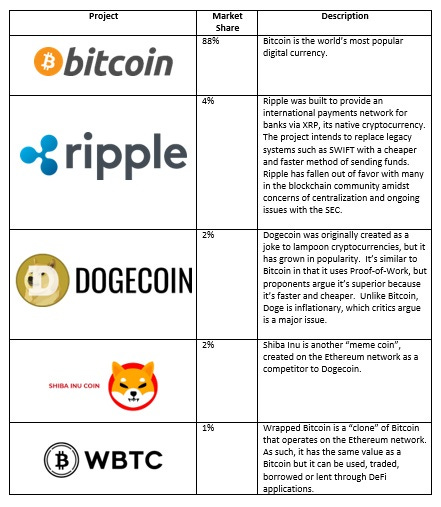

Although Bitcoin is by far the largest digital currency, there are a few other players in the space.

Who are the Other Players in the Space?

Bitcoin dominates the digital currency market holding almost 90% market share. In addition to Bitcoin, other notable projects that can be considered pure “digital currencies” (as opposed to smart contract platforms, stablecoins or tokens designed to run a specific protocol) are Ripple, Dogecoin, Shiba Inu and Wrapped Bitcoin.

Ether

What is Ether?

Ether is a form of “programmable” money. It was conceived in 2013 by Vitalik Buterin, launched in 2015 and is currently the second largest cryptocurrency with a market capitalization of $406 Billion.

Ethereum’s Market Cap is Nearly $500 Billion

Unlike Bitcoin – which functions very similar to traditional forms of money such as the USD or gold – Ether can be programmed to act in a certain way if predetermined criteria are met.

This has several important applications including (but not limited to):

Recurring Payments: Ethereum can be programmed to make automatic payments at predetermined times. This has an almost unlimited number of use cases including loan repayments, stock divided payments, automated payroll, etc…

Escrow: Large transactions often require escrow services to hold funds while a sale takes place. Currencies like Ethereum eliminate the need for this as they can be programmed to automatically release the funds once the deal is consummated

Contracts: Ethereum can also be programmed to settle more complex transactions. For instance, one could write an insurance contract that automatically pays policy holders if certain criteria are met (i.e. it could pay drought insurance funds to a farmer if the temperature averages over 90 degrees for any given month)

This functionality is supported by a decentralized “cloud” computer known as the Ethereum Virtual Machine (“EVM”). Like any computer, it can run a variety of programs – not only the ones listed above, but also a host of decentralized applications such as cryptocurrency exchanges, play-to-earn games, lending and borrowing protocols, music streaming services, etc… (to learn more check out the article on Smart Contract Platforms).

In addition to serving as a currency to buy goods and services, Ether is also needed to i) pay for the computing power required for transactions on the EVM and ii) serve as the platform’s primary consensus mining mechanism.

This trifecta of uses makes the coin unique among assets.

What are the Benefits of ETH?

Perhaps the most interesting take I’ve heard on the potential of Ether as money comes from David Hoffman of Bankless in his article “Ether: The Triple Point Asset”.

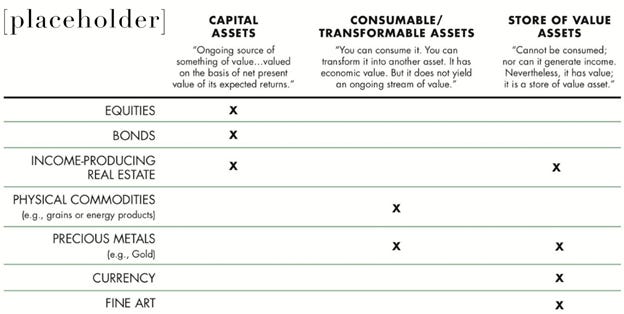

Hoffman references an argument by economist Robert Greer that assets have historically served one of three functions. They are either:

Capital Assets: Capital assets generate cash flows for the owner. Examples include stocks that pay dividends, bonds or rentable real estate.

Consumable Assets: Consumable assets generate value when they are used. Oil, coffee and electricity all fall in this category. outcome that is economically beneficial. Think about the gold plating in electronics, the gasoline in a car, or the coffee beans in a coffee machine.

Store-of-Value Assets; Store of assets can’t be consumed nor do they provide cashflows, but they nonetheless have value. Examples include gold, traditional currencies, real estate, art, or Bitcoins.

Although real estate and gold come close, no single asset has satisfied all three functions.

No existing asset simultaneously produces cash flow, stores value and is consumable

Ether, however, does. A token on the Ethereum network has what Hoffman calls an “economic trifecta” because it acts as a:

Capital Asset: Ether produces passive income through staking

Consumable Assets: It is needed to pay gas fees on the Ethereum Virtual Machine

Store-of-Value Asset: Ether is the most used form of collateral to be “locked” in DeFi

So in a sense, owning an Ethereum token is like a dollar bill, blue chip stock and barrel of oil all rolled into one!

Who are the Other Players in the Space?

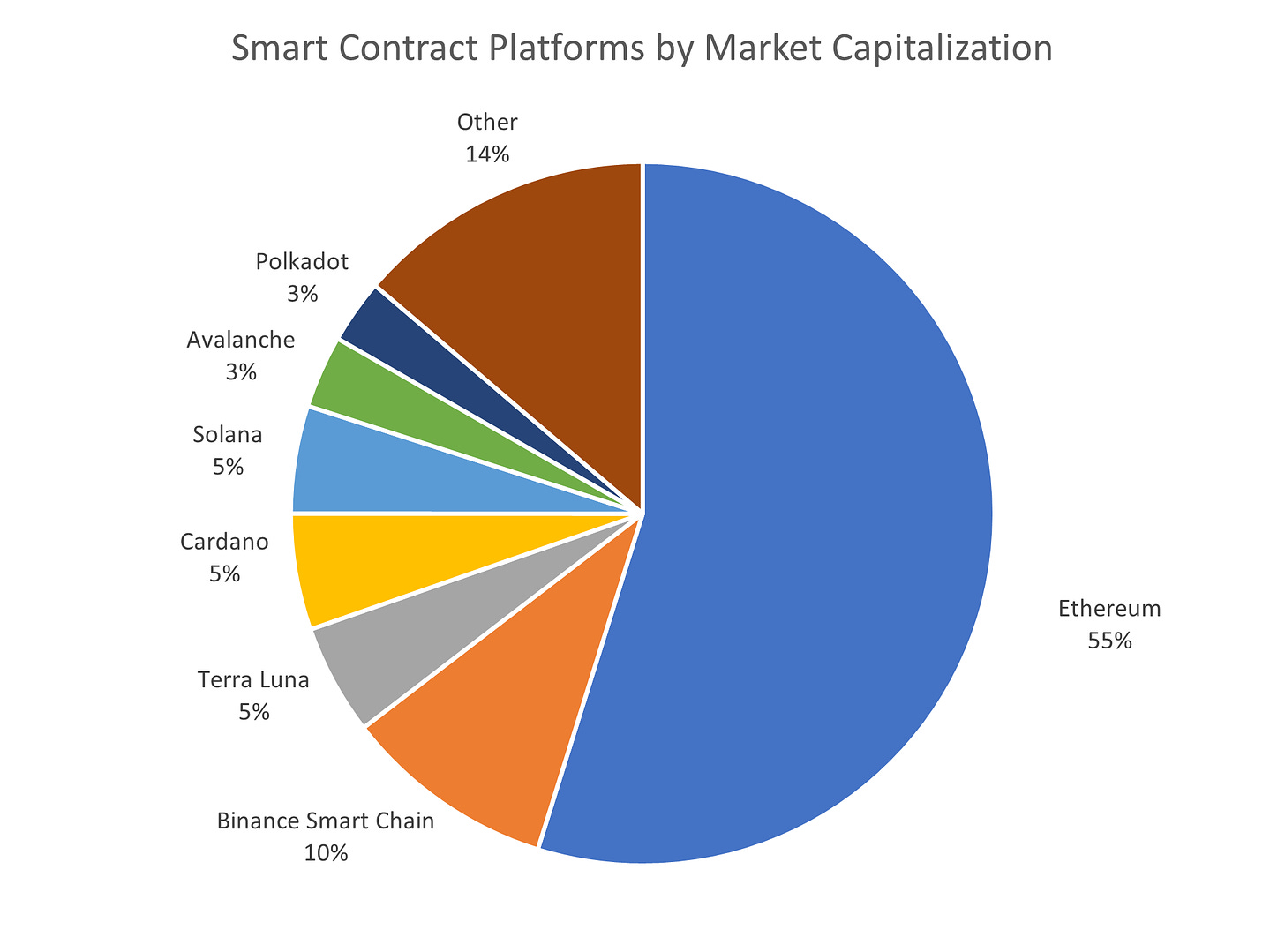

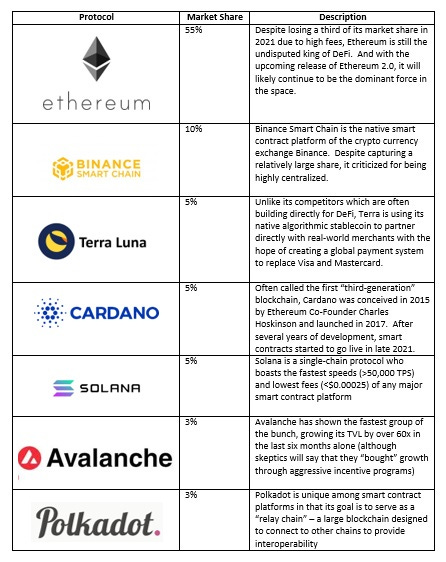

The smart contract market is highly consolidated, with Ether holding over 50% of market share and the second six players – Binance, Terra Luna, Cardano, Solana, Avalanche and Polkadot garnering an additional 31%.

Stablecoins

What are Stablecoins?

While both Bitcoin and Ethereum have their benefits, one thing limiting their development is price volatility. After all, how can we use cryptocurrencies as a medium of exchange if the value is so unpredictable? What good are double-digit interest rates if the value of the underlying assets can decrease by 50% overnight?

Stablecoins help mitigate this volatility. In a sense, a stablecoin is nothing more than a cryptocurrency pegged to a (relatively) secure asset such as the US Dollar. They can be used to buy things, lend and borrow, collect interest and even hold as a store of value. In effect, anything you can do with cash you can do with a stablecoin.

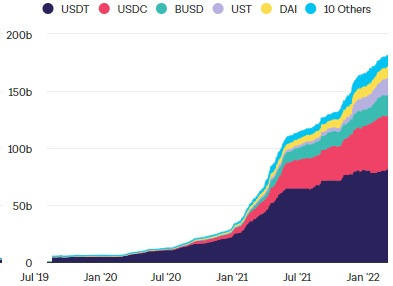

Total Stablecoin Supply

The stablecoin market has grown more than 500% in the past year alone, and currently stands at $181B.

How do Stablecoins Work?

While on the surface stablecoins might seem very similar to the digital money we use today, under the hood they are very different animals. Perhaps the most glaring distinction is in the ownership and control of the assets. The dollar is owned by the United States government – the Fed sets the rules and controls the supply, commercial banks distribute the funds through fractional reserve banking and depositors receive interest.

Stablecoins on the other hand, are a form of private money. They either are governed by a corporation or a DAO (to keep things simple you can think of this as a collective), users create and distribute the funds by depositing collateral and token owners claim the interest.

Today, there are three main types of stablecoins:

Fiat-Collateralized: Fiat-collateralized stablecoins such as Tether and USDC are (or at least claim to be) fully backed by cash. That is, for each $1 of Tether, there should be $1 sitting in a bank account somewhere.

The problem with these coins is that, by definition, they are still centralized, relying on banks and other third-parties to keep custody of the collateral. This goes against the decentralized ethos of DeFi, as any centralized point in the chain makes the entire system vulnerable and serves as a magnet for regulators.Crypto-Collateralized: Crypto-collateralized stablecoins such as Dai are, as the name suggest, backed by a basked of cryptocurrencies and use autonomous protocols to maintain the peg.

While promising, crypto-collateralized stablecoins are currently very inefficient, requiring huge amounts of overcollateralization. That’s why the holy grail of DeFi has long been the creation of an Algorithmic Stablecoin.Algorithmic: Algorithmic stablecoins are decentralized and do not require collateral. The peg is maintained through a complicated incentive program. In essence, when the price goes above $1, more coins are issued, diluting the supply and lowering the price. When it goes below $1, coins are bought back to raise the price.

While algorithmic stablecoins are great in theory, they may not be possible in practice. Economists are quick to point out that they violate the “impossible trinity”, which states that you can’t have a free capital flow, sovereign monetary policy and a fixed exchange rate at the same time.

Indeed, virtually every experiment in this space has failed because incentives stop working if people don’t believe there’s inherent value in the currency. Once trust is loss, everyone sells contributing to a “death spiral” that quickly reduces the value of the coin to zero.

What are the Benefits of Stablecoins?

Whether or not this problem is solved by the current batch of market participants, stablecoins will likely continue to play a major role in the economy as they offer several core benefits:

Permissionless: Anyone can access stablecoins and use them to freely move assets across international borders

Cheaper: Although Ethereum is currently experiencing a significant fee problem, many competing networks offer near-zero fees for using stablecoins (much less than the 2-3% charged by Visa and Mastercard)

Faster: Stablecoin transactions and transfers are near instant and can be performed at any time

Programmable: It’s helpful to remember that stablecoins are software and, as such, can be easily programmed into smart contracts, creating a variety of potential use cases

Transparent: Anyone can view the underlying code and all transactions are easily discoverable on blockchain explorers

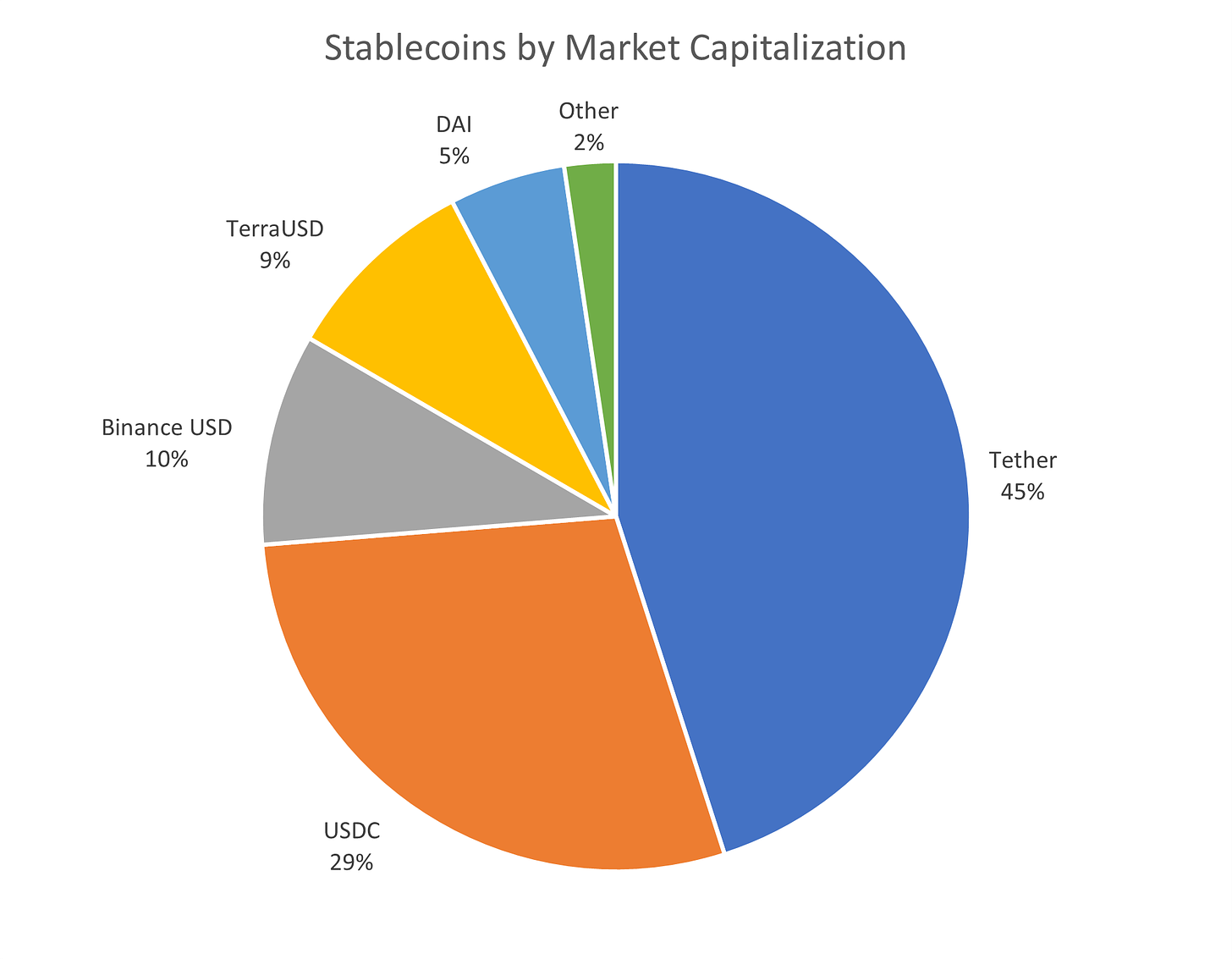

Who are the Key Players in the Stablecoin Market?

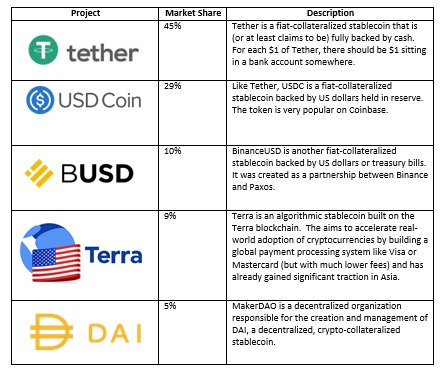

The market for stablecoins is currently dominated by the fiat-collateralized model, with Tether, USDC and BUSD holding a combined 83% market share.

Other

This report focuses on cryptocurrencies that are primarily used as a form of payment or, in the case of smart contract platforms, to run a payment network.

That said, while virtually all cryptocurrencies can be used as a form of money, many were designed primarily for other means, including tokens that are used to:

Run DeFi protocols (e.g. Uniswap and Aave)

Power decentralized oracle networks (e.g. Chainlink)

Serve as gaming tokens (e.g. Axie Infinity)

Provide currency for virtual worlds (e.g. Decentraland and Sandboxx)

Assist with DAO governance (e.g. ApeCoin)

Enable key web3 infrastructure (e.g. Arweave, Filecoin, Helium, Pocket Network, The Graph)

Assist with interoperability (e.g. Thorchain)

Since there are tens of thousands of cryptocurrencies, we won’t focus on these here, but they will be covered in detail in other reports.

Problems with Cryptocurrencies

Although cryptocurrencies definitely have their benefits, they also come with their share of downsides. Among the most notable of these are:

High Fees

Volatility

Environmental Concerns

Tax Cheats & Criminals

MEV

Let’s take a deeper look into each concern.

Fees

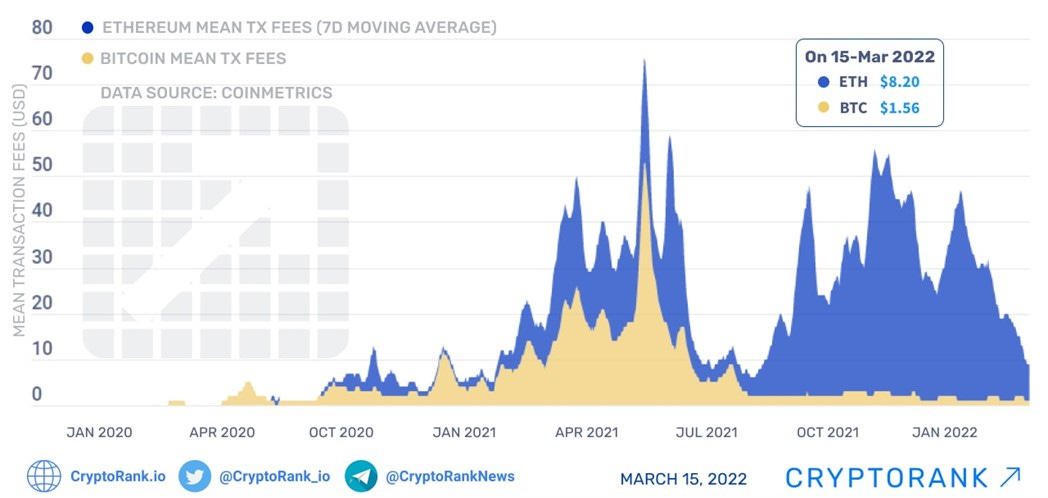

Both Bitcoin and Ethereum suffer from high fees. As of March 2022, the mean transaction fee was $1.56 for BTC and $8.20 for ETH (and these are actually historical lows, as ETH fees averaged $50 to $75 several times in 2021).

This makes them impractical for daily use – after all, imagine having to pay $2 to $8 (or even $75) dollars in fees for a cup of coffee!

Average Transaction Fees Bitcoin and Ethereum

While this seems like an insurmountable problem, there are several mitigating factors to consider:

Unlike traditional finance, fees are independent of the transaction amount (i.e. it costs the same to send $1 or $1 million), so while this may be a problem for daily use, it’s actually much cheaper than standard costs for bank wires and remittances and also cheaper than a credit card for larger purchases

Projects like Ethereum are working very hard on lowering fees, and some estimate the transactions may cost less than a penny when the upgrade to ETH 2.0 is finally complete (although that is likely years away)

We have recently seen the creation of alternative blockchains – such as Avalanche, Solana, Cardano, Polkadot, Binance Smart Chain and Terra – that offer significantly lower feeds and transaction times.

Volatility

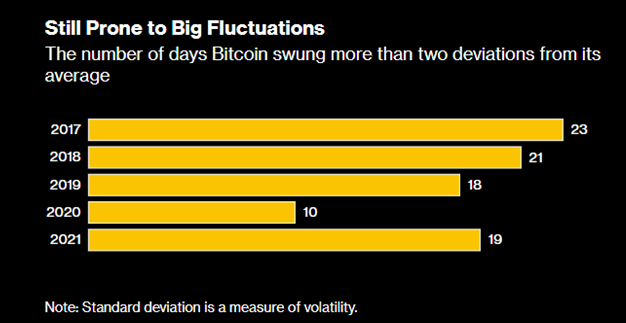

Cryptocurrencies are notoriously volatile – Bitcoin alone recorded swings greater than 2 standard deviations an average of almost 20x per year over the past 5 years.

Bitcoin has swung more than 2 SDs almost 20 times a year since 2017

Many critics argue that this volatility will be their ultimate downfall. After all, something can’t function as a medium of exchange if its value fluctuates wildly from one day to the next. Imagine waking up not knowing whether the coins in your digital wallet could buy you a new car or a cup of coffee.

This concern is a big driver of the demand for stablecoins, which offer many of the benefits of cryptocurrencies while maintaining a 1:1 peg to the USD, Renminbi, Euro or Korean Won. In fact, Terra Luna’s TerraUSD stablecoin is already gaining significant traction in Asia, where it is used for a variety of purchases including purchasing coffee or hailing taxis.

But cryptocurrency disciples will tell you that stablecoins won’t be necessary in the long-run, because volatility is a matter of perspective. Given that we price goods in the United States in US dollars, we measure “volatility” by that standard (i.e how much did an asset go up or down in dollar value). But if you were to measure using Bitcoin as the baseline, you could argue that it’s the dollar that’s volatile!

Indeed, purists argue that’s the direction we’re headed. They believe that once cryptocurrencies gain widespread adoption, businesses will begin to use them to price goods and services. When this happens, there will be no more volatility as a 10 satoshi cup of coffee will always be worth 10 satoshis, no matter what happens to the Dollar, Yen or Won (FYI – a “satoshi” is the smallest unit of Bitcoin, worth 1/100millionth or a BTC) .

While this might seem far-fetched it should be noted that this is already happening on a limited scale. Many Web3 goods, such as NFTs, are already natively priced in Ether and not USD.

Environmental Concerns

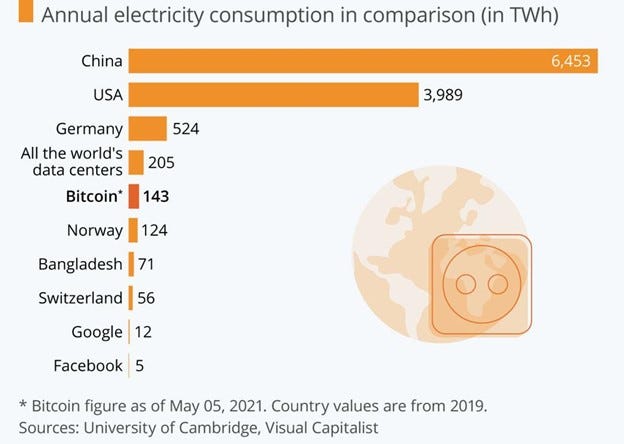

Proof-of-work consensus mining uses a significant amount of energy. It has been estimated that each transaction uses enough electricity to power the average home for six weeks. When you add all the transactions together, the cost is staggering – Bitcoin alone consumes roughly X% of the world’s energy. That’s 7x the amount Google uses and more than Norway!

Bitcoin consumes more energy than many countries

Fortunately, these statistics may not be as alarming as they seem at first glance. First of all, energy expenditure does not necessarily equate to environmental impact. In fact, because miners are incentivized to find the cheapest source of energy possible, many rely on alternative sources such as wind or solar Some estimates believe that 40% to 75% of the energy to power proof-of-work mining may come from renewable sources.

Second, many newer cryptocurrencies are adopting a proof-of-stake model (and Ethereum is transitioning to one), which uses almost no energy.

Tax Cheats & Criminals

Several of the core benefits of cryptocurrencies could also be seen as weaknesses. Indeed, critics argue that they are the ideal venue for:

Tax Evasion: Because cryptocurrency transactions are anonymous, people will use them to evade taxes

Criminal Activity: Transactions can’t be regulated, which means that people will buy illegal goods online and criminals can easily log in to a decentralized service to launder money

Funding Terrorists: Because the government can’t seize assets like they did with Russia after it invaded Ukraine, terrorist groups will hold all of their funds in Bitcoin

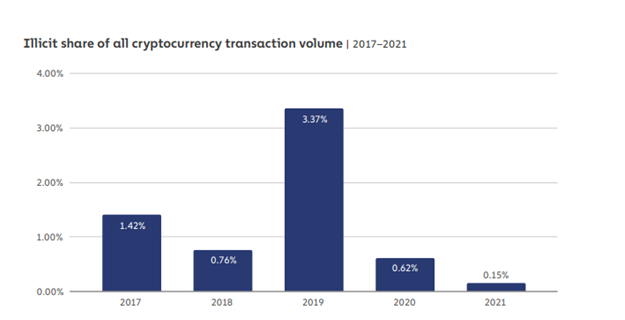

While all of these are definitely possible – and even seem logical at first blush -- the data simply doesn’t support these fears. In fact, only 0.15% of all cryptocurrency transactions are connected to criminal dealings.

Illegal Activities Represent Only 0.15% of Cryptocurrency Transactions

A big part of the reason for this is probably because cryptocurrency transactions aren’t anonymous, they are “pseudonymous” – meaning that if anyone can tie you to your address, they can see all of your transactions. This has proven a boon time and time again to law enforcement, who have used the transaction history to track down several high profile thieves. In 2022 alone, the Department of Justice seized $3.6 billion from crypto hackers.

Ironically, given the fact that all transactions are recorded forever on a digital ledger, cryptocurrencies may ultimately reduce crime, fraud and tax evasion.

MEV

As discussed previously, cryptocurrencies are secured by miners (or “validators” for Proof-of-Stake systems), who gather transactions, verify them and include them in the next block.

Because each block can only contain a limited number of transactions, miners generally choose which transactions to include based on an auction process – those who offer to pay the highest fees will be included first.

Unfortunately, miners aren’t technically forced to follow this rule and ultimately have full discretion over which transactions to include, which to ignore and how to order them. When miners abuse this power to personally profit, it’s known as Miner-Extractable Value (MEV).

There are a host of MEV tactics, but a common one is known as frontrunning. To see how this works, let’s imagine that you noticed that ETH was trading for a lower price on exchange A than it was on exchange B. Seeing a great arbitrage opportunity, you put in an order to buy ETH on exchange A and then sell it on B. Once you place the order, it gets sent to the miners who put it in a transaction queue.

Once this transaction is in the queue an unethical miner could now see what you are trying to do and decide to ignore your request and make the same trade himself, stealing your profit opportunity in the process.

As mentioned, there are several of MEV tactics and, to make matters worse, many of them are now employed by automated bots. As such, MEV is becoming a substantial problem that is estimated to cost users over $1 billion annually.

The Long-Term Potential of Cryptocurrencies

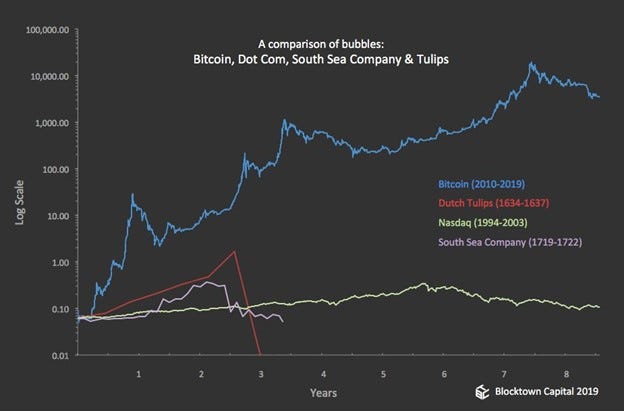

While pundits have long compared the rise of cryptocurrencies to the infamous ‘Tulip Bubble’ that gripped Amsterdam in the early 1600s, I think we’re well beyond that point.

Bitcoin has Lasted Over 4x Longer Than Comparative “Bubbles”

Bubbles don’t pop and form again, and the Bitcoin “run” has lasted significantly longer than either tulips or the South Sea Company (where Issac Newton famously lost more than $3 million in today’s money)

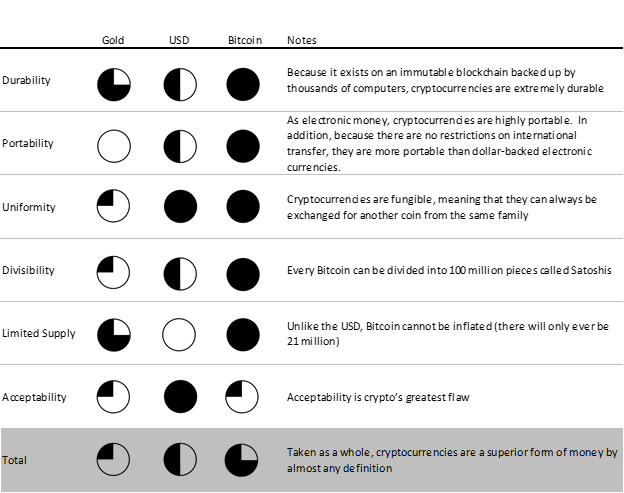

Indeed, cryptocurrencies have survived on merit, and one could argue that they’re the best form of money that the world has ever known.

The Best form of Money the World Has Ever Seen

If we were to use the six properties of money discussed earlier to compare cryptocurrencies to the USD and gold, we would see that they stand head-and-shoulders above in almost all areas.

Strengths and Weaknesses of Gold vs. USD vs. Bitcoin as a Form of Money

The only area where crypto falls short is the fact that it’s not widely accepted. But adoption has been steadily increasing now, and we may soon see a “tipping point”. According to Zippia:

Over 15K businesses worldwide accept Bitcoin, including Microsoft, PayPal, Whole Foods, Etsy, Home Depo, AMC Theatres and Starbucks

36% of small and midsize businesses in the US accept cryptocurrency

There are over 35K Bitcoin ATMs in the US

In addition, El Salvador became the first country to accept Bitcoin as legal tender in 2021 and several researchers argue that Panama, Cuba, Ukraine and Paraguay may soon follow suit.

Stoking the Fires of Disruption

In addition to being a better form of money, cryptocurrencies are leading to revolutions in several other related spheres including:

Digital Gold: Gold has long been sought out as both an inflation hedge and seizure-resistant asset (small amounts of it at least). Bitcoin offers all the benefits of gold with two major advantages – it’s infinitely divisible and internationally portable. This could benefit numerous parties, including the super-wealthy who want to replace their Swiss bank accounts, those in developing countries who need an inflation hedge but can’t access gold and anyone who wants to avoid the cost and restrictive nature of sending money abroad. As such:

Digital Gold could replace fiat currencies and central banks (e.g the USD, Euro, British Pound, RMB, Yen, the Fed, Bundesbank, Bank of England and IMF)Decentralized Finance: Cryptocurrencies, especially stablecoins, are already creating an entirely new financial infrastructure known as decentralized finance (“DeFi”). DeFi offers many of the same features as the traditional financial ecosystem, such as i) lending and borrowing, ii) asset trading, iii) derivatives and iv) insurance without relying on the banks. This eliminates unnecessarily high fees, onerous KYC requirements and the threat of seizure and gives the almost 2 billion unbanked people access to basic financial services.

Decentralized Finance could replace Wall Street (e.g. Goldman Sachs, Morgan Stanley, Bank of America, Chase, Fidelity, the New York Stock Exchange)Web3: Cryptocurrencies such as Ethereum have the potential to form the basis for a new, “internet-first” economy – one owned by it’s users instead of global mega-corporations. We are already seeing the beginning phases of several new industries enabled by blockchain technology such as NFTs, Play-to-Earn Games, the Metaverse and DAOs. In many of these ecosystems, cryptocurrencies are the dominant form of money. As such:

Web3 could replace Silicon Valley and Wall Street (e.g. Microsoft, Amazon, Apple, Facebook, Netflix, Spotify, Disney, Activision, Warner Music, Google)

Given the enormous potential of cryptocurrencies, it’s not surprising that many analysts believe that the market could still grow by orders of magnitude.

Quantifying the Potential Value of Cryptocurrencies

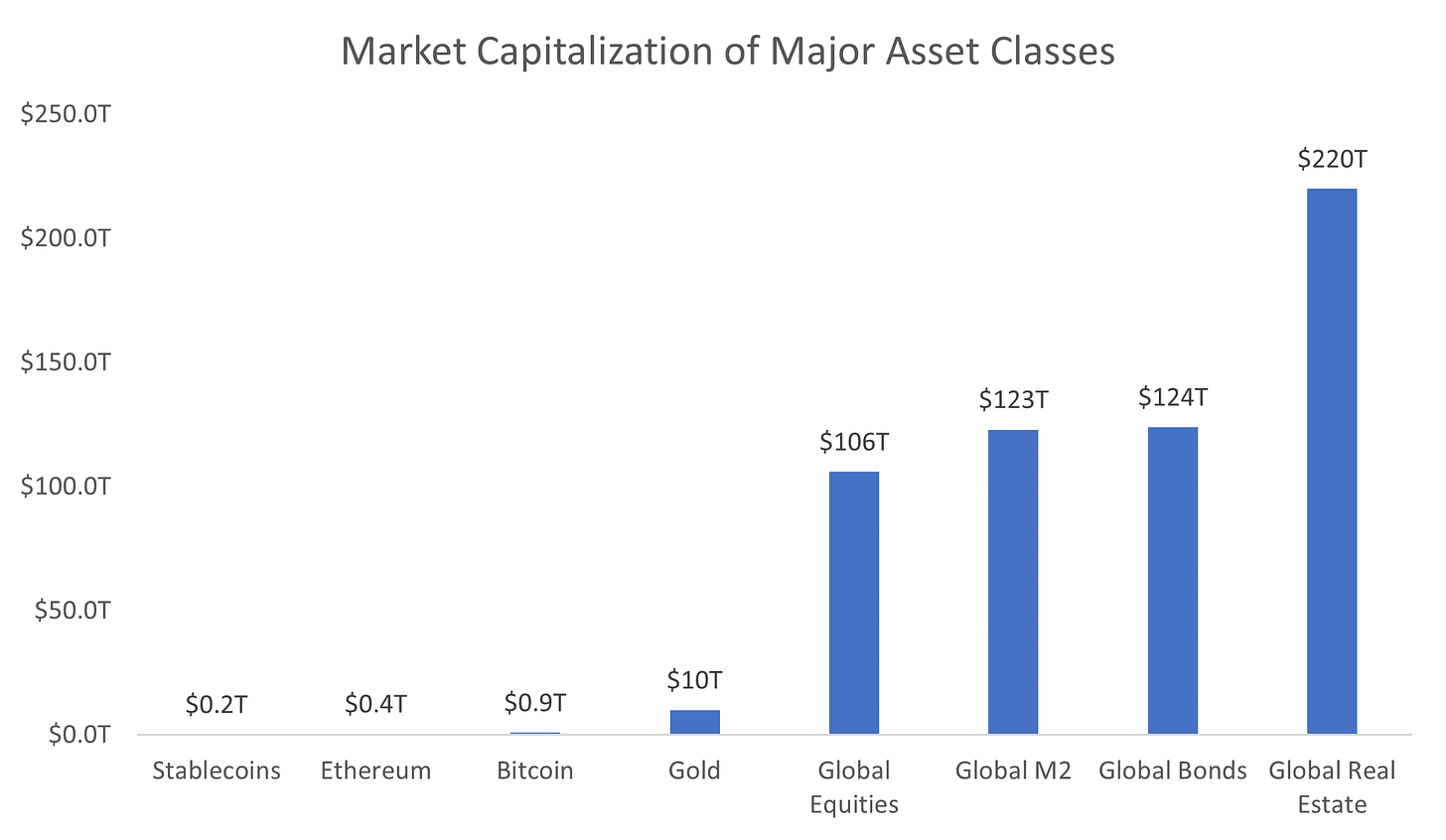

While it’s difficult to put a number on disruption, when we compare cryptocurrencies to the market cap of gold, global equities, global currency, bonds and real estate, we can see that there is still significant room for appreciation.

Cryptocurrencies Represent a Fraction of Global Asset Values

Perhaps it’s for this reason that we’ve seen some mind-blowing predictions for the future value of Bitcoin, Ethereum and several stablecoins:

The Stablecoin market could grow 1,000x: While this prediction from Jeremy Allaire, the founder and CEO of Circle (the company behind USDC) is both aggressive and probably a bit biased, there is at least some merit to the logic. Allaire argues that the minimum TAM for stablecoins is $120T (the global value of M2 currency) and that the technology’s advantages over conventional money may ultimately grow the market (a la Uber). While achieving 100% market penetration is unlikely, this prediction nonetheless helps make the case that stablecoins likely have a lot of room to grow from their current market cap of $180B.

Bitcoin could be worth $1M per BTC: Ark Invest, the $50B fund founded by Cathie Wood, believes that a single Bitcoin could be worth $1 million by 2030. She reasons that the currency could capture up to 50% of global remittance payments, 10% of M2 in emerging markets, 25% of US bank settlement volumes, 1% of total national reserves, 5% of the treasuries of S&P 500 companies, 5% of global HNWI wealth, ~3% of the institutional asset base and 50% of gold’s total market cap.

Ethereum could hit a $20T market cap: Ethereum has started to see legitimate traction as “money”. It’s the preferred collateral in DeFi, the unit of account in NFT marketplaces and likely currency of Web3. As such, Ark believes it could capture 15%-20% of the global M2 supply over the next ten years. This would equate to almost $170K per ETH, an >60x increase over the time of writing.

Wherever the future takes us, it’s important to watch as it has the potential to be both an existential to the existing system and a road to almost unlimited potential for investors.

Note: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.